Wireless Sensor Market Statistics - 2031

The global wireless sensor market was valued at $15.5 billion in 2021, and is projected to reach $102.5 billion by 2031, growing at a CAGR of 20.6% from 2022 to 2031

A wireless sensor is an enhanced monitoring and recording tool equipped with sensing and computing systems, radio transceivers, and power components. The wireless sensors can measure real-time physical conditions such as temperature, sound, pollution level, and humidity and share this information with the mainframe to be observed and analyzed. Furthermore, wireless sensors such as WiFi sensors and monnit sensors are electronic devices that collect data and transmit it wirelessly to a remote receiver or computer system. These sensors use various communication technologies such as Wi-Fi, Zigbee, Bluetooth, and cellular to transmit data wirelessly. Wireless sensors have a wide range of applications in various fields, including industrial automation, environmental monitoring, healthcare, and smart homes. They offer several benefits over traditional wired sensors, including increased flexibility, ease of installation, and reduced risk of damage due to physical interference. These wireless IoT sensors are majorly used in industrial, environmental, and home automation applications.

The report offers a thorough analysis of the wireless sensor market with a detailed study of various aspects of the market such as market dynamics, vital segments, major geographies, key players, and competitive landscape. The report provides a clear picture of the current market situation and future trends of the wireless sensor market based on the impact of various market dynamics and vital forces influencing the market. The drivers and opportunities in the market contributing to the market growth are acknowledged in the market dynamics. Besides, challenges and restraints that hold the potential to hamper market growth are also premeditated in the wireless sensor market. Porter's five forces analysis is delivered through the report which precisely highlights the effects of key forces on the wireless sensor market. The report offers market size and estimations analyzing the wireless sensor market through various segments.

In addition, the report includes a geographical market analysis of these segments. Each segment entailed in the report is studied at the regional and country levels as well to provide complete coverage of the wireless sensor Market. The report categorizes the Wireless Sensor Market into four major geographies including North America, Europe, Asia-Pacific, and LAMEA. These geographies are further sub-categorized into countries to cover the wireless sensor Market scenario across respective regions. Furthermore, the report covers the competitive scenario of the Wireless Sensor Market. The key players operating in the wireless sensor Market are studied in the report to understand their current market position and competitive strengths in the industry.

The global wireless sensor market is expected to witness notable growth during the forecast period, owing to the surge in the use of wireless sensors in IoT applications. Moreover, the rise in the adoption of wireless-sensor applications for remote monitoring majorly drives the wireless sensors market outlook. Furthermore, the rise in the establishment of smart cities, buildings, and factories is projected to shape the future of manufacturing industries by standardizing the processes.

However, the high risk associated with data privacy and security-related concerns is one of the prime factors that restrain the wireless sensor market growth. Furthermore, the rise in the adoption of wireless sensors in wearable devices is projected to provide lucrative opportunities to expand the wireless sensor industry during the forecast period.

Segment Overview

The wireless sensor market overview is segmented into Product Type, Industry Vertical, and Region.

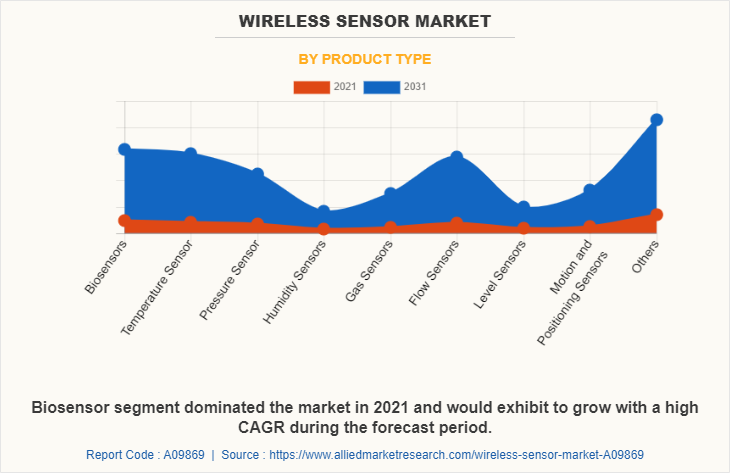

Based on product type, the market is segmented into biosensors, temperature sensors, pressure sensors, flow sensors, humidity sensors, gas sensors, level sensors, motion and positioning sensors, and others. In 2021, the biosensors segment dominated the market in terms of revenue and is expected to follow the same trend during the forecast period. However, the flow sensors segment is expected to emerge as the fastest-growing segment of the market during the forecast period 2022-2031.

