Water Treatment Chemicals Market Size & Insights:

The global water treatment chemicals market was valued at $37.5 billion in 2022 and is projected to reach $53.8 billion by 2032, growing at a CAGR of 3.8% from 2023 to 2032.

Introduction

Water treatment chemicals are substances used to improve the quality of water by eliminating impurities and contaminants. These chemicals play a crucial role in purifying water for consumption, industrial processes, and environmental protection. Common water treatment chemicals include coagulants, flocculants, disinfectants, pH adjusters, and corrosion inhibitors. Coagulants promote the aggregation of particles, aiding in their removal through sedimentation or filtration. Flocculants encourage the formation of larger particles for easier removal. Disinfectants, such as chlorine or ozone, eliminate harmful microorganisms. pH adjusters regulate the acidity or alkalinity of water to meet specific standards. Corrosion inhibitors protect pipes and equipment from degradation. Effective water treatment chemicals ensure compliance with regulatory standards, prevent waterborne diseases and safeguard infrastructure. Proper dosing and application of these chemicals are essential for optimizing water treatment processes and maintaining the health and safety of water supplies.

Key Takeaways:

Quantitative information mentioned in the global water treatment chemicals market report includes the market numbers in terms of value ($Million) and volume (Kilotons) with respect to different segments, pricing analysis, annual growth rate, CAGR (2023-32), and growth analysis.

The analysis in the report is provided based on type and end-use industry, and region. The study will also contain qualitative information such as the market dynamics (drivers, restraints, opportunities), Porter’s Five Force Analysis, key regulations across the region, and value chain analysis.

- Top companies, included in the water treatment chemicals market are Akzo Nobel N.V., Baker Hughes Company, BASF SE, Cortec Corporation, Ecolab, Italmatch Chemicals spa, Canadian Clear, Dober, and Kemira, hold a large proportion of the water treatment chemicals market.

- This report makes it easier for existing market players and new entrants to the water treatment chemicals business to plan their strategies and understand the dynamics of the industry, which ultimately helps them make better decisions.

Market Dynamics

Rising awareness of waterborne diseases is expected to drive the growth of the water treatment chemicals market. Increasing knowledge about the health risks associated with waterborne diseases such as cholera, typhoid, and dysentery has led to a higher demand for effective water treatment solutions. Water treatment chemicals are essential for disinfecting water and eliminating harmful pathogens, bacteria, and viruses, thereby reducing the risk of disease outbreaks and improving public health outcomes. In March 2025, the Canadian federal government announced a substantial investment of $258 million to enhance water and wastewater infrastructure nationwide, reflecting a commitment to improving water quality and treatment capabilities. Governments and health organizations are emphasizing the importance of clean water to prevent disease epidemics. This has resulted in more stringent laws and regulations that mandate the use of effective water treatment chemicals in both municipal and industrial settings. Compliance with these regulations further boosts the adoption of water treatment chemicals. Moreover, in April 2024, the U.S. Environmental Protection Agency (EPA) established its first enforceable limits on six per- and polyfluoroalkyl substances (PFAS) in drinking water, mandating near-zero levels within three years. This move aims to protect approximately 100 million Americans from these persistent chemicals.

However, the availability of alternatives is expected to restrain the growth of the water treatment chemicals market. The availability and increasing adoption of non-chemical water treatment technologies such as ultraviolet (UV) disinfection, reverse osmosis (RO), and biological treatment systems present a significant restraint to the growth of the water treatment chemicals market. As these alternative methods gain traction for being more environmentally friendly and often more effective for specific applications, they are gradually reducing the reliance on conventional chemical-based treatment solutions. In 2023, the Indian government completed 38 water treatment projects and sanctioned 45 new ones, including 21 sewage treatment projects, many incorporating UV disinfection technologies to enhance water quality.

