Warehouse Automation Market Overview

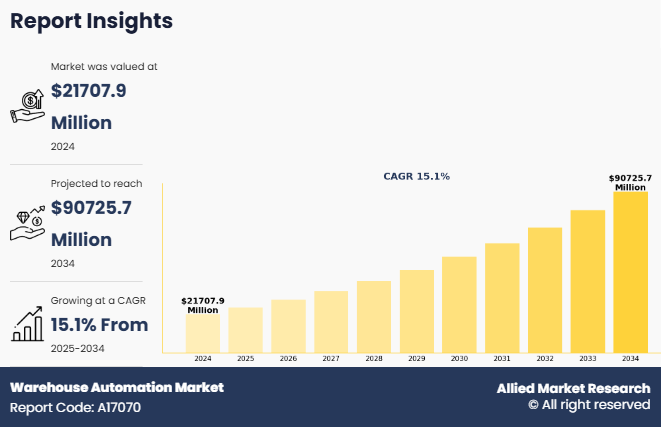

The global warehouse automation market size was valued at $21,707.9 million in 2024, and is projected to reach $90,725.7 million by 2034, growing at a CAGR of 15.1% from 2025 to 2034. The warehouse automation market is thriving due to the exceptional strength, durability, and resilience of automated systems under high pressure and challenging environments. Their long operational life, resistance to corrosion, and effectiveness in large-scale and underground infrastructure make them ideal for applications in water distribution, wastewater treatment, and various industrial sectors worldwide.

Market Dynamics & Insights

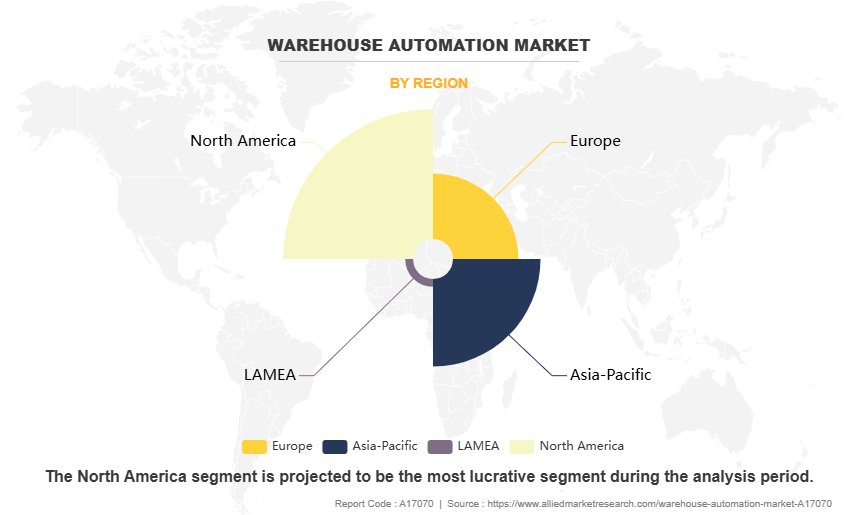

- The warehouse automation industry in North America held a significant share of over 44.7% in 2024.

- The warehouse automation industry in Germany is expected to grow significantly at a CAGR of 15.5% from 2025 to 2034

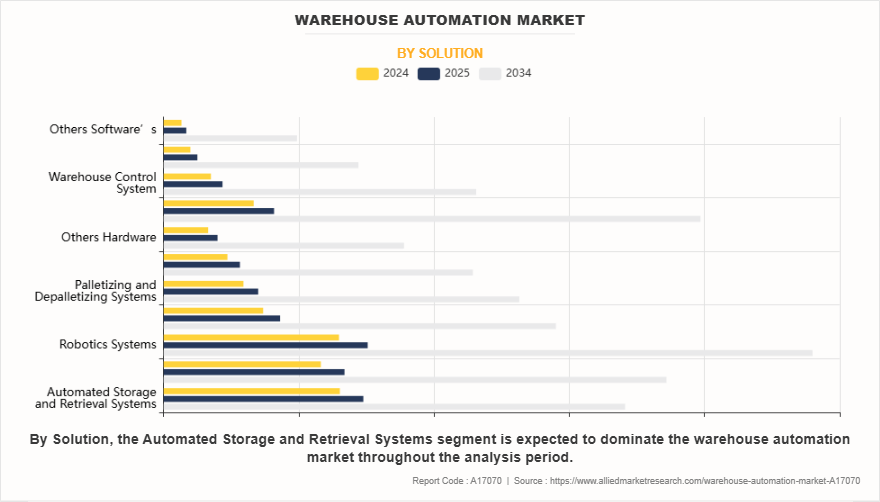

- By solution, the automated Storage and Retrieval Systems segment is one of the dominating segments in the market and accounted for the revenue share of over 18% in 2024.

