Zero Liquid Discharge System Market Research: 2032

The Global Zero Liquid Discharge System Market size was valued at $6.1 billion in 2022, and is projected to reach $11.2 billion by 2032, growing at a CAGR of 6.2% from 2023 to 2032.

Zero Liquid Discharge (ZLD) is an industrial wastewater treatment method that processes liquid discharge and produces solid waste. The process involves using a combination of processes to treat the waste solids and recover clean water for reuse.

Market Dynamics

The textile industry is one of the largest water-consuming industries globally and generates significant amounts of wastewater during the manufacturing process. With rise in concerns about water scarcity and environmental regulations, textile manufacturers are increasingly adopting zero liquid discharge (ZLD) systems to treat and recycle their wastewater. ZLD systems allow textile manufacturers to recover & reuse water, reduce freshwater consumption, and eliminate wastewater discharge into the environment. As a result, the demand for ZLD systems in the textile industry has increased, driving the zero liquid discharge system market growth.

The growth of the food and beverage industry has led to a corresponding increase in demand for zero liquid discharge systems, as companies seek to reduce their environmental footprint and improve their sustainability credentials. This trend is expected to continue in the coming years, with the global zero liquid discharge system market projected to grow at a significant rate.

Moreover, the high capital costs involved in setting up zero liquid discharge systems can be a major obstacle for many industries, especially those that are already dealing with other significant investments. In addition, the operating costs associated with zero liquid discharge systems can be high due to the need for specialized equipment, chemicals, and maintenance.

The demand for zero liquid discharge system decreased in the year 2020, owing to low demand from different industries due to lockdowns imposed by the government of many countries. The COVID-19 pandemic had shut down the production of various industries, mainly owing to prolonged lockdowns in major global countries. This hampered the growth of the zero liquid discharge system market significantly during the pandemic. The major demand for zero liquid discharge system was previously noticed from giant manufacturing countries including the U.S., Germany, Italy, the UK, and China, which was severely affected by the spread of coronavirus, thereby halting demand for zero liquid discharge system. Moreover, the market has recovered due to the launch of COVID-19 vaccine due to which the government has relaxed the lockdown norms.

Advancements in technology have created an opportunity for the Zero Liquid Discharge (ZLD) system market to provide more efficient and sustainable solutions for industries facing water scarcity and pollution challenges. The development of improved membrane technologies, automation & monitoring systems, advanced analytics & machine learning, and the use of renewable energy sources such as solar and wind have made ZLD systems more efficient and cost-effective. The integration of ZLD with other water treatment technologies such as reverse osmosis and thermal treatment can improve overall water quality and reduce costs. Such trends are expected to offer lots of opportunities in emerging countries for the growth of the zero liquid discharge system market.

