Wound Care Biologics Market Research, 2032

The global wound care biologics market size was valued at $1.8 billion in 2022, and is projected to reach $3.3 billion by 2032, growing at a CAGR of 6.1% from 2023 to 2032. Wound care biologics refers to a category of advanced therapies and products used in the management and treatment of various types of wounds. These biologics are derived from living organisms, such as human cells, animal tissues, or microorganisms, and are designed to facilitate the healing process, promote tissue regeneration, and enhance wound closure. These biologics are used in diabetic foot ulcer, venous leg ulcer, pressure ulcer, surgical and accidental wounds.

Market Dynamics

The major factors driving the growth of the wound biologics market are the increase in prevalence of chronic wounds such as diabetic foot ulcer, rise in geriatric population, and rise in advancements in wound care management products. The surge in prevalence of diabetes is a significant driver for the wound care biologics market share. For instance, as per National Diabetes Statistics Report by Centers for Disease Control and Prevention (CDC) in 2022, 130 million adults living with the diabetes or prediabetes in the U.S. Thus, rise in prevalence of diabetes led to increase in the demand for wound care biologic products.

The advancements in wound care technologies such as development of biologic-based therapies, have significantly contributed toward the wound care biologics market share growth. Innovations such as growth factors, cellular matrices, tissue-engineered products, and extracellular vesicles have improved wound healing outcomes and provided new treatment options for complex wounds that support the market growth. For instance, Osiris Therapeutics, a part of Smith & Nephew plc developed Grafix, a cryopreserved placental membrane product. Grafix contains an intact extracellular matrix and a variety of growth factors, cytokines, and other bioactive components. This product has advanced minimally manipulative processing methods that preserve the native properties and components of fresh placental membranes. Such advanced features of wound care biologic product support the wound care biologics market growth.

In addition, the aging population is prone to chronic wounds due to factors such as reduced mobility, compromised immune systems, and underlying health conditions. As people age, their skin becomes thinner, less elastic, and more fragile. This makes it more susceptible to damage and slower to heal, increasing the risk of developing chronic wounds. Thus, rise in the geriatric population provide the wound care biologics market opportunity .

The growth of the wound biologics market is expected to be driven by high potential in untapped, emerging markets, due to availability of improved healthcare infrastructure, increase in unmet healthcare needs, rise in prevalence of chronic diseases, and surge in demand for advanced wound care biologic products. The demand for wound care biologics is not only limited to developed countries but is also being witnessed in the developing countries, such as China, Brazil, and India, which fuel the wound care biologics market.

Wound care biologics are more expensive than traditional wound care treatments. The production, development, and manufacturing processes involved in creating biologic-based therapies contribute to their higher cost. The high cost may pose a financial burden on healthcare systems, insurers, and patients, limiting their accessibility and adoption which negatively impacted the market growth. In addition, insufficient education and awareness about these therapies lead to underutilization or suboptimal use which hinders the market growth.

The outbreak of the COVID-19 pandemic had a significant impact on various sectors, including the healthcare industry. The global wound care biologics market, including wound care biologics, experienced a decline in 2020 due to the global economic recession caused by the pandemic. The temporary closure of healthcare facilities and disruptions in workflows contributed to this decline. Many non-urgent medical procedures, including wound care, were delayed or canceled during the height of the pandemic. Patients faced challenges in accessing healthcare facilities, leading to reduced patient visits for wound care and delays in receiving appropriate treatments, including wound care biologics.

However, the wound care biologics market recovered after the pandemic and is expected to show stable growth in the future. This is attributed to the increase in prevalence of chronic wounds, advancements in wound care biologics products and surge in awareness among healthcare professionals and patients about the benefits and applications of wound care biologics.

