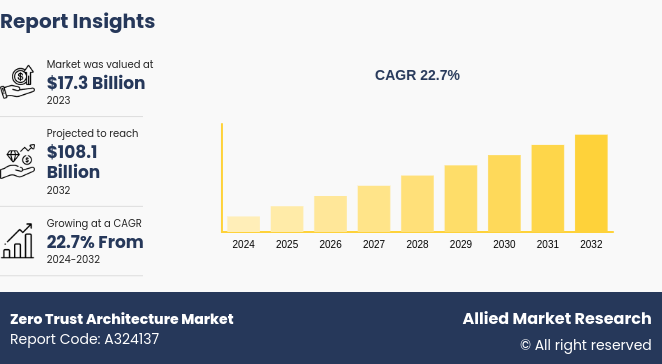

The zero-trust architecture market was valued at $17.3 billion in 2023 and is estimated to reach $108.1 billion by 2032, exhibiting a CAGR of 22.7% from 2024 to 2032. The zero trust architecture market growth is propelled by the increasing cyber threats, regulatory compliance and technological advancements.

Market Introduction and Definition

Zero trust architecture is a cybersecurity concept centered around the belief that organizations should not automatically trust any entity inside or outside their perimeters. It is designed to protect modern digital environments by assuming that threats could exist both inside and outside the network. In addition, Zero Trust Architecture typically involves strict identity verification processes for every person and device trying to access resources on a network, regardless of whether they are inside or outside the network perimeter. This approach aims to reduce the risk of data breaches, improve security, and protect sensitive information.

Key Takeaways

The zero trust architecture market size study covers 20 countries. The research includes a segment analysis of each country in terms of value ($Million) for the projected period 2024-2032.

More than 1,500 product literatures, industry releases, annual reports, and other such documents of major zero trust architecture industry participants along with authentic industry journals, trade associations' releases, and government websites have been reviewed for generating high-value industry insights.

The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global zero trust architecture industry and to assist stakeholders in making educated decisions in order to achieve their most ambitious growth objectives.

Key Market Dynamics

The zero-trust architecture market is driven by the increasing frequency and sophistication of cyber threats. As organizations adopt digital transformation and remote work, the attack surface expands, which makes them more vulnerable to security breaches. In addition, the zero-trust architecture provides a robust security framework that continuously verifies users, devices, and applications, regardless of their location, making it more resilient against evolving cyber threats which is driving the growth of market.

However, the market faces restraints due to the high implementation costs associated with zero trust architecture. The deployment of a comprehensive zero trust solution requires significant investment in infrastructure, software, and personal training. The organizations may need to replace legacy systems, implement advanced authentication mechanisms, and establish robust monitoring and analytics capabilities, the small companies may face high implementation costs, which hinder the market growth.

Furthermore, the government initiatives and regulatory compliance requirements accelerated the adoption of zero trust architecture. Governments worldwide recognized the importance of strengthening cybersecurity measures, particularly in critical infrastructure sectors and for safeguarding sensitive data government is taking initiatives for adopting zero trust architecture. The government initiatives such as the U.S. government's Cybersecurity Executive Order and the European Union's NIS2 Directive, which mandated the implementation of zero trust security principles, is expected to drive market growth.

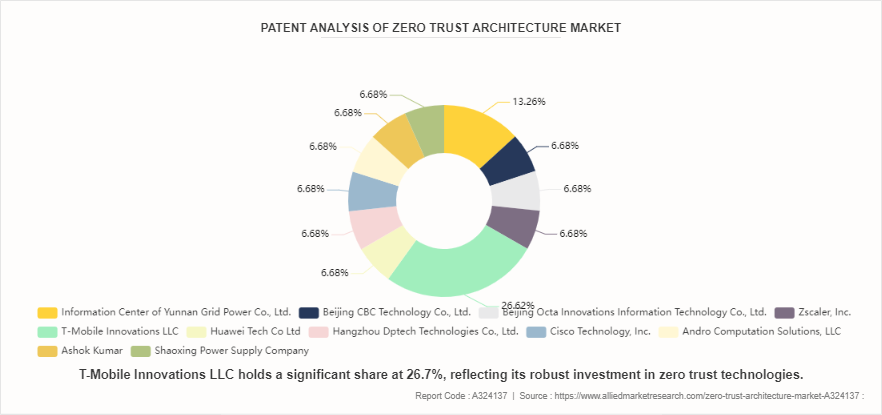

Patent Analysis Of Zero Trust Architecture Market

According to World Intellectual Property Organization (WIPO) patent analysis from 2021 to 2024, the T-Mobile Innovations LLC holds a significant share at 26.7%, reflecting its robust investment in zero trust technologies. The Information Center of Yunnan Grid Power Co., Ltd. follows with 13.3%, indicating strong activity in the power sector. The companies such as Beijing CBC Technology Co., Ltd., Beijing Octa Innovations Information Technology Co., Ltd., Zscaler, Inc., Huawei Tech Co Ltd, Hangzhou Dptech Technologies Co., Ltd., Cisco Technology, Inc., Andro Computation Solutions, LLC, Ashok Kumar, and Shaoxing Power Supply Company each hold a 6.7% share. This distribution highlights the widespread interest and innovation in zero trust solutions across various industries, such as telecommunications, technology, and power supply. The diverse patent holdings highlight the growing recognition of zero trust architecture as essential for enhancing cybersecurity measures in an increasingly interconnected digital landscape.