Moreover, innovation in green & bio-based chemicals for water treatment is expected to provide lucrative opportunities in the water treatment chemicals market. Green water treatment chemicals are typically derived from plant-based sources or developed through biotechnological processes, such as fermentation. These include bio-polymers used as coagulants and flocculants, naturally occurring acids for pH control, and enzymes that can replace harsh oxidizing agents. Unlike traditional chemicals, which may persist in the environment or form harmful by-products, green chemicals are designed to break down into harmless substances after use, reducing the risk of water pollution and aquatic toxicity. In December 2024, the New South Wales government initiated a $3.5 million project to install advanced filtration systems, including Granular Activated Carbon and ion exchange resins, to address elevated PFAS levels in the Blue Mountains' water supply.

Segments Overview:

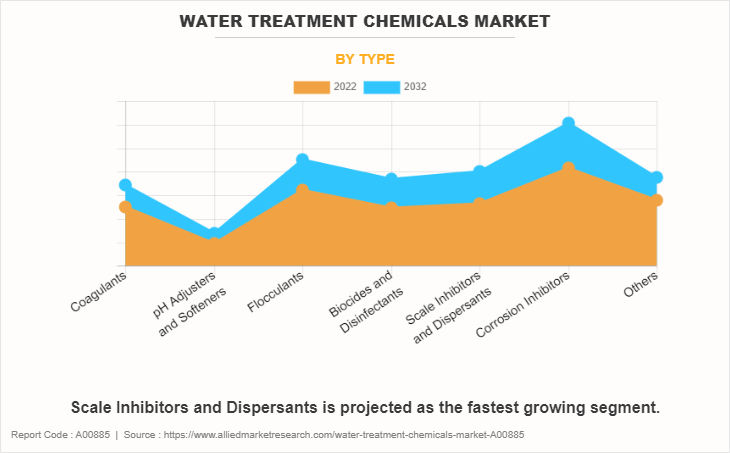

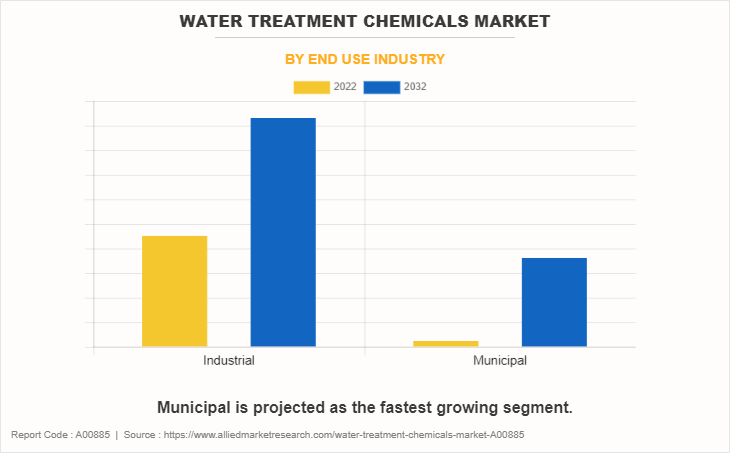

The global water treatment chemicals market is segmented into type, end-use industry, and region. By type, the market is fragmented into coagulants, PH adjusters & softeners, flocculants, biocides & disinfectants, scale inhibitors & dispersants, corrosion inhibitors, and others. Based on end-use industry, it is categorized into industrial and municipal. Region-wise, it is studied across North America, Europe, Asia-Pacific, and LAMEA.

On the basis of type, the corrosion inhibitors segment accounted for the largest share in 2022. The demand for corrosion inhibitors is on the rise due to expanding industrial activities, growing infrastructure development, and the increasing use of metals in various sectors. As industries strive for efficiency and longevity, corrosion inhibitors become essential in preventing deterioration and ensuring equipment durability. In November 2024, the U.S. Environmental Protection Agency's revisions to the Lead and Copper Rule (LCR) have increased the demand for corrosion inhibitors that minimize lead leaching in water systems. Municipalities have been allocating substantial budgets to comply with these requirements, emphasizing the need for effective corrosion control chemicals. Scale inhibitors and dispersants is expected to register the highest CAGR of 4.4%. The increasing demand for scale inhibitors and dispersants is driven by the expanding industrial processes, particularly in oil and gas production. As operational scales rise, the risk of scale formation and system fouling grows, necessitating effective chemical solutions to mitigate these challenges and ensure optimal process efficiency.

