X-Ray Detector Market Overview:

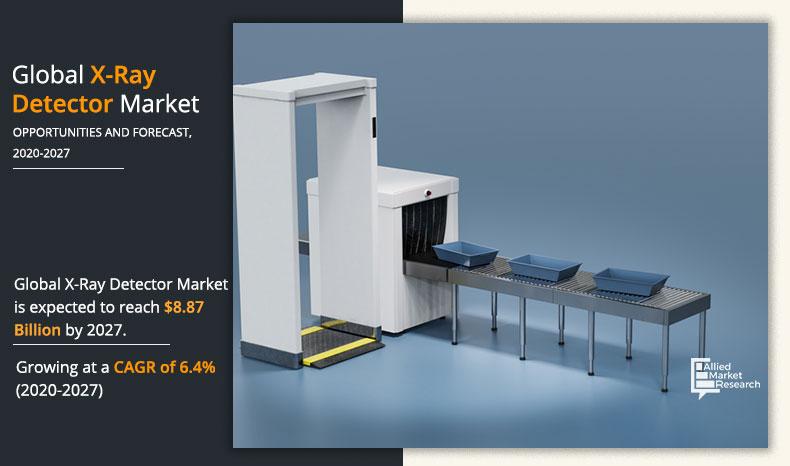

The global X-ray detector market size was valued at $5.12 billion in 2019, and is projected to reach $8.87 billion by 2027, registering a CAGR of 6.4% from 2020 to 2027.

X-ray is a form of electromagnetic radiation that has high energy and can pass through most objects, including body. Among many applications of X-rays such as veterinary, medical, dental, industrial and security, it is most widely used in medical imaging to create images of tissues and structures inside the body. For medical imaging, an X-ray beam is passed through the body where a portion of X-rays is either absorbed or scattered by internal structures, and the remaining X-ray pattern is transmitted to a detector. X-ray detectors are devices that are used to measure flux, spatial distribution, spectrum, and other properties of X-rays. The most common methods of X-rays in medical imaging include X-ray radiography, computed tomography (CT), mammography, and angiography. X-ray radiography can be used to detect or diagnose bone fractures; infections such as pneumonia; and calcifications including kidney stones. Moreover, technological advancements in radiography has brought wide-scale adoption of digital radiography in all relevant industries.

Growth of the global X-ray detector market is majorly driven by rise in demand for digital imaging technologies. Moreover, various advantages that digital detectors offer further drive growth of the X-ray detector market. Furthermore, favorable reimbursement policies for X-ray diagnostics also drive growth of the market. However, high cost of digital X-ray systems is anticipated to restrict growth of the market. On the contrary, increase in demand for wireless X-ray detectors and growth in medical tourism in developing countries are expected to offer lucrative opportunities for market expansion during the forecast period.

COVID-19 has diverted stimulus funds to diagnostic X-ray systems to help facilitate much needed diagnostic imaging facilities, resulting in a higher than expected upliftment in the radiography market. Chest X-ray is often the first imaging exam acquired after a positive reverse-transcription polymerase chain reaction (RT-PCR), if a patient is at the risk for disease progression. In addition, mobile digital radiography (DR) systems are at the forefront in providing an initial screening for pneumonia and secondary and more progressive stage of severe COVID-19 cases. Moreover, for emerging countries, mobile DR systems provide imaging capabilities for diagnosis of COVID-19, owing to their increased affordability compared to CT systems. Hence, surge in demand for digital X-ray radiography is expected to have a positive impact from the COVID-19 pandemic.

By Type

Flat panel detectors (FPDs) holds the dominant position in 2019 and would continue to maintain the lead over the forecast period.

Type segment review

By type, the flat panel detectors (FPDs) segment acquired a major share of the X-ray detector market in 2019, and anticipated to maintain its dominance during the forecast period, owing to high demand of FPDs and various advantages that it offers such as excellent image quality and ability to retrofit into existing X-ray tables.

By Application

Veterinary segment is projected as one of the most lucrative segments.

Application segment review

By application, the veterinary segment is expected to grow at the fastest rate during the forecast period, owing to rise in adoption of pets, increase in animal health expenditure, and growth in adoption of radiography in veterinary practices.

By Region

Asia-Pacific region would exhibit the highest CAGR of 8.4% during 2020-2027.

Region segment review

Region wise, North America acquired a major share of the market, owing to presence of key players that offer popular X-ray detectors in the region, well-established healthcare facilities, growth in number of medical imaging procedures, favorable reimbursement policies, rise in threats of terrorism, large focus on product quality & non-destructive testing, and growth in adoption of pets & animal farming. However, Asia-Pacific is expected to grow at the fastest rate during the forecast period, owing to increase in healthcare expenditure, growth in medical tourism, rise in adoption of technologically advanced X-ray imaging products, presence of large geriatric population, and focus on skill development in the region, which also offers lucrative opportunities for the X-ray detector market.

