White Cement Market Size & Insights:

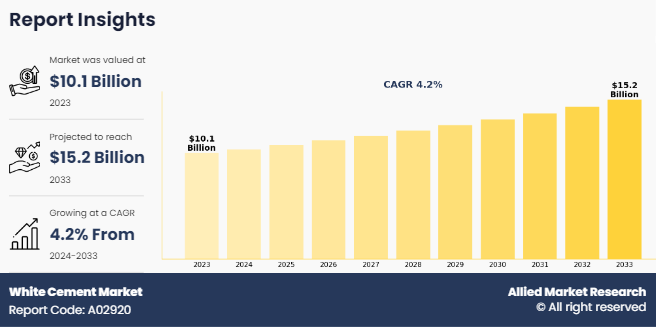

The global white cement market size was valued at $10.1 billion in 2023, and is projected to reach $15.2 billion by 2033, growing at a CAGR of 4.2% from 2024 to 2033. The rise in development in architectural and decorative construction industry is expected to boost the demand for white cement globally.

Introduction

White cement is a construction material, which exhibits appealing, whiteness, and low energy consumption properties. This cement is often mixed with pigments to impart attractive colors to concretes and mortars, which is otherwise not feasible using ordinary gray cement. The white color of this cement is due to its raw materials used during the production process, such as iron and manganese. White cement is similar to Ordinary Portland Cement, except that fuel oil is used instead of coal with an iron oxide content below 0.4% to ensure whiteness. A special cooling technique is used in its production. It serves as a key ingredient in the production of architectural and decorative concrete for use in terrazzo tiles, paints, pavers, and pre-fabricated products such as artificial walls and tile adhesives.

Key Takeaways

- The key players in the white cement market report are Cementir Holding SPA, Çimsa Cement Industry and Trade Inc., JK Cement, Cemex, The Cementos Portland Valderrivas, Birla White (Ultratech), Federal White Cement, Saveh White Cement Co., Adana Cement, and Saudi White Cement Co. The other key players include Lafargeholcim, Secil, Dyckerhoff, Royal El Minya Cement, Fars & Khuzestan Cement Co., SCG, Italcementi, Rakwhitecement.Ae, Union Cement Company, Royal White Cement, and Neyeariz White Cement Company.

- The segment analysis of each country in terms of value and volume during the forecast period 2023-2033 is covered in the global white cement market report.

- More than 6,765 product literatures, industry releases, annual reports, and other such documents of major industry participants along with authentic industry journals, trade associations' releases, and government websites have been reviewed for generating high-value industry insights.

Market Dynamics

The global white cement market is driven by increase in demand for white cement in countries with hot climates, owing to its heat reflecting properties. In addition, rise in the adoption of white cement in construction of designer buildings and future landmarks also fuels its demand. Moreover, white cement finds extensive applications in the developing economies such as India and China, owing to high purchasing power, increase in per capita GDP, and rise in expenditure by the government. However, lower strength of white cement in comparison with other cements and higher cost are the major factors that limit the growth of the market.

Moreover, growing awareness of environmental sustainability and green building practices is driving demand for eco-friendly construction materials, including white cement. Manufacturers are increasingly focused on reducing environmental impact through sustainable sourcing, production processes, and recycling initiatives, meeting the preferences of environmentally-conscious consumers and businesses. In addition to new construction projects, the renovation and rehabilitation of existing infrastructure, historical buildings, and heritage sites often require specialty materials like white cement to preserve their architectural integrity and aesthetics. This segment presents opportunities for white cement manufacturers in both developed and developing markets.

However, high cost of white cement products is expected to negatively influence the white cement market growth during the forecast period. White cement is more expensive than gray cement owing to its complex manufacturing process. Moreover, excess energy requirement during its production in comparison to gray cement further increases its production cost, which in turn increases the overall pricing. In addition, energy costs accounting up to 60% of manufacturing price of cement and insufficient access to natural gas has forced cement manufacturers to switch to expensive alternatives such as diesel and coal. Furthermore, rise in transportation and labor costs owing to supply shortages further driven the white cement prices, which in turn is expected to deter the white cement market growth.

