Waste To Energy Market Overview

The global waste to energy market size was valued at USD 35.6 billion in 2022, and is projected to reach USD 56.0 billion by 2032, growing at a CAGR of 4.7% from 2023 to 2032. Government regulations on waste reduction and clean energy goals are driving demand for waste-to-energy technologies. However, high investment and facility costs remain key barriers to widespread market adoption.

Key Market Insight

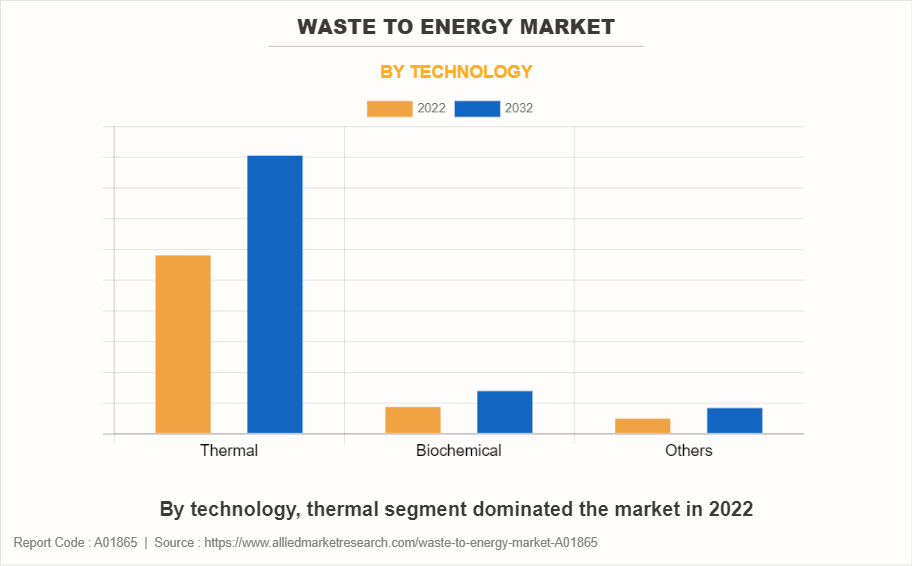

- Technology: Thermal segment led the market, contributing over four-fifths share in 2022.

- Region (Europe): Europe dominated with over two-fifths share in 2022, growing at a CAGR of 4.6%.

- Region (Asia-Pacific): Asia-Pacific is the fastest-growing region, expanding at a CAGR of 5.1%.

Market Size & Forecast

- 2032 Projected Market Size: USD 56.0 billion

- 2022 Market Size: USD 35.6 billion

- Compound Annual Growth Rate (CAGR) (2023-2032): 4.7%

Report Key Highlighters:

- The waste to energy industry covers covers 20 countries. The research includes a segment analysis of each country in terms of value ($million) for the projected period 2023-2032.

- The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global waste to energy markets and to assist stakeholders in making educated decisions in order to achieve their most ambitious growth objectives.

- Over 3,700 product literature, annual reports, industry statements, and other comparable materials from major industry participants were reviewed to gain a better understanding of the market.

- The waste to energy market share is highly fragmented, with several players including Babcock & Wilcox Enterprises, Inc., China Everbright Environment Group Limited, Covanta Holding Corporation, Hitachi Zosen Inova AG, Keppel Infrastructure Group, MVV Energie AG, Suez, Veolia, Viridor Limited, and Wheelabrator Technologies Inc.. Also tracked key strategies such as acquisitions, product launches, mergers, expansion etc. of the players operating in the waste to energy market growth.

Introduction

Waste to energy (WtE) is a process that involves the conversion of various types of waste materials into usable forms of energy. This method utilizes different technologies such as incineration, gasification, anaerobic digestion, or pyrolysis to extract energy from waste streams that would otherwise end up in landfills or cause environmental pollution.

It involves various technologies aimed at converting non-recyclable waste into usable energy forms while reducing the volume of waste destined for landfills. The process typically begins with the collection and segregation of waste materials. Non-recyclable waste such as organic matter, plastics, and paper, undergoes treatment through combustion, gasification, or pyrolysis. Combustion involves burning the waste at high temperatures, releasing heat energy that turns water into steam to drive turbines and generate electricity.

Incineration is one of the most widely used methods, involves the controlled burning of waste at high temperatures. The heat produced from combustion generates steam, which in turn powers turbines to produce electricity. This process significantly decreases the volume of waste, minimizing its environmental impact and simultaneously producing energy. However, concerns about air pollution and emissions of greenhouse gases necessitate advanced filtration systems to mitigate these environmental effects.

