Water Treatment Equipment Market Size & Insights:

The global water treatment equipment market was valued at $54.3 billion in 2022, and is projected to reach $93.9 billion by 2032, growing at a CAGR of 5.7% from 2023 to 2032.

Introduction

Water treatment equipment refers to a wide range of technologies and machinery designed to improve the quality of water by removing contaminants, reducing harmful substances, and making it suitable for a specific end-use. These uses may include drinking, industrial processes, irrigation, or safe discharge into the environment. The equipment involved in water treatment plays a pivotal role in the global effort to maintain public health, protect the environment, and ensure a sustainable supply of clean water.

Municipal water treatment facilities use equipment to process water for human consumption and to treat wastewater before its return to natural water bodies. This includes equipment for sedimentation, filtration, chlorination, and sludge treatment. The goal is to ensure that drinking water meets health standards and that discharged wastewater does not harm aquatic ecosystems or human health. Municipalities employ a combination of primary, secondary, and tertiary treatment processes, including technologies like UV disinfection systems, membrane bioreactors, and chemical dosing systems. In addition, advanced water treatment techniques such as reverse osmosis (RO) and ultrafiltration (UF) are increasingly being adopted to address emerging contaminants and pharmaceutical residues.

Key Takeaways:

- Quantitative information mentioned in the global water treatment equipment market report includes the market numbers in terms of value (USD Million) with respect to different segments, pricing analysis, annual growth rate, CAGR (2023-32), and growth analysis.

- The analysis in the report is provided based on type, and end-use industry. The study will also contain qualitative information such as the market dynamics (drivers, restraints, opportunities), Porter's Five Force Analysis, key regulations across the region, and value chain analysis.

- A few companies, including Calgon Carbon Corporation, Culligan Water, Ecolab, General Electric, Hydranautics, Pentair, Lenntech B.V., Suez, Veolia, and Xylem, hold a large proportion of the water treatment equipment market.

- This report makes it easier for existing market players and new entrants to the prepreg business to plan their strategies and understand the dynamics of the industry, which ultimately helps them make better decisions.

Market Dynamics

Increasing demand for clean and potable water is expected to drive the growth of the water treatment equipment market. As cities expand and rural populations migrate toward urban centers, the strain on municipal water supply systems intensifies. Simultaneously, industrial facilities ranging from manufacturing plants to refineries—require large volumes of high-quality water for various processes. This dual pressure from residential and industrial sectors is fueling the need for advanced water treatment infrastructure that can meet rising consumption demands while ensuring regulatory compliance and public health standards. In May 2023, Jordan initiated the Aqaba Amman Water Desalination and Conveyance Project, aiming to produce about 300 million cubic meters of clean drinking water annually. This project, supported by international donors including the EU and USAID, will utilize solar power and reverse osmosis technology to address the country's water scarcity. Moreover, in September 2023, Uganda launched the Masaka–Mbarara Water Supply and Sanitation Project to serve approximately 1 million people by 2030. The project includes the construction of water treatment plants and expansion of sewer networks, funded by the French Development Agency and the European Union. Governments are prioritizing investments in water treatment technologies to maximize existing water supplies and encourage reuse and recycling of equipment. These efforts include upgrading aging infrastructure, promoting decentralized treatment systems, and supporting public-private partnerships to improve water access, particularly in water-stressed areas.

However, high capital and operational costs are expected to restrain the growth of the water treatment equipment market. High capital and operational costs remain a significant barrier to the widespread adoption of advanced water treatment technologies. The initial investment required to install systems such as reverse osmosis (RO), ultraviolet (UV) disinfection, and membrane bioreactors (MBRs) can be substantial. These technologies, while highly effective in removing contaminants and ensuring water quality, often involve sophisticated components, automation systems, and specialized infrastructure, which drive installation expenses. For instance, the U.S. Environmental Protection Agency (EPA) estimates that the average annual operating cost for a typical municipal wastewater treatment plant in the U.S. ranges from $500,000 to $2 million, depending on the facility’s size and complexity. Advanced technologies like membrane filtration or reverse osmosis further increase costs, sometimes adding up to $1 million per year in maintenance for larger plants due to the need for specialized personnel and frequent membrane replacements.