Segmental Overview

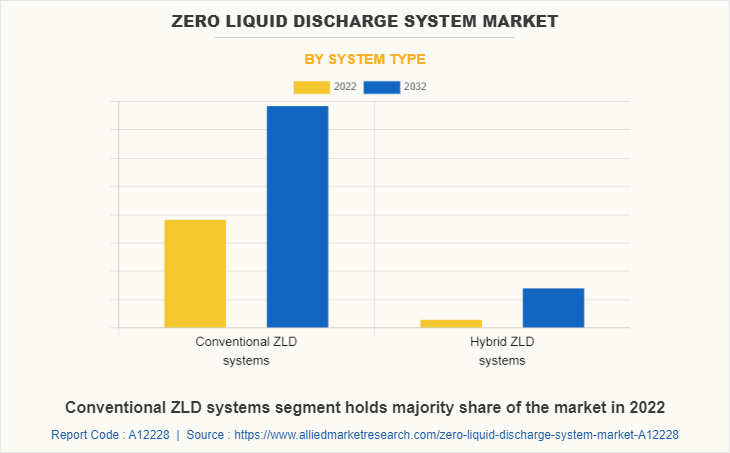

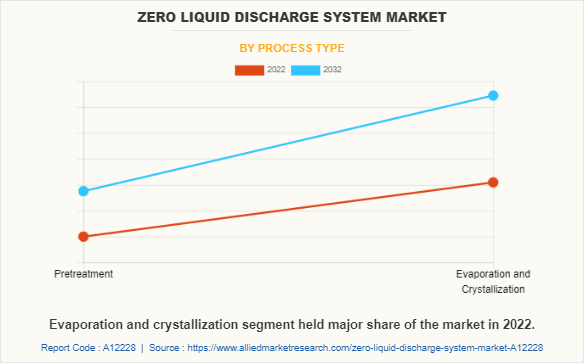

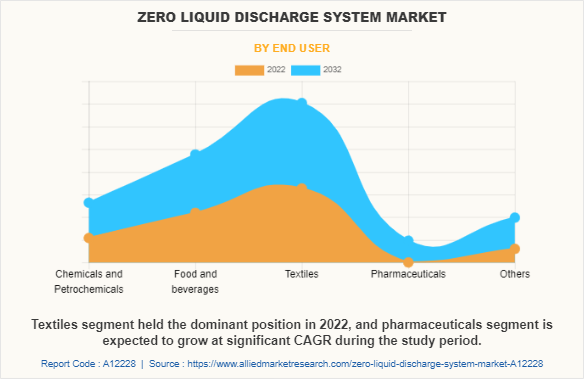

The zero liquid discharge system market is segmented into System Type, Process Type, End User, and region. By system type, the market is divided into conventional ZLD systems, and hybrid ZLD systems. By process type, the market is classified into pretreatment and evaporation & crystallization. By end user, the market is categorized into chemicals & petrochemicals, food & beverages, textiles, pharmaceuticals, and others. Region wise, the market is analyzed across North America (the U.S., Canada, and Mexico), Europe (the UK, France, Germany, Italy, and rest of Europe), Asia-Pacific (China, Japan, India, and rest of Asia-Pacific), and LAMEA (Latin America, the Middle East, and Africa).

By System Type:

The zero liquid discharge system market is categorized into conventional ZLD systems, and hybrid ZLD systems. Conventional Zero Liquid Discharge (ZLD) systems are wastewater treatment systems that aim to eliminate the discharge of liquid waste from industrial processes. These systems typically use a combination of pre-treatment processes, such as filtration and sedimentation, and advanced separation technologies, such as reverse osmosis and evaporation, to treat the wastewater and recover clean water for reuse, while producing a solid waste stream that can be safely disposed of. Conventional ZLD systems are widely used in industries such as power generation, chemical manufacturing, and textile production. Hybrid Zero Liquid Discharge (ZLD) systems are wastewater treatment systems that combine multiple technologies, such as conventional ZLD systems and thermal treatment, to achieve a higher level of wastewater treatment and resource recovery.

By Process Type:

The zero liquid discharge system market is classified into pretreatment and evaporation & crystallization. Pretreatment for zero liquid discharge (ZLD) systems involves removing solids, oils, and other contaminants from wastewater before it enters the main ZLD system. This ensures that the ZLD system operates efficiently and prolongs the lifespan of its components. Evaporation and crystallization are two processes used in Zero Liquid Discharge (ZLD) systems to remove water from the wastewater stream. In the evaporation process, wastewater is heated and the water is vaporized and separated from the solids. In crystallization, the concentrated wastewater is further processed to produce solid salts or crystals that can be safely disposed of, while recovering clean water for reuse.

By End User:

The zero liquid discharge system market is divided into chemicals & petrochemicals, food & beverages, textiles, pharmaceuticals, and others. The food & beverages industry includes processing of raw agricultural produce into processed food & beverages. ZLD system in food & beverages processing are used for recovering from wastewater stream, reducing water consumption and discharge while leaving behind solid waste for disposal. Petrochemicals are produced using a variety of chemical substances, primarily hydrocarbons. Crude oil and natural gas are the sources of these hydrocarbons. Naphtha, kerosene, and petrol oil are the three main feedstocks for the petrochemical sector among the many fractions produced by distillation of crude oil. Pharmaceuticals include spirits, elixirs, and tinctures. In addition, Ointments are one of numerous semisolid remedies, along with creams, pastes, and jellies. Pills, tablets, lozenges, and suppositories are examples of solid medications.

Production plants in pharmaceuticals requires Zero Liquid Discharge (ZLD) systems for removing waste from water. The other industries include energy & power, oil and gas, metallurgy and mining, which utilize zero liquid discharge (ZLD) on a considerable scale. These industries mainly utilize zero liquid discharge (ZLD) for wastewater management. The textiles segment is expected to exhibit the largest revenue share during the forecast period. The pharmaceuticals segment is expected to exhibit the highest CAGR during the forecast period.

By Region:

The zero liquid discharge system market is analyzed across North America, Europe, Asia-Pacific, and LAMEA. In 2022, Europe held the highest revenue in zero liquid discharge system market share. And Asia-Pacific is expected to exhibit the highest CAGR during the forecast period.

