Wellness Water Market Research, 2033

Market Introduction and Definition

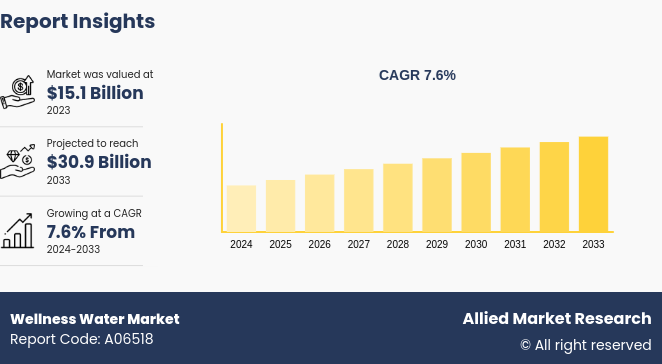

The global wellness water market was valued at $15.1 billion in 2023, and is projected to reach $30.9 billion by 2033, growing at a CAGR of 7.6% from 2024 to 2033. Wellness water, also known as functional or enhanced water, is a type of beverage that has been fortified with additional nourishment, minerals, vitamins, antioxidants, and in some cases, probiotics to boost overall health and wellness. Consumer health consciousness has increased, resulting in an increasing preference for healthier beverage choices over typical sugary beverages. In addition, consumers are aware of the importance of hydration in general health and its link to increased physical and mental performance, which is pushing them to choose enhanced water products. Furthermore, the surge in number of fitness enthusiasts and sportsmen is driving the rise in demand for water to assist hydration and recuperation.

Key Takeaways

The wellness water market study covers 20 countries. The research includes a segment analysis of each country in terms of value for the projected period.

More than 1, 500 product literatures, industry releases, annual reports, and other such documents of major wellness water industry participants along with authentic industry journals, trade associations' releases, and government websites have been reviewed for generating high-value industry insights.

The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global markets and to assist stakeholders in making educated decisions to achieve their most ambitious growth objectives.

Key market dynamics

Over the years, the daily schedules of the consumers have become increasingly chaotic, necessitating a lifestyle change to handle the daily tasks. The shift in lifestyle hampers health and is becoming a root cause of health complications such as obesity, cardiovascular disease, vitamin deficiencies, and others. In response to this concern, wellness water companies have developed products that are enriched with minerals, alkaloids, antioxidants, and protein. For instance, in 2021, The Alkaline Water Company, headquartered in Scottsdale, Arizona, launched its alkaline water infused with flavors in six different variants. The added health advantages of alkaline flavored waters, such as colon cleansing qualities, anti-aging characteristics, and skin hydration properties, lead customers to switch from sweetened beverages to wellness water.

Essence is a major ingredient that is used in flavoring wellness water. Increased usage of synthetic flavoring essence is restraining the wellness water market growth, since it has been related to dental issues in consumers as a result of long-term consumption. According to the American Dental Association, synthetic flavoring essences such as citric acid affect the teeth and lead to erosion. The prolonged consumption of flavored water dissolves away the layer of enamel and affects the structural integrity. The damage further leads to hypersensitivity and increases the chances of formation of cavities, and tooth erosion. Furthermore, synthetic flavor essence affects the pH level of the water and it tends to keep it lower than the neutral pH level limit. The pH of a beverage is the most important factor in determining its ability to affect the teeth. A pH of less than 4 is regarded to be harmful to oral health. Overall, consumers are becoming more aware of the importance of maintaining good dental health, which is preventing them from drinking wellness water containing synthetic flavor essences.

Parent Market Analysis of Global Wellness Water Market

The wellness water market share a dynamic and quickly developing subset of the bottled water market, is defined by additional health advantages such as minerals, antioxidants, vitamins, and other functional components. According to wellness water market statistics, the functional beverage market was valued at $132.6 Billion in 2023, out of which wellness water market size was valued at $15.1 Billion in 2023.

The functional beverage industry focuses on delivering a convenient source of hydration through energy drinks as a popular source among individuals, whereas the wellness water market targets health-conscious consumers looking for extra hydration through fortified water products. The expanding consciousness regarding health and fitness, along with a growing appetite for beverages that provide more than just hydration, has increased the need for wellness water. The wellness water industry is growing faster than its parent market because of advancements in product compositions and marketing methods that address particular health problems such as digestion, immune function, and energy.

Parent Market Analysis, 2023

Market Name | Market Size (Billion) |

Functional Beverage Market | 132.6 |

Wellness Water Market | 15.1 |

Market Segmentation

The wellness water market is segmented into functional ingredient, flavor, distribution channel, and region. On the basis of functional ingredient, the market is divided into vitamin & minerals, botanical ingredients, and other functional ingredients. As per flavor, the market is segregated into fruit flavor, herb flavor, and others. On the basis of distribution channel, the market is bifurcated into hypermarkets/supermarkets, convenience stores, drug stores, online store, and others. Region wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Regional/Country Market Outlook

The industry is witnessing trends across regions and nations, driven by differences in customer choices, economic situations, and health consciousness levels providing a wellness water market opportunities for growth. In North America, the U.S.?dominates the industry, owing to a strong wellness and health culture and a high-income level that encourages the use of luxury functional drinks. The U.S. market is distinguished by a significant presence of established companies and a rising preference for organic and natural goods. Countries in Europe such as Germany, the UK, and France are witnessing substantial growth as a result of growing awareness of health issues and a move towards preventative health practices. Germany has experienced an increase in the market for wellness water as people become more aware of the advantages of hydration and functioning additives.