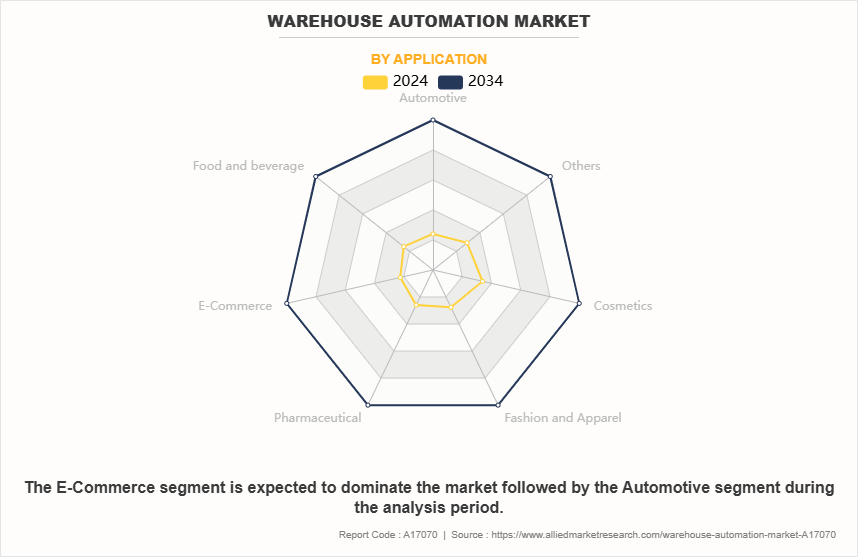

- By application, e-commerce segment is the fastest growing segment in the market.

Market Size & Future Outlook

- 2024 Market Size: $21.7 Billion

- 2034 Projected Market Size: $90.75 Billion

- CAGR (2025-2034): 15.1%

- North America: Largest market in 2024

- Asia-Pacific: Fastest growing market

What is Meant by Warehouse Automation

Warehouse automation market refers to the use of advanced technologies and systems to perform tasks within a warehouse with minimal human intervention. It involves the integration of software, robotics, and control systems to streamline operations such as inventory management, picking, packing, sorting, and transporting goods. Automated solutions like conveyor belts, automated storage and retrieval systems (AS/RS), drones, and robotic arms help improve accuracy, speed, and efficiency while reducing labor costs and operational errors.

Key Takeaways

- On the basis of solution, the automated storage and retrieval system segment held the largest share in the warehouse automation market in 2024.

- By application, the e-commerce segment was the major shareholder in 2024.

- By end user industry, the manufactures segment dominated the market, in terms of share, in 2024.

- Region wise, North America region held the largest market share in 2024.

Warehouse Automation Industry play a central role in coordinating these technologies, providing real-time data and analytics for better decision-making. Automation is particularly valuable in handling high-volume orders and repetitive tasks, enhancing throughput and scalability. As e-commerce continues to grow and supply chains become more complex, warehouse automation market is increasingly being adopted to meet the demands for faster delivery and improved customer satisfaction. It also supports better space utilization, improved safety, and sustainability in warehouse operations.

For instance, In March 2025, Honeywell International Inc. introduced smart warehouse execution software (WES) on cloud-based platform. WES is a critical component to warehouse automation market that orchestrates multiple processes within the warehouse in real-time, from picking and routing to order management and capacity planning. It helps ensure that workers in the facility are completing the most optimal work at any given time. By collecting data from various technologies across the warehouse‐”such as robots, scanners and mach. Moreover, In September 2023, FANUC CORPORATION collaborated with OSARO, San Francisco-based company to expand the capabilities of FANUC robots for warehousing and e-commerce order fulfillment with OSARO's machine vision software. Through this collaboration, OSARO delivers automated piece-picking systems to address challenges including high SKU inventories, complex packaging, and fragile items.

The growth of the e-commerce industry is increasing the demand for the warehouse automation market share as businesses seek faster, more accurate order fulfillment. With rising online shopping, companies require efficient storage, picking, and shipping solutions to handle high volumes. Automation helps reduce errors, lower labor costs, and meet same-day or next-day delivery expectations. This shift is pushing e-commerce players to invest in advanced technologies to enhance operational speed and customer satisfaction. Furthermore, increase in volume of inventory, and adoption of warehouse automation market in Small and Medium Enterprises have driven the demand for warehouse automation market.

