Wood Adhesives Market Research - 2032

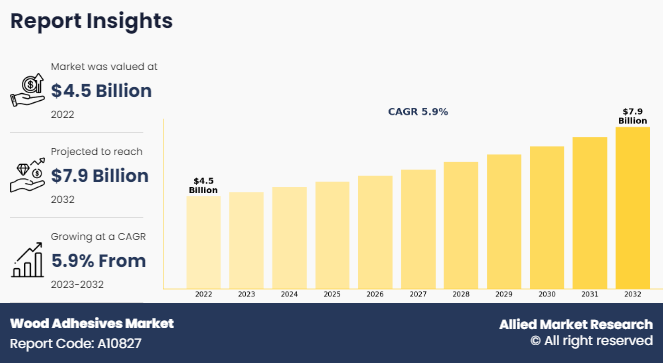

The global wood adhesives market was valued at $4.5 billion in 2022, and is projected to reach $7.9 billion by 2032, growing at a CAGR of 5.9% from 2023 to 2032. Wood adhesives are formulated for bonding wood substrates in various applications, including construction, furniture manufacturing, and woodworking. These adhesives exhibit characteristics such as high bonding strength, resistance to environmental factors like moisture and temperature, and compatibility with different types of wood. They are available in various forms, including liquid, solid, and hot melt adhesives, tailored to specific bonding requirements.

The global wood adhesives market growth is majorly driven by surge in demand for durable and eco-friendly bonding solutions coupled with technological advancements aimed at enhancing performance and sustainability of wood products. In addition, the primary driver of the wood adhesive market is the growing construction industry. However, volatile raw material prices hamper the growth of the market. On the contrary, innovative product development, high market growth potential in emerging economies, and increase in customization & collaboration to meet specific application needs are expected to offer lucrative opportunities for the expansion of the global market during the forecast period.

Key Takeaways

The wood adhesive market study covers 20 countries. The research includes a segment analysis of each country in terms of value ($million) and volume (kilotons) for the projected period 2023–2032.

The study integrates high-quality data, professional opinions & analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global markets and to assist stakeholders in making educated decisions to achieve their most ambitious growth objectives.

Over 3,700 product literature, annual reports, industry statements, and other comparable materials from major industry participants were reviewed to gain a better understanding of the market.

The wood adhesive market is highly fragmented, with several players, including HB Fuller, Henkel AG & Co., KGaA, Bostik SA, 3M, Sika AG, Ashland, Inc., Pidilite Industries Ltd., Jubiulant Industries Ltd., DowDuPont Inc., and Akzo Nobel N.V.

Market Dynamics

The construction industry serves as a significant driver of the wood adhesives market. This is attributed to the fact that steady rise in construction activities worldwide, spanning residential, commercial, and infrastructure projects, underscores the indispensability of wood adhesives across various applications within the sector. In residential construction, wood adhesives play a vital role in bonding structural elements such as beams, trusses, and joists, ensuring the integrity and stability of buildings. Moreover, adhesives are extensively utilized in flooring installations, providing secure adhesion between wood planks or panels, thereby enhancing durability and longevity.

In commercial construction, wood adhesives are widely applicable in interior finishes, including paneling, cabinetry, and millwork. These adhesives facilitate the assembly of wood-based components, delivering robust bonds that withstand the rigors of commercial environments while offering aesthetic appeal and design versatility. Furthermore, the burgeoning infrastructure sector drives the demand for wood adhesives in various applications such as bridges, tunnels, and public buildings. Adhesives are integral to the fabrication of prefabricated wood components utilized in these projects, enabling efficient construction processes and accelerating project timelines.

The versatility of wood adhesives extends beyond traditional construction methods, encompassing innovative techniques such as mass timber construction and modular building systems. These advanced construction methodologies leverage wood adhesives to achieve structural integrity, seismic resilience, and energy efficiency in buildings, thereby revolutionizing the construction landscape. The rising investment in construction activities is expected to boost the demand for the wood adhesive market as it has various applications in the construction sector. For instance, the Department for Promotion of Industry and Internal Trade (DPIIT) reports that foreign direct investment (FDI) in India's development and construction activity sectors reached $26.17 billion and $26.30 billion, respectively, between April 2000 and December 2021. In 2021, infrastructure operations accounted for $81.72 billion, or 13% of all FDI inflows.

