Angiography