Windows And Doors Market Overview

The Global Windows And Doors Market size was valued at $208.1 billion in 2022, and is projected to reach $356.7 billion by 2032, growing at a CAGR of 5.5% from 2023 to 2032. The market has seen significant growth due to increased investments in residential and non-residential construction. Additionally, the rising trend of home renovation and remodeling, supported by higher disposable incomes, is fueling demand. Urban infrastructure development further boosts the need for windows and doors, driving overall market expansion.

Market Dynamics & Insights

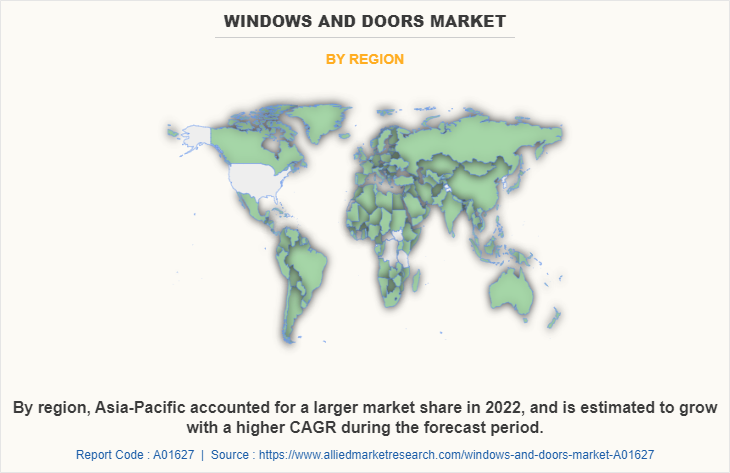

- The windows and doors industry in Asia-Pacific held a significant share of over 47.9% in 2022.

- The windows and doors industry in U.S. is expected to grow significantly at a CAGR of 4.7% from 2023 to 2032

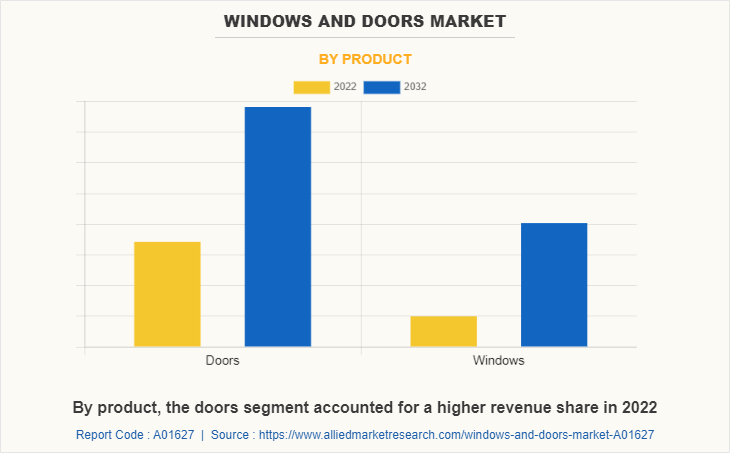

- By product, doors segment is one of the dominating segments in the market and accounted for the revenue share of over 61.6% in 2022.

- By end-user, non-residential segment is the fastest growing segment in the market.

Market Size & Future Outlook

- 2022 Market Size: $208.1 Billion

- 2032 Projected Market Size: $356.7 Billion

- CAGR (2023-2032): 5.5%

- Asia-Pacific: Largest market in 2022

- Asia-Pacific: Fastest growing market

What is Meant by Windows and Doors

Windows and doors are an integral part of any residential and non-residential buildings. A door is a movable panel located in the doorway of a building. Its major objective is to control the movement through the doorway. On the contrary, windows consist of single or multiple movable panels located in the wall opening meant for the exchange of light, air, and view. In addition to the functional aspect associated with the windows and doors market, they help to enhance the visual appeal of a building.

Windows And Doors Market Dynamics

The windows and doors market is driven by rise in residential and nonresidential construction activities. The growth in the construction sector is attributed to increase in disposable income of people across the world, especially in the countries such as India, China, Brazil, South Africa, and Vietnam. Moreover, high disposable income increases the demand for new homes and home renovation. According to the data from the U.S. Census Bureau, about 59% of the total homes renovated their houses between 2019 and 2021. During this period, about $1,800 were spent on doors and windows by an average U.S. resident, which is significantly higher than the previous average spending. Moreover, rise in population and rapid urbanization are the major factors that drive the demand for commercial and residential buildings, which significantly boosts the need for installing windows and doors market .