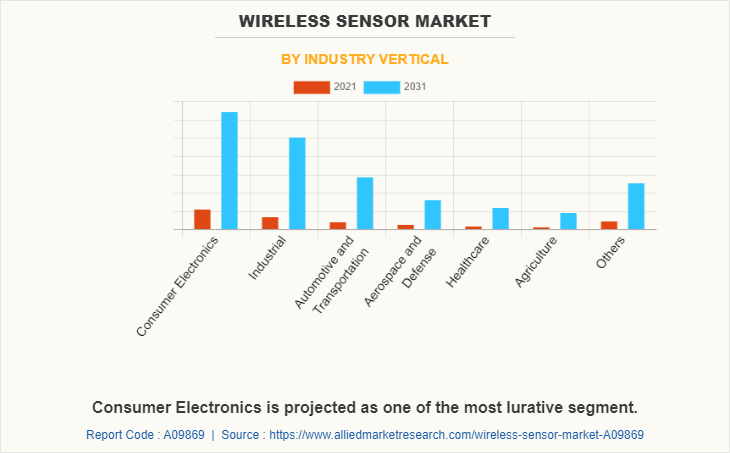

By industry vertical, the wireless sensor market size is classified into consumer electronics, industrial, automotive & transportation, aerospace & defense, healthcare, agriculture, and others. The consumer electronics segment dominated the market in 2021 in terms of revenue and is expected to dominate the market during the forecast period.

By region, the wireless sensor market trends are studied across North America (the U.S., Canada, and Mexico), Europe (UK, Germany, France, Italy, and the Rest of Europe), Asia-Pacific (China, Japan, India, South Korea, and Rest of Asia-Pacific), and LAMEA (Latin America, Middle East, and Africa). Asia-Pacific, specifically China, remains a significant participant in the wireless sensor market. Major organizations and government institutions in the Asia-Pacific region have significantly put resources into action to develop enhanced wireless sensor-based wearable electronics solutions that drive the growth of the wireless sensor industry in Asia-Pacific.

Competition Analysis

Competitive analysis and profiles of the major global wireless sensor market players that have been provided in the report include ABB Ltd., Texas Instruments Inc., STMicroelectronics, Emerson Electric Co., Honeywell International Inc., Siemens AG, Schneider Electric, Broadcom Inc., General Electric Company, NXP Semiconductors, Rockwell Automation Inc., TE Connectivity Ltd., and Broadcom Inc.

Country Analysis

Country-wise, the U.S. acquired a prime share in the wireless sensor market in the North American region and is expected to grow at a high CAGR of 17.4% during the forecast period of 2022-2031. The U.S. holds a dominant position in the wireless sensor market, owing to the presence of prime players in this region putting resources into action to develop next-generation advanced wearable solutions.

In Europe, Germany dominated the wireless sensor market growth in terms of revenue in 2021 and is expected to follow the same trend during the forecast period. Furthermore, the UK is expected to emerge as the fastest-growing country in Europe's wireless sensor with a CAGR of 21.3%, owing to a significant development in the Internet of Things and consumer electronics solutions.

In Asia-Pacific, China holds a dominant wireless sensor market share in the Asia-Pacific region and is expected to follow the same trend during the forecast period, owing to a significant rise in investment by prime players in next-generation temperature, humidity, motion, and proximity sensors for Internet of Things solutions, which is expected to drive the market in China during the forecast period. However, South Korea is expected to emerge as a dominant country in the wireless sensor market in the Asia-Pacific region.

In LAMEA, Latin America garnered a significant wireless sensor market forecast in 2021 owing to the presence of prime vendors such as Parker Hannifin Corp, IoT Plus, and Others. Moreover, Africa is expected to emerge as the fastest-growing region of the LAMEA region, which a high CAGR of 22.6% from 2022 to 2031.

Historical Data & Information

The wireless sensor market is highly competitive, owing to the strong presence of existing vendors. Vendors of wireless sensor machines with extensive technical and financial resources are expected to gain a competitive advantage over their competitors because they can cater to market demands. The competitive environment in this market is expected to increase as technological innovations, product extensions, and different strategies adopted by key vendors increase.

Key Developments / Strategies

Texas Instruments, STMicroelectronics, TE Connectivity Ltd., Honeywell International Inc., and ABB Ltd. are the top 5 companies holding a prime share in the wireless sensor market. Top market players have adopted various strategies, such as product launches, partnerships, acquisitions, product upgrades, and product development, to expand their foothold in the wireless sensor market.

In 2022, Honeywell announced a new sustainability solution for carbon emissions monitoring and optimization which it has launched for earlier adopters and has also been deployed at its own facility. Honeywell Versatilis™ Signal Scout™ wireless Industrial IoT leak detection sensors will enable organizations to monitor and visualize emissions in near real-time. The new solution will help customers in the industrial sector as they strive to reduce their greenhouse gas (GHG) emissions and meet their carbon reduction goals.