However, High initial costs are hampering the demand for the warehouse automation market growth, particularly among small and medium-sized enterprises. The investment required for robotics, automated systems, software integration, and infrastructure upgrades can be substantial. These upfront expenses, along with ongoing maintenance and training costs, make it difficult for some businesses to justify automation. As a result, many companies delay or limit adoption, especially in cost-sensitive industries or regions with limited access to capital.

On the contrary, advancements in warehouse automation market technology present a warehouse automation market opportunity. Innovations such as AI-powered robotics, Internet of Things (IoT), machine vision, and cloud-based warehouse management systems are making automation more efficient, scalable, and accessible. These technologies enhance real-time data tracking, predictive maintenance, and intelligent inventory control. As solutions become more cost-effective and adaptable, even small and mid-sized businesses are increasingly adopting automation to boost productivity and remain competitive.

Warehouse Automation Market Segment Review

The warehouse automation market outlook is segmented on the basis of solution, application, end-use industry, and region. Based on solution, the warehouse automation market is divided into automated storage and retrieval systems, conveyors and sortation systems, robotics systems, picking and packing equipment, palletizing and depalletizing systems, sensors and scanners, others hardware, warehouse management system, warehouse control system, warehouse execution system, and others software. Based on application, the warehouse automation market is classified into automotive, food and beverage, e-commerce, pharmaceutical, fashion and apparel, cosmetics, and others. Based on end user industry, the warehouse autmation market is fragmented into retailers, and manufacturers and distributors. Region wise, it is studied across North America, Europe, Asia-Pacific, and LAMEA.

By Solution

On the basis of solution, the automated storage and retrieval system segment attained the highest market share in 2024 in the warehouse automation market. This is due to its ability to enhance storage efficiency, reduce human error, and improve order processing speed. AS/RS solutions optimize space utilization by allowing high-density storage and enable faster, more accurate retrieval of items, which is critical for industries like e-commerce, retail, and manufacturing. These systems also minimize labor costs and improve safety by reducing manual handling. The growing demand for real-time inventory management and just-in-time delivery has further boosted the adoption of AS/RS across global warehouses.

By Application

On the basis of application, the e-commerce segment acquired the highest market share in 2024 in the Warehouse automation market. this is due to the rapid growth of online shopping and increasing customer expectations for fast and accurate deliveries. E-commerce companies manage high order volumes and a wide range of SKUs, requiring efficient and scalable warehouse operations. Automation solutions such as robotic picking, conveyor systems, and automated storage and retrieval systems help streamline order fulfillment, reduce errors, and enhance delivery speed. The push for same-day and next-day shipping, along with rising labor costs, has further driven e-commerce players to invest heavily in automation.

By Region

Region-wise, North America emerged as the leading region in the warehouse automation market in 2024, securing the highest market share due to its early adoption of advanced technologies and strong presence of key industry players. The region has a well-established e-commerce sector, high labor costs, and increasing demand for faster delivery, all of which drive the need for automated solutions. Companies across the U.S. and Canada are investing in robotics, AI-based warehouse systems, and IoT-enabled devices to improve operational efficiency. Additionally, government support for technological innovation and the growing emphasis on supply chain optimization have further boosted market growth.

However, Asia-Pacific is projected to grow at the fastest rate in the warehouse automation market during the forecast period, driven by rapid industrialization, expansion of the e-commerce sector, and increasing investments in smart logistics infrastructure. Countries such as China, India, Japan, and South Korea are witnessing rising demand for faster and more accurate order fulfillment, prompting companies to adopt advanced automation technologies. Government initiatives supporting digital transformation and manufacturing efficiency are encouraging widespread implementation of robotics, AS/RS, and automated guided vehicles. The growing need to address labor shortages and improve warehouse productivity is further accelerating the adoption of automation in the region.

The report focuses on growth prospects, restraints, and trends of the warehouse automation market analysis. The study provides Porter‐™s five forces analysis to understand the impact of numerous factors, such as bargaining power of suppliers, competitive intensity of competitors, threat of new entrants, threat of substitutes, and bargaining power of buyers, on the warehouse robotics.

Competitive Analysis

The report analyses the profiles of key players operating in the Warehouse automation market such as ABB, Amazon.Com, Inc., Atmos Systems, Bastian Solutions Llc, Daifuku Co., Ltd., Fanuc Corporation, Zebra Technologies Corp (Fetch Robotics, Inc.), Honeywell International Inc., Jungheinrich Ag, Kion Group Ag (Dematic), Kuka Ag, Ssi Schaefer Group, Omron Corporation, Schneider Electric, Siemen, Yaskawa Electric Corporation, and Falcon Autotech.. These players have adopted various strategies to increase their warehouse automation market penetration and strengthen their position in the warehouse automation market.

