Wind Turbine Nacelle Market Research, 2033

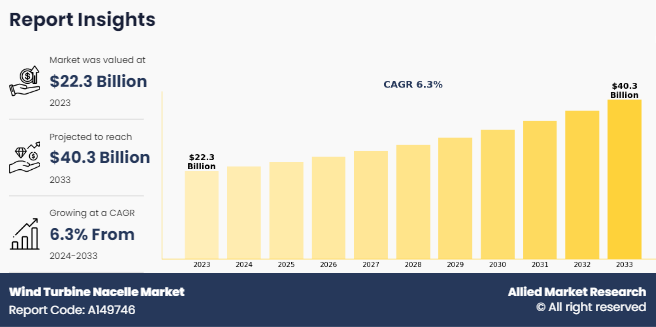

The global wind turbine nacelle market size was valued at $22.3 billion in 2023, and is projected to reach $40.3 billion by 2033, growing at a CAGR of 6.3% from 2024 to 2033. The global demand for renewable energy has increased in recent years, driven by mounting concerns over climate change and the need to transition away from fossil fuels. This surge in demand for renewable energy has notably propelled the growth of the wind energy sector. As part of this expansion, there has been a significant rise in the development of offshore wind farms, particularly in regions with abundant offshore wind resources.

Introduction

The wind turbine nacelle is the housing or enclosure atop the tower of a wind turbine where critical components such as the generator, gearbox, rotor shaft, and control electronics are housed. It contains machinery that converts wind energy into electrical energy. The nacelle is typically positioned so it rotates that allows it to face into the wind for optimal energy capture. In addition, it includes various sensors and control systems to optimize performance and monitor conditions.

Key Takeaways

- The global wind turbine nacelle market has been analyzed in terms of value ($million). The analysis in the report is provided on the basis of components, capacity, deployment, end use, 4 major regions, and more than 15 countries.

- The global wind turbine nacelle market report includes a detailed study covering underlying factors influencing the industry opportunities and trends.

- The key players in the wind turbine nacelle market are Vestas, Goldwind, GE VERNOVA, Siemens Gamesa Renewable Energy, NORDEX SE, Envision Group, ENERCON Global GmbH, Suzlon Energy Limited, Mingyang Smart Energy Group, and Windey Energy Technology Group Co., Ltd.

- The report facilitates strategy planning and industry dynamics to enhance decision making for existing market players and new entrants entering the PVC additives industry.

- Countries such as China, the U.S., India, Germany, and Brazil hold a significant share in the global wind turbine nacelle market.

Market Dynamics

Governments around the world are implementing ambitious renewable energy targets and enacting supportive policies to accelerate the transition to cleaner energy sources. Subsidies, tax incentives, and renewable energy mandates incentivize investments in wind power infrastructure such as manufacturing and installation of wind turbine nacelles. These policy measures create a conducive environment for industry players to expand their operations and meet the rising demand for nacelles. According to the International Energy Agency (IEA), in 2022 wind electricity generation increased by a record 265 TWh (up 14%), reaching more than 2‐¯100 TWh. This was the second highest growth among all renewable power technologies, behind solar PV. All these factors are expected to drive the demand for the wind turbine nacelle market during the forecast period.

However, the high initial cost of investment presents a substantial barrier to the growth of wind turbine nacelles, particularly in the context of expanding wind energy infrastructure. Wind turbine nacelles constitute a significant portion of the overall cost of wind energy projects, encompassing essential components such as the gearbox, generator, and control systems. As a result, the upfront capital required for nacelle procurement and installation is a deterrent for project developers and investors. All these factors hamper the wind turbine nacelle market growth.

The integration of digitalization and the Internet of Things (IoT) in nacelle design represents a transformative opportunity for the wind turbine industry, offering numerous benefits across the entire lifecycle of wind energy projects. By incorporating digital technologies and IoT-enabled sensors into nacelle design, manufacturers enhance operational efficiency, optimize performance, and improve maintenance practices, ultimately driving down costs and increasing the competitiveness of wind energy. All these factors are anticipated to offer new growth opportunities in the wind turbine nacelle market forecast.

