Wax Market Size & Insights:

The global wax market size was valued at $11.6 billion in 2020, and is projected to reach $16.7 billion by 2030, growing at a CAGR of 3.7% from 2021 to 2030. The rise in demand from various end-use industries is a significant driver for the global wax industry. Waxes are versatile materials that find applications across a wide range of sectors due to their unique properties, such as moisture resistance, smooth texture, and melting points.

Introduction

Wax is a versatile, organic compound that exists in solid form at room temperature but melts upon heating, exhibiting a smooth, water-resistant, and moldable texture. It is composed of long-chain hydrocarbons and can be derived from natural, synthetic, or petroleum-based sources. Natural waxes include beeswax, carnauba wax, and soy wax, while synthetic variants such as polyethylene wax are engineered for specific industrial applications. Wax is widely used in cosmetics, candles, packaging, coatings, adhesives, and polishes due to its lubricating, protective, and binding properties. Its ability to enhance moisture resistance, gloss, and durability makes it a crucial material in diverse industries, from food and pharmaceuticals to automotive and construction.

Key Takeaways

The wax market study covers 20 countries. The research includes a segment analysis of each country in terms of both value ($million) and volume (kiloton) for the projected period 2020-2030.

The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global wax markets and to assist stakeholders in making educated decisions in order to achieve their most ambitious growth objectives.

Over 3,700 product literatures, annual reports, industry statements, and other comparable materials from major industry participants were reviewed to gain a better understanding of the wax industry.

The wax market is highly fragmented, with several players including Akzo Nobel N.V., Baker Hugher Company, BASF SE, Cepsa, China National Petroleum Corporation, Evonik Industries AG, Exxon Mobil Corporation, HollyFrontier Sinclair Corporation, Honeywell International Inc., The International Group Inc. Also tracked key strategies such as acquisitions, product launches, mergers, expansion etc. of the players operating in the wax industry.

Market Dynamics

The growing demand for wax in packaging and coatings industries is a key driver of the wax market, fueled by the increasing need for moisture resistance, durability, and enhanced aesthetics in various applications. Wax is widely used in food packaging, corrugated boxes, and flexible packaging materials to provide a protective barrier against moisture and contaminants, ensuring product safety and longevity. In the coatings industry, wax additives improve the scratch resistance, gloss, and water repellency of paints, varnishes, and industrial coatings, making them essential in automotive, construction, and consumer goods applications. With the rise in e-commerce, food delivery services, and sustainable packaging solutions, the demand for wax-based coatings is increasing. In addition, innovations in bio-based and synthetic wax formulations are further expanding their applications, aligning with the global push for environmentally friendly and sustainable materials.

Waxes play a crucial role in the personal care and cosmetics industry. Beeswax is commonly used in lip balms, creams, and lotions due to its emulsifying properties and ability to create a barrier that retains moisture. It also offers a natural fragrance and color, making it a popular choice for organic products. Paraffin wax is used in hair removal products, where it is heated and applied to the skin for effective hair removal.

In the food industry, waxes serve multiple purposes, primarily as coatings and additives. Food-grade paraffin wax is used to coat fruits and vegetables to extend shelf life by reducing moisture loss and preventing spoilage. This practice helps maintain the appearance of produce, making it more appealing to consumers. Beeswax is also employed in food wrapping and packaging, providing a natural alternative to plastic. Products such as beeswax wraps are gaining popularity as eco-friendly food storage options. Waxes are utilized in the pharmaceutical industry for their binding and coating properties. They are often used in the production of tablets and capsules to control the release of active ingredients. Waxes can also be used to create protective coatings for sensitive medications, ensuring their stability and efficacy.

Increase in demand for wax in the cosmetics industry is expected to drive the growth of the wax market during the forecast period. Waxes play a crucial role in the formulation of many cosmetics, providing texture, stability, and a desirable finish. For instance, in lip care products, waxes help to create a smooth application and contribute to long-lasting wear. Similarly, in creams and lotions, they act as emollients, enhancing moisture retention and skin feel. The demand for natural and organic products is also reshaping the cosmetics landscape, with consumers increasingly seeking out products formulated with natural waxes such as beeswax, carnauba wax, and candelilla wax. This shift towards clean beauty not only drives the demand for traditional waxes but also creates opportunities for the development of innovative, eco-friendly formulations.

