3D Printing Market Research, 2030

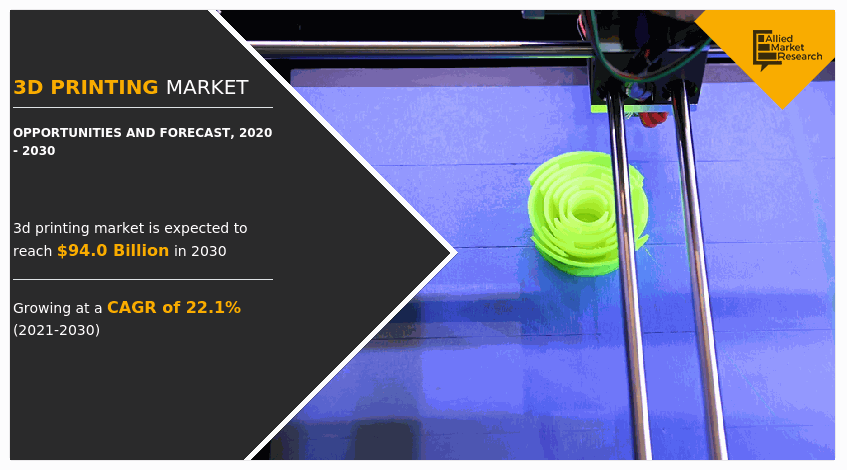

The global 3d printing market was valued at $13.2 billion in 2020 and is projected to reach $94.0 billion by 2030, growing at a CAGR of 22.1% from 2021 to 2030. 3D printing is a manufacturing technique for creating three-dimensional items from a digital file. 3D printing is used to create objects through additive processes of sequential layers of material. Owing to its great precision and economical use of resources. Further, 3D printing solutions such as resin 3d printers, 3d printer filaments, and 3d printing services have gained popularity in a variety of sectors for the production of bespoke items. Previously, 3D printing was only used for quick prototyping. However, as technology advances and applications expand, 3D printing is increasingly being utilized for the functional testing of prototypes under working settings as well as the creation of final goods.

In addition, 3D printing is a part of additive manufacturing and uses similar techniques, such as an inkjet printer-albeit in three dimensions. Moreover, the 3D printing method has witnessed a surge in demand across the healthcare, defense, and automotive sectors owing to the rise in deployment of 3D technology, thereby driving the market growth.

The 3D Printing industry is expected to witness notable growth during the forecast period, owing to a reduction in manufacturing cost and process downtime. Furthermore, government investments in 3D printing projects have driven the growth of the market. Moreover, the ease of development of customized products is expected to propel the growth of the 3D Printing market during the forecast period.

However, lack of standard process control and limited availability & high cost associated with 3D printing materials are some of the prime factors that restrain the market growth. On the contrary, the rise in utilization of 3D printing in healthcare sectors, applications in various industries, and improved manufacturing processes are expected to provide lucrative opportunities for the growth of the market during the forecast period.

Segment Overview:

The 3D Printing market is segmented into technology, applications, and country.

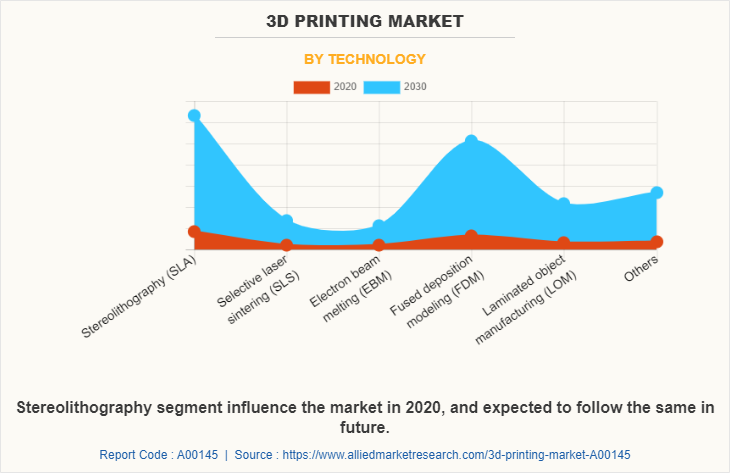

Depending on the technology, the market is segregated into stereolithography (SLA), selective laser sintering (SLS), electron beam melting (EBM), Fused deposition modeling (FDM), laminated object manufacturing (LOM), and others. The selective laser sintering (SLS) segment dominated the market, in terms of revenue, in 2020, and is expected to follow the same trend during the forecast period.

