Wedding Loans Market Research, 2033

The global wedding loans market was valued at $11.6 billion in 2023, and is projected to reach $23.3 billion by 2033, growing at a CAGR of 7.3% from 2024 to 2033.

A wedding loan, also known as a marriage loan, is a type of personal loan designed to provide financial assistance to individuals who require funds to cover the expenses associated with weddings. Whether arranging for venue bookings, catering, decorations, or purchasing bridal attire and jewelry, it can help insurers to easily manage wedding expenses.

Key Takeaways of Wedding Loans Market Report

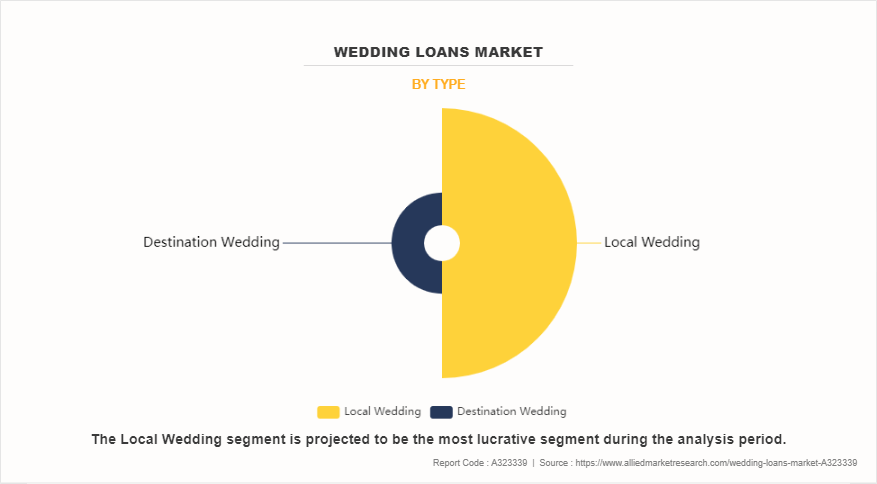

- On the basis of type, the local wedding segment acquired a major share in the wedding loans market in 2023.

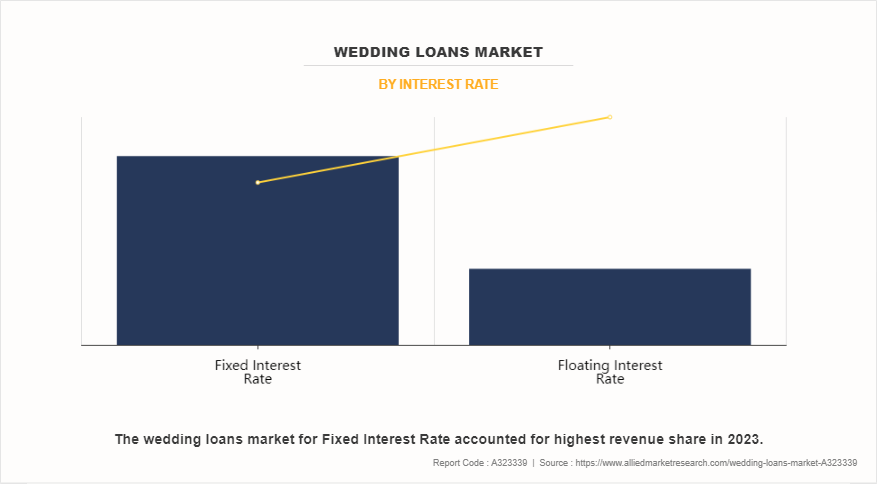

- On the basis of interest rate, the fixed interest rate segment dominated the wedding loans market size in terms of revenue in 2023.

