Wood Coatings Market Size & Insights: 2033

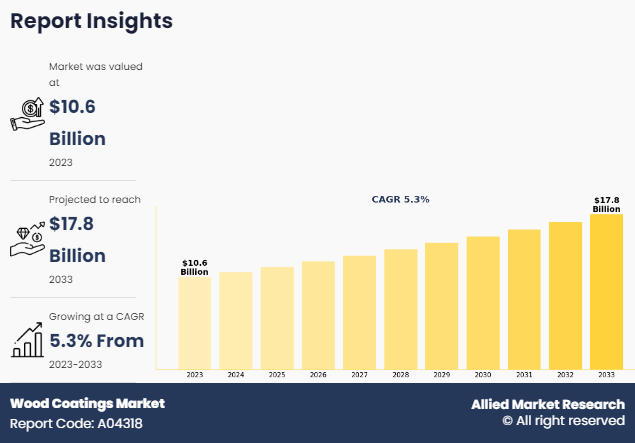

The global wood coatings market size was valued at $10.6 billion in 2023, and is projected to reach $17.8 billion by 2033, growing at a CAGR of 5.3% from 2023 to 2033. Wood coatings refer to protective finishes applied to wooden surfaces to enhance their appearance and durability. These coatings can include varnishes, stains, paints, and sealants, among others. They serve several purposes, including sealing the wood to prevent moisture damage, enhancing the natural grain and color of the wood, and providing resistance to scratches, stains, and UV rays. Wood coatings can be transparent, allowing the natural beauty of the wood to show through, or opaque, providing a colored or painted finish. They are essential for both indoor and outdoor wood applications, offering protection and aesthetic appeal to furniture, floors, and architectural elements.

Key Takeaways:

- The wood coatings market report provides competitive dynamics by evaluating business segments, product portfolios, target market revenue, geographical presence and key strategic developments by prominent manufacturers.

- The wood coatings market is fragmented in nature among prominent companies such as Sherwin-Williams Company, AKZO NOBEL N.V., PPG Industries Inc, Nippon Paint Holdings Co., Ltd, DowDuPont INC, Eastman Chemical Company, RPM International Inc., Kansai Paint Co., Ltd, BASF SE, and Axalta Coating Systems.

- The study contains qualitative information such as the market dynamics (drivers, restraints, challenges, and opportunities), public policy analysis, pricing analysis, and Porter’s Five Force Analysis across North America, Europe, Asia-Pacific, LAMEA regions.

- Latest trends in global wood coatings market such as undergoing R&D activities, regulatory guidelines, and government initiatives are analyzed across 16 countries in 4 different regions.

- More than 3,200 wood coatings-related product literatures, industry releases, annual reports, and other such documents of key industry participants along with authentic industry journals and government websites have been reviewed for generating high-value industry insights for global wood coatings market.

Market Dynamics:

The global construction industry is witnessing substantial growth, driven by urbanization, infrastructure development, and increasing disposable incomes. Wood coatings are extensively used in construction for protection, aesthetics, and durability, thus experiencing a surge in demand alongside the construction sector. Furthermore, the furniture industry is a significant consumer of wood coatings. With the rise in purchasing power and changing lifestyles, there is a growing demand for aesthetically pleasing and durable furniture. Wood coatings enhance the appearance and lifespan of furniture, thereby driving wood coatings market growth.

Continuous innovations in wood coating technologies have led to the development of advanced formulations with superior performance characteristics. Nanotechnology, UV-curable coatings, and water-based coatings are some examples. These advancements not only improve product quality but also address environmental concerns, driving adoption across various end-user industries. Moreover, environmental regulations and consumer preferences are steering the wood coatings market towards eco-friendly solutions. Water-based and low-VOC (volatile organic compound) coatings are gaining popularity due to their reduced environmental impact and improved indoor air quality. Manufacturers are thus investing in sustainable practices to align with regulatory standards and consumer expectations.

However, one of the primary restraints facing the wood coatings market is the increasing stringency of environmental regulations and growing concerns regarding sustainability. Traditional solvent-based coatings often contain volatile organic compounds (VOCs), which can contribute to air pollution and have adverse health effects. Governments around the world are imposing stricter regulations on VOC emissions, forcing manufacturers to reformulate their products to comply with these standards. Additionally, there is a growing demand for environmentally friendly coatings that utilize renewable resources and have minimal environmental impact throughout their lifecycle.

On the contrary, water-based wood coatings have gained traction owing to their low VOC content, quick drying time, and ease of cleanup. Manufacturers are increasingly focusing on developing water-based alternatives to traditional solvent-based coatings to meet regulatory requirements and cater to eco-conscious consumers. Furthermore, there is a growing demand for high-performance coatings capable of withstanding harsh environmental conditions, abrasion, and chemical exposure. This trend is particularly prominent in industrial and outdoor applications where durability and longevity are paramount.

