Wet Shave Market Research, 2033

Market Introduction and Definition

The global wet shave market size was valued at $18.3 million in 2023, and is projected to reach $46.8 million by 2033, growing at a CAGR of 9.9% from 2024 to 2033. The market for traditional shaving techniques, which include a razor or blade, water, shaving cream, gel, or soap, is known as the "wet shave market." This market includes a broad range of products, such as safety, straight, and disposable razors, as well as shaving lotions, aftershaves, and other grooming products. Compared to electric shaving techniques, wet shaving is valued for offering a tighter, smoother shave, and it's frequently connected to a more opulent and customized grooming ritual. Although it is mostly focused on males, the market serves both genders and is driven by consumer demands for high-quality and environmentally friendly grooming products as well as trends in personal grooming and technological advancements in shaving products.

Key Takeaways

- The wet shave market study covers 20 countries. The research includes a segment analysis of each country in terms of value ($Billion) for the projected period 2024-2033.

- More than 1, 500 product literature, industry releases, annual reports, and other such documents of major wet shave market participants along with authentic industry journals, trade associations' releases, and government websites have been reviewed for generating high-value industry insights.

- The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global markets and to assist stakeholders in making educated decisions in order to achieve their most ambitious growth objectives.

Key market dynamics

Several important factors influence the wet shave market growth and development. The growing emphasis on personal hygiene and grooming, especially among men, is one of the main causes. Raising standards of beauty have led to an increase in the market for premium shaving supplies, such as aftershave lotions, shaving creams, and razors. The increased popularity of social media and grooming experts that support traditional shaving techniques is also supporting this trend by raising customer knowledge and wet shave market demand.

Technological developments in product development are another significant factor impacting the wet shave market. Manufacturers are always coming up with new ideas to provide more ergonomic designs, better blade technology, and better shaving gels and creams. The development attracts a broader customer base, including people who have utilized electric shaving techniques and improves the shaving experience overall.

The market is also impacted by e-commerce platforms' growing prevalence. Online shopping's ease of use has facilitated consumers' access to a large range of wet shaving products from various companies, which has fueled market expansion. Furthermore, subscription-based shaving kit business models are becoming more common. These models guarantee organizations constant revenue and customer loyalty by sending customers frequent delivery of shaving supplies.

However, the market for wet shave products is facing challenges, especially as electric razors become more popular and as people start maintaining facial hair like mustaches and beards. Certain demographic groups may be less inclined to wet shave as a result of these developments, which could hinder market expansion. In addition, the growing market for natural and organic products is encouraging businesses to get creative and provide sustainable and environmentally friendly substitutes for conventional wet shaving products. In addition to this, the wet shave industry is constantly changing due to shifting consumer tastes, technological improvements, and the ease of buying goods online. However, it still has competition from other grooming practices.

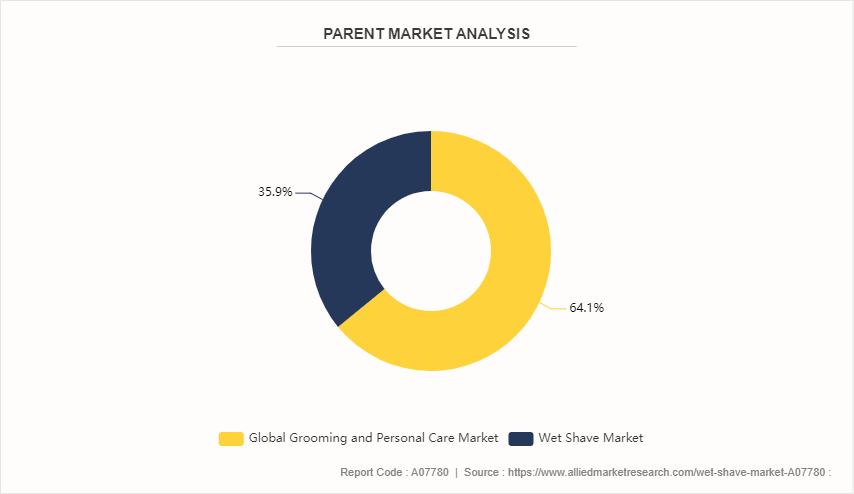

Parent Market Overview of the Global Wet Shave Market

The larger grooming and personal care market, which includes a broad range of products like razors, shaving creams, aftershaves, and other grooming accessories, includes the global wet shave market. Rising disposable incomes, a growing emphasis on hygiene and appearance, and increased knowledge of personal grooming are the main drivers of this parent industry. The wet shave market has also expanded as a result of trends like the return of conventional grooming techniques, consumer demand for sustainable and eco-friendly products, and the impact of social media on grooming standards. The industry also gains from the existence of well-known brands and the ongoing release of innovative products that satisfy various consumer demands in different regions.

Market Segmentation

The wet shave market is segmented into gender, product, distribution channel, and region. On the basis of gender, the market is divided into male and female. On the basis of product, the market is classified into disposable razors, non-disposable razors, shaving lotions & creams, razor cartridges, blades, and others. On the basis of distribution channel, it is segmented into hypermarkets, supermarkets, independent retailers, and others. Region wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Regional/Country Market Outlook

Consumer preferences, economic factors, and cultural grooming customs all impact the wet shave market, which is defined by the usage of water, shaving cream, and razors. These factors lead to major variations in the market outlook across various regions and countries.