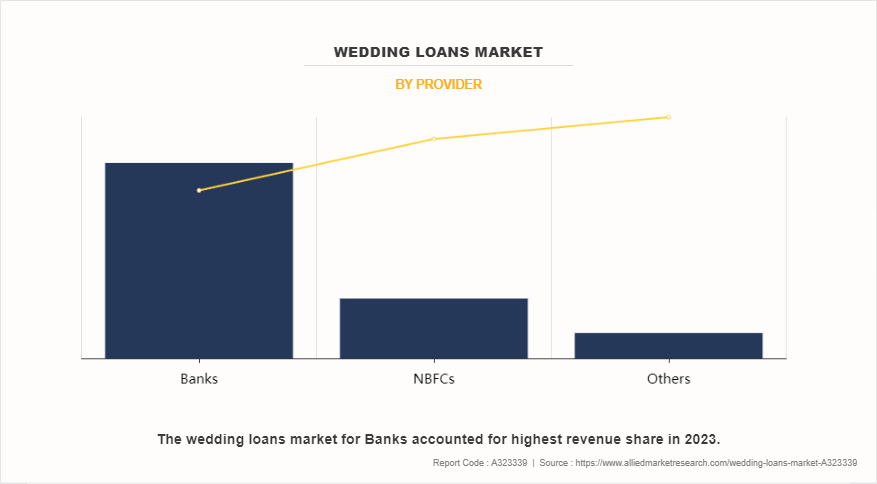

- On the basis of provider, the NBFCs segment is anticipated to grow at the fastest CAGR during the forecast period.

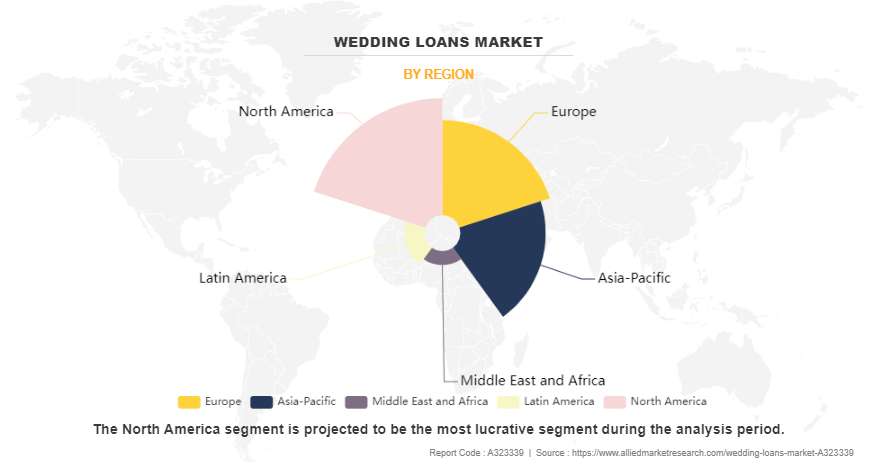

- Region-wise, North America dominated the wedding loans market in terms of revenue in 2023. However, the market in Asia-Pacific is anticipated to grow at the highest CAGR during the forecast period.

The wedding loans market is driven by rise in popularity of destination weddings, rise in wedding costs, and the growing acceptance of non-traditional weddings. Destination weddings have become increasingly popular in recent years, with couples looking to create unique and memorable experiences for themselves and their guests. Furthermore, the cost of weddings has been on the rise, with the average wedding in the U.S. currently costing over $30,000. This has led to increase in demand for wedding loans, as couples look for ways to finance their special day without incurring significant debt. However, high interest rates that often come with wedding loans, make them a less attractive option for couples who are already facing significant wedding expenses. This can deter couples from taking out wedding loans, limiting the growth of the market. Moreover, lack of awareness about wedding loans and their benefits limits the market growth. On the contrary, rise in digitalization and online lending platforms offer a convenient and efficient way for couples to apply for and receive wedding loans, which is expected to expand the market's potential reach in the upcoming years.

Market Dynamics

Increase in the popularity of destination weddings

Rise in popularity of destination weddings is driving the growth of the wedding loans industry by creating a demand for financing options to cover the high costs associated with these unique and memorable wedding experiences. As more couples opt for destination weddings, which often come with elevated expenses, the need for financial assistance becomes increasingly necessary. Destination weddings are becoming a preferred choice for couples looking to create unforgettable moments in picturesque locations, leading to surge in demand for wedding loans to fund these special events.

High-interest rates of wedding loans

The high-interest rates of wedding loans are limiting the growth of the wedding loans market by making these loans a less attractive option for couples looking to finance their weddings. High-interest rates can lead to higher monthly payments and high overall cost for the loan, making it more difficult for couples to manage their wedding expenses and their debt after the wedding. This can discourage couples from taking out wedding loans, limiting the market's potential growth.