According to the United Nations, the global population is expected to reach 8.5 billion by 2030, a significant increase from 8 million in 2023. Moreover, the trend indicates that the total population will be more than 9.5 billion by 2050. Exponential increase in population is anticipated in Asia and Africa. Moreover, United Nations reported that the global urban population is anticipated to increase to 68% in 2050, rising significantly from 55% in 2018. Countries such as India and China are anticipated to contribute majorly to the rising urbanization in the next 30 years. For example, according to the Investment Information and Credit Rating Agency (ICRA), the residential real estate sector in India witnessed surge in quarter 4 of 2022, by growing 11% year-on-year (YoY). Demand for affordable doors and windows such as PVC doors and hollow core doors is anticipated to grow from rural areas. Such factors are positively influencing the windows and doors market overview.

However, aesthetically appealing doors and windows made from glass and expensive solid wood are expected to witness increased demand from urban areas. Moreover, countries such as the U.S., Canada, Australia, and countries in Europe are experiencing strong demand for commercial and institutional buildings owing to high disposable and rise in job opportunities. Commercial buildings often demand for visually appealing doors and windows that can augment the aesthetics of the buildings. In addition, commercial buildings are susceptible to theft and burglary; therefore, key market players offer doors that are strong and incorporate technologies to prevent forced entry.

However, factors such as fluctuating cost of raw materials required to construct windows and doors are anticipated to restrain the windows and doors market growth. In addition to this, lack of skilled labor in countries such as the U.S., Canada, European countries, and Australia is negatively affecting the construction sector in these nations. In addition, high initial cost of automatic doors is one of the major challenges that restrain the windows and doors market growth. In addition, the technique of predictive maintenance utilizes the data collected in real-time through detection or optical sensors installed in the automatic doors and windows, and subsequently analyses it for predictive maintenance.

Moreover, technological developments in the windows and doors industry are expected to provide lucrative opportunities for players that operate in the windows and doors market. Various companies involved in manufacturing windows and doors have been developing automatic doors and windows. In addition, key players offer doors that incorporate the latest technologies that can prevent forced entry, and record unauthorized users, so that they can later be identified.

Windows And Doors Market Segmental Overview

The windows and doors market is segmented on the basis of product type, material, application, end-user, and region. By product type, the windows and doors market is bifurcated into doors and windows. On the basis of material, it is divided into wood, metal, and plastic. Depending on application, it is categorized into swinging, sliding, folding, and revolving & others. On the basis of end user, the windows and doors market is categorised into residential, and non-residential. Region wise, it is analyzed across North America (U.S., Canada, and Mexico), Europe (Germany, France, Italy, UK, Spain, and rest of Europe), Asia-Pacific (China, India, Japan, South Korea, Australia and rest of Asia-Pacific), and LAMEA (Latin America, Middle East, and Africa).

By product type: The windows and doors market is divided into doors and windows. In 2022, the doors segment dominated the windows and doors market, in terms of revenue, and the windows segment is expected to grow with a higher CAGR during the forecast period. Windows are designed in a way, so that air exchange can occur, along with the diffusion of natural ambient light inside the building. In addition, owing to rise in trend of making buildings energy efficient, the demand for windows that allow large amount of air and light penetrate inside the building is on rise. Moreover, increase in households all across the world is playing pivotal role in driving demand for doors as well as windows.