On the basis of end use industry, the industrial segment accounted for the largest share in 2022. The common industrial applications of water treatment chemicals is in boiler water treatment, where chemicals like oxygen scavengers, scale inhibitors, and anti-foaming agents are used to enhance heat transfer efficiency and extend the lifespan of equipment. Companies like SUEZ and Ecolab have introduced eco-friendly boiler water treatment chemicals, such as phosphate-free corrosion inhibitors and biodegradable antifoaming agents, aligning with global sustainability goals. Municipal is expected to register the highest CAGR of 4.0%. In municipal water systems, these chemicals are used at various stages of treatment to remove contaminants, control microbial growth, and improve water quality. One of the primary uses of water treatment chemicals is in coagulation and flocculation, where chemicals like aluminum sulfate (alum) and ferric chloride are added to destabilize suspended particles and promote their aggregation into larger flocs. In May 2025, Laredo, Texas, U.S., an $11.3 million project was approved to replace over 30,000 feet of aging waterlines using trenchless technology, aiming to reduce water loss and improve system reliability.

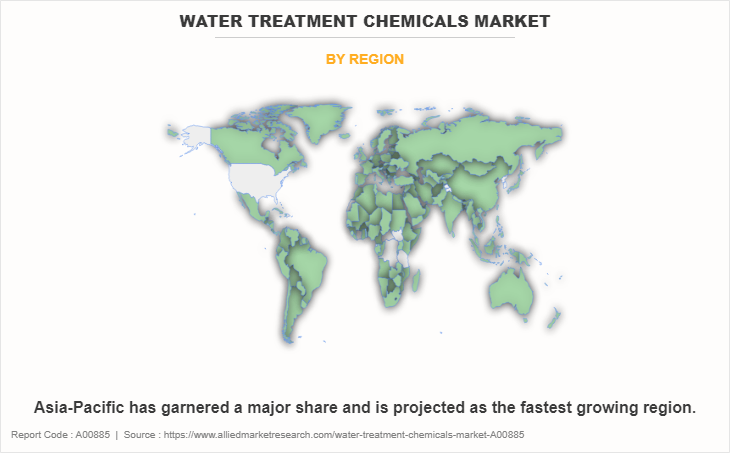

Asia-Pacific garnered the largest share in 2022. The usage of water treatment chemicals in Asia-Pacific countries has been growing steadily due to increasing industrialization, urbanization, and heightened awareness of water quality and safety standards. In countries like China, India, Japan, South Korea, and Australia, the demand for these chemicals is driven by the need to treat both municipal and industrial wastewater, ensuring safe drinking water and compliance with stringent environmental regulations. In September 2022, Toray established the Toray India Water Research Center in Chennai to enhance research and development in water treatment membrane technology, aiming to meet India's growing water treatment demands.

Competitive Analysis:

The major players operating in the global water treatment chemicals market include Akzo Nobel N.V., Baker Hughes Company, BASF SE, Cortec Corporation, Ecolab, Italmatch Chemicals spa, Canadian Clear, Dober, Kemira, Hydrite Chemical, Dow, Lonza, Nouryon, Solenis, Solvay, American Water Chemicals, Inc., Kurita Water Industries Ltd., SNF, US WATER SYSTEMS INC., and Veolia.

Recent Key Developments in the Water Treatment Chemicals Market

In November 2024, Ecolab acquired Barclay Water Management, a company specializing in water safety and digital monitoring solutions for industrial and institutional clients. This acquisition enhances Ecolab's capabilities in water treatment and safety.

In August 2024, Ecolab's subsidiary, Nalco Water, partnered with Danieli to enhance industrial water treatment solutions for the metal industry. This collaboration aims to improve metal production efficiency and minimize environmental impacts.

In November 2023, Kemira announced that its ferric sulfate water treatment chemicals production facility in Goole, UK, has been significantly expanded in capacity. The new and stricter Asset Management Plan 7 and 8 regulations on phosphorus and other nutrient discharge from wastewater treatment set out in the UK's Water Industry National Environment Program help meet the growing demand for coagulants, which is met in part by the additional 70,000 tons of capacity investment. This expansion will strengthen the product portfolio of water treatment chemicals, leading to market growth.