Segments Overview

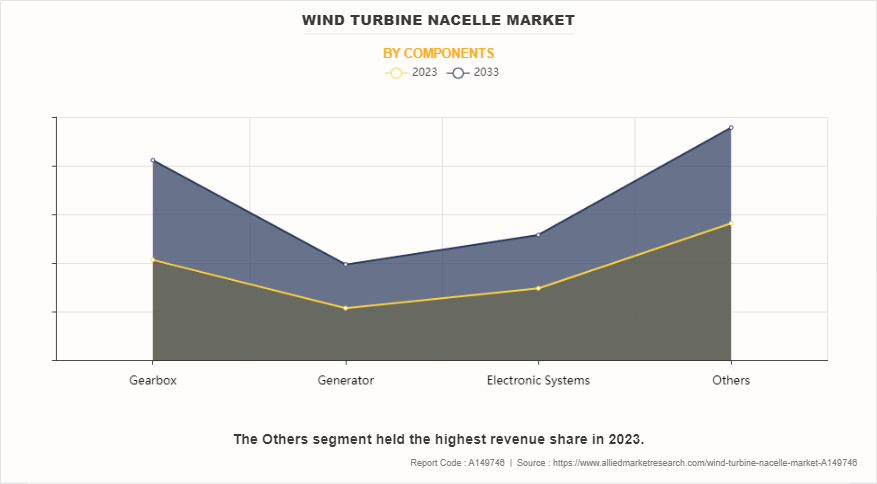

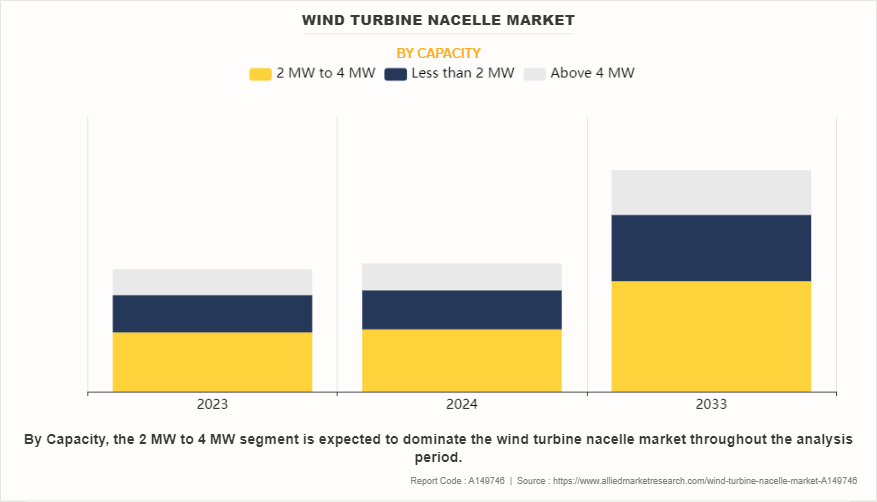

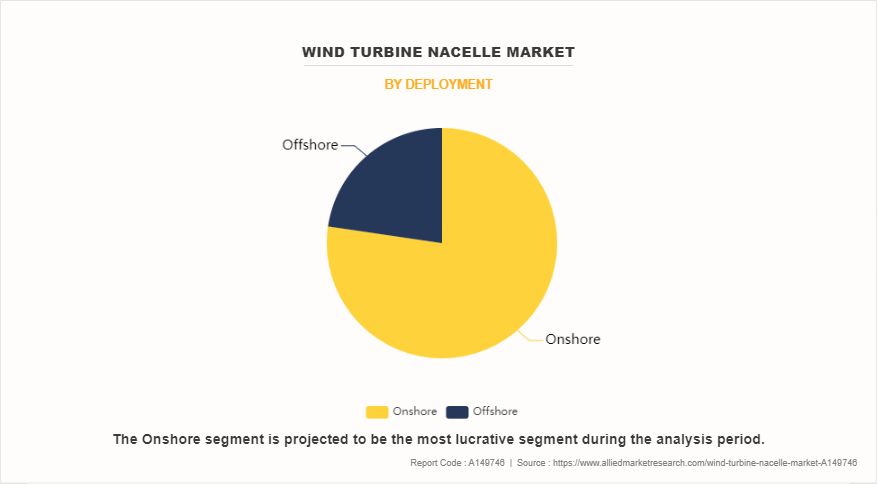

The wind turbine nacelle market is segmented on the basis of components, capacity, deployment, application, and region. On the basis of components, the market is categorized into gearbox, generator, electronic systems, and others. On the basis of capacity, the market is categorized into 2 MW to 4 MW, less than 2 MW, and above 4 MW. On the basis of deployment, the market is bifurcated into onshore, and offshore. On the basis of end use, the market is divided into utilities and industrial. Region-wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

By components, the others segment accounted for less than two-fifths of global wind turbine nacelle market share in 2023 and is expected to maintain its dominance during the forecast period. In other segment include yaw system components, blade pitch system, sensors, and ventilation systems. The yaw system components, responsible for orienting the turbine rotor into the wind, are crucial for maximizing energy capture and optimizing turbine performance. As wind conditions change, the yaw system must swiftly and accurately adjust the nacelle's orientation to ensure the rotor is facing the wind direction, thereby maximizing energy extraction. In addition, blade pitch systems play a vital role in regulating the angle of wind turbine blades to optimize power generation and respond to fluctuating wind speeds and directions.