Nevertheless, there is an increase in demand for white cement in countries, such as Saudi Arabia, Kuwait, and Russia with high temperature close to 55°C owing to heat-reflecting properties and superior aesthetic appearance. In comparison with gray concrete, more heat is reflected with white concrete surface which further creates attractive opportunities to the white cement market growth. Light colored concrete like white concrete absorbs less heat and reflects more light than dark-colored concrete such as gray concrete. The rapid mixture of white cement in concrete for decoration at roofs creates soothing effects, which in turn creates opportunities for the white cement market growth. Growth in the number of white cement flooring and roofing applications is projected to have a positive impact on demand for white cement products, thus providing lucrative opportunities for manufacturers and suppliers globally.

Moreover, ongoing innovation in white cement technology opens up further opportunities for product diversification and market expansion. Manufacturers are continuously developing new formulations, additives, and production techniques to improve product performance, enhance durability, and reduce environmental footprint. By staying at the forefront of innovation, white cement manufacturers can capitalize on emerging trends and evolving customer preferences to drive market growth.

Segments Overview

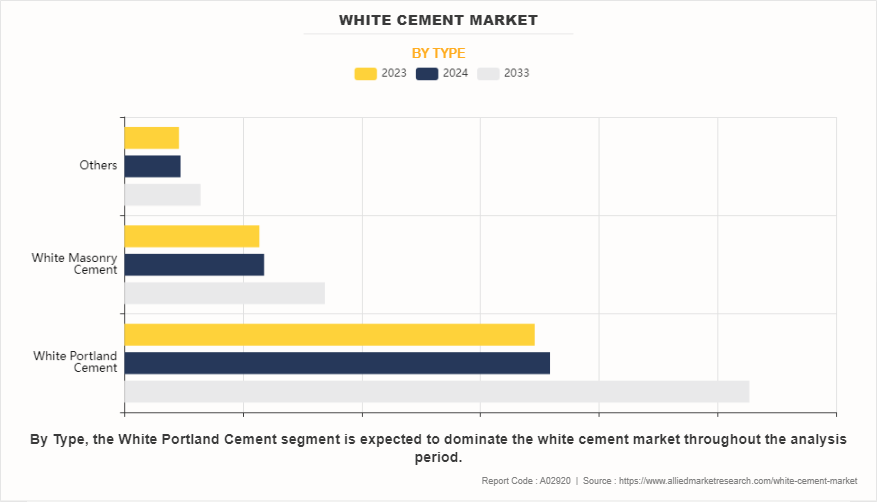

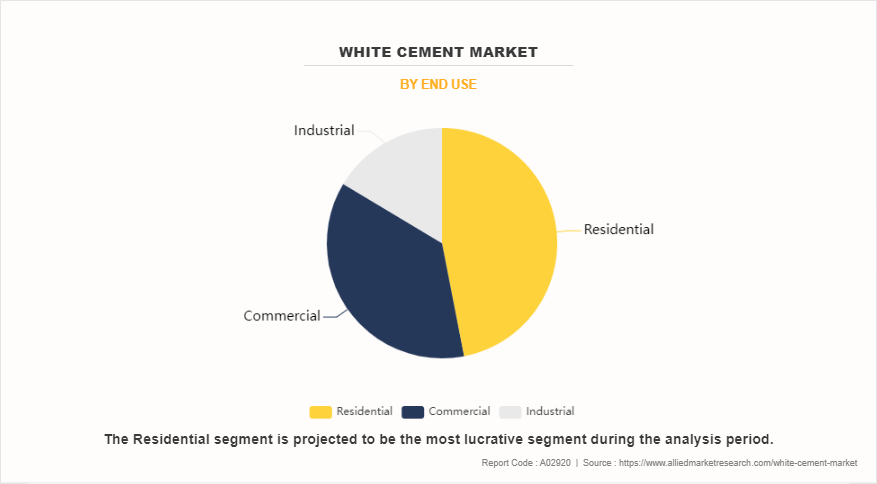

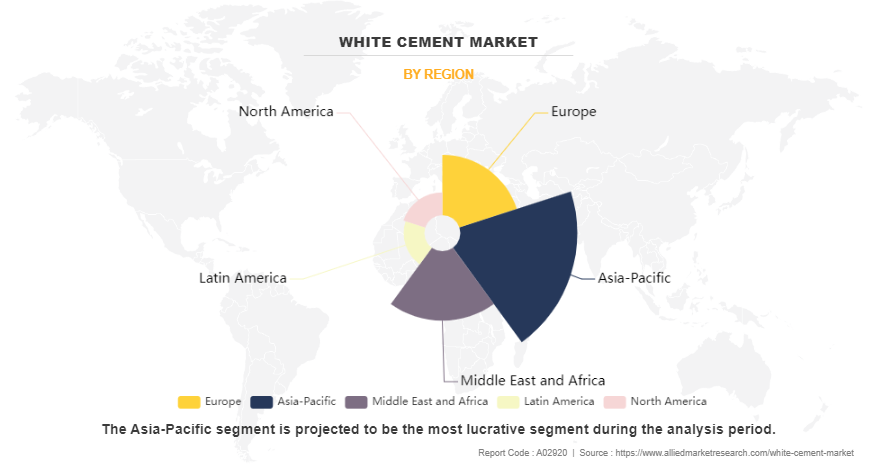

The global white cement industry is segmented based on type, end use, and region. On the basis of type, it is classified into white Portland cement, white masonry cement, and others. On the basis of end use, it is divided into residential, commercial, and industrial. By region, the white cement market share is analyzed across North America, Europe, Asia-Pacific, Latin America and MEA.