Moreover, the rise of social media and beauty influencers has played a significant role in shaping consumer preferences and driving trends within the cosmetics industry. As beauty standards evolve and new products gain popularity, the demand for specific formulations that utilize waxes increases. This is particularly evident in the growth of niche brands that focus on high-quality, specialized products, often emphasizing the use of premium waxes. According to Cosmetics Europe, the European cosmetics and personal care market reached EUR 80 billion (approximately $93.4 billion) in retail sales in 2021. The largest markets in Europe for these products are Germany, France, Italy, the UK, Spain, and Poland. In that same year, the industry employed over 255,111 individuals directly, with an additional 1.71 million jobs supported indirectly throughout the cosmetics value chain. Meanwhile, the Southeast Asian region, characterized by a dynamic and diverse emerging middle class, is expected to see increased cosmetics consumption driven by the significant purchasing power of its consumers.

However, fluctuating raw material prices are expected to hamper the growth of the wax market during the forecast period. Many traditional waxes, such as paraffin wax, are sourced from crude oil, making them vulnerable to the inherent volatility of oil prices. When crude oil prices rise, production costs for waxes also increase, which can lead to higher prices for consumers. This volatility not only affects manufacturers' profit margins but also complicates pricing strategies and long-term planning, contributing to market instability. The impact of fluctuating raw material prices extends beyond just the production costs of waxes. It can ripple through the entire supply chain, influencing everything from procurement to distribution. Manufacturers may face challenges in securing stable supply contracts, leading to potential shortages or delays in production. Furthermore, the unpredictability of raw material costs can deter investment in new projects or expansions, as companies become hesitant to commit resources in an uncertain economic environment.

Segments Overview

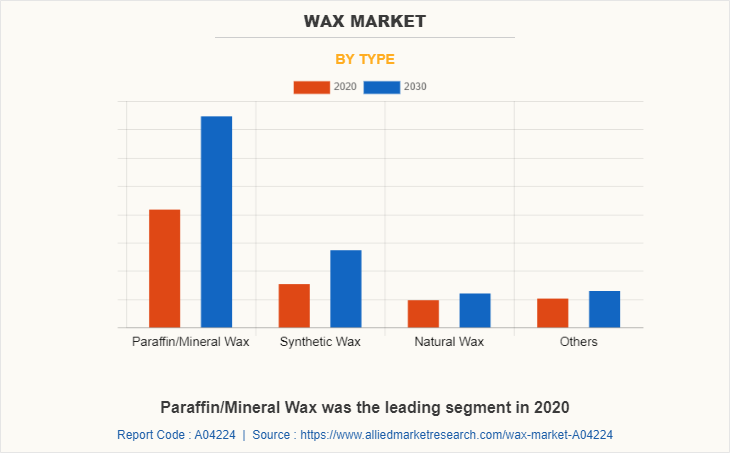

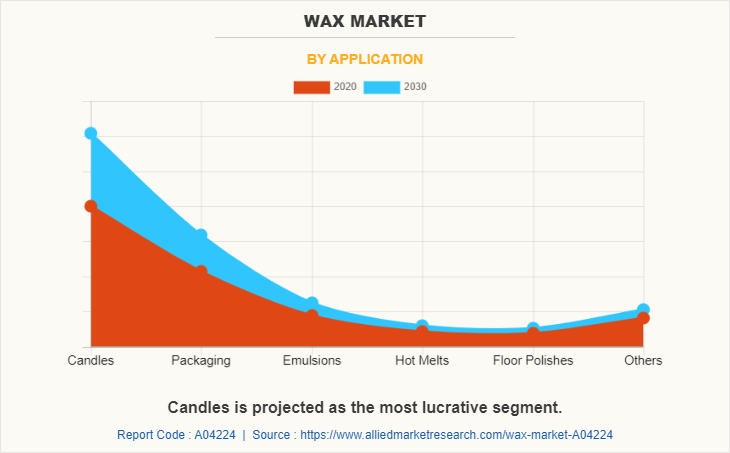

The wax market is segmented on the basis of type, application, and region. By type, the market is segregated into paraffin/mineral wax, synthetic wax, natural wax, and others. On the basis of application, it is fragmented into candles, packaging, emulsions, hot melts, floor polishes, and others. Region-wise, it is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

By Type

On the basis of type, paraffin/mineral wax dominated the wax market accounting for more than half of the market share in 2020. Paraffin wax, derived from petroleum, is one of the most widely used waxes across various industries due to its desirable properties, such as low cost, excellent moisture resistance, and versatility. In the cosmetics and personal care sector, paraffin wax is a key ingredient in products such as lip balms, creams, and lotions, where it helps provide texture, enhance moisture retention, and offer a smooth application. Its ability to form a protective barrier on the skin makes it particularly valuable in formulations aimed at providing hydration and preventing moisture loss.