Growth of e-commerce Industry

The e-commerce industry has experienced remarkable growth over the past decade and is expected to continue expanding at a substantial rate in the coming years. This rapid growth is primarily driven by the convenience of online shopping and the wide variety of products available to consumers. Additionally, the surge in e-commerce activities is particularly prominent in developed regions, where consumers increasingly prefer the ease of purchasing goods from the comfort of their homes. For instance, according to data from the U.S. Census Bureau, the quarterly retail e-commerce sales in the U.S. as a percentage of total retail sales were around 6% in 2013, and this figure increased to over 14% in 2022, reflecting the ongoing shift toward online shopping. The growth of e-commerce is not limited to developed economies; emerging markets are also witnessing a rapid rise. For instance, the Philippines is experiencing a developing e-commerce sector, fueled by the widespread adoption of smartphones and an increasing number of active online users. In 2021, e-commerce sales in the Philippines reached $17 billion, with 73 million active users. This warehouse automation market is expected to grow by 17%, reaching $24 billion by 2025, as reported by the International Trade Administration. The COVID-19 pandemic further accelerated e-commerce adoption, as Filipinos adapted to remote work and education, which fueled online shopping demand.

Moreover, countries like India are making significant investments in digital infrastructure, with the Indian government allocating $1.24 billion for 5G broadband services in Tier 1, 2, and 3 cities, which will further enhance e-commerce capabilities. Similar trends are evident in China, Brazil, and other developing nations, where the rise of online shopping is driving demand for faster, more efficient order fulfillment systems. These developments are expected to significantly increase the need for warehouse automation market solutions, enabling e-commerce businesses to meet growing consumer expectations for faster deliveries and improved service quality across global markets

Increase in Volume of Inventor

The global population is increasing at a significant pace. According to the UN, the global population is expected to reach more than 9.8 billion in 2050, from about 8.09 billion in 2023. This is expected to boost the growth of the industrial sector across the world. This has also resulted in a rise in global trade. For instance, according to the United Nations Conference on Trade and Development (UNCTAD) the value of global trade registered rise of $1 trillion dollars to reach $7.7 trillion in Q1 2022, as compared to Q1 2021. Moreover, companies offer a wide variety of products to meet the requirements of all their customers, to remain competitive. These factors have played an important role in increasing the average volume of inventory held by the warehouses. Furthermore, the domestic industrial sector is also witnessing significant growth in various countries. This is largely attributed to the various favorable policies unveiled by the governments of their respective countries. Increase in volume of inventory has stressed out the labor-intensive traditional warehouses. This brings inefficiency in the warehouse management, while making it expensive to manage. Thus, companies are adopting warehouse automation; thereby, driving the growth of the warehouse automation industry. therefore, the increase in volume of inventor is increase the demand for the warehouse automation market

Adoption of Warehouse Automation in Small and Medium Enterpise

The growth of small- and medium-sized enterprises (SMEs) across various industries is a significant driver of the warehouse automation market. With SMEs accounting for more than 60% of businesses in most sectors, excluding industries such as defense and weapons that are dominated by oligopolies or monopolies, the increasing number of warehouse automation market players is surging competition. To maintain competitiveness, SMEs are increasingly integrating automation technologies into their warehouse operations. Warehouse automation market offers critical benefits in optimizing material handling, inventory management, and order fulfillment, all of which are essential for improving operational efficiency and reducing costs.

As SMEs face pressure to meet growing consumer demand and optimize operational costs, automation presents a scalable and cost-effective solution. These technologies enhance storage capacity, accelerate processing times, and increase throughput. These factors are crucial for staying competitive in dynamic markets. Additionally, SMEs can reduce the risk of human error, which can lead to costly mistakes or delays, by automating repetitive tasks such as sorting, picking, and packaging. Also, businesses are able to reallocate resources to more value-added functions by minimizing human intervention in routine tasks, thus improving overall productivity. Furthermore, SMEs are leveraging warehouse automation market to enhance their order fulfillment capabilities, with the rise of e-commerce and increase in customer expectations for faster, more accurate deliveries. Such factors drive the growth of the warehouse automation market.