Fluctuations in raw material prices, like resins and solvents, directly influence the production costs of wood adhesives, potentially diminishing their cost-effectiveness for manufacturers. When prices rise, production expenses increase, limiting the profit margins and necessitating price hikes, making wood adhesives less competitive against alternative bonding options. For instance, according to Echemi, a chemical supply chain service company, in July 2022, the liquid epoxy resin prices went down. The highest average price in the month was 3,057 $/ton, and the lowest average price was 2,473 $/ton, a drop of 19.09%; from January to July. In addition, volatile prices can disrupt supply chain planning, hindering budgeting and forecasting accuracy. According to Plastic Technology—a leading provider of technical and business information for plastic processors in injection molding, plastic additives, and plastic materials—in January 2023, polyethylene prices were expected to be a roll over from December 2022, but suppliers implemented increases of $0.29/lb. In addition to cutting their January scheduled price increases from $0.49 to $0.78/lb down to $0.29/lb, they then issued additional price hikes for February on the order of $0.29–0.49/lb

Manufacturers need to adjust formulations or source alternative materials to maintain affordability, which compromises adhesive quality or performance. To address these challenges, companies often employ strategies such as hedging against price fluctuations, diversifying their supplier base, or investing in research to optimize formulations. However, the unpredictability of raw material costs remains a persistent concern, demanding vigilant management to uphold competitiveness and profitability in the wood adhesive market. Contrarily, product innovation in the wood adhesives market presents a compelling opportunity for manufacturers to meet the evolving needs of customers while staying ahead of competitors. By focusing on enhancing performance, manufacturers develop adhesives with superior bonding strength, durability, and environmental sustainability. For example, the formulation of bio-based adhesives derived from renewable sources can address growing concerns about the environmental impact of traditional adhesives, offering eco-friendly alternatives without compromising performance.

Moreover, tailoring adhesives for specific applications, such as outdoor use or fire resistance, allows manufacturers to cater to niche markets with unique requirements. Adhesives designed to withstand harsh weather conditions or high temperatures provide added value to customers in the industries such as construction, furniture manufacturing, and automotive, where durability and reliability are paramount. By investing in R&D to innovate and diversify their product offerings, adhesive manufacturers can differentiate themselves in the market, attract new customers, and foster long-term customer loyalty.

In addition, innovative products that address sustainability concerns and offer superior performance can command premium pricing, contributing to increased profitability and market share. For instance, in May 2021, Henkel made a significant investment in a new innovation hub located in Shanghai, China, with the goal of fortifying its presence within Asia Pacific. In February 2020, Henkel took steps to enhance its R&D capabilities by upgrading its innovation center situated in Sydney.