By Application

On the basis of application, the candles segment dominated the wax market accounting for more than half of the market share in 2020. The use of wax in candle manufacturing is a significant aspect of the market, driven by both consumer preferences and innovative product developments. Candles have evolved from simple sources of light to multifunctional products used for ambiance, decoration, and aromatherapy. This shift has led to a diversification in the types of wax used in candle production, catering to various consumer demands. The rise in eco-conscious consumerism has led to a surge in demand for candles made from sustainable wax sources. Many consumers are now seeking candles that not only provide a pleasant aroma but also align with their values regarding environmental responsibility.

By Geography

Region-wise, Asia-Pacific dominated the wax market accounting for more than one third of the market share in 2020. The usage of wax in Asia-Pacific countries is witnessing significant growth, driven by the expansion of various end-use industries in the region. The cosmetics and personal care sector is one of the major consumers of wax, with countries such as China, India, and Japan leading the market. In these nations, the rising disposable incomes and changing lifestyles have fueled the demand for skincare and beauty products, where natural waxes such as beeswax and carnauba wax are increasingly favored for their skin-friendly properties. In the packaging sector, Asia-Pacific countries are experiencing a boom due to rapid urbanization and e-commerce growth. Nations such as China and India have seen a surge in demand for wax-coated packaging materials, particularly in food and beverage industries. Wax coatings provide essential moisture resistance and protection, making them ideal for packaging fresh produce and other perishables. As the region's middle class expands, the need for durable and high-quality packaging solutions is expected to drive the market further.

Competitive Analysis

The key players profiled in the wax market report include Akzo Nobel N.V., Baker Hugher Company, BASF SE, Cepsa, China National Petroleum Corporation, Evonik Industries AG, Exxon Mobil Corporation, HollyFrontier Sinclair Corporation, Honeywell International Inc., The International Group Inc. The global market report provides in-depth competitive analysis as well as profiles of these major players.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the wax market analysis from 2020 to 2030 to identify the prevailing the market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global wax market trends, key players, market segments, application areas, and market growth strategies.

Wax Market Report Highlights

| Aspects | Details |

| By Application |

|

| By Type |

|

| By Region |

|

| Key Market Players | BASF SE, china national petroleum corporation, Akzo Nobel N.V., Cepsa, The International Group Inc., Evonik Industries AG, Honeywell International Inc., Baker Hughes Company, HollyFrontier Sinclair Corporation, Exxon Mobil Corporation |

Analyst Review

Wax is hydrocarbon lipid that melts at temperatures above 40°C, resulting in a viscous liquid. Wax is mostly utilized in manufacturing industry, particularly for coatings. In addition, wax is widely utilized as a basic material for processing and as an additive. Wax is widely used in the manufacturing of metal items as a corrosion inhibitor. As the popularity of candles grows, so does the use of wax by companies that make a range of candles in various sizes, colors, and shapes. The increase in use of wax in many industries, including medicines, textiles, paints, coatings, and packaging is due to its particular qualities such as malleability, hydrophobicity, and solubility in organic nonpolar solvents.

The major factor driving the market studied is the increasing demand from the candle and packaging industries?. Growing personal care industry in the Asia-Pacific region? is the other factor driving the market studied.

The market players are adopting various growth strategies and also investing in R&D extensively to develop technically advanced unique products which are expected to drive the market size.

Asia-Pacific region will provide more business opportunities for wax market in coming years

Akzo Nobel N.V, Baker Hughes Company, BASF SE, Cepsa, China National Petroleum Corporation, Evonik Industries AG, Exxon Mobil Corporation, HollyFrontier Sinclair Corporation, Honeywell International Inc. are the top players in wax market.

By type segment holds the maximum share of the wax market

Candles, packaging, emulsions, hot melts, floor polishes, plastics & rubber, and pharmaceuticals application are the potential customers of wax industry

Increase in usage of waxes in the packaging industry significantly drives the growth of global wax market, as paraffin waxes used for packaging offer resistance towards heat. Moreover, rise in use of wax as a base ingredient in cosmetic products boosts the market growth.

The demand for the product is anticipated to be driven by the growing demand in various industries because of its superior properties such as high gloss, good water repellency, and outstanding chemical resistance. The market is highly competitive in nature owing to the major involvement of multinationals in constant capacity expansion and product diversification and innovation.

Loading Table Of Content...