Segmental Overview

The wound care biologics industry is segmented into product, wound type, end user, and region. By product, the market is categorized into biological skin substitutes and topical agents. On the basis of wound type, the market is segregated into acute wound and chronic wound. The acute segment further categorized into the burns and trauma, accidental and surgical. The chronic segment further categorized into the pressure ulcers, diabetic ulcers, venous ulcers, and others. By end user, the market is classified into hospitals & clinics, homecare settings, and others. Region wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

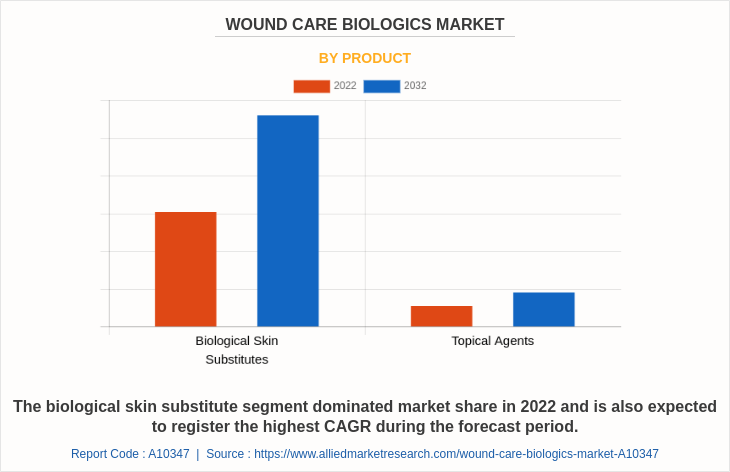

By Product

The biological skin substitute segment dominated the global market in 2022 and is expected to register the highest CAGR during the forecast period, owing to the increase in prevalence of chronic wounds and the surge in number of burn and trauma cases. In addition, advancements in biotechnology and tissue engineering enhances the development of biological skin substitutes, which further supports the segment growth.

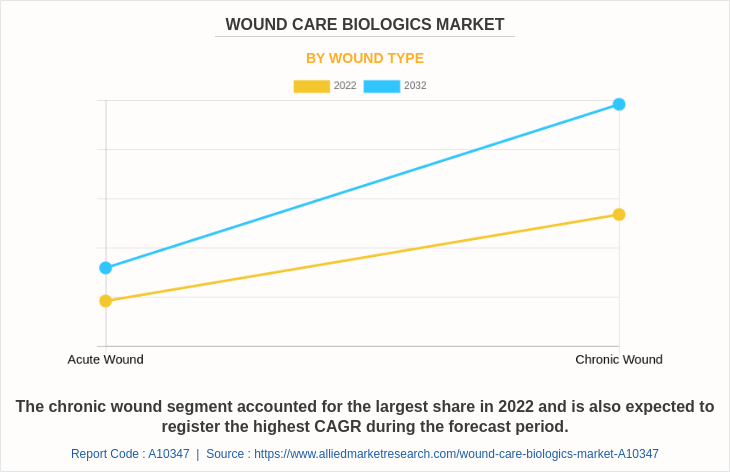

By Wound Type

The chronic wound segment dominated the global market in 2022 and is anticipated to continue this trend during the forecast period. This is attributed to the rise in incidence of chronic diseases such as diabetes and lifestyle factors contribute to the rise in prevalence of chronic wounds. This drives the demand for effective wound care solutions, leading to the dominance of the chronic wound segment in the market.

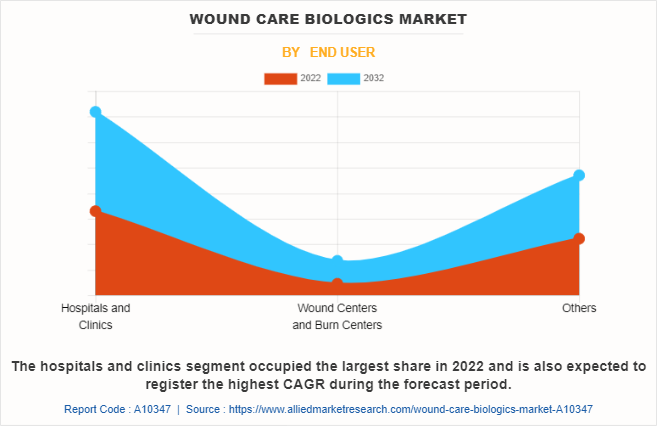

By End User

The hospitals and clinics held the largest wound care biologics market size in 2022 and is expected to remain dominant throughout the forecast period, owing to presence of specialized healthcare professionals, advanced infrastructure, collaborative healthcare services, centralized procurement, and reimbursement support contribute to their segmental growth.