Moreover, the perception of wedding loans as a more expensive financing option as compared to other alternatives, such as credit cards or personal loans with lower interest rates, is expected to further limit the demand for wedding loans. Couples may opt for other financing methods that they perceive as more affordable or less risky, reducing the growth of the wedding loans market.

Rise in digitalization and online lending platforms

Rise in digitalization and online lending platforms is expected to provide lucrative opportunities to the wedding loans market growth as online lending platforms offer several benefits such as increased efficiency, regulatory compliance, and enhanced customer experience. Digital lending platforms use automation to streamline the loan process, making it faster and more efficient for borrowers to access wedding loans. This automation also enables lenders to comply with regulations and norms more efficiently, reducing the risk of non-compliance and associated penalties.

Moreover, the evolution of funding models in the digital lending industry, such as marketplace lenders, balance sheet lenders, and bank channel lenders, is creating a more diversified investment approach that caters to the growing digital behavior of consumers. Thus, this diversification is expected to attract more borrowers to digital lending platforms, including those seeking personal loan for wedding.

Segment Review

The wedding loans market is segmented into type, interest rate, provider, and region. On the basis of type, the market is divided into local wedding and destination wedding. On the basis of interest rate, the market is bifurcated into fixed interest rate and floating interest rate. On the basis of provider, the market is differentiated into banks, NBFCs, and others. Region-wise, it is analyzed across North America (the U.S., and Canada), Europe (the UK, Germany, France, Italy, Spain, and rest of Europe), Asia-Pacific (China, Japan, India, Australia, South Korea, and rest of Asia-Pacific), Latin America (Brazil, Argentina, and rest of Latin America), and Middle East and Africa (GCC Countries, South Africa, and rest of Middle East and Africa).

By type, the local wedding segment acquired a major share of the market in 2023. This is attributed to the high costs associated with traditional weddings, as the expenses often exceed the planned budget. However, the destination wedding segment is expected to be the fastest-growing segment in the wedding loans market during the forecast period. This is attributed to the rising affluence of the middle class, the growing popularity of destination weddings both within India and abroad, and the increased availability of more affordable travel options have all contributed to the surge in demand for destination wedding loans.

By interest rate, the fixed interest rate segment acquired a major share in the wedding loans market in 2023. This is attributed to the fact that it provides borrowers with a clear understanding of their monthly payments and the total cost of the loan. Predictability and transparency are important factors for couples planning a wedding, as they can budget their expenses more accurately and avoid any unexpected costs. Furthermore, the fixed interest rate of wedding loans offers borrowers security and stability, as they know exactly how much they need to pay each month and for how long. This can help couples avoid the stress and uncertainty of fluctuating interest rates and payments. However, the floating interest rate segment is expected to be the fastest-growing segment in the wedding loans market during the forecast period. This is attributed to the fact that floating interest rates are more cost-effective in the long run, especially if interest rates decrease, allowing borrowers to capitalize at lower rates. The interest rate of a floating loan adjusts according to market conditions, which can result in lower monthly payments during periods of declining interest rates.

By provider, the banks segment acquired a major wedding loans market share in 2023, as the pandemic brought about surge in credit demand from retail customers, with people borrowing money for medical expenses, daily expenses, and weddings. A recent study conducted by IndiaLends, in December 2023, a digital lending platform, revealed that wedding loans constituted 33% of the total loans borrowed during the second wave of the pandemic, making it the highest among all other purposes. However, the NBFCs segment is expected to be the fastest-growing segment in the wedding loans market forecast period. This is attributed to their ability to provide a streamlined loan process with quick approval and disbursement, making them convenient for financial support in a medical emergency, home renovation project, or debt consolidation. Loans from NBFCs are disbursed within 24-48 hours, which is a significant advantage for borrowers who need quick access to funds.

Region-wise, North America dominated the wedding loans market in 2023. This is attributed to the increasing popularity of wedding loans as a financing option for couples planning their weddings. However, Asia-Pacific is considered to be the fastest-growing region during the forecast period as convenience, speed, and tailored solutions offered by lenders have contributed to the growth of the wedding loans market in the region. The flexibility in loan amounts and repayment terms has made it easier for couples to access funds to finance their dream weddings. Stretch loans have become a popular substitute for traditional wedding financing, offering an alternative perspective on this traditional problem that appeals to various financial goals and mindsets. According to data analyzed by LenDenClub, in India, the demand for wedding loans drastically increased by 40% in 2021 from 2020.

