Workplace Wellness Market Outlook, 2027

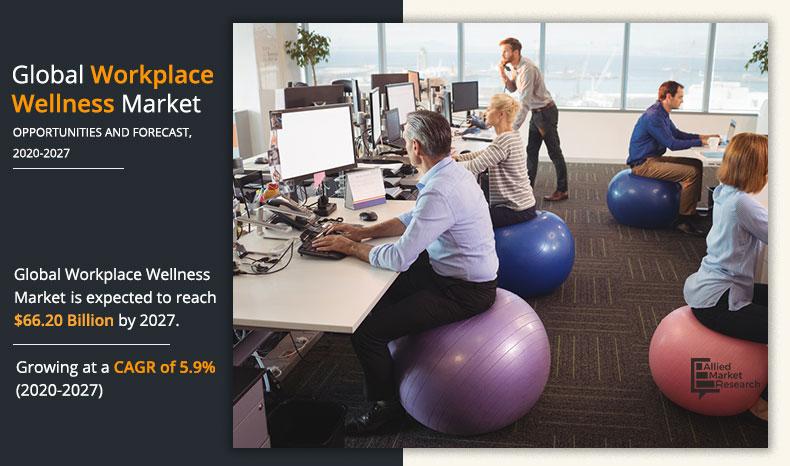

The global workplace wellness market size was valued at $49.81 billion in 2019, and is projected to reach $66.20 billion by 2027, registering a CAGR of 5.9% from 2020 to 2027. Increase in prevalence of chronic diseases across the globe and adoption of sedentary lifestyle are the major factors that drive growth of the workplace wellness market. In addition, economic benefits offered by these programs and rise in awareness and implementation of wellness programs by employers further propel the workplace wellness market growth.

Workplace wellness programs are a harmonized set of health promotion strategies that are executed at worksites and include programs, policies, and certain benefits to the community designed to encourage health and safety of employees. Employee wellness programs are gradually becoming common in many organizations to keep employees productive and decrease employee turnover. The report covers types of workplace wellness plans including weight management & fitness services, nutrition & dietary plan, stress management services, health screening & assessment, and smoking cessation.

Wellness programs approach certain policies and interferences that address multiple risk factors and health conditions and plan strategies that may influence multiple organization levels, including individual employee behavior change, organizational culture, and worksite environment. Workplace wellness programs are considered as important integral part of an organization or a company, which combines individual and organizational level strategies and interventions to influence health.

The COVID-19 outbreak will impact the market in the initial phase of the forecast period. The COVID-19 impact has resulted in downsizing of employees in many organizations. Companies are laying off employees in an effort to cut costs. Laying off employees in the form of cost cutting has reduced workplace wellness cost, which is anticipated to create a negative impact on the workplace wellness market.

Recently, workplace wellness programs have gained importance. In addition, the COVID-19 pandemic has underlined to prioritize health and wellbeing of employees, in terms of physical and mental health. Various strategies were adopted by the key players and government initiatives were undertaken for the better understanding of COVID-19 impact on the global workplace wellness market.

Telemedicine is also anticipated to help in well-being of employees, which allows people to stay at work or at home and still take care of their health. Insurance companies and government-administered healthcare programs provide consultations through telemedicine. In addition, owing to lockdown and social distancing implementations by government authorities, use of telemedicine in pandemic period has increased rapidly.

However, huge cost for companies to adopt workplace wellness plans is anticipated to hamper the market growth. Moreover, significant focus by public and private sectors of developing economies toward improvement in health of their employees is predicted to create lucrative opportunities in the future.

According to CXOs, the workplace wellness market is anticipated to witness a significant growth in the future. The most adopted type of workplace wellness programs include health screening & assessments including standard tests such as total cholesterol, LDL (low-density lipoproteins), HDL (high-density lipoproteins), triglycerides, glucose, and body composition (BMI, waist circumference, and body fat percentage). Moreover, there is a steady increase of such programs in developing economies, which further propels the market growth. Further, North America dominated the global market, owing to increase in adoption of wellness programs by companies, presence of more large-scale organizations, and awareness among employers toward maintenance of the wellbeing of their employees.

Employees are under stress, owing to rise in workload, long working hours, and constant multitasking, which makes it difficult for them to take time for wellness. Many companies are implementing on-site wellness programs such as fitness and yoga sessions, gym vouchers to avail concession, and healthy lunches. For instance, ZocDoc offers catered lunches and follows an eat together family culture. It has also created a FunRoom for employees, which includes guitar, arcade games, and hammock where employees can take power naps and then resume back to work.

Microsoft, a leading tech giant promotes healthy living, which includes creating healthy community services through volunteering. It offers $17 per hour to an employee volunteer. Furthermore, owing to COVID-19 impact, growth and awareness programs toward wellbeing of employees have increased drastically in 2020 by many key players and government initiatives to support mental health of employees. For instance, on June 11, 2020, in a public meeting, the Equal Employment Opportunity Commission (EEOC) proposed a new notice for rulemaking on wellness programs.

By Type

Health screening and assessment accounted for largest share.