Segments Overview

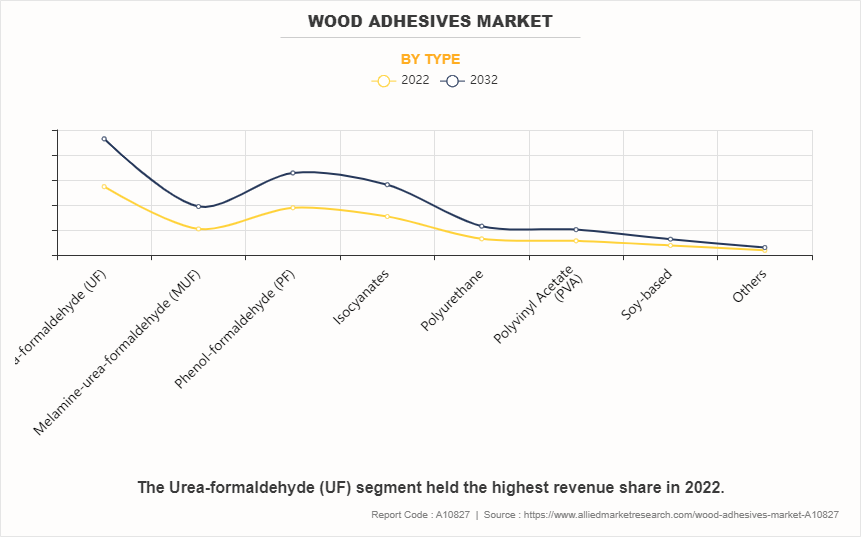

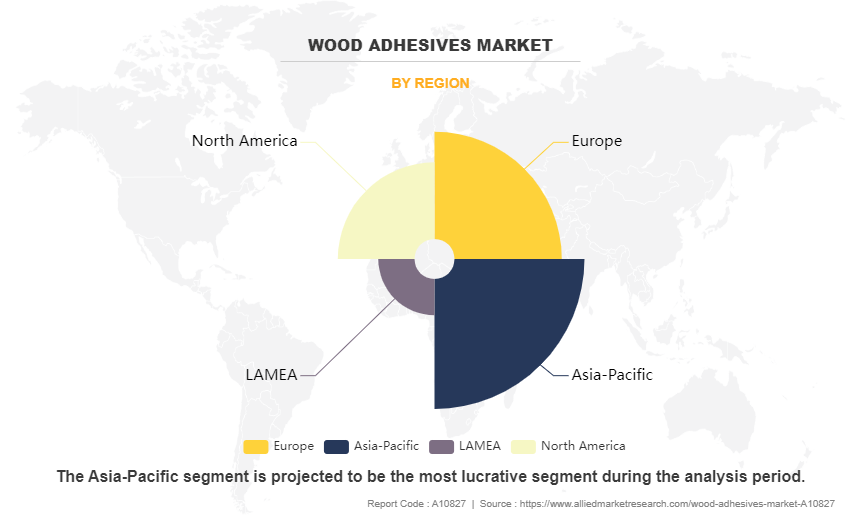

The global wood adhesives market is segmented into product, application, and region. By product, the market is divided into urea-formaldehyde, melamine urea-formaldehyde, phenol-formaldehyde, isocyanates, polyurethane, polyvinyl acetate, soy-based, and others. On the basis of application, it is categorized into flooring, furniture, doors & windows, housing components, and others. Region wise, the wood adhesive market is studied across North America, Europe, Asia-Pacific, and LAMEA.

By type, the urea formaldehyde segment accounted for the largest share in 2022 due to the cost-effectiveness, versatility, strong bonding capabilities, fast curing properties, regulatory compliance, and widespread availability of urea formaldehyde. Urea formaldehyde adhesives offer manufacturers a reliable and economical solution for bonding various wood types and products, meeting diverse application needs from interior to exterior settings. Rise in government spending on construction and infrastructure is beneficial for wood adhesive market as adhesives such as urea formaldehyde are used widely in the construction projects. For instance, according to India Brand Equity Foundation, the Dubai Government and India signed a contract in October 2021 to build infrastructure in Jammu and Kashmir, including industrial parks, IT towers, multipurpose towers, logistics centers, medical colleges, and specialized hospitals.

The melamine-urea formaldehyde (MUF) segment is expected to register the highest CAGR of 6.5% due to its superior bonding strength, water resistance, and lower formaldehyde emissions compared to traditional urea formaldehyde adhesives. MUF adhesives offer improved performance and environmental benefits, making them increasingly favored in applications requiring higher durability and compliance with stringent regulations regarding formaldehyde emissions. According to the European Construction Industry Federation, the investment in building construction in France was around $141,000 million in 2022, which was higher than civil engineering construction. Thus, rising investment in building construction is boosting the growth rate of melamine urea formaldehyde as it has various applications in building construction.

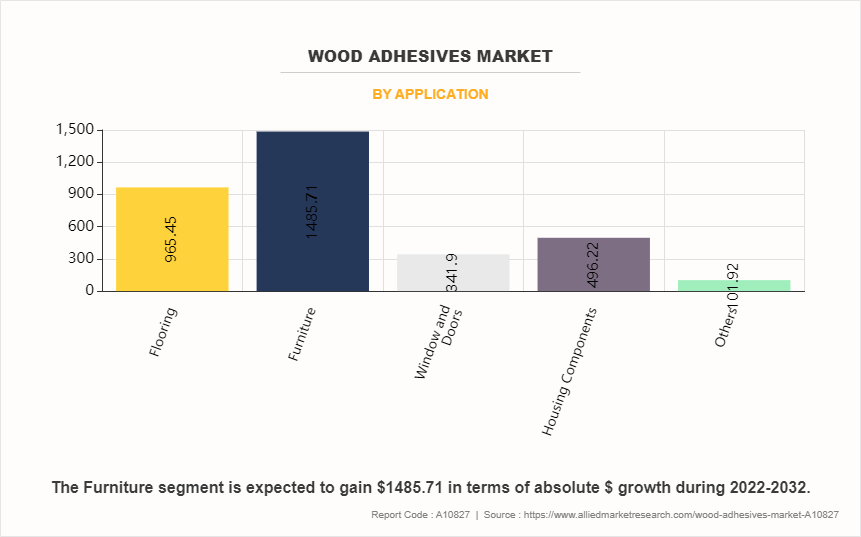

By application, the furniture segment accounted for the largest market share in 2022, as wood adhesives are essential for assembling furniture pieces such as chairs, tables, cabinets, and beds, providing strong and durable bonds for structural integrity and longevity. Moreover, the demand for customizable and aesthetically pleasing furniture drives the need for high-quality adhesives that can withstand diverse manufacturing processes and design requirements. The flooring segment is expected to register the highest CAGR of 6.2%. This growth is fueled by increasing demand for wood flooring solutions in residential, commercial, and industrial sectors.