Moreover, gasification and pyrolysis are alternative approaches that operate in high-temperature, low-oxygen environments to convert waste into syngas or bio-oil, which is used for electricity generation or refined into biofuels. These methods often produce fewer emissions compared to traditional incineration, making them attractive for environmentally conscious energy production.

The primary goal of the waste to energy method is to generate energy from waste while simultaneously addressing waste management challenges. This technology produces energy, helps to reduce the volume of waste sent to landfills, and minimizes the environmental impacts associated with waste disposal. This aligns with sustainable waste management practices which contribute to a circular economy by maximizing resource utilization and minimizing waste.

Moreover, waste to energy processes contribute to reducing reliance on fossil fuels, thereby curbing greenhouse gas emissions. By diverting waste from landfills, these technologies also help mitigate the release of methane, a potent greenhouse gas, from decomposing organic matter. The versatility of waste to energy technologies allows for scalability and customization according to regional needs. In developed nations facing limited landfill space and stringent environmental regulations, it serves as a viable waste management solution. Simultaneously, in developing regions dealing with inadequate waste infrastructure and energy deficits presents an opportunity to address both challenges.

Market Dynamics

Governments are making stringent regulations to tackle waste and protect the environment. They are promoting less waste in landfills, more recycling, and better ways to manage waste. Waste to energy methods like incineration & anaerobic digestion abide by these rules by keeping waste out of landfills and reducing pollution. In addition, the demand for renewable energy is boosting due to strong government support and clean energy goals established at global climate meetings. Waste-to-energy methods help by turning waste into clean energy, reducing pollution, and lowering the need for non-renewable fuels. These attributes are increasing the demand for waste-to-energy technologies.

However, waste-to-energy facilities require specialized infrastructure such as incinerators or anaerobic digestion units which demand significant upfront investment in land, equipment, and construction. In addition, ongoing maintenance, skilled labor, and monitoring are essential to ensure the safe & efficient operation of waste to energy plants which increase long-term costs. These factors hamper the waste-to-energy market growth as they increase overall project costs and operational complexities for the technology.

On the contrary, waste to energy processes tackle waste problems while producing usable forms of energy, such as electricity, heat, or biofuels. They cut landfill waste, lower harmful emissions such as methane, and clean up the environment. This helps to reduce dependency on non-renewable resources and contributes to the development of a more sustainable & diverse energy portfolio. These factors are anticipated to offer new growth opportunities for waste to energy during the forecast period.

Market Segmentation

The waste to energy market is segmented on the basis of technology and region. By technology, the market is divided into thermal, biochemical, and others. By region, the market is classified into North America, Europe, Asia-Pacific, and LAMEA.

Thermal waste to energy processes encompass various technologies that convert solid waste into usable forms of energy. These technologies include incineration, gasification, and pyrolysis, each with distinct approaches to harnessing energy from waste materials. This present a viable solution by converting waste materials into electricity, heat, or fuels; contributing to diversified energy sources and reducing reliance on finite fossil fuels. The versatility of thermal WtE processes allows for the utilization of various waste streams such as municipal solid waste, industrial residues, agricultural by-products, and biomass. These technologies play a crucial role in addressing waste management challenges by reducing waste volume, mitigating environmental pollution, and generating renewable energy.

Moreover, boost in global demand for energy drives the exploration of alternative and renewable energy sources. According to the International Energy Agency (IEA), global electricity demand is expected to grow at a rapid pace of 3% per year over the 2023-2025 period compared with the 2022 growth rate. All these factors are increase the demand for thermal technology during the forecast period.

Waste to energy plays a vital role in Europe's sustainable waste management and energy production strategy. European countries have been actively adopting these technologies to address both the challenges of waste disposal and the need for renewable energy sources. Several European nations such as Sweden, Denmark, and the Netherlands, have been pioneers in WtE implementation. They have established advanced facilities that utilize incineration, gasification, and pyrolysis to convert waste into electricity, heat, and even biofuels.

In addition, Europe leads in circular economy, prioritizing resource efficiency and waste reduction. Waste to energy aligns with these goals, diverting waste from landfills, generating energy, and recovering resources. Moreover, strict regulations drive waste to energy demand, maximizing value from waste with minimal environmental impact. Waste to energy contributes to renewable energy targets, reducing reliance on fossil fuels while addressing carbon emissions. All these factors increase the demand for waste to energy processes in Europe.

Which are the Top Waste to Energy companies

Key players in the waste to energy market include Babcock & Wilcox Enterprises, Inc., China Everbright Environment Group Limited, Covanta Holding Corporation, Hitachi Zosen Inova AG, Keppel Infrastructure Group, MVV Energie AG, Suez, Veolia, Viridor Limited, and Wheelabrator Technologies Inc.

Apart from these major players, there are other key players in the waste to energy market. These include EEW Energy from Waste GmbH, Fortum Corporation, Waste Management, Inc., Ramboll Group, Acciona S.A., Advanced Plasma Power, BioHiTech Global, Inc., GFL Environmental Inc., Herz GmbH, KEPPEL SEGHERS, CNIM Group, and Plasco Energy Group Inc.

Historical Trends Of Waste To Energy:

- In the late 19th century, the inception of waste to energy technology emerged as incineration gained attention for waste disposal. Initial applications focused on small-scale incineration for municipal waste management.

- During the mid-20th century, advancements in incineration processes and environmental controls enhanced the efficiency and emissions management of waste to energy plants. This led to increased utilization in larger urban areas and industrial zones.

- In the late 20th century, waste to energy gained attraction as a viable solution for addressing landfill issues and reducing dependence on fossil fuels. In addition, policies promoting waste management and renewable energy bolstered waste to energy implementation across various regions.

- The early 21st century witnessed a surge in waste to energy development due to heightened environmental concerns and the push for sustainable energy. Innovations in gasification, pyrolysis, and anaerobic digestion technologies expanded waste to energy capabilities.

- By the mid-2010s, waste to energy integration into energy strategies grew substantially, driven by stricter environmental regulations and increased awareness of renewable energy's significance. Adoption expanded into diverse sectors like power generation and district heating.

- In the late 2010s and early 2020s, the waste to energy sector experienced a notable surge. Heightened climate change concerns and the shift towards low-carbon economies accelerated the adoption of waste to energy technologies. Continued R&D efforts improved processes and widened the range of viable waste materials for energy conversion.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the waste to energy market analysis from 2022 to 2032 to identify the prevailing waste to energy market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the waste to energy market forecast to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global waste to energy market trends, key players, market segments, application areas, and market growth strategies.

Waste to Energy Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 56 billion |

| Growth Rate | CAGR of 4.7% |

| Forecast period | 2022 - 2032 |

| Report Pages | 250 |

| By Technology |

|

| By Region |

|

| Key Market Players | MVV Energie AG, Suez, Keppel Infrastructure Group, Veolia, Babcock & Wilcox Enterprises, Inc., China Everbright Environment Group Limited., Wheelabrator Technologies Inc., Hitachi Zosen Inova AG, Viridor Limited, Covanta Holding Corporation |

Analyst Review

According to the opinions of various CXOs of leading companies, the waste to energy market is expected to witness significant traction during the forecast period. Surge in demand for renewable energy and rise in environmental concerns & regulations are projected to propel the waste to energy market during the forecast period.

WtE involves converting various organic materials such as municipal solid waste, agricultural residues, and organic waste into usable energy forms such as electricity or heat. WtE is gaining traction owing to surge in focus on decarbonization in the energy sector. In addition, integration with other renewable energy systems enhances overall energy efficiency and increases the appeal of WtE solutions.

Furthermore, government policies and international agreements promoting renewable energy technologies contribute significantly toward the expansion of WtE initiatives. These supportive regulations encourage the adoption of sustainable waste management practices, thereby augmenting the growth of waste to energy market during the forecast period.

The global waste to energy market was valued at $35.6 billion in 2022, and is projected to reach $56.0 billion by 2032, growing at a CAGR of 4.7% from 2023 to 2032.

Thermal segment is the leading technology of waste to energy market.

Europe is the largest regional market for waste to energy market.

The surge in demand for renewable energy and a rise in environmental concerns and regulations are the leading drivers for the waste to energy market.

Rising energy demand and sustainable solutions are the upcoming trends of waste to energy market in the world.

Asia-Pacific is the fastest growing region for the waste to energy market.

Key players in the waste to energy market include Babcock & Wilcox Enterprises, Inc., China Everbright Environment Group Limited, Covanta Holding Corporation, Hitachi Zosen Inova AG, Keppel Infrastructure Group, MVV Energie AG, Suez, Veolia, Viridor Limited, and Wheelabrator Technologies Inc.

Loading Table Of Content...

Loading Research Methodology...