The global workplace wellness market is categorized on the basis of type, end user, and region. The market is experiencing a growth rate of 5.9%, attributed to rise in adoption of workplace wellness programs in developing and developed economies. The stress management segment is anticipated to grow at the fastest CAGR of 6.6% during the forecast period. This is attributed to surge in stressed environment in workplaces, owing to stringent timelines. Stressed workplaces can lead to many other problems such as anxiety, headache, and migraine. Therefore, most public and private sectors are conducting stress management programs for their employees.

The workplace wellness is segmented on the basis of type, end user, and region. By type, it is divided into weight management & fitness services, nutrition & dietary plan, stress management services, health screening & assessment, and smoking cessation. On the basis of end user, it is categorized into large-size private organizations, mid-size private organizations, small-size private organizations, public sector, and NGO. By region, it is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

By End User

Large organizations accounted for largest share and are expected to dominate during the forecast period.

The report provides an extensive competitive analysis and profiles of the key market players such as Fitbit, Novant Health, EXOS, Virgin Pulse, Vitality Health, ComPsych, HealthifyMe, MDVIP, Marino Wellness, WorkStride. Some of the others players considered are FitLinxx, Truworth Wellness, Central Workplace Wellness Workplace Solutions, Privia Health, and Wellsource.

By type, the health screening & assessment segment dominated the workplace wellness market in 2019. This is attributed to increase in adoption of health screening & assessment programs by most employers worldwide to improve health fitness of their employees. However, the stress management services segment is anticipated to grow at the fastest growth rate during the forecast period. By end user, the large-size organizations segment dominated the market in 2019, and is anticipated to maintain its dominance during the forecast period. This is attributed to the fact that large-size organizations have more workforce strength. This segment is anticipated to grow at the fastest growth rate during the forecast period

Key Benefits for Stakeholders

- The study provides an in-depth analysis of the global workplace wellness market size along with the current trends and future estimations to elucidate the imminent investment pockets.

- It offers workplace wellness market analysis from 2020 to 2027, which is expected to enable stakeholders to capitalize on prevailing opportunities in the market.

- A comprehensive analysis on region assists to understand the regional market and facilitate strategic business planning and determine prevailing opportunities.

- The profiles and growth strategies of key players are thoroughly analyzed to understand the competitive outlook of the global workplace wellness market growth.

Workplace Wellness Market Report Highlights

| Aspects | Details |

| By Type |

|

| By End User |

|

| By Region |

|

| Key Market Players | VIRGIN PULSE, INC., NOVANT HEALTH, COMPSYCH CORPORATION, MDVIP, EXOS, FITBIT, INC., MARINO WELLNESS, LLC, VITALITY HEALTH LIMITED, WORKSTRIDE, HEALTHIFYME WELLNESS PRIVATE LIMITED |

Analyst Review

This section provides opinions of top-level CXOs in the industry. According to them, adoption of workplace wellness by large-scale employers as well as small scale employers have augmented in recent years. Further, as per CXOs, a worker’s well-being or fitness is the key factor that defines an organization’s long-term success. Many studies show a direct link between productivity levels and general health and well-being of any workforce. Various enterprises and organizations are gradually recognizing significance of well-being of their employees. Small scale organizations have initiated programs to address well-being of employees and focus on their health issues.

According to CXOs, the workplace wellness market is anticipated to witness a significant growth in the future. The most adopted type of workplace wellness programs include health screening & assessments including standard tests such as total cholesterol, LDL (low-density lipoproteins), HDL (high-density lipoproteins), triglycerides, glucose, and body composition (BMI, waist circumference, and body fat percentage). Moreover, there is a steady increase of such programs in developing economies, which further propels the market growth. Further, North America dominated the global market, owing to increase in adoption of wellness programs by companies, presence of more large-scale organizations, and awareness among employers toward maintenance of the wellbeing of their employees.

The total value of Workplace Wellness market was $49.81 billion in 2019.

The forecast period in the report is from 2020-2027.

The market value of Workplace Wellness market in 2020 was $44.33 billion.

The base year calculated is 2019 in the report.

According to CXOs, the workplace wellness market is anticipated to witness a significant growth in the future. The most adopted type of workplace wellness programs include health screening & assessments including standard tests such as total cholesterol, LDL (low-density lipoproteins), HDL (high-density lipoproteins), triglycerides, glucose, and body composition (BMI, waist circumference, and body fat percentage). Moreover, there is a steady increase of such programs in developing economies, which further propels the market growth. Further, North America dominated the global market, owing to increase in adoption of wellness programs by companies, presence of more large-scale organizations, and awareness among employers toward maintenance of the wellbeing of their employees.

Significant increase in prevalence of chronic diseases across the globe and adoption of sedentary lifestyle are the major factors that drive growth of the workplace wellness market. In addition, economic benefits offered by these programs and rise in awareness and implementation of wellness programs by employers further propel the workplace wellness market growth.

The growth % of the Workplace Wellness market is 5.9%.

Health Screening & Assessment segment holds the maximum market share.

Loading Table Of Content...