By type, the white Portland cement segment accounted for more than two-thirds of global white cement market share in 2023 and is expected to maintain its dominance during the forecast period. White Portland cement has aesthetic appeal and versatility in architectural and decorative applications. Its bright white color provides a pristine canvas for architectural designs, enabling the creation of visually striking structures and surfaces. Architects, designers, and builders prefer white cement for projects where aesthetics play a crucial role, such as high-end residential buildings, commercial spaces, and historical restoration projects. All these factors drive the demand for the white Portland cement segment in the white cement market.

By end use, the residential segment accounted for less than half of global white cement market share in 2023 and is expected to maintain its dominance during the forecast period. White cement offers exceptional flexibility in design, enabling the creation of bespoke features tailored to individual preferences. Its adaptability to various finishes, such as polished, textured, or stained, allows for the realization of diverse design concepts, ranging from minimalist to lavish. This versatility fosters creativity and innovation, empowering architects, and designers to explore new possibilities in residential construction and renovation projects.

Asia-Pacific accounted for two-fifths of the global white cement market share in 2023 and is expected to maintain its dominance during the forecast period. The surge in disposable incomes and changing lifestyles of consumers in Asia-Pacific are influencing the demand for premium construction materials such as white cement. As aspirations for modern and luxurious living spaces increase, there is a growing preference for high-end finishes and architectural elements that utilize white cement. In addition, the rise in tourism and hospitality sectors in many Asia-Pacific countries are contributing to the demand for white cement. The construction of hotels, resorts, shopping malls, and entertainment complexes requires materials that exude elegance and sophistication, making white cement a preferred choice for interior and exterior applications.