In October 2023, Solenis, a leading manufacturer of specialty chemicals for water-intensive industries, acquired CedarChem LLC. CedarChem offers a wide range of water and wastewater treatment products for industrial and municipal uses, primarily in the southeastern U.S. The acquisition is by Solenis' direct go-to-market approach, which aims to give customers better chemical and wastewater treatment product and service solutions.

In September 2022, Solenis acquired Clearon Corp., expanding its portfolio of water treatment chemical products, particularly for residential and commercial pool and spa water treatment.

In August 2022, Nouryon announced an exclusive arrangement with Brenntag Specialties, which will make Brenntag Specialties the only distributor of its unique LumaTreat tagged polymers in the U.S. and Canada. Through this agreement, water treatment professionals will gain easier access to Nouryon's wide variety of specialty polymers as well as critical parts for commercial and industrial heating and cooling systems. Brenntag will distribute a variety of Nouryon's other water treatment technologies, such as Aquatreat, Versaflex, and Versa-TL polymers, which offer scale control and dispersancy and function as deposit-control agents to stop scale and debris from adhering to the heat transfer surfaces, in addition to the patented LumaTreat tagged polymers. This agreement will boost the growth of the water treatment chemicals market.

In March 2021, Nouryon introduced LumaTreat, a novel range of water management products that are patent-filed and made of smart-tagged polymers. The fluorescent monomers used in LumaTreat products adhere to a deposit control agent. A Smart Tag that precisely monitors the amount of "free" or unused polymer in the water treatment system is made possible by the combination of the fluorescent monomer and deposit control polymer. This product launch will strengthen the demand for water treatment chemicals, leading to market growth.

In October 2023, Solenis, a leading manufacturer of specialty chemicals for water-intensive industries acquired CedarChem LLC. CedarChem offers a wide range of water and wastewater treatment products for industrial and municipal uses, primarily in the southeastern U.S. The acquisition is by Solenis' direct go-to-market approach, which aims to give customers better chemical and wastewater treatment product and service solutions.

In July 2020, Solenis completed the acquisition of Poliquímicos, S.A. de C.V. (Poliquímicos), a producer and supplier of specialized chemical solutions for water-intensive industries in Mexico. The acquisition of Poliquímicos will strengthen Solenis' direct sales channel and expand its capacity for production in Mexico, leading to the growth of the water treatment chemicals market.

Public Policies on the Water Treatment Chemicals Market:

U.S.

The U.S. Environmental Protection Agency (EPA) regulates water treatment chemicals under the Safe Drinking Water Act (SDWA), setting legal limits for over 90 contaminants in drinking water.

The EPA mandates water-testing schedules, methods, and risk assessments for community water systems, with periodic updates and reviews of regulated and unregulated contaminants.

Certification standards such as NSF/ANSI/CAN 60 are required for chemicals used in potable water treatment, ensuring they do not pose health risks at approved dosages.

European Union

The EU updated its Urban Wastewater Treatment Directive in January 2025, expanding requirements for advanced treatment (including removal of micropollutants and nutrients like nitrogen and phosphorus) and tightening effluent standards.

The directive enforces the "polluter pays" principle, requiring industries (e.g., pharmaceuticals, cosmetics) to cover at least 80% of advanced treatment costs for micropollutant removal.

By 2035, all urban areas with over 1,000 inhabitants must have adequate wastewater collection and treatment, with tertiary treatment becoming mandatory for large plants by 2039.

Socioeconomic Impact on the Water Treatment Chemicals Market:

The ongoing Russia–Ukraine war and the persistent challenges posed by the COVID-19 pandemic have significantly impacted the global water treatment chemicals industry. The conflict in Eastern Europe has disrupted supply chains and heightened geopolitical tensions, leading to increased volatility in commodity prices, including those of crucial water treatment chemicals. The uncertainty surrounding the availability of raw materials, such as chlorine and alum, essential for water treatment processes, has resulted in supply chain disruptions and elevated production costs. This has subsequently translated into higher prices for water treatment chemicals, affecting both suppliers and end users.