Moreover, digitalization and smart water networks are expected to provide lucrative opportunities in the water treatment equipment market. One of the most impactful benefits of digitalization is the ability to implement predictive maintenance strategies. AI algorithms can analyze historical and real-time data to predict equipment failures or identify when components, such as filters or membranes, need servicing before issues escalate. This reduces downtime, extends the lifespan of equipment, and minimizes operational costs. Additionally, smart water networks facilitate remote management and automation, which is especially valuable for decentralized or rural systems where on-site staffing may be limited. In April 2025, the Environmental Protection Agency (EPA) implemented stringent water conservation regulations, mandating the use of smart technologies in water management. Federal and state funding programs, such as the Water Infrastructure Finance and Innovation Act (WIFIA), have allocated over $6 billion in loans and grants for water infrastructure upgrades since their inception. Also, in February 2025, a consortium led by Veolia and IBM secured a $750 million project from the Singapore government to develop and implement an AI-driven smart water management system for the entire city-state by 2030.

Segments Analysis:

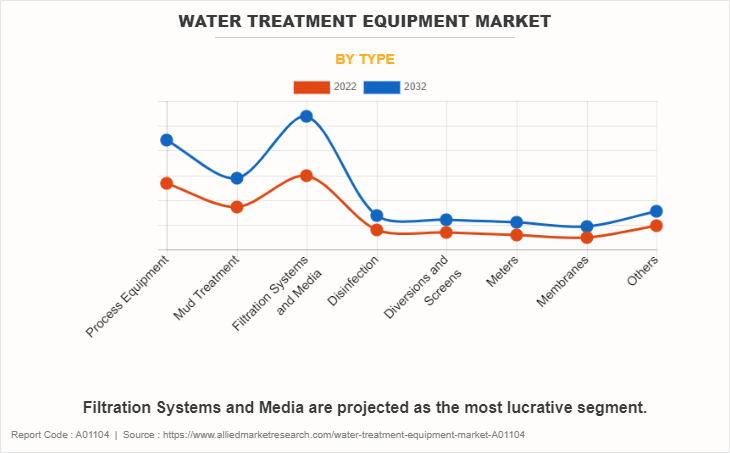

The water treatment equipment market is segmented into type, end-use industry, and region. On the basis of type, the market is fragmented into process equipment, mud treatment, filtration systems & media, disinfection, diversions & screens, meters, membranes, and others. On the basis of end-use industry, the market is categorized into industrial water treatment equipment and municipal water treatment equipment. Region-wise, it is studied across North America, Europe, Asia-Pacific, and LAMEA.

By type, the filtration systems & media segment held the largest water treatment equipment market share in 2022 and is expected to register the highest CAGR during the forecast period. Water treatment equipment plays a vital role in ensuring clean and safe water by utilizing various filtration systems and media to remove physical, chemical, and biological contaminants. In filtration systems, the choice of media is critical to achieving desired water quality. Common filter media include sand, gravel, anthracite, activated carbon, and specialty resins. Sand and gravel are typically used in multimedia filters to remove suspended solids and turbidity. In April 2024, Veolia has implemented over 30 treatment systems across four U.S. states to address per- and polyfluoroalkyl substances (PFAS) contamination. Utilizing technologies like activated carbon and nanofiltration, these systems have treated more than 2.1 billion gallons of water, effectively reducing PFAS levels below regulatory thresholds.

[ENDUSEINDUSTRYGRAPH]

By end-use industry, the municipal water treatment equipment segment held the largest water treatment equipment share in 2022. Municipal water treatment facilities rely heavily on a diverse range of water treatment equipment to ensure that water supplied to communities is safe, clean, and meets regulatory standards. These facilities typically handle large volumes of water from surface or groundwater sources and treat it through multiple stages, each requiring specific types of equipment tailored to remove contaminants, adjust chemical balances, and improve water quality for public consumption. In February 2023, the Democratic Republic of the Congo inaugurated a $72 million water treatment facility in Kinshasa, capable of processing 110,000 cubic meters of water daily, funded by the World Bank.