By capacity, the 2 MW to 4 MW segment accounted for less than half of global wind turbine nacelle market share in 2023 and is expected to maintain its dominance during the forecast period. The increase in demand for renewable energy and the growing emphasis on decarbonization have spurred the need for larger wind turbines with higher capacities. According to the Global Wind Energy Council, wind power helped to avoid approximately 1.1 billion tons of CO2 emissions in 2022. Wind energy has become a mainstream source of electricity generation globally, driven by environmental concerns, energy security, and the declining costs of wind power. Furthermore, economies of scale play a significant role in driving the adoption of larger wind turbine nacelles.

By deployment, the onshore segment accounted for more than three-fourths additives market share in 2023 and is expected to maintain its dominance during the forecast period. Onshore wind energy is more cost-effective to install and maintain compared to offshore alternatives. The absence of complex offshore installation procedures, such as seabed preparation and marine logistics, reduces upfront capital costs. In addition, onshore wind farms have easier access to existing electricity infrastructure, minimizing transmission costs. This cost efficiency makes onshore wind turbine nacelles an attractive option for both developers and investors, contributing to their widespread adoption.

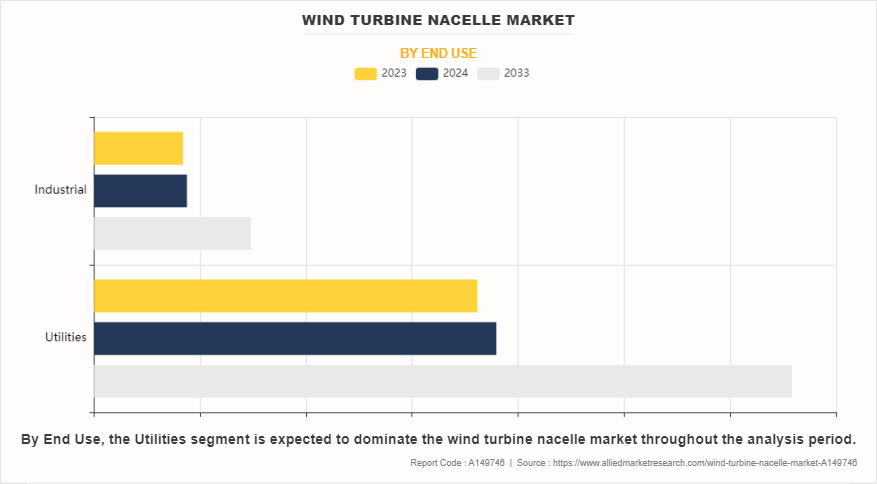

By end use, the utilities segment accounted for more than four-fifths of global wind turbine nacelle market share in 2023 and is expected to maintain its dominance during the forecast period. The scalability and modular design of wind turbine nacelles make them well-suited for utility-scale deployment. Wind farms are scaled up by adding additional turbines and nacelles as needed, allowing utilities to flexibly expand their renewable energy capacity to meet growing demand or regulatory requirements. This scalability enables utilities to optimize their energy generation portfolios by integrating wind power with other renewable and conventional energy sources, enhancing grid stability and reliability.