Market Segmentation

The zero trust architecture market size is segmented into offering, organization size, deployment, end-user, and region. On the basis of offering, the market is divided into solutions and services. As per organization size, the market is segregated into small and medium-sized enterprises (SMEs) and large enterprises. On the basis of deployment, the market is divided into cloud and on-premises. On the basis of end user, the market is divided into BFSI, government and defense, IT & ITES, healthcare, retail and ecommerce, energy and utilities, and other verticals. Region wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Regional/Country Market Outlook

The zero trust architecture market forecast exhibits promising growth trends across different regions. North America leads with a robust technology driven by advanced cybersecurity measures and proactive responses to evolving threats. Asia Pacific, particularly China and India, is anticipated to emerge as a rapidly growing market due to the region is expanding IT infrastructure, coupled with the proliferation of connected devices, necessitates the adoption of zero-trust models to protect against a diverse range of cyber threats. Government initiatives, such as India's Personal Data Protection Bill and China's Cybersecurity Law, further drive the adoption of zero-trust principles. In addition, Europe, known for its stringent data privacy laws such as GDPR, is also witnessing a rise in zero trust adoption. The General Data Protection Regulation (GDPR) enforces strict data privacy and security standards, compelling businesses to adopt robust security measures. Countries such as UK, Germany, and France are increasingly recognizing the need for zero-trust principles to mitigate sophisticated cyber threat the European Union’s focus on digital transformation and cybersecurity resilience under initiatives like the EU Cybersecurity Strategy, which propels the market's expansion.

Industry Trends

In May 2021, Chief Information Security Officer (CISO) Andy Hanks announced that Montana plans an adopting of zero-trust security statewide.

In May 2023, the Pentagon's senior information security official announced that the defense department is on track to implement its zero trust cybersecurity framework by fiscal year 2027 as planned.

In June 2023, Science Applications International Corp. announced the availability of Trust ResilienceTM, a holistic approach to support government agencies adopting the mandated Zero Trust architecture.

Competitive Landscape

The major players operating in the zero trust architecture market include Palo Alto Networks, VMware, Zscaler, Akamai, Microsoft, Cisco, IBM, Citrix, Check Point and Trellix. Other players in the zero trust architecture market are Forcepoint, CrowdStrike and so on.

Recent Key Strategies and Developments

In December 2023, Appgate the secure access company, announced that DXC Technology a leading Fortune 500 global IT services provider, selected Appgate as a Zero Trust Network Access (ZTNA) provider for its new Zero Trust Framework solution for its worldwide customer base.

In December 2023, Versa Networks, the global leader in AI/ML-powered Unified Secure Access Service Edge (SASE) and Software-Defined WAN (SD-WAN) announced it has been selected to provide SD-WAN, Zero Trust access and Customer Edge Security Stack (CESS) functions for Thunderdome, the Defense Information Systems Agency’s (DISA) zero trust network access (ZTNA) and application security architecture.

In May 2023, Zscaler partnered with the Center for Internet Security (CIS) to help the U.S. State, Local, Tribal, and Territorial (SLTT) government agency's identity, maintain control, and enforce policy with the Zscaler Zero Trust Exchange platform.

Key Sources Referred

NIST (National Institute of Standards and Technology)

Cisco

Zscaler

Microsoft

Google Cloud

IBM Security

Cybersecurity and Infrastructure Security Agency (CISA)

Key Benefits for Stakeholders

This report provides a quantitative analysis of the zero trust architecture marketsegments, current trends, estimations, and dynamics of the zero trust architecture market analysis from 2024 to 2032 to identify the zero-trust architecture market opportunities.

Market research is offered along with information related to key drivers, restraints, and opportunities.

Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders to make profit-oriented business decisions and strengthen their supplier-buyer network.

In-depth analysis of the zero trust architecture market share assists to determine the prevailing market opportunities.

Major countries in each region are mapped according to their revenue contribution to the global zero trust architecture market statistics.

Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

The report includes the analysis of the regional as well as global zero trust architecture market trends, key players, market segments, application areas, and market growth strategies.

Zero Trust Architecture Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 108.1 Billion |

| Growth Rate | CAGR of 22.7% |

| Forecast period | 2024 - 2032 |

| Report Pages | 200 |

| By Offering |

|

| By Organization Size |

|

| By Deployment |

|

| By End User |

|

| By Region |

|

| Key Market Players | VMware Inc., Akamai Technologies, Palo Alto Networks, Microsoft Corporation, Trellix, Citrix Systems Inc., Check Point Software Technologies Ltd., Cisco Systems Inc., IBM Corporation, Zscaler, Inc. |

The global market size of zero trust architecture market in 2023 is valued at US$ 17.3 billion in 2023.

The BFSI industry is expected to grow with the largest CAGR in the global zero trust architecture market over the forecast period.

North America is the largest regional market for zero trust architecture market in 2023.

The zero trust architecture market is estimated to reach $108.1 billion by 2032.

Some of the major companies operating in the market include Palo Alto Networks, VMware, Zscaler, Akamai, Microsoft, Cisco, IBM, Citrix, Check Point and Trellix, Forcepoint, and CrowdStrike.

Loading Table Of Content...