Window Sensors Market Outlook - 2025

The global window sensors market size was valued at $7,430.0 million in 2017 and is projected to reach $15,392.3 million by 2025, registering a CAGR of 9.3% from 2018 to 2025. North America accounted for the highest share in 2017 and is anticipated to maintain its lead in the global window sensors market throughout the forecast period.

Window sensors are vital components of any security system. These sensors are attached to a door or window, which if breached sends a signal to the main control panel, triggering an alarm. Various types of window sensors are available in the market that perform the same function. Most window systems come with a set number of sensors, and one can add more at an additional cost. Ideally, these sensors are placed on every window on the premises. The window sensors come in two pieces: one fits onto the window itself, while its counterpart is attached to the frame. Adhesive keeps the sensors in place, though sensors are secured directly into the frame. The two pieces of the sensor are positioned right next to each other, to cause their interaction in case of breaching that cuts down the electromagnet contact between them. When the two pieces are separated, such as when the door or window is opened, they send a signal to the alarm panel. These window sensors are either wired directly into the alarm system, or they have a battery to power them, so they can function wirelessly.

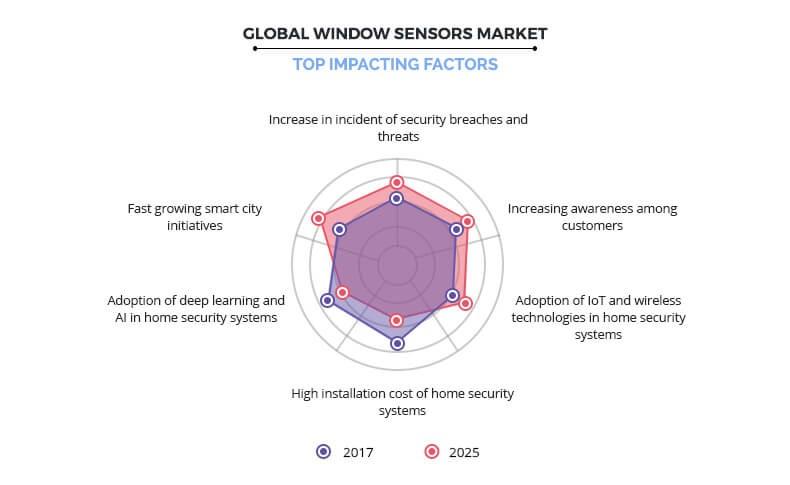

Factors such as increase in incident of security breaches and threats and rise in awareness about home security systems among customers is driving the growth of window sensors market. In addition, adoption of IoT and wireless technologies in home security systems is anticipated boost the growth of the market. However, high installation cost of home security systems is expected to hinder the growth of the window sensors market. Furthermore, adoption of deep learning & AI in home security systems and fast-growing smart city initiatives present remarkable growth opportunities for the key players operating in the window sensors market.

The global window sensors market is segment based on type, application, and region. Based on type, the market is divided into indoor and outdoor. Based on application, it is bifurcated into commercial and household. Based on region, it is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Key players including Honeywell International, Inc., Optex Group co., Ltd., Pepperl+Fuchs GmbH, Panasonic Corporation, SecurityMan Inc., iSmart Alarm, Inc., Eve Systems, Samsung Electronics Co., Ltd., SABRE - Security Equipment Corp., United technologies Corporation, and others holds major window sensors market share.

Increase in incident of security breaches and threats

A window sensor is an important part of the home security system that provides protection from intruders, burglars, and others. Thus, these windows sensors are installed on the potential entry points of the house, so that if any door or window is opened while the security system is armed, the sensor will send a signal to the central panel, which in turn will trigger an alarm. Installation of home security gives a sense of security to the people. In addition, the need of security is on the rise due to the increase in security breaches and threats. For instance, according to the crime statistics report by FBI, around 1,579,527 houses were burgled in the U.S. with a loss of around $3.5 billion in property. The installation of a home security system makes it difficult for a burglar to break in, which in turn reduce the chance of burglary. Thus, increase in incidents of security breaches and threats boosts the adoption of home security systems, which in turn fuel the growth of the window sensors market.