The report provides a comprehensive analysis of the key players operating in the global X-ray detector market, namely Agfa-Gevaert N.V., Analogic Corporation (Altaris Capital Partners, LLC), Canon, Inc., Carestream Health, Inc., Comet Holding (YXLON International GmbH), Detection Technology Plc., Fujifilm Holdings Corporation (Fujifilm Medical Systems), General Electric, Konica Minolta Holdings Inc., Koninklijke Philips N.V., Siemens AG, Teledyne Technologies Incorporated (Teledyne DALSA, Inc.), Thales Group (Trixell), and Varex Imaging Corporation. The other players in the value chain include (profiles not included in the report), Agilent Technologies, Hamamatsu Photonics K.K., Vieworks Co., Ltd., and Rayence Inc

Key Benefits For Stakeholders

- This report provides a detailed quantitative analysis of the current X-ray detector market trends and forecast estimations from 2020 to 2027, which assists to identify the prevailing market opportunities.

- An in-depth X-ray detector market analysis includes analysis of various regions, which is anticipated to provide a detailed understanding of the current trends to enable stakeholders formulate region-specific plans.

- A comprehensive analysis of factors that drive and restrain the growth of the global X-ray detector market is provided.

- Region-wise and country-wise market conditions are comprehensively analyzed in this report.

- An extensive analysis of various regions provides insights that are expected to allow companies to strategically plan their business moves.

- Key market players within the X-ray detector market are profiled in this report and their strategies are analyzed thoroughly, which helps in understanding competitive outlook of global X-ray detector market.

Key Market Segments

By Type

- Flat panel detectors (FPDs)

- By Type

- Indirect capture FPDs

- Direct capture FPDs

- By Panel Size

- Small area FPDs

- Large area FPDs

- By Type

- Charge-Coupled Device Detectors (CCDs)

- Line scan detector

- Computed radiography plates/cassettes

By Application

- Medical

- By Type

- Static imaging

- Dynamic imaging

- By Indication

- Oncology

- Others

- By Type

- Veterinary

- Security

- Dental

- Industrial

By Region

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Rest of Europe

- Asia-Pacific

- Australia

- Japan

- India

- China

- South Korea

- Rest of Asia-Pacific

- LAMEA

- Brazil

- Saudi Arabia

- South Africa

- Rest of LAMEA

X-Ray Detector Market Report Highlights

| Aspects | Details |

| By TYPE |

|

| By APPLICATION |

|

| By Region |

|

| Key Market Players | DETECTION TECHNOLOGY PLC, KONINKLIJKE PHILIPS N.V. (PHILIPS HEALTHCARE), AGFA-GEVAERT GROUP, TELEDYNE TECHNOLOGIES INCORPORATED, ANALOGIC CORPORATION (ALTARIS CAPITAL PARTNERS, LLC), COMET HOLDING AG (YXLON INTERNATIONAL GmbH), CARESTREAM HEALTH, INC., SIEMENS, VAREX IMAGING CORPORATION, THALES GROUP (TRIXELL S.A.S.), GENERAL ELECTRIC COMPANY (GE HEALTHCARE), CANON INC. (CANON MEDICAL SYSTEMS CORPORATION), KONICA MINOLTA, INC., .FUJIFILM HOLDINGS CORPORATION |

Analyst Review

X-ray detectors are expected to witness high adoption in the near future, owing to increase in demand for digital imaging technologies and favorable reimbursement policies for X-ray procedures. In addition, the market is exhibiting high growth rate, owing to diverted stimulus funds for COVID-19 diagnostic X-ray systems to help facilitate much needed diagnostic imaging facilities, resulting in a higher than expected upliftment in the radiography market. Moreover, surge in demand for digital X-ray radiography, owing to COVID-19 is another factor that significantly contributes toward growth of the market.

Furthermore, Asia-Pacific and LAMEA are expected to offer lucrative growth opportunities to key players. This is majorly attributed to factors such as improvement in healthcare facilities and rapid improvement in economic conditions. The key players have further focused on expanding their presence in emerging economies to strengthen their foothold in the market. However high cost associated with X-ray detectors hinder growth of the market

The market value of global X-ray detector market was $5.12 billion in 2019.

The forecast period is from 2020 to 2027.

The market value of global X-ray detector market in 2020 is $5.73 billion.

Growth in number of medical imaging procedures and favorable reimbursement policies. In addition, rise in threats of terrorism, large focus on product quality & non-destructive testing, and growth in adoption of pets & animal farming are anticipated to supplement the market growth

The base year is 2019 in X-ray detector market

Rise in demand for digital imaging technologies, expansion of healthcare in the developing countries, aging population, medical tourism, increased security concerns and increasing need for X-ray imaging applications in industrial inspection

The North America market held a major share in the X-ray detector market in 2019 and is expected to continue the trend in the forecasting period. This is attributed to adoption of advanced technology in healthcare & industrial fields as well as high concern toward security at the airport and the other public places due to rise in terrorism.

Loading Table Of Content...