Segment Overview:

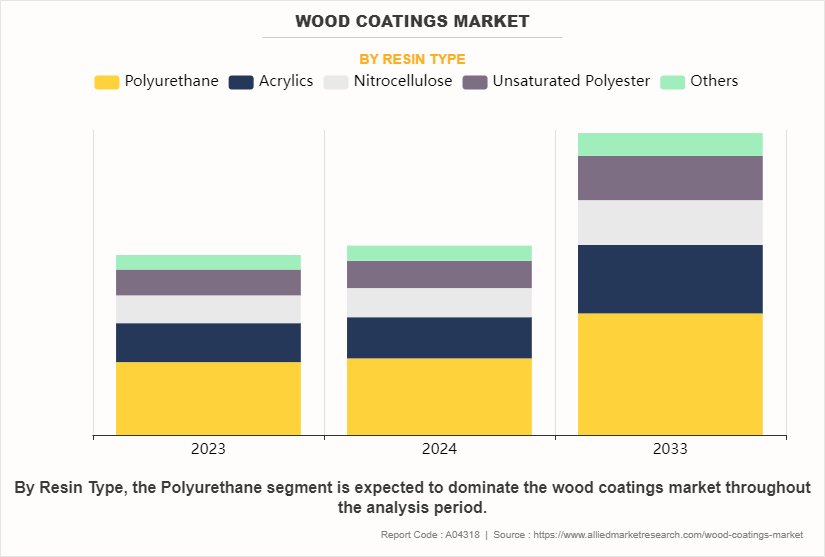

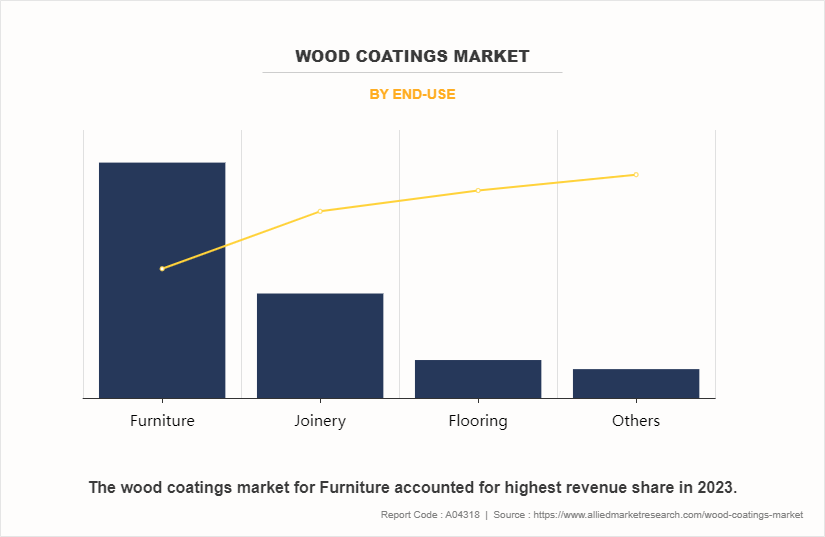

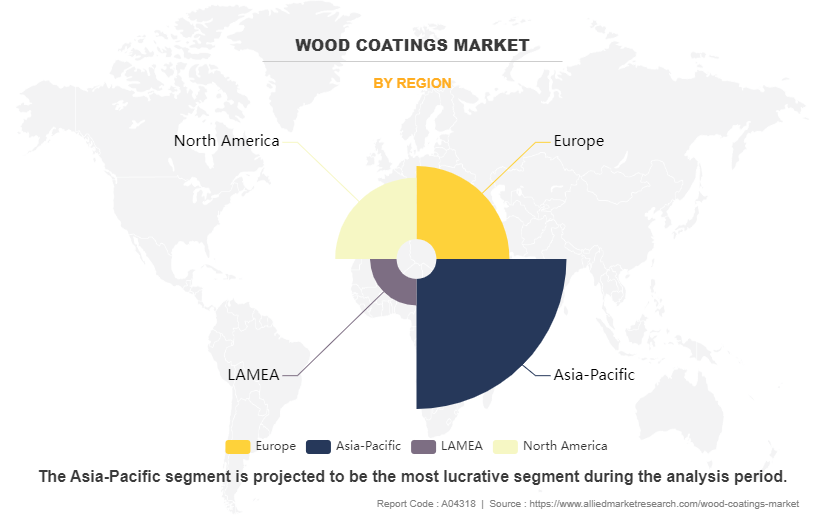

The wood coatings market is segmented on the basis of resin type, technology, end-use, and region. On the basis of resin type, the market is categorized into polyurethane, acrylics, nitrocellulose, unsaturated polyester, and others. By technology, the market is divided into waterborne, conventional solid solvent borne, high solid solvent borne, powder coating, radiation cured, and others. By end-use, the wood coating market is classified into furniture, joinery, flooring, and others. Region-wise, the market is studied across North America, Europe, Asia-Pacific, and LAMEA.

In 2023, the polyurethane segment was the largest revenue generator, and is anticipated to grow at a CAGR of 5.3% during the forecast period. Polyurethane coatings are relatively easy to apply, whether by spraying, brushing, or wiping. This ease of application makes them popular among DIY enthusiasts as well as professionals, contributing to their increasing demand. Moreover, the construction and furniture industries, which are major consumers of polyurethane wood coatings, have been experiencing growth in recent years due to factors such as urbanization, renovation trends, and increased consumer spending. As these industries expand, so does the demand for wood coatings.