Simultaneously, the COVID-19 pandemic has further strained the water treatment chemicals market. The increased focus on public health and sanitation measures to curb the spread of the virus has driven up the demand for water treatment chemicals, especially in industries such as healthcare, municipal water treatment, and pharmaceuticals. However, lockdowns, travel restrictions, and workforce shortages have impeded the production and distribution of these chemicals, causing supply–demand imbalances.

Moreover, the economic downturn triggered by the pandemic has led to budget constraints for municipalities and industrial facilities, affecting their ability to invest in water treatment solutions. As countries navigate the dual challenges of the Russia–Ukraine conflict and the ongoing pandemic, the water treatment chemicals market faces a complex landscape with shifting dynamics. Industry stakeholders must adapt to these multifaceted challenges, balancing the need for effective water treatment solutions with the economic constraints imposed by geopolitical uncertainties and the global health crisis.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the water treatment chemicals market analysis from 2022 to 2032 to identify the prevailing water treatment chemicals market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the water treatment chemicals market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global water treatment chemicals market trends, key players, market segments, application areas, and market growth strategies.

Water Treatment Chemicals Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 53.8 billion |

| Growth Rate | CAGR of 3.8% |

| Forecast period | 2022 - 2032 |

| Report Pages | 1108 |

| By End Use Industry |

|

| By Type |

|

| By Region |

|

| Key Market Players | American Water Chemicals, Inc., Kurita Water Industries Ltd., SNF, Ecolab, Dow, Cortec Corporation, Solenis, BASF SE, Akzo Nobel N.V., Solvay, Veolia, Dober, Baker Hughes Company, Italmatch Chemicals S.p.A, Hydrite Chemical, US WATER SYSTEMS INC, Kemira, Canadian Clear, Nouryon, Lonza |

Analyst Review

According to the insights of the CXOs of leading companies, the water treatment chemicals market has been witnessing several notable trends and developments. One prominent trend is the growing emphasis on sustainable and eco-friendly water treatment solutions. With increasing environmental awareness and stringent regulations, the demand for chemicals that have minimal environmental impact and are effective in treating water pollutants has increased considerably.

In addition, advancements in technology have spurred innovations in water treatment chemicals. Companies are investing in research and development to introduce novel chemicals that offer improved efficiency, cost-effectiveness, and safety in water treatment processes. Furthermore, nanotechnology is gaining traction, enabling the development of nano-scale water treatment chemicals for enhanced performance.

The CXOs further added that the global water scarcity issue has led to an increased focus on water reuse and recycling, driving the demand for specialized chemicals that can facilitate these processes. This includes chemicals for advanced wastewater treatment and the removal of specific contaminants such as heavy metals and emerging pollutants. As industries strive to reduce their water footprint and comply with increasingly stringent regulations, the water treatment chemicals market is expected to witness continued growth. Key players are likely to focus on strategic collaborations and partnerships to expand their product portfolios and geographical presence, ensuring they stay at the forefront of this dynamic and evolving market.

The global water treatment chemicals market was valued at $37.5 billion in 2022, and is projected to reach $53.8 billion by 2032, growing at a CAGR of 3.8% from 2023 to 2032.

The Water Treatment Chemicals Market is studied across North America, Europe, Asia-Pacific, and LAMEA.

Asia-Pacific is the largest regional market for Water Treatment Chemicals.

The global water treatment chemicals market is into type, end-use industry, and region. By type, the market is fragmented into coagulants, pH adjusters & softeners, flocculants, biocides & disinfectants, scale inhibitors & dispersants, corrosion inhibitors, and others. On the basis of end-use industry, it is bifurcated into industrial and municipal.

Municipal is the leading end-use industry of Water Treatment Chemicals Market.

The major players operating in the global water treatment chemicals market include Akzo Nobel N.V., Baker Hughes Company, BASF SE, Cortec Corporation, Ecolab, Italmatch Chemicals spa, Canadian Clear, Dober, Kemira, Hydrite Chemical, Dow, Lonza, Nouryon, Solenis, Solvay, American Water Chemicals, Inc., Kurita Water Industries Ltd., SNF, US WATER SYSTEMS INC., and Veolia.

Utilization of the 3R method of sustainability is the upcoming trend of Water Treatment Chemicals Market in the world.

Loading Table Of Content...

Loading Research Methodology...