By Region

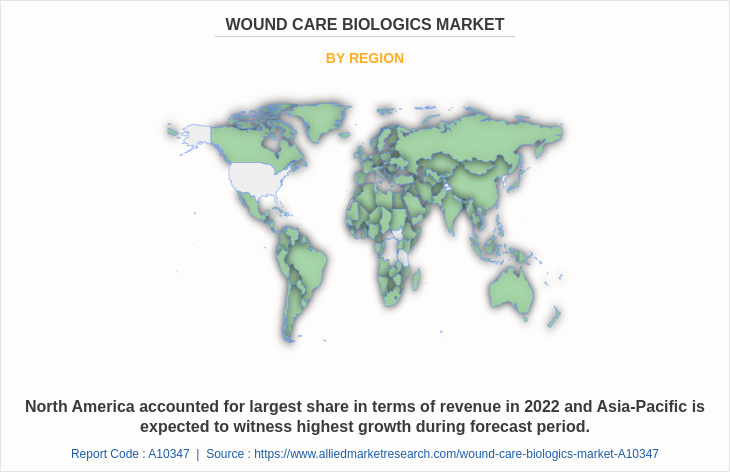

The wound care biologics industry is analyzed across North America, Europe, Asia-Pacific, and LAMEA. North America accounted for a major share of the wound care biologics market in 2022 and is expected to maintain its dominance during the forecast period.

The presence of several major players, such as Integra LifeSciences Holdings Corporation, Smith & Nephew plc, and Stryker Corporation and advancement in manufacturing technology of wound care biologics in the region drive the growth of the market. In addition, the presence of well-established healthcare infrastructure, high purchasing power, and rise in adoption rate of advanced wound care biologics are expected to drive the market growth. Furthermore, product launch, product approval, and acquisitions adopted by the key players in this region boost the growth of the market.

Asia-Pacific is expected to grow at the highest rate during the wound care biologics market forecast period. The market growth in this region is attributable to purchasing power of populated countries, such as China and India. In addition, rise in the prevalence of chronic wounds such as diabetic foot ulcers, venous leg ulcers, and pressure ulcers due to aging population, increasing incidence of diabetes, and changes in lifestyle contribute to the growing burden of chronic wounds and creating a demand for advanced wound care solutions. Moreover, growing awareness among healthcare professionals and patients about the benefits of biologic-based wound care therapies is contributing to market growth.

Asia-Pacific offers profitable opportunities for key players operating in the wound care biologics market, thereby registering the fastest growth rate during the forecast period, owing to the growing infrastructure of industries as well as well-established presence of domestic companies in the region. Furthermore, the establishment of comprehensive wound care centers, advancements in diagnostic technologies, and access to modern treatment modalities drive the wound care biologics market.

Competition Analysis

Competitive analysis and profiles of the major players in the wound care biologics, such as Bioventus, ConvaTec Group plc, Integra LifeSciences Holdings Corporation, Kerecis, MIMEDX Group, Inc., ORGANOGENESIS HOLDINGS INC., Skye Biologics Holdings, LLC, Smith+Nephew, and Tissue Regenix Group Plc. are provided in this report.

There are some important players in the market such as Lavior Pharma Inc. and others. Major players have adopted agreement, product launch, geographical expansion and acquisition as key developmental strategies to improve the product portfolio of the wound care biologics market.

Recent Product Launches in the Wound Care Biologics Market

- In September 2022, MiMedx Group, Inc., a transformational placental biologics company, announced the launch of AXIOFILL, an Extracellular Matrix (ECM) Particulate product derived from human placental tissue.

- In September 2022, MiMedx Group, Inc., a transformational placental biologics company, announced the launch of AMNIOEFFECT, a tri-layer PURION processed human tissue allograft consisting of the amnion, intermediate, and chorion membrane layers of the placenta.

Recent Product Approval in the Wound Care Biologics Market

- In March 2023, Convatec received clearance from the U.S. Food and Drug Administration for its InnovaBurn placental extracellular matrix medical device for management of complex surgical wounds and burns, including partial-thickness second-degree burns.

Recent Agreements in the Wound Care Biologics Market

- In January 2023, MiMedx Group, Inc., a leader in placental biologics, announced that it has entered into an exclusive distribution agreement with GUNZE MEDICAL LIMITED, a subsidiary of Gunze Limited, for sales of EPIFIX in Japan.

- In December 2022, MiMedx Group, Inc., a leader in placental biologics announced an agreement with Turn Therapeutics. This agreement provides MIMEDX with exclusive rights to Turn’s PermaFusion proprietary antimicrobial intellectual property (IP) and utilize the PermaFusion platform in the development of future biologic products, with a specific focus on applications related to wound healing and surgical recovery.