By technology, the conventional solid solvent borne segment dominated the global market in 2023, and is anticipated to grow at a CAGR of 5.0% during forecast period. Solvent-borne coatings often exhibit good flow and leveling properties, resulting in smooth and uniform finishes. This ease of application can be beneficial for both industrial-scale production and on-site application. Moreover, solvent-borne coatings can be formulated to achieve a wide range of gloss levels and finishes, from high gloss to matte. This versatility allows manufacturers to meet various aesthetic requirements and consumer preferences. Additionally, solvent-borne coatings have the ability to penetrate deeply into wood substrates, providing enhanced protection against moisture, UV radiation, and other environmental factors. This penetration helps prolong the lifespan of wood products and maintains their appearance over time.

By end-use, the furniture segment dominated the global market in 2023, and is anticipated to grow at a CAGR of 5.3% during forecast period. Wood coatings enable furniture manufacturers to customize products according to customer specifications. Whether it is achieving a specific color, texture, or sheen, coatings provide flexibility in design, allowing for the creation of unique and personalized furniture pieces. Furthermore, consumers are increasingly seeking furniture that not only looks good but also aligns with their values, including sustainability and environmental responsibility. This has led to a growing demand for eco-friendly coatings, such as water-based or low-VOC formulations, which minimize environmental impact and promote healthier indoor air quality. Moreover, with a rise in home renovation and DIY projects, there's a demand for coatings that can rejuvenate and protect existing furniture pieces. Coatings offer a cost-effective way to update the look of furniture without the need for full replacement.

The Asia-Pacific wood coatings market size is projected to grow at the highest CAGR of 5.3% during the forecast period and accounted for 44.7% of the market share in 2022. Wood has long been a preferred material for furniture and interior decor in many Asian cultures due to its natural beauty and warmth. As disposable incomes rise, consumers are willing to invest in wooden furniture, creating a sustained demand for coatings to preserve and beautify these products. Furthermore, with increasing urbanization, there is a growing trend towards home renovation and interior decoration projects. As homeowners seek to upgrade and personalize their living spaces, there is a corresponding demand for wood coatings to refinish and protect existing furniture, flooring, and wood surfaces. Additionally, infrastructure projects, such as commercial buildings, hotels, and public spaces, often utilize wood for interior finishes and furnishings. The demand for wood coatings in these sectors is driven by the need for products that offer both aesthetic appeal and long-term durability in high-traffic environments.

Competitive Analysis:

The global wood coatings market report profiles leading players that include The Sherwin-Williams Company, AKZO NOBEL N.V, PPG Industries Inc, Nippon Paint Holdings Co., Ltd, DowDuPont INC, Eastman Chemical Company, RPM International Inc, Kansai Paint Co., Ltd, BASF SE, and Axalta Coating Systems. The global wood coating market report provides in-depth competitive analysis as well as profiles of these major players.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the wood coatings market analysis from 2023 to 2033 to identify the prevailing wood coatings market opportunities.

- The wood coatings market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the wood coatings market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global wood coatings market share.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global wood coatings market trends, key players, market segments, application areas, and market growth strategies.

Wood Coatings Market Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 17.8 billion |

| Growth Rate | CAGR of 5.3% |

| Forecast period | 2023 - 2033 |

| Report Pages | 450 |

| By Resin Type |

|

| By Technology |

|

| By End-Use |

|

| By Region |

|

| Key Market Players | The Sherwin-Williams Company, PPG Industries Inc, Dow Inc., Kansai Paint Co., Ltd., Akzo Nobel N.V., BASF SE, Eastman Chemical Company, Nippon Paint Holdings Co., Ltd., Axalta Coating Systems, RPM International Inc. |

Analyst Review

According to the CXOs of leading companies, the wood coatings market is influenced by a complex interplay of economic, social, technological, and regulatory factors. Economic growth, urbanization, construction industry dynamics, and changing consumer preferences are driving demand for wood coatings across various end-use sectors. Technological advancements, regulatory considerations, and supply chain dynamics further shape the competitive landscape of the wood coatings market. To succeed in this dynamic environment, coating manufacturers must stay abreast of market trends, invest in innovation, and collaborate with industry partners to deliver sustainable, high-performance solutions that meet the evolving needs of customers and regulatory requirements.

Increase in demand from construction sector, technological advancements, and global furniture industry trends are the upcoming trends of wood coatings market in the world,

Furniture is the leading application of wood coatings market.

Asia-Pacific is the largest regional market for wood coatings.

The global wood coatings market was valued at $10.6 billion in 2023, and is estimated to reach $17.8 billion by 2033, growing at a CAGR of 5.3% from 2023 to 2033.

The Sherwin-Williams Company, AKZO NOBEL N.V., PPG Industries Inc., Nippon Paint Holdings Co., Ltd, DowDuPont INC, Eastman Chemical Company, RPM International Inc., Kansai Paint Co., Ltd., BASF SE, and Axalta Coating Systems are the top companies to hold the market share in wood coatings.

Loading Table Of Content...

Loading Research Methodology...