Competition Analysis

Competitive analysis and profiles of the major players in the wedding loans market include Social Finance, LLC, LendingPoint LLC, Prosper Funding LLC, Discover Bank, HDFC Bank Ltd., LightStream, Best Egg, Achieve.com, Tata Capital Limited, and Bajaj Finserv. These players have adopted various strategies to increase their market penetration and strengthen their position in the industry.

Recent Developments in Wedding Loans Industry

- In December 2023, Tata Capital, a leading financial services provider and part of the iconic Tata Group, launched an innovative new loan app that offers customized wedding financing. The app offers instant paperless approval for loans that borrowers are pre-qualified for. With a simple check, application, and quick fund transfer process, borrowers can access funds without the burden of lengthy paperwork.

- In November 2023, Shaadify, a trailblazer in revolutionizing wedding planning experiences, launched its Marry Now, Pay Later wedding loan services. This innovative offering aims to transform the way couples approach their dream weddings. With a steadfast dedication to turning dreams into realities, Shaadify empowers couples from diverse backgrounds to celebrate their love without immediate financial burdens.

Key Benefits for Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the wedding loans market analysis from 2023 to 2033 to identify the prevailing wedding loans market opportunity.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- The Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders to make profit-oriented business decisions and strengthen their supplier-buyer network on the wedding loans market outlook.

- In-depth analysis of the wedding loans market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as wedding loans market trends, key players, market segments, application areas, and market growth strategies.

Wedding Loans Market Report Highlights

| Aspects | Details |

| Forecast period | 2023 - 2033 |

| Report Pages | 347 |

| By Interest rate |

|

| By Provider |

|

| By Type |

|

| By Region |

|

| Key Market Players | LightStream, LendingPoint LLC, Tata Capital Limited, Social Finance, LLC, Best Egg, Bajaj Finserv, Discover Bank, Achieve.com, HDFC Bank Ltd., Prosper Funding LLC |

Analyst Review

A growing number of millennials are opting to finance their weddings, which is a trend that challenges societal norms. According to the IndiaLends Wedding Spends Report 2.0, 2023, 41% of brides and grooms plan to self-fund their weddings and intend to use their savings, while 26% are open to considering personal loans, disrupting the conventional restriction associated with wedding financing.

Key players in the wedding loans market adopt partnership, acquisition, and product launch as their key development strategies to sustain their growth in the market. For instance, in November 2023, Shaadify, a trailblazer in revolutionizing wedding planning experiences, announced the launch of its Marry Now, Pay Later wedding loan services. This innovative offering aims to transform the way couples approach their dream weddings. With a steadfast dedication to turning dreams into realities, Shaadify empowers couples from diverse backgrounds to celebrate their connection without immediate financial burdens. Therefore, such strategies adopted by key players propel the growth of the wedding loans market.

The key players in the wedding loans market include Social Finance, LLC, LendingPoint LLC, Prosper Funding LLC, Discover Bank, HDFC Bank Ltd., LightStream, Best Egg, Achieve.com, Tata Capital Limited, and Bajaj Finserv. These players have adopted numerous strategies to increase their marketplace penetration and strengthen their position in the wedding loans market.

The size of the global wedding loans market was valued at $11.63 billion in 2023 and is projected to reach $23.26 billion by 2033.

The key players operating in the global wedding loans market include Social Finance, LLC, LendingPoint LLC, Prosper Funding LLC, Discover Bank, HDFC Bank Ltd., LightStream, Best Egg, Achieve.com, Tata Capital Limited, and Bajaj Finserv.

North America is the largest regional market for Wedding Loans.

Partnership and product launch are the key strategies opted by the operating companies in this market.

The wedding loans market is segmented into type, interest rate, and provider. On the basis of type, the market is divided into local wedding and destination wedding. On the basis of interest rate, the market is bifurcated into fixed interest rate and floating interest rate. On the basis of provider, the market is differentiated into banks, NBFCs, and others.

Loading Table Of Content...

Loading Research Methodology...