Increase in awareness among customers

Owing to the increase in burglaries and break-in incidents in regions such as North America, Europe, and others, the penetration of home security systems has increased. Due to the introduction of a new range of home security systems by the top manufacturers with advanced and smart technologies such as artificial intelligence and Internet of Things (IoT) , adoption of security systems is on the rise. Installing a home security system increases the security level and makes it difficult for a burglar to break-in, which in turn reduces the chances of burglary. Therefore, rise in awareness among the customers about the security advantages offered by the system is driving the adoption of home security systems, which in turn is expected to propel the growth of the window sensors market.

High installation cost of home security systems

Home security systems consist of components such as central control panel, 2-3 window sensors, motion detector, sirens, alarms, and others. In addition, components such as surveillance cameras, smoke detector, and others, are expensive, which in turn increase the overall cost of home security systems. Also, if more components are required to cover the area under protection depending on the need of the customer, it adds up to the cost of home security system. Furthermore, some security systems require complex installation procedure and cost. Thus, high installation cost of home security and expensive components hinder penetration of the home security systems, which in turn restrains the growth of the window sensors market.

Adoption of deep learning and AI in home security systems

Top home security manufactures are launching new home security systems with IoT and wireless technologies that allow users to remotely access home security. Addition of such technologies in home security systems resulted in emergence of new range of smarter home security systems with improved intrusion detection quality. However, adoption of artificial intelligence and deep learning in security systems is expected to provide a boost and deliver advanced level of security and comfort to the customer. Thus, adoption of deep learning and artificial intelligence in home security system is anticipated to provide potential growth opportunities for the players operating in the window sensors market.

Key Benefits for Window Sensors Market:

- This study presents the analytical depiction of the global window sensors market analysis along with the current trends and future estimations to depict the imminent investment pockets.

- The overall window sensors market opportunity is determined by understanding the profitable trends to gain a stronger foothold.

- The report presents information related to the key drivers, restraints, and opportunities of the global window sensors market with a detailed impact analysis.

- The current window sensors market is quantitatively analyzed from 2018 to 2025 to benchmark the financial competency.

- Porter’s five forces analysis illustrates the potency of the buyers and suppliers in the industry.

Window Sensors Market Report Highlights

| Aspects | Details |

| By Type |

|

| By Application |

|

| By Region |

|

| Key Market Players | Eve Systems, Honeywell International Inc., Optex Group Co.,Ltd., Panasonic Corporation, iSmart Alarm, Inc., Samsung Electronics Co., Ltd., SABRE - Security Equipment Corp., United Technologies Corporation, SecurityMan Inc., Pepperl+Fuchs GmbH |

Analyst Review

Window sensors are a crucial component in the home security systems that promptly notify the owner if someone forcefully tries to enter the house through the door or window. A magnet and switch are attached to the window frame, and as long as the window is closed, the magnets keep the switch circuit intact. When the window is opened while the system is armed, the magnet is pulled away and the circuit breaks, which triggers the alarms. There are various types of window sensors such as wireless and wired; however, majority of the consumers opt for the wireless sensors to avoid mess of cords.

Factors such as increase in incident of security breaches and threats and rise in awareness among customers about home security systems, drive the growth of the window sensors market. In addition, adoption of IoT and wireless technologies in home security systems is anticipated to boost the growth of the market. However, high installation cost of home security systems is expected to hinder the growth of the window sensors market. Furthermore, adoption of deep learning & AI in home security systems and fast-growing smart city initiatives presents a remarkable growth opportunity for the key players operating in the market.

Among the analyzed regions, currently, North America is the highest revenue contributor, and is expected to maintain the lead during the forecast period, followed by Europe, Asia-Pacific, and LAMEA.

Loading Table Of Content...