Countries in Asia-Pacific, including China, Japan, and India, are developing as profitable markets for wellness water. China's increasing urbanization and growing middle class are fueling the demand for healthful and convenient beverage choices. Japan's aging population is also driving market expansion, with a demand for functional beverages that address particular health concerns including musculoskeletal health and digestive wellness. India, with its large population and rising health awareness, offers a substantial development opportunity, however, price sensitivity remains a wellness water market demand barrier.

In Latin America, Brazil and Mexico are significant markets, with a rising number of health-conscious consumers driving demand for multifunctional and fortified beverages. The Middle East and Africa are also showing promise, notably in the UAE and South Africa, where growing disposable incomes and a booming retail sector are driving market expansion.

Industry Trends

In September 2023, UC Berkeley and PepsiCo reaffirmed their collaboration, naming PepsiCo as the campus' official beverage provider for the next decade. This prolonged engagement with PepsiCo is expected to strengthen the business's support for Berkeley's long-term viability &?equality, and wellness and health promotion efforts. According to the deal, and in line with PepsiCo's pep+ (PepsiCo Positive) business strategy, the corporation will supply energy-efficient beverage distribution and cooling systems to Berkeley, as well as financial assistance for campus sustainability initiatives.

In October 2022: CENTR Brands Corporation extended its line of health and wellness products with the release of CENTR Enhanced, a non-CBD functional sparkling water.

In March 2021, Nestlé S.A., a food and beverage giant, announced the purchase of Essentia Water, a premium functional water brand located in Washington. The firm is expanding its range to include foreign mineral and premium water brands, in addition to healthy hydration options such as functional water.

Competitive Landscape

According to wellness water market analysis the major players operating include Danone S.A., The Coca-Cola Company, PepsiCo Inc., Nestle S.A., Keurig Dr Pepper, Hint Water Inc, Tata Group, The Alkaline Water Co., Nirvana Water Sciences, and Balance Water Company LLC.

Other players in wellness water market forecast period includes Athlex Beverages Private Limited, Flow Beverage Corp, VOSS of Norway AS, Alkaline88, SUNNYD, Disruptive Beverages Inc, Agua Mineral San Benedetto, S.A.U., Vichy Catalan Corporation, Triamino Brands LLC, and Unique Foods.

Recent Key Strategies and Developments

In July 2022, Flow Beverage Corp., a US-based beverage manufacturer, expanded its Flow Vitamin-Infused Water product range with three additional organic flavors: cherry, citrus and elderberry. The newly developed vitamin-infused water is accessible directly to US customers via its website.

In March 2022, Nirvana Water Sciences Corp, a beverage manufacturer, increased its product line by launching Nirvana HMB + Vitamin D3 natural spring water at Expo West in California. This new product promotes muscle repair and immunity.

In May 2021, PepsiCo Inc., a renowned global food and beverage corporation, introduced Soulboost, an improved sparkling water infused with beneficial nutrients. The drink comes in two varieties: Lift and Ease. Lift has 200 mg of ginseng to help sustain mental stamina, while Ease contains 200 mg of theanine, helping in relaxing.

Wellness Water Market Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 30.9 Billion |

| Growth Rate | CAGR of 7.6% |

| Forecast period | 2024 - 2033 |

| Report Pages | 200 |

| By Functional Ingredient |

|

| By Flavor |

|

| By Distribution Channel |

|

| By Region |

|

| Key Market Players | Tata Group, Nirvana Water Sciences, Balance Water Company LLC, Nestle S.A., The Alkaline Water Co., PepsiCo Inc., Nirvana Water Sciences, PepsiCo Inc., Hint Water Inc, Hint Water Inc, Balance Water Company LLC, Danone S.A., Nestle S.A., The Alkaline Water Co., Danone S.A., Tata Group, Keurig Dr Pepper, Keurig Dr Pepper, The Coca-Cola Company, The Coca-Cola Company |

The global wellness water market was valued at $15.1 billion in 2023, and is projected to reach $30.9 Billion by 2033, growing at a CAGR of 7.6% from 2024 to 2033.

The wellness water market registered a CAGR of 7.6% from 2024 to 2033.

The forecast period in the wellness water market report is from 2024 to 2033.

The top companies that hold the market share in the wellness water market include Danone S.A., The Coca-Cola Company, Nestle S.A., Keurig Dr Pepper, Hint Water Inc, and others.

The wellness water market report has 3 segments. The segments are functional ingredient, flavor, and distribution channel.

Loading Table Of Content...