Competition analysis

The major players profiled in the zero liquid discharge system market forecast report include Aquarion AG, Aquatech International LLC,Condorchem Envitec., Lenntech B.V., Gea Group, H2O GmbH, Oasys Water, Inc., Praj Industries Ltd., Veolia Water Technologies, and SafBon Water Technology.

Major companies in the market have adopted several key developmental strategies such as product launch, and business expansion to offer better products and services to customers and maintain their market share in the zero liquid discharge system industry.

Some examples of instances that support the market growth.

In March 2023, Aquatech International LLC., a leading water purification solutions provider, and Fluid Technology Solutions, Inc., which is a manufacturer of separation technologies and advanced membranes, formed a partnership to provide innovative water treatment technology and process solutions in significant sectors such as brine mining, inland desalination, and zero liquid discharge systems.

In February 2023, SunOpta Inc., a renowned manufacturer of food & beverages products, announced the opening of its brand-new plant-based beverage manufacturing facility in Midlothian, Texas. This new production facility is 285,000 square feet in size and has the ability to be expanded to 400,000 square feet to accommodate future development. Such factors are expected to play a crucial role in the growth of the zero liquid discharge systems market.

In October 2022, BASF SE, which is a leading manufacturer of chemical products, invested in Neopentyl Glycol (NPG) plant, which has an 80 thousands metric tons annual manufacturing capability at its newly built Zhanjiang Verbund plant in China.

In August 2022, Unilever invested in two Mexican food factories to boost production capacity and meet demand for both the domestic and international markets. Such instances are expected to increase the demand of zero liquid discharge systems.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the zero liquid discharge system market analysis from 2022 to 2032 to identify the prevailing zero liquid discharge system market opportunities.

- The market research is offered along with information related to zero liquid discharge system market overview, key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the zero liquid discharge system market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global zero liquid discharge system market trends, key players, market segments, application areas, market growth strategies, and overall zero liquid discharge system market outlook.

Zero Liquid Discharge System Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 11.2 billion |

| Growth Rate | CAGR of 6.2% |

| Forecast period | 2022 - 2032 |

| Report Pages | 260 |

| By System Type |

|

| By Process Type |

|

| By End User |

|

| By Region |

|

| Key Market Players | Lenntech B.V., Praj Industries Ltd., SafBon Water Technology, Aquarion AG, H2O GmbH, GEA Group Aktiengesellschaft, Aquatech International LLC., Veolia, Oasys Water, Inc., Condorchem Envitech |

Analyst Review

The zero liquid discharge system is used to eliminate liquid discharge and produce solid waste in industrial wastewater. The market for ZLD systems is expected to witness significant growth in the coming years as the textile industry continues to expand and adopt sustainable manufacturing practices. In addition, the rise in adoption of ZLD systems in other industries such as power generation, chemicals, and pharmaceuticals is anticipated to contribute to the growth of the ZLD system market. In addition, ZLD system market has seen significant growth as a result of these regulations, with industries such as power generation, oil & gas, and chemicals leading the way. ZLD systems not only comply with government regulations, and, also provide and environmental benefits by reducing water consumption and minimizing the discharge of pollutants. However, the high initial and operating costs associated with these systems can be a significant restraint for the ZLD system market growth. In addition, the use of nanomaterials, advanced sensors & control systems, AI, and data analytics can optimize ZLD system operation and minimize energy consumption and waste generation. Overall, advancements in technology provide an opportunity for the ZLD system market.

Growth of the manufacturing industry and increasing government rules and regulations for the safe disposal of industrial wastewater are some of the major trends influencing the zero liquid discharge system market.

Zero liquid discharge systems are extensively used for processing wastewater in the textile, chemical, and pulp and paper industry.

Europe is the largest regional market for Zero Liquid Discharge System,

$6068.5 Million is the estimated industry size of Zero Liquid Discharge System.

Aquarion AG, Aquatech International LLC, Condorchem Envitec., Lenntech B.V., Gea Group, Praj Industries Ltd., Veolia Water Technologies, and SafBon Water Technology. are some of the top companies to hold the market share in Zero Liquid Discharge System.

The Zero Liquid Discharge System market is projected to reach $11,187.3 million by 2032.

The company profile has been selected on factors such as geographical presence, market dominance (in terms of revenue and volume sales), various strategies and recent developments.

Latest version of global Zero Liquid Discharge System market report can be obtained on demand from the website.

Loading Table Of Content...

Loading Research Methodology...