High Initial Costs

Warehouse automation market systems include various systems such as robots, software, and other machineries. These systems offer various advantages when it comes to quick, and effective warehouse management. However, the cost associated with procurement, installation and setting-up of automated warehouse systems is very high especially among small and medium-sized enterprises (SMEs) operating with limited financial flexibility. Implementing advanced systems such as automated storage and retrieval systems (AS/RS), autonomous mobile robots (AMRs), conveyors, and warehouse management software requires significant capital outlay. These investments not only cover the purchase of hardware and software but also include expenses for infrastructure modifications, system integration, and employee training. Moreover, the customization required to align these systems with specific warehouse operations often increases implementation complexity and cost. For many businesses, especially those in developing economies or low-margin industries, the long payback period can deter investment, as the return on automation is typically realized over several years.

Furthermore, the ongoing operational costs associated with maintaining these automated systems add to the financial strain. Regular maintenance, software updates, and the employment of skilled personnel to operate and troubleshoot the technology represent continuous expenditures. In regions where manual labor remains cost-effective, companies may opt to retain traditional workflows rather than invest heavily in automation. Moreover, uncertainty around technological compatibility and scalability can lead to hesitancy among businesses considering automation. While warehouse automation promises long-term efficiency, accuracy, and scalability, these advantages are often overshadowed by the substantial upfront costs, making affordability a critical challenge for broader warehouse automation market penetration.

Advancement in Warehouse Automation Technology

Advancements in technology are creating significant opportunities for the expansion of the warehouse automation market. The integration of cutting-edge solutions such as artificial intelligence (AI), machine learning (ML), computer vision, and the Internet of Things (IoT) is revolutionizing warehouse operations worldwide. These innovations enable automated systems to perform complex tasks such as picking, sorting, inventory tracking, and material handling with heightened precision and minimal human intervention. For example, Hörmann Logistik has developed intelligent robotic systems equipped with advanced sensors and cameras that can autonomously identify and sort items, streamlining warehouse workflows and improving overall efficiency. Moreover, companies like Honeywell are enhancing automation capabilities with innovations such as smart depalletizer robots, which efficiently manage the unloading of pallets in warehouses and distribution centers by reducing manual labor requirements and minimizing errors. In addition, AI-powered software platforms are being increasingly deployed to optimize warehouse layouts, manage inventory in real-time, and enhance decision-making processes. These technologies not only reduce operational costs but also support scalability and agility in supply chain management. The demand for intelligent warehouse automation solutions is expected to surge as businesses continue to prioritize speed, accuracy, and efficiency. Thus, these technological advancements present lucrative growth opportunities for stakeholders in the global warehouse automation market.

What are the Key Benefits for Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the warehouse automation market analysis from 2025 to 2034 to identify the prevailing warehouse automation market forecast.

- Market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders to make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the warehouse automation market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- warehouse automation market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global warehouse automation market trends, key players, warehouse automation market segments, application areas, and market growth strategies.

Warehouse Automation Market Report Highlights

| Aspects | Details |

| Market Size By 2034 | USD 90725.7 million |

| Growth Rate | CAGR of 15.1% |

| Forecast period | 2024 - 2034 |

| Report Pages | 1015 |

| By Solution |

|

| By Application |

|

| By End User Industry |

|

| By Region |

|

| Key Market Players | YASKAWA ELECTRIC CORPORATION, ABB, Siemen, Daifuku Co., Ltd., Omron Corporation, Zebra Technologies Corp (Fetch Robotics, Inc.), Amazon.com, Inc., Bastian Solutions LLC, Schneider Electric, Jungheinrich AG, KION GROUP AG (DEMATIC), Atmos Systems, FANUC CORPORATION, Falcon Autotech, Honeywell International Inc., KUKA AG, SSI SCHAEFER Group |

The global warehouse automation market is witnessing key trends such as the integration of AI and machine learning for smarter inventory management, increased use of collaborative robots (cobots), and adoption of automation-as-a-service models to reduce upfront costs.

E-commerce is the leading application of Warehouse Automation Market

North America is the largest regional market for Warehouse Automation

the warehouse automation market was valued at $21707.9 million in 2024, and is estimated to reach $90725.7 million by 2034, growing at a CAGR of 15.1% from 2025 to 2034.

ABB, Amazon.Com, Inc., Atmos Systems, Bastian Solutions Llc, Daifuku Co., Ltd., Fanuc Corporation, Zebra Technologies Corp (Fetch Robotics, Inc.), Honeywell International Inc., Jungheinrich Ag, Kion Group Ag (Dematic), Kuka Ag, Ssi Schaefer Group, Omron Corporation, Schneider Electric, Siemen, Yaskawa Electric Corporation, and Falcon Autotech

Loading Table Of Content...

Loading Research Methodology...