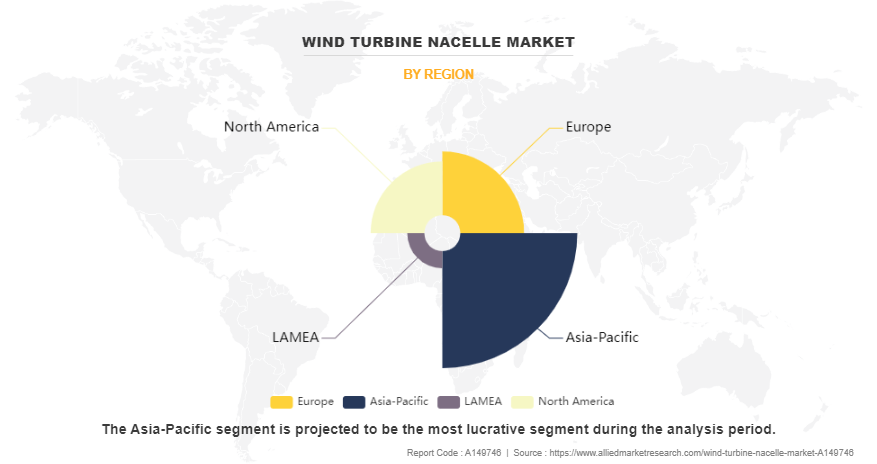

Asia-Pacific accounted for less than half of the global wind turbine nacelle market share in 2023 and is expected to maintain its dominance during the forecast period. The abundant wind resources in many parts of the Asia-Pacific region present a compelling opportunity for wind energy development. Countries such as China, India, Australia, and Japan have vast areas with strong and consistent wind speeds suitable for harnessing wind energy. As a result, there is a growing interest in exploiting these resources to diversify the energy mix and reduce reliance on fossil fuels. According to the International Energy Agency, Asia Pacific of energy demand and emissions is 50% and 60%, respectively, between 2022 and 2050. In addition, technological advancements and cost reductions in wind energy technology makes wind power increasingly competitive with conventional energy sources in the Asia-Pacific region.

Competitive Analysis

Key players in the wind turbine nacelle market include Vestas, Goldwind, GE VERNOVA, Siemens Gamesa Renewable Energy, NORDEX SE, Envision Group, ENERCON Global GmbH, Suzlon Energy Limited, Mingyang Smart Energy Group, and Windey Energy Technology Group Co., Ltd. Apart from these major players, there are other key players in the wind turbine nacelle industry. These include China Energy Group, CSIC Haizhuang Windpower, Goldwind, LM Wind Power, MingYang Smart Energy, MingYang Wind Power Group Limited, Sinovel Wind Group Co., Ltd., United Power, Xinjiang Goldwind Science & Technology Co., Ltd., and Zhejiang Windey Co., Ltd.

In the global wind turbine nacelle market, companies have adopted strategies such as product launch and expansion strategies to expand the market or develop new products. For instance, in November 2023, General Electric launched the first nacelle and hub for the 6.1-158 onshore wind turbine. This is the largest nacelle ever to be manufactured in the U.S. at a facility in Schenectady, New York. Moreover, in February 2023, Siemens Gamesa Renewable Energy announced to build a major offshore nacelle manufacturing facility in New York, The planned facility located at the Port of Coeymans.

Key Announcements

- China published its 14th Five-Year Plan for renewable energy in June 2022, which includes an ambitious target of 33% of electricity generation to come from renewables by 2025 (up from about 29% in 2021), including an 18% target for wind and solar technologies.

- In August 2022. the federal government of the U.S. introduced the IRA, which significantly expands support for renewable energy in the next ten years through tax credits and other measures.

- In February 2023, the Commission announced The Green Deal Industrial Plan, aiming to support the expansion of clean energy technology manufacturing, including wind power. Furthermore, in April 2023 nine European countries announced plans to significantly accelerate offshore wind deployment and increase installed power capacity from 30 GW in 2022 to over 120 GW by 2030 and over 300 GW by 2050.

- During COP26 held in November 2021, India announced new 2030 targets of 500 GW of total non-fossil power capacity and a 50% renewable electricity generation share (more than double the 22% share in 2020), as well as net zero emissions by 2070.

Investments in Wind Power

Investment in wind generation increased by 20% in 2022, returning to growth after a slowdown in 2021, and leading to expectations of significant capacity deployment in 2023. Investment reached a record $185 billion, the second largest among all power generation technologies and this is expected to grow further in the forecasted years due to the ambitious government targets, policy support and high competitiveness.

Historical Trends of Wind Turbine Nacelle

- The early to mid-20th century marked the nascent stages of wind turbine nacelle development, with initial prototypes emerging in response to growing interest in harnessing wind energy for electricity generation. Early pioneers in the industry, such as Danish and American researchers, laid the foundation for nacelle design and functionality, focusing on optimizing aerodynamics and structural integrity to withstand varying wind conditions.

- The 1960s witnessed significant advancements in wind turbine technology, leading to the commercialization and deployment of larger-scale turbines with more sophisticated nacelle designs. Companies such as Vestas and General Electric (GE) emerged as leaders in nacelle manufacturing, introducing innovations such as yaw systems, pitch control mechanisms, and enclosed drivetrains to improve turbine performance and reliability.

- In the 1970s, the wind turbine nacelle underwent further evolution with the development of advanced materials, manufacturing processes, and control systems. Improved blade designs, composite materials, and tower configurations contributed to increased efficiency, energy capture, and operational lifespan, driving the expansion of wind energy projects globally.