Recent Geographical Expansion in the Wound Care Biologics Market

- In June 2023, Convatec opens new global headquarters in London. This relocation of Convatec headquarter forms part of a wider strategic review of its property footprint globally to create a productive working environment and enhance the employee experience. The new facility is designed to support the company's growth plans and provide a modern and collaborative workspace for employees.

Recent Acquisitions in the Wound Care Biologics Market

- In November 2020, Stryker Corporation announced that it has completed the acquisition of Wright Medical Group N.V., a global medical device company focused on extremities and biologics. This acquisition strengthens its global market position in the field of trauma and extremities and creating substantial opportunities to drive innovation.

- In October 2021, Bioventus Inc., a global leader in innovations for active healing, announced the acquisition of Misonix, a provider of minimally invasive therapeutic ultrasonic medical devices and regenerative tissue products.

- In March 2022, Convatec Group Plc is pleased to be announced that it has completed the acquisition of Triad Life Sciences Inc. The Triad, current portfolio and product pipeline transition expected to Convatec Advanced Wound Care (AWC) business and be known as Convatec Advanced Tissue Technologies.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the wound care biologics market analysis from 2022 to 2032 to identify the prevailing wound care biologics market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the wound care biologics market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global wound care biologics market trends, key players, market segments, application areas, and market growth strategies.

Wound Care Biologics Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 3.3 billion |

| Growth Rate | CAGR of 6.1% |

| Forecast period | 2022 - 2032 |

| Report Pages | 255 |

| By Wound Type |

|

| By End User |

|

| By Product |

|

| By Region |

|

| Key Market Players | Stryker Corporation., Skye Biologics Holdings, LLC, Tissue Regenix Group Plc, ORGANOGENESIS HOLDINGS INC., Kerecis, Smith & Nephew plc, Integra LifeSciences Holdings Corporation, ConvaTec Group plc, Lavior Pharma Inc., MIMEDX Group, Inc. |

Analyst Review

This section provides various opinions in the wound care biologics market. The increase in prevalence of chronic wounds, rise in aging population, and the surge in demand for advanced wound care solutions provide a favorable market landscape. In addition, surge in investments for developing advanced wound care products globally is expected to offer profitable opportunities for the expansion of the market. However, the high cost of wound care biologics products and strict regulations for the manufacturing wound care biologics are expected to limit the market growth.

In addition, the surge in cases of diabetic patients as well as increase in prevalence of chronic wounds such as pressure ulcer, diabetic foot ulcers, venous leg ulcers, arterial ulcers, increase in number of patients undergoing surgeries, and rise in geriatric population are expected to drive the growth of the wound care biologics market.

Furthermore, North America is expected to witness the largest growth, in terms of revenue, owing to the surge in geriatric population suffering from chronic diseases, rise in prevalence of acute & chronic wounds in the region, and presence of developed infrastructure in the healthcare industry. However, Asia-Pacific is anticipated to witness notable growth owing to increase in prevalence of chronic wounds, surge in healthcare expenditure, advancements in wound care biologics to develop novel products, and a large patient population.?

The total market value of wound care biologics market is $1,786.50 million in 2022.

The forecast period for wound care biologics market is 2023 to 2032.

The market value of wound care biologics market in 2032 is $3,249.14 million.

The base year is 2022 in wound care biologics market.

The biological skin substitutes segment is the most influencing segment in wound care biologics market owing to high adoption of biological skin substitutes as they offer benefits such as faster wound closure, reduced infection risk, and improved outcomes.

Integra LifeSciences Holdings Corporation, Smith & Nephew plc, Stryker Corporation., MIMEDX Group, Inc., and ConvaTec Group plc held a high market position in 2022. These key players held a high market position owing to the strong geographical foothold in North America, Europe, Asia-Pacific, and LAMEA.

Wound care biologics are commonly used for chronic and non-healing wounds, such as diabetic foot ulcers, venous ulcers, and pressure ulcers. They may also be used in burns and surgical wounds to enhance healing and minimize scarring.

Wound care biologics are medical products derived from living organisms or substances that are used to promote wound healing and tissue regeneration. They may include growth factors, cytokines, extracellular matrix components, or stem cells.

Loading Table Of Content...

Loading Research Methodology...