Competitive Analysis

The key players profiled in the white cement market report include Cementir Holding SPA, Çimsa Cement Industry and Trade Inc., JK Cement, Cemex, The Cementos Portland Valderrivas, Birla White (Ultratech), Federal White Cement, Saveh White Cement Co., Adana Cement, and Saudi White Cement Co. The other key players include Lafargeholcim, Secil, Dyckerhoff, Royal El Minya Cement, Fars & Khuzestan Cement Co., SCG, Italcementi, Rakwhitecement.Ae, Union Cement Company, Royal White Cement, and Neyeariz White Cement Company.

Recent Key Developments in the White Cement Market

- In 2023, Dyckerhoff introduced Dyckerhoff Weiss Blue Star, a pozzolanic white cement product designated as CEM IV/A (P) 42.5 R. This innovative product received approval from the German cement association, VDZ, in mid-June 2023 and is currently in production at the Amöneburg plant. Notably, this new offering boasts lower CO2 emissions, with approximately 15% less CO2 released compared to traditional CEM I cements. Additionally, it stands out as a blended white cement, marking a significant advancement in sustainable construction materials.

- In 2022, UltraTech Cement, a subsidiary of Aditya Birla Group, inaugurated a state-of-the-art putty plant in Rajasthan with an annual capacity of 400,000 metric tons. This facility is dedicated to producing UltraTech's renowned WallCare brand of white cement-based putty.

- In 2022, Cementir Holding introduced its innovative Futurecem limestone calcined clay cement into the Benelux and French cement markets. This groundbreaking cement leverages Cementir Holding's patented processes to replace over 35% of clinker in cement with limestone and calcined clay. This substitution not only maintains the cement's strength and quality but also significantly reduces its carbon footprint by approximately 30% compared to ordinary Portland cement (OPC).

Key Benefits for Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the white cement market analysis from 2023 to 2033 to identify the prevailing white cement market opportunities.

- The white cement market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the white cement market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global white cement market trends, key players, market segments, application areas, and market growth strategies.

White Cement Market Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 15.2 billion |

| Growth Rate | CAGR of 4.2% |

| Forecast period | 2023 - 2033 |

| Report Pages | 280 |

| By Type |

|

| By End Use |

|

| By Region |

|

| Key Market Players | The Cementos Portland Valderrivas, Saudi White Cement Co., Adana Cement, Saveh White Cement Co., CEMEX, S.A.B. de C.V., Birla White (Ultratech), Cementir Holding SPA, Federal White Cement, JK Cement, Çimsa Cement Industry and Trade Inc. |

Analyst Review

According to the insights of the CXOs of leading companies, the white cement market is driven by rapid urbanization and the construction of new infrastructure projects, such as airports, bridges, and highways, contribute to the demand for white cement. Emerging economies undergoing significant urbanization typically exhibit strong demand for construction materials, including white cement.

White cement is valued for its aesthetic appeal and versatility in architectural design. Trends favoring modern and minimalist designs, as well as the use of white or light-colored materials, can boost demand for white cement products. Manufacturers are continuously innovating to develop new white cement formulations with improved performance characteristics, such as strength, durability, and workability. Innovations in production processes and the introduction of eco-friendly or sustainable white cement variants can stimulate market growth.

The white cement market was valued at $10.1 billion in 2023, and is estimated to reach $15.2 billion by 2033, growing at a CAGR of 4.2% from 2024 to 2033.

Asia-Pacific is the largest regional market for White Cement

Rapid demand for aesthetics in the construction industry and rapid urbanization in developing countries are the leading drivers for the White Cement Market

Residential industry is the leading application of White Cement Market

Sustainable construction practices is the upcoming trends of White Cement Market in the world

Asia-Pacific is the fastest growing region for the White Cement Market

The major companies profiled in the report include Cementir Holding SPA, Çimsa Cement Industry and Trade Inc., JK Cement, Cemex, The Cementos Portland Valderrivas, Birla White (Ultratech), Federal White Cement, Saveh White Cement Co, Adana Cement, and Saudi White Cement Co.

Loading Table Of Content...

Loading Research Methodology...