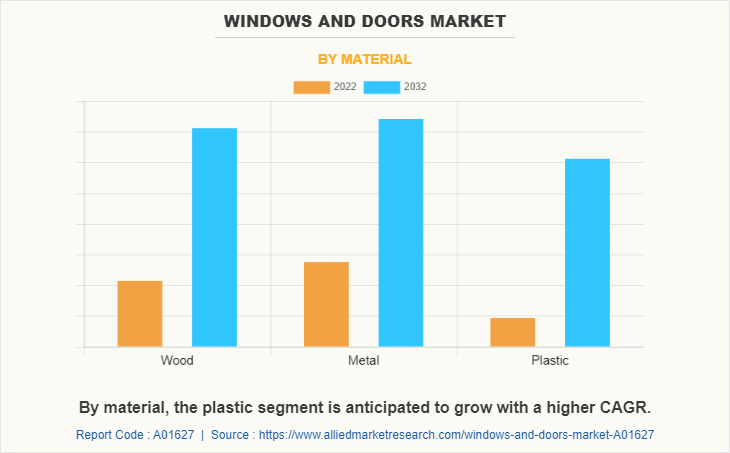

By material: The metal segment accounted for a higher market share in 2022. This is attributed to the fact that metal is a favorable material for construction of windows and doors market as it is highly strong and tough, and is durable. Doors made from metal can withstand and resist forced entry. Moreover, frames of doors and windows are made using metal. Furthermore, the plastic segment is anticipated to grow with a higher CAGR during the forecast period, owing to its relatively inexpensive price, and properties such as weather resistant, insect resistance, lightweight, and durability.

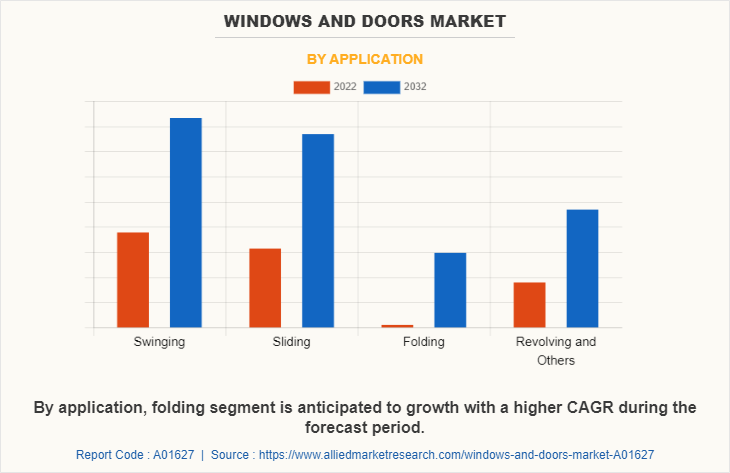

By application: The swinging segment accounted for a larger windows and doors market share in 2022, and the sliding segment grossed the second-highest revenue share in 2022. Sliding doors and windows do not take up excessive space like a swinging door, making them suitable for small rooms and houses. In addition, sliding doors are installed where the door is in the center of the wall. Furthermore, the folding segment is anticipated to grow with a higher CAGR during the forecast period, largely due to the growing demand for doors that are easy to operate.

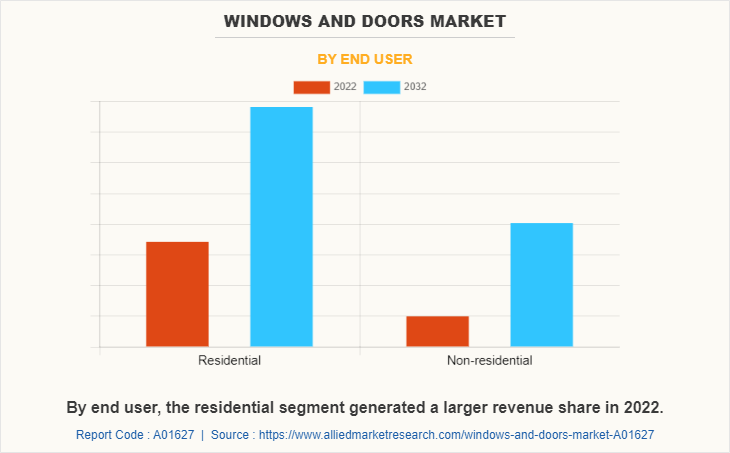

By end user: The residential segment accounted for a higher market share in 2022. On the other hand, the nonresidential segment is anticipated to growth with a significant CAGR during the forecast period. The residential construction segment is witnessing growth due to increase in population. Moreover, the non-residential segment is expected to grow with the growth in disposable income and rapid urbanization.

By region: In 2022, Asia-Pacific garnered the highest share and is anticipated to secure the leading position during the forecast period. This growth is attributed to extensive economic growth and growth of population and urbanization in countries such as China, India, Vietnam, and Indonesia. Furthermore, Asia-Pacific is also anticipated to grow with a higher CAGR during the forecast period, due to high rate of population growth and increase in job opportunities that enable the common people to own and renovate their houses.

Competition Analysis

Competitive analysis and profiles of the major players in the windows and doors is provided in the report. Major companies included in the report include, Marvin, YKK Corporation, Sanwa Holdings Corporation (Horton Automatics Inc,), Cornerstone Building Brands, Inc. (Atrium Corporation), MI Windows and Doors, LLC., Andersen Corporation, Pella Corporation, JELD-WEN Holding, Inc., LIXIL Corporation, and DCM Shriram Ltd. (Fenesta Building System).