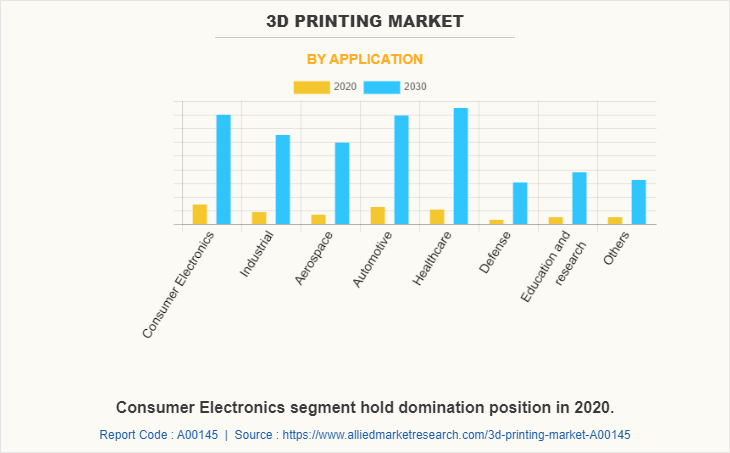

Based on application, it is categorized into consumer electronics, industrial, aerospace, automotive, healthcare, defense, education & research, and others. The consumer electronics segment acquired the largest 3D Printing market share in 2020; however, the healthcare segment is expected to grow at a high CAGR from 2021 to 2030.

Region-wise, the 3D display market trends are analyzed across North America (the U.S., Canada, and Mexico), Europe (the UK, Germany, France, and the rest of Europe), Asia-Pacific (China, Japan, India, and the rest of the Asia-Pacific), and LAMEA (Latin America, the Middle East, and Africa). North America, specifically the U.S., remains a significant participant in the global 3D printing industry. This is attributed to the fact that major organizations and government institutions in the country are intensely putting resources into the technology, which is anticipated to open new avenues for the expansion of the market.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the 3d printing market from 2020 to 2030 to identify the prevailing 3d printing market opportunities.

- Market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders to make profit-oriented business decisions and strengthen their supplier-buyer network.

- An in-depth analysis of the 3d printing market forecast segmentation assists in determining the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes an analysis of the regional as well as global 3d printing market trends, key players, market segments, application areas, and market growth strategies.

3D Printing Market Report Highlights

| Aspects | Details |

| By Technology |

|

| By Application |

|

| By Region |

|

| Key Market Players | Autodesk, Inc., Arcam AB, Optomec, Inc, Stratasys Ltd., Voxelijet AG, ExOne Company, Organovo Holdings, Inc., Protolabs, 3D Systems Corp., Hoganas AB |

Analyst Review

3D printing is an enhanced process designed to use layers of materials to build 3D equipment or object. Furthermore, 3D printing is intended to enable users to develop a complex shape using less material than traditional manufacturing methods. In addition, the surge in demand for AI, the IoT, and smart infrastructure solutions across the automotive, consumer electronics, and healthcare sectors are expected to drive the growth of the market across North America in the coming years.

The 3D printing market is highly competitive owing to the strong presence of existing vendors. 3D printing vendors who have access to extensive technical and financial resources are anticipated to gain a competitive edge over their rivals, as they have the capacity to cater to the market requirements. The competitive environment in this market is expected to further intensify with rise in technological innovations, product extensions, and different strategies adopted by key vendors.

The surge in the adoption of 3D printing in the healthcare sector, owing to the emergence of COVID-19 has significantly boosted the growth of 3D printing solutions. Moreover, prime economies, such as the U.S. and Canada, are planning to develop and deploy next-generation 3D printing solutions across various sectors. For instance, in February 2022, AM-giant 3D Systems Inc. announced the acquisition of pellet extruding machine company Titan Robotics LLC, which is anticipated to provide lucrative opportunities for market growth.

Among the analyzed regions, the U.S.exhibits the highest adoption rate of 3D printing solutions. On the other hand, North America is expected to grow at a faster pace, due to emerging countries, such as Mexico, investing in these technologies.

Globally, various key players and government agencies operating in North America are investing in 3D printing solutions to make them compatible with various industrial platforms. For instance,in2019, according to a report by New Story, a nonprofit organization based in Mexico, announced the development of the world’s first 3D printed community. The NPO has officially revealed the first set of 3D printed homes in Mexico, which is showcasing lucrative growth opportunities for market growth.

The key players profiled in the report include 3D Systems, Arcam AB, Autodesk Inc., Stratasys Ltd., The ExOne Company, Optomec, Inc., Organovo Holdings, Inc., Protolabs, Voxeljit AG, and Hoganas AB.

The rise in the utilization of 3D printing solutions in the manufacturing and construction sector is forecast to propel the market in the coming years.

Consumer electronics is the leading application of the 3D Printing Market in 2020.

3D systems, Protolabs, Voxeljit AG, and Arcam AB, Autodesk Inc are some of the key players in the global 3D printing market.

North America, specifically U.S., remains a significant participant in the global 3D printing industry.

The 3D Printing market was valued at $13.22 billion in 2020.

Loading Table Of Content...