In February 2022, STMicroelectronics, a global semiconductor leader serving customers across the spectrum of electronics applications and a top manufacturer of micro-electro-mechanical systems (MEMS), is introducing its third generation of MEMS sensors. The new sensors enable the next leap in performance and features for consumer mobiles and smart industries, healthcare, and retail.

In June 2021, STMicroelectronics and Metalenz Inc., the pioneer in meta-surface design and commercialization, announced a co-development and license agreement to develop manufacturing processes for sensing for consumers called Metalenz’s meta-optics technology for next-generation smartphones, consumer devices, healthcare, and automotive applications.

In March 2020, TE Connectivity Ltd. completed its public takeover of First Sensor AG (XTRA: SIS). First Sensor, founded as a technology start-up in the early 1990s, is a global player in sensor technology. With its expertise in chip design and production, as well as microelectronic packaging, it develops and produces standard sensors and customer-specific sensor solutions in the fields of photonics, pressure, and advanced electronics for applications within the industrial, medical, and transportation markets.

In May 2021, Honeywell developed two new Inertial Measurement Units (IMU) for military and rugged industrial environments. The HG1125 and HG1126 are Honeywell’s sensors that can withstand a shock of up to 40,000 G. Honeywell designed these to be suitable for extremely harsh impacts, such as those found in ballistics tests.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the wireless sensor market analysis from 2021 to 2031 to identify the prevailing wireless sensor market opportunities.

- Market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders to make profit-oriented business decisions and strengthen their supplier-buyer network.

- An in-depth analysis of the wireless sensor market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes an analysis of the regional as well as global wireless sensor market trends, key players, market segments, application areas, and market growth strategies.

Wireless Sensor Market Report Highlights

| Aspects | Details |

| Market Size By 2031 | USD 102.5 billion |

| Growth Rate | CAGR of 20.6% |

| Forecast period | 2021 - 2031 |

| Report Pages | 428 |

| By Product Type |

|

| By Industry Vertical |

|

| By Region |

|

| Key Market Players | NXP Semiconductors., ABB Ltd., Siemens AG, Texas Instruments Inc., Emerson Electric Co., Rockwell Automation Inc., STMicroelectronics, TE Connectivity Ltd., Broadcom Inc., Schneider Electric, General Electric Company, Honeywell International Inc. |

Analyst Review

The Internet of Things (IoT) and Industry 4.0 are commonly seen as being made possible in large part by wireless sensor technologies. Industry experts think it has the potential to disrupt several industries, by supplying real-time data and connectivity to a variety of devices and systems. Security and privacy issues, the possibility of interference, and signal deterioration in particular situations are all things to be concerned about. In general, professionals see wireless sensor technology as a potent instrument with enormous promise, but one that needs considerable thought and planning to be used successfully.

The global wireless sensors market is highly competitive, owing to the strong presence of existing vendors. Wireless sensors vendors, who have access to extensive technical and financial resources, are anticipated to gain a competitive edge over their rivals, as they have the capacity to cater to the market requirements. The competitive environment in this market is expected to further intensify with increase in technological innovations, product extensions, and different strategies adopted by key vendors.

Rise in demand for wireless sensors solution in home and industrial automation applications has witnessed a surge, owing to its ability to process data in real-time. Moreover, prime economies, such as the U.S., China, Germany, and Japan, plan to develop and deploy next-generation wireless sensors-based electronics solutions across various industrial sector applications, which is anticipated to provide lucrative opportunities for market growth.

Among the analyzed geographical regions, Asia-Pacific exhibits the highest adoption of wireless sensors and has been experiencing a massive expansion of the market. On the other hand, North America is expected to grow at a faster pace, predicting lucrative growth due to emerging countries such as the U.S. and Mexico, which invest in these technologies. Regions such as the Middle East and Africa are expected to offer new opportunities for the growth of the wireless sensors market in the future.

The Wireless Sensor Market valued for $15,508.69 million in 2021 and is estimated to reach $102,448.60 million by 2031, exhibiting a CAGR of 20.6% from 2022 to 2031

Consumer Electronics is the leading application of wireless sensor market.

North America is the largest region of wireless sensor market.

Significant factors that impact the growth of the global wireless sensor industry include the rise in the adoption of wireless sensors in the automotive industry paired with the rising establishment of smart cities, buildings, and factories.

Texas Instruments, STMicroelectronics, TE Connectivity Ltd., Honeywell International Inc. and ABB Ltd. are the top 5 companies holding a prime share in the wireless sensor market.

Loading Table Of Content...