- The 1980s marked a period of rapid growth and innovation in the wind energy sector, fueled by supportive government policies, technological breakthroughs, and declining costs. Nacelle manufacturers focused on enhancing reliability, scalability, and grid integration capabilities, paving the way for the widespread adoption of wind power as a viable renewable energy source.

- The 1990s witnessed a surge in demand for wind turbine nacelles driven by environmental concerns, energy security, and advances in turbine technology. Nacelle manufacturers invested in R&D to optimize component design, minimize maintenance requirements, and reduce lifecycle costs, making wind energy increasingly competitive with conventional power sources.

- By the early 2000s, wind turbine nacelle technology evolved to accommodate larger and more powerful turbines, capable of generating higher levels of electricity output. Innovations such as direct-drive systems, permanent magnet generators, and condition monitoring solutions improved overall efficiency, performance, and reliability, positioning wind energy as a mainstream contributor to the global energy mix.

- In the 2010s, wind turbine nacelle technology continued to advance with a focus on digitalization, optimization, and grid integration. Nacelle manufacturers embraced data analytics, predictive maintenance, and remote monitoring solutions to enhance asset management and operational efficiency, enabling wind farms to maximize energy production and revenue generation.

- In the 2020s, the wind turbine nacelle market experienced further evolution with a growing emphasis on sustainability, circular economy principles, and technological innovation. Companies introduced lightweight materials, modular designs, and end-of-life recycling solutions to minimize environmental impact and support the transition to a more sustainable energy future in alignment with global climate objectives.

Key Benefits for Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the wind turbine nacelle market analysis from 2023 to 2033 to identify the prevailing wind turbine nacelle market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the wind turbine nacelle market overview and segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global wind turbine nacelle market trends, key players, market segments, application areas, and market growth strategies.

Wind Turbine Nacelle Market Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 40.3 billion |

| Growth Rate | CAGR of 6.3% |

| Forecast period | 2023 - 2033 |

| Report Pages | 250 |

| By Capacity |

|

| By Deployment |

|

| By End Use |

|

| By Component |

|

| By Region |

|

| Key Market Players | Siemens Gamesa Renewable Energy, Suzlon Energy Limited, Goldwind, NORDEX SE, GE VERNOVA, Envision Group, ENERCON Global GmbH, Mingyang Smart Energy Group, Vestas, Windey Energy Technology Group Co.,Ltd. |

Analyst Review

According to the opinions of various CXOs of leading companies, the global wind turbine nacelle market is expected to witness growth during the forecast period owing to increase demand for renewable energy, and surge in development of offshore wind farms. As countries seek to transition away from fossil fuels and reduce greenhouse gas emissions to mitigate climate change, renewable energy sources such as wind power have emerged as vital solutions. Wind energy offers a clean, abundant, and sustainable alternative to traditional fossil fuel-based electricity generation, making it a cornerstone of the transition toward a greener energy future.

Offshore wind farms have experienced remarkable growth in recent years. Offshore wind offers several advantages over onshore installations such as stronger and more consistent wind speeds, larger available sites, and reduced visual and noise impacts on land. These factors have spurred an unprecedented expansion of offshore wind projects across various regions globally, with governments, utilities, and energy companies increasingly investing in offshore wind as a key component of their renewable energy portfolios. Furthermore, advancement in technology such as larger rotor diameters, higher hub heights, and improved offshore foundation designs, have enabled the deployment of larger and more powerful wind turbines, driving the need for larger nacelles to accommodate these advancements.

The global wind turbine nacelle market was valued at $22.3 billion in 2023, and is projected to reach $40.3 billion by 2033, growing at a CAGR of 6.3% from 2024 to 2033.

Asia-Pacific is the largest regional market for Wind Turbine Nacelle.

Utilities are the leading end use of Wind Turbine Nacelle Market

Focus on sustainability and environmental impact reduction the upcoming trends of Wind Turbine Nacelle Market in the world.

Rise in demand for renewable energy, and surge in development of offshore wind farms are the leading drivers for the Wind Turbine Nacelle Market.

Asia-Pacific is the fastest growing region for the Wind Turbine Nacelle Market.

Key players in the Wind turbine nacelle market include Vestas, Goldwind, GE VERNOVA, Siemens Gamesa Renewable Energy, NORDEX SE, Envision Group, ENERCON Global GmbH, Suzlon Energy Limited, Mingyang Smart Energy Group, and Windey Energy Technology Group Co.,Ltd.

Loading Table Of Content...

Loading Research Methodology...