North America is the market leader for wet shave products, especially in the U.S. and Canada, where well-established grooming habits and disposable income fuel demand for high-end products. Along with a growing trend toward eco-friendly and sustainable shaving products, the U.S. industry is also supported by the strong presence of well-known brands like Schick and Gillette. Handcrafted and premium shaving products are becoming more popular in Canada, despite the country's small market.

Prominent European nations include the UK, Germany, and France. This is an established market where traditional, high-quality shaving techniques are the main focus. A shift to more traditional grooming methods and a desire for eco-friendly products has led to a growing trend among European consumers towards luxury wet shaving products. This market is further supported by the existence of well-known grooming brands and a robust e-commerce industry.

Wet shaving is experiencing significant growth in the Asia-Pacific region, led by nations like China, Japan, and India. Urbanization and growing disposable incomes are key drivers in these nations. Traditional razors are gradually being replaced in China and India by more contemporary, branded products that prioritize accessibility and price. In contrast, Japan has a well-established market that favors high-end, precise shaving equipment.

The wet shave market is growing in the Middle East and Africa due to rising urbanization and a younger population. The availability of multinational brands and the rising awareness of personal grooming have an impact on the market in nations like as Saudi Arabia and the United Arab Emirates. Still in its early stages, the African market favors affordable, regionally accessible products. The wet shave market is therefore expected to expand globally, with regional variations influenced by cultural customs, economic conditions, and consumer preferences.

Industry Trends:

- A major leader in the wet shave market statistic, Gillette, introduced a new range of razors known as "Fusion ProGlide Shield" in May 2024. These razors use innovative blade technology designed to minimize skin irritation and give a smoother shave. The introduction aims to meet the rising demand from customers for high-end, effective grooming products.

- Harry's Inc., a direct-to-consumer grooming firm, was purchased by Edgewell Personal Care, the parent company of brands including Schick and Wilkinson Sword, in August 2023. The purpose of this transaction was to fortify Edgewell's standing in the competitive wet shave market and increase its market footprint in the U.S.

- Philips introduced a new range of razors in June 2024 that were created especially for the Chinese market. These razors feature innovative blade technology and cooling gels to satisfy the increasing number of middle-class customers who demand a high-end shaving experience.

- Local Chinese companies such as S'yo are making ripples in the wet shave sector in November 2023 by providing reasonably priced, high-quality shaving products. Due to growing nationalism and price sensitivity, these companies are becoming more well-liked among younger consumers who want local products.

- Regional companies began selling environmentally friendly wet shave items in January 2024. These products include organic shaving lotions and recycled-material blades. This tendency has been driven by the Asia-Pacific region's growing environmental consciousness, especially in nations like Australia and Japan.

Competitive Landscape

The major players operating in the wet shave market forecast include Procter & Gamble, Unilever PLC, Edgewell Personal Care Company, Beiersdorf AG, Johnson & Johnson, Raymond Limited, and Godrej Consumer Products Limited.

Recent Key Strategies and Developments

- In April 2019, Procter & Gamble's Gillette Venus brand and Vera Bradley worked together to create a range of designer razors for women. Vera Bradley is an American designer of women's purses, home & fashion accessories, and travel and luggage items.

- In August 2020, Edgewell Personal Care declared that it will be acquiring Cremo Company LLC, a provider of personal grooming products, to grow its portfolio of skin care products for men's grooming. These products are used to take care of hair, beard, and shave prep.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the wet shave market share, segments, current trends, estimations, and dynamics of the wet shave market analysis from 2024 to 2033 to identify the prevailing wet shave market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the wet shave market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global wet shave market trends, key players, market segments, application areas, and market growth strategies.

Wet Shave Market Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 46.8 Million |

| Growth Rate | CAGR of 9.9% |

| Forecast period | 2024 - 2033 |

| Report Pages | 250 |

| By Gender |

|

| By Product |

|

| By Distribution Channel |

|

| By Region |

|

| Key Market Players | Beiersdorf AG, Godrej Consumer Products Limited, Johnson & Johnson, Procter & Gamble, Raymond Limited, Edgewell Personal Care Company, Unilever PLC |

The global wet shave market is witnessing trends like the rise of eco-friendly products, increased demand for luxury grooming items, and the growing popularity of subscription-based shaving services.

The leading application of the Wet Shave Market is **personal grooming** for men, with products like razors, blades, and shaving creams primarily used for facial hair maintenance and styling.

The Asia-Pacific region is the largest market for wet shave products, driven by a large population, increasing grooming awareness, and rising disposable income in countries like India and China.

The global wet shave market was valued at $18.3 million in 2023, and is projected to reach $46.8 million by 2033, growing at a CAGR of 9.9% from 2024 to 2033.

The major players operating in the wet shave market include Procter & Gamble, Unilever PLC, Edgewell Personal Care Company, Beiersdorf AG, Johnson & Johnson, Raymond Limited, and Godrej Consumer Products Limited.

Loading Table Of Content...