Wood adhesives play a pivotal role in securely bonding flooring materials such as hardwood, laminate, and engineered wood, meeting stringent performance standards for durability, moisture resistance, and stability. Rise in construction activities and renovation projects worldwide further propels the expansion of the flooring segment. For instance, according to the European Construction Industry Federation, the investment in construction in Europe Union in 2022 was around $1,251,962 million, which was 2% higher than previous year.

Asia-Pacific leads the wood adhesive market size in 2022 and is expected to continue its dominance during the forecast period. This is majorly attributed to increase in construction activities in the countries such as China, India, and Southeast Asian nations. Moreover, the region's burgeoning furniture, construction, and automotive sectors substantially drives demand for wood adhesives. Furthermore, investments in infrastructure projects, and the expanding manufacturing base contribute to the market's growth. According to the India Brand Equity Foundation, the Private Equity Investments in India’s real estate sector stood at $4.2 billion in 2023.

Competitive landscape

The players operating in the global wood adhesive market report are HB Fuller, Henkel AG & Co., KGaA, Bostik SA, 3M, Sika AG, Ashland, Inc., Pidilite Industries Ltd., Jubiulant Industries Ltd., DowDuPont Inc., and Akzo Nobel N.V.

Global competitors encounter intense competition not only among themselves but also from regional players equipped with robust distribution networks and a deep understanding of suppliers and regulations. For example, in January 2023, Sika AG launched MB EZ Rapid, a high-performance single-component adhesive substrate consolidator and rapid-drying moisture barrier tailored for residential and commercial floor covering installations. Moreover, key players in wood adhesive the market compete on the basis of quality offered and the technology used for the manufacturing of the product.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the wood adhesives market analysis from 2022 to 2032 to identify the prevailing wood adhesives market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the wood adhesives market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global wood adhesives market trends, key players, market segments, application areas, and market growth strategies.

Wood Adhesives Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 7.9 billion |

| Growth Rate | CAGR of 5.9% |

| Forecast period | 2022 - 2032 |

| Report Pages | 300 |

| By Type |

|

| By Application |

|

| By Region |

|

| Key Market Players | Ashland, Inc, HB Fuller, Jubiulant Industries Ltd., 3M, DowDuPont Inc., Bostik SA, Pidilite Industries Ltd, Akzo Nobel N.V., Henkel AG & Co. KGaA, Sika AG |

Analyst Review

According to the insights of the CXOs of leading companies, the wood adhesive market is driven by increasing preference for engineered wood products, such as plywood and particleboard, in construction and furniture manufacturing. These products require reliable adhesives for their fabrication, thus boosting the demand. However, environmental impact associated with traditional wood adhesives, particularly formaldehyde emissions, hamper the market growth. Stringent regulations and consumer preferences for eco-friendly products are pressuring manufacturers to develop low-emission or formaldehyde-free alternatives.

The CXOs further added that an opportunity lies in the development of smart adhesives that offer additional functionalities beyond bonding, such as self-healing properties or enhanced fire resistance. These innovations cater to the evolving needs of industries such as construction and automotive, where materials with advanced properties are increasingly sought after. By leveraging technological advancements and sustainability initiatives, wood adhesive manufacturers can address market demands while minimizing environmental impact, thus fostering the growth and competitiveness in the industry.

The wood adhesive market accounted for $4.5 billion in 2022 and is projected to reach $7.9 billion by 2032, growing at a CAGR of 5.9% from 2023 to 2032.

The players operating in the global wood adhesive market are HB Fuller, Henkel AG & Co., KGaA, Bostik SA, 3M, Sika AG, Ashland, Inc., Pidilite Industries Ltd., Jubiulant Industries Ltd., DowDuPont Inc., and Akzo Nobel N.V.

Region wise, Asia-Pacific is projected to register robust growth during the forecast period during the forecast period.

The growth of the global wood adhesives market is majorly driven by surge in demand for durable and eco-friendly bonding solutions coupled with technological advancements aimed at enhancing performance and sustainability of wood products

Innovative product development, high market growth potential in emerging economies, and increase in customization & collaboration to meet specific application needs are expected to offer lucrative opportunities for the expansion of the global market during the forecast period.

Upcoming trends in the wood adhesives market include bio-based formulations, digitalization in production, and enhanced eco-friendly solutions.

By application, the furniture segment accounted for the largest share in 2022 owing to adhesives' critical role in assembling diverse wooden furniture components, from intricate joints to robust structures, ensuring both aesthetic appeal and structural integrity

Loading Table Of Content...

Loading Research Methodology...