Major players to remain competitive adopt development strategies such as acquisition, product launch, and others. For instance, in March 2023, Marvin, a major player in the windows and doors market, launched Elevate Bi-Fold door for exterior application. Such factors associated with folding doors are driving the demand for folding doors. Similarly, in August 2020, Fenesta Building System, a major manufacturer of doors launched aluminum windows and doors systems to cater to all application needs of retail and institutional customers.

What are the Key Benefits for Stakeholders

- The report provides an extensive analysis of the current and emerging windows and doors market trends and dynamics.

- In-depth windows and doors market analysis is conducted by constructing market estimations for key market segments between 2022 and 2032.

- Extensive analysis of the windows and doors market is conducted by following key product positioning and monitoring of top competitors within the windows and doors market framework.

- A comprehensive analysis of all the regions is provided to determine the prevailing opportunities.

- The windows and doors market forecast analysis from 2023 to 2032 is included in the report.

- The key players within the windows and doors market are profiled in this report and their strategies are analyzed thoroughly, which help understand the competitive outlook of the windows and doors industry.

Windows and Doors Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 356.7 billion |

| Growth Rate | CAGR of 5.5% |

| Forecast period | 2022 - 2032 |

| Report Pages | 265 |

| By Product |

|

| By Application |

|

| By End User |

|

| By Material |

|

| By Region |

|

| Key Market Players | LIXIL Corporation, Marvin, Sanwa Holdings Corporation (Horton Automatics Inc,), DCM Shriram Ltd. (Fenesta Building System)s, Andersen Corporation, YKK Corporation, JELD-WEN Holding, Inc., Pella Corporation, MI Windows and Doors, LLC., Cornerstone Building Brands, Inc. (Atrium Corporation) |

Analyst Review

According to the insights of the top-level CXOs, the windows and doors market has witnessed significant growth in the past few years owing to a rise in construction activities, fueled by the increasing demand for homes, office buildings, shopping malls, retail stores, public buildings, and others. Moreover, home renovation is also playing a major role in driving market growth.

The demand for different types of windows and doors is widely dependent on disposable income and ongoing trends in a country. For example, India has a large rural population having relatively lower disposable income; thus, affordable flush doors made of wood and PVC are in high demand. However, in developed countries, doors with attractive designs and mechanisms such as sliding and folding are in high demand. Furthermore, for office buildings, the trend is almost the same across the world. Office buildings often make use of glass doors owing to their attractive aesthetics and transparency. Moreover, commercial buildings have to consider excessive use of doors and windows owing to the high footfall of people; therefore, the demand for automated and durable doors typically made of steel and glass is in high demand.

The CXOs further added that windows and doors have been made for centuries, and for very long time the way they are operated and function have remained the same. However, with advancements in technology, windows and doors are getting automated, making them easy to operate. In addition, advancements in materials such as fiberglass and improving recycling capabilities of plastic have been instrumental in growing utilization of these materials. Contrarily, fluctuating cost of raw materials used for construction of doors and windows is anticipated to restrain the market growth to a certain level.

Increase in number of households, surge in demand for commercial and institutional buildings, and increase in building renovation and improvement activities are few upcoming trends of Windows and Doors Market in the world.

Windows and doors are installed in all types of residential and non-residential buildings.

Asia-Pacific is the largest region market for Windows and Doors, and it is also estimated to maintain its dominance throughout the forecast period.

The global windows and doors market was valued at $2,08,121.6 million in 2022.

Major companies included in the report include, Marvin, YKK Corporation, Sanwa Holdings Corporation (Horton Automatics Inc,), Cornerstone Building Brands, Inc. (Atrium Corporation), MI Windows and Doors, LLC., Andersen Corporation, Pella Corporation, JELD-WEN Holding, Inc., LIXIL Corporation, and DCM Shriram Ltd. (Fenesta Building System).

The company profile has been selected on factors such as geographical presence, market dominance (in terms of revenue and volume sales), various strategies and recent developments.

The global windows and doors market is projected to reach $3,56,666.8 million by 2032, registering a CAGR of 5.5% from 2023 to 2032.

By material, the metal segment held a larger market share in 2022.

Loading Table Of Content...

Loading Research Methodology...