By region, the Asia-Pacific region dominated the water treatment equipment market. Water treatment equipment usage in Asia-Pacific countries has witnessed substantial growth in recent years, driven by rapid urbanization, industrialization, and the growing emphasis on environmental sustainability. Countries like China, India, Japan, and South Korea are leading the adoption of advanced water treatment technologies, spurred by increasing water scarcity and the need to treat wastewater for reuse. In China, strict environmental regulations and the government's “Beautiful China” policy have spurred investments in municipal and industrial water treatment infrastructure. In March 2023, India announced a planned investment of approximately $240 billion in the water sector, focusing on groundwater restoration and dam rehabilitation.

Competitive Analysis

Major players operating in the water treatment equipment market include Lenntech B.V., Ecolab, Veolia, Culligan Water, Calgon Carbon Corporation, Suez, Pentair, Hydranautics, Xylem, General Electric and others.

Recent Key Developments in the Water Treatment Equipment Market

In May 2023, Xylem Inc. completed its acquisition of Evoqua Water Technologies for $7.5 billion, creating the world's largest pure-play water technology company.

In April 2024, Thermax launched a modern manufacturing facility in Pune, focused on producing advanced water and wastewater treatment solutions. This milestone highlights Thermax’s dedication to resource conservation and long-term sustainability. Covering two acres, the facility reflects the company’s commitment to engineering excellence, driven by innovation, quality, and customer-centricity. Additionally, the facility will showcase Thermax’s latest technologies, such as softener and filter vessels, tubular membrane modules, and capacitive deionization solutions.

In May 2023, Jordan's largest water infrastructure initiative, this project plans to desalinate seawater from the Red Sea and transport it over 300 kilometers to Amman, producing about 300 million cubic meters of clean drinking water annually.

In 2024, the Uttar Pradesh Pollution Control Board (UPPCB) reported a 68.8% improvement in water quality across rivers and reservoirs, attributed to initiatives like the Namami Gange Mission and Swachh Bharat Abhiyan. The state enhanced wastewater treatment infrastructure by establishing 152 sewage treatment plants (STPs), with 141 operational and 126 meeting environmental standards.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the water treatment equipment market analysis from 2022 to 2032 to identify the prevailing water treatment equipment market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the water treatment equipment market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global water treatment equipment market trends, key players, market segments, application areas, and market growth strategies.

Water Treatment Equipment Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 93.9 billion |

| Growth Rate | CAGR of 5.7% |

| Forecast period | 2022 - 2032 |

| Report Pages | 286 |

| By End-use Industry |

|

| By Type |

|

| By Region |

|

| Key Market Players | General Electric, Lenntech B.V., Veolia, Xylem, Hydranautics, Ecolab, Suez, Culligan Water, Pentair, Calgon Carbon Corporation |

Analyst Review

According to the opinions of various CXOs of leading companies, the water treatment equipment market is driven by rapidly expanding industrialization sector, and awareness about environmental sustainability. Moreover, the Asia-Pacific region is projected to register robust growth, significantly from the emerging economies such as China, India, and Indonesia, as they have huge potential with regards to the adoption of water treatment equipment due to growth in population and supportive policies that are aimed to the treatment of wastewater. However, high equipment costs are expected to pose a threat to the water treatment equipment market. Furthermore, the presence of alternative water treatment processes such as UV radiation and membranes, among others, hampers the growth of this market.

The industry is characterized by a high number of new market entrants that seek to tap lucrative opportunities in the global market while existing players enter strategic collaborations to increase capacities & expand their reach into emerging markets. The joint venture, merger, and acquisition activities in the industry have increased significantly over the past decade. Companies constantly seek to establish long-term contract agreements with trusted partners for sustainable business operations globally.

Governments and regulatory bodies worldwide have been implementing strict water quality standards and regulations. These regulations have compelled industries to invest in advanced water treatment equipment to meet the required standards and ensure environmental compliance.

industrial water treatment equipment and municipal water treatment equipment application are the potential customers of Water Treatment Equipment market industry

Asia-Pacific region will provide more business opportunities for Water Treatment Equipment market in coming years.

The market players are adopting various growth strategies and also investing in R&D extensively to develop technically advanced unique products which are expected to drive the market size.

Calgon Carbon Corporation, Culligan Water, Ecolab, General Electric, Hydranautics, Pentair, Lenntech B.V., Suez, Veolia, and Xylem are the top players in Water Treatment Equipment market.

Loading Table Of Content...

Loading Research Methodology...