Water As A Fuel Market Research, 2032

The global water as a fuel market was valued at $4.1 billion in 2022 and is projected to reach $13.4 billion by 2032, growing at a CAGR of 12.5% from 2023 to 2032.

Key Report Highlighters:

- The water as a fuel market has been analyzed in terms of value ($ million), covering more than 15 countries.

- For growth prediction, we have looked into historical trends including present and future activities of key business players.

- The report covers detailed profiling of the major 10 market players.

Water in its pure or raw form cannot be used as a direct fuel. Since water molecules are highly stable, they require a high amount of energy to separate. It consumes much more energy than the energy produced during the chemical reaction. Thus, it can never be used as a direct fuel. However, water is used for the production of hydrogen (H2) and oxyhydrogen (HHO). In electrolysis, water molecules are separated into H2 and O through electricity.

Since governments across the globe are pushing through for energy transition for a clean energy economy, the demand for hydrogen has increased several folds. According to the World Bank, the demand for hydrogen reached an estimated 87 million metric tons (MT) in 2020 and is expected to grow to 500–680 million MT by 2050. From 2020 to 2021, the hydrogen production market was valued at $130 billion and is estimated to grow up by 9.2% per year through 2030. Hydrogen is entirely supplied from fossil fuels. Around 6% of total global natural gas and around 2% of total global coal are used for hydrogen production through fossil fuels. As a consequence, the production of hydrogen is responsible for carbon dioxide (CO2) emissions of around 830 million tons per year (MtCO2/year).

Hydrogen is considered a building block for a clean energy economy. Hydrogen is used as feedstock in many industrial, metallurgical, and chemical processes. It can be used in fuel cell technology where it is used for producing heat, electricity, and water. It has several applications in the transportation industry. The surge in potential for hydrogen demand acts as a major driving factor for water as a fuel market growth. Hydrogen is majorly used to produce ammonia, of which 80% is used for fertilizer production. This contributes to the growth of water as a fuel industry.

However, the high cost of water as a fuel and relatively higher energy consumption in the production process when compared to other fuels restrain the water as a fuel market growth. As hydrogen is highly volatile and inflammable, extensive safety procedures need to be followed, which further adds to the final cost and thus acts as a market constraint.

Similarly, oxyhydrogen (HHO) is produced through water electrolysis. Oxyhydrogen is a mixture of diatomic hydrogen and oxygen. On combustion, the gas produces water and a remarkably high amount of energy. The energy produced is 142.35 kJ (34,116-gram calories) of heat for each gram of hydrogen burned. Oxyhydrogen is used for cutting and welding metals, glass, and some plastics.

Hydrogen is rapidly being used for power generation as a clean energy source. Since the hydrogen generated from electrolysis leaves out a lower carbon footprint, thus the hydrogen generated through electrolysis is used as a conventional energy alternative. The transportation sector is one of the major contributors to carbon emissions. Therefore, the industry is continuously seeking ways to reduce its carbon footprint.

Electric vehicles that run on fuel cells or batteries serve as an ideal way for the transportation industry to lower its carbon emissions. Hydrogen is required in many industrial sectors. For example, in the food industry, hydrogen is used to make hydrogenated vegetable oils such as margarine and butter. Similarly, in some industries, it is used as feedstock to power the energy requirement during processing or operational activities. Such uses of hydrogen as industry feedstock drive the demand for on-site hydrogen generation plants.

Scientists have been contemplating a hypothetical concept to run vehicles on actual water. The concept is to use water directly as fuel and then use electrolysis to split water molecules and use hydrogen directly in the vehicle engine. However, the amount of energy required is far more than the energy produced, and thus running vehicles by using water cannot be practically achieved. This led to many international patents and was termed as pseudoscience and later on, was found to be investment fraud. Thus, water as fuel is not to be confused with the fact that actual vehicles can be run on water, however, rather be treated as indirect fuel to produce hydrogen and oxyhydrogen, which can further become fuel in several applications.

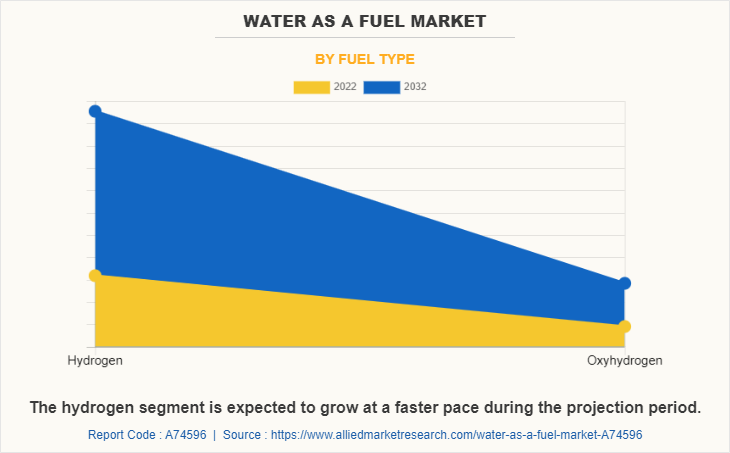

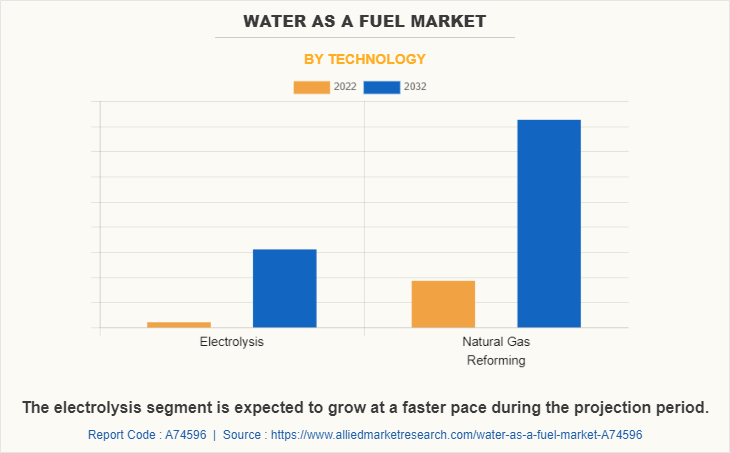

The water as a fuel market size is segmented on the basis of fuel type, technology, and region.

By fuel type, the water as a fuel market is bifurcated into hydrogen and oxyhydrogen. The hydrogen segment dominated the water as a fuel market share in 2022. The same is expected to grow at a higher CAGR owing to the development of new green hydrogen plants and commitment to the decarbonizing economy, and the development of new efficient technologies encourages the market growth for water as a fuel.

Hydrogen is produced through electrolysis, burning coal, and steam reforming of natural gas. In addition, there are several types of hydrogen produced depending on the source and method of its production. Blue, green, and gray/black hydrogen are the most commonly produced forms. Majorly, methane is used for producing blue hydrogen. However, to term it as blue hydrogen, the carbon emission during the process is captured at the location and is stored for further utilization in any way or form.

Oxyhydrogen is a mixture of hydrogen and oxygen. It is a gaseous mixture of two parts of hydrogen and one part of oxygen (HHO). It has the same ratio as water, which is 2:1. It is most widely used for welding purposes. It is produced through the electrolysis of water, where electric current is used to separate hydrogen and oxygen from the water molecules.

Depending on the technology, the market is classified into electrolysis and natural gas reforming. the natural gas reforming segment dominated the market share in 2022. This can be attributed to the fact that producing hydrogen from natural gas is relatively cheaper than through electrolysis. However, rising projects for green and blue hydrogen production are positively impacting electrolysis technology growth, and thus electrolysis segment is projected to grow at a higher CAGR during the water as a fuel market forecast.

Electrolysis is a process of converting water into hydrogen and oxygen molecules when electricity is applied. This is done through devices called electrolyzers. The electrolyzer systems are used for breaking water into hydrogen and oxygen through electrolysis. The electrolyzers consist of a cathode, an anode, and a membrane. Hydrogen is collected on the cathode side, which is further stored for use in various industries. Oxygen is either released into the atmosphere or collected and used in further industrial processes. It is estimated that around 95% of the hydrogen produced is from fossil fuels. 1-4% of hydrogen is produced through electrolysis.

Natural gas contains methane (CH4), which when subjected to the thermal process, produces hydrogen. The thermal process may be steam reformation or partial oxidation. Steam-methane reforming is the most widely used method of hydrogen production. Steam reforming is an endothermic reaction that requires an external heat supply for the process to occur. In this method, methane is made to react with steam under the pressure of 3-25 bar in the presence of a catalyst. The result is hydrogen, carbon monoxide, and carbon dioxide. Furthermore, steam and carbon monoxide are made to react to produce more hydrogen and carbon dioxide.

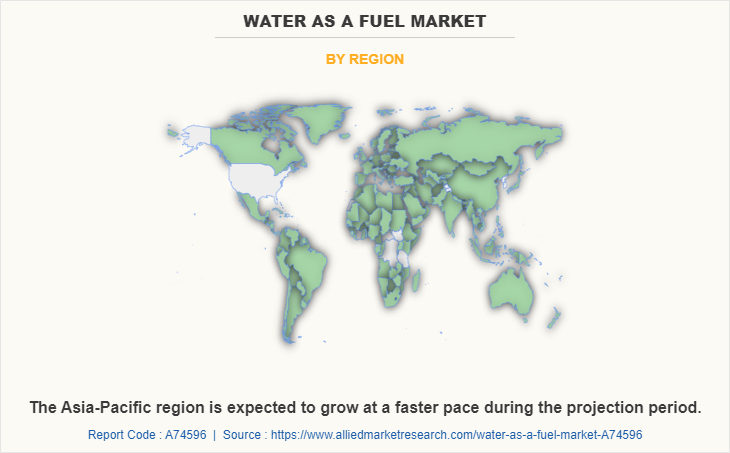

By region, the water as a fuel market analysis is done across North America, Europe, Asia-Pacific, and LAMEA (Latin America, the Middle East, and Africa). North America dominated the water as a fuel market share for 2022. This is attributed to a rise in activities in the on-site application of electrolyzers in the region. The presence of big corporations that produce hydrogen with major applications in the automobile and industrial sectors drives the demand for water as a fuel.

Asia-Pacific is projected to grow at a higher CAGR during the forecast period. Asia-Pacific is a large consumer of electric vehicles, which drives the demand for hydrogen fuel cells. China dominated the world hydrogen market being the largest producer as well as consumer of the product. China consumes around 24 million tons of hydrogen annually.

The major players operating in the water as a fuel industry are Panasonic Corporation, Plug Power Inc., FuelCell Energy Inc., Linde plc, Iberdrola SA, Exxon Mobil Corporation, Orsted AS, Air Liquide, China Petroleum and Chemical Corporation, and Enel Green Power SpA. The players in the industry have majorly adopted agreement as a key strategy for sustaining market competition. For example,

- In November 2022, Australian renewable green energy developer Fortescue Future Industries (FFI) and Enel's global renewables arm Enel Green Power S.p.A. (EGP), announced that they will partner together to explore co-development of the green hydrogen value chain with an initial focus on Latin America and Australia. The partnership will support FFI and EGP in their goals to not only diversify future energy supply and increase energy security, but also to help the world in its fight to lower emissions and fight climate change.

- In September 2022, Orsted A/S and Williams have signed a memorandum of understanding (MOU) to explore potential jointly developed Power-to-X projects in the US. As part of this agreement, the parties are exploring large-scale wind energy, electrolysis, and synthetic gas-via-methanation co-development in western Wyoming where Williams owns a significant land area and natural gas infrastructure.

- In March 2022, ExxonMobil planned a hydrogen production plant and one of the world's largest carbon capture and storage projects at its integrated refining and petrochemical site at Baytown, Texas, supporting efforts to reduce emissions from company operations and local industry. The proposed hydrogen facility would produce up to 1 billion cubic feet per day of “blue” hydrogen, which is an industry term for hydrogen produced from natural gas and supported by carbon capture and storage. The carbon capture infrastructure for this project would have the capacity to transport and store up to 10 million metric tons of CO2 per year, more than doubling ExxonMobil's current capacity.

- In February 2022, China Petroleum and Chemical Corporation held launching ceremonies for its first hydrogen demonstration project in the Inner Mongolia Autonomous Region, the Inner Mongolia Erdos Wind-Solar Green Hydrogen Project. The Project will utilize the rich solar and wind energy resources in the Erdos region to produce green hydrogen directly, projecting to reach an annual production capacity of 30,000 tons of green hydrogen and 240,000 tons of green oxygen.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the water as a fuel market analysis from 2022 to 2032 to identify the prevailing water as a fuel market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the water as a fuel market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global water as a fuel market trends, key players, market segments, application areas, and market growth strategies.

Water as a fuel Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 13.4 billion |

| Growth Rate | CAGR of 12.5% |

| Forecast period | 2022 - 2032 |

| Report Pages | 300 |

| By Fuel Type |

|

| By Technology |

|

| By Region |

|

| Key Market Players | Plug Power Inc., Enel Green Power Spa, Linde plc, Orsted A/S, Panasonic, Air Liquide, ExxonMobil, Iberdrola S.A., FuelCell Energy Inc, China Petroleum & Chemical Corporation |

Analyst Review

According to the insights from the CXO’s, hydrogen is projected to contribute around 15-17% to the energy mix by 2050. Water as a fuel leaves a lower carbon footprint for the production of hydrogen. Hydrogen is projected to contribute around 15-17% to the energy mix by 2050. Green hydrogen leaves a lower carbon footprint than other forms of hydrogen. This will aid in decarbonizing the carbon extensive economy and lead to a clean energy economy. Hydrogen production can be boosted by encouraging investments from both government and the public. Moreover, building infrastructure to support the safe transmission and storage of the product is expected to enable hydrogen production. Furthermore, scaling up green and blue hydrogen production capacities and capabilities of the supply chain also drives the water as a fuel industry growth. However, the lack of a policy framework and the high cost of clean hydrogen production compared to conventional methods hampers the market growth. Meanwhile, a proper regulatory framework for boosting investments in the sector will open wide opportunities for industry growth in the future.

Natural gas Reforming technology is the leading technology of Water as a fuel Market.

Growth in the application of hydrogen, net-zero targets aiming to decarbonize the economy, and a rise in demand for hydrogen as alternative fuel are the upcoming trends of Water as a fuel Market in the world.

Water as a fuel market is estimated to reach $13.4 billion by 2032.

North America is the largest regional market for Water as a fuel.

Panasonic Corporation, Plug Power Inc., FuelCell Energy Inc., Linde plc, Iberdrola SA, Exxon Mobil Corporation, Orsted AS, Air Liquide, China Petroleum and Chemical Corporation, and Enel Green Power SpA are the top companies to hold the market share in Water as a fuel.

Loading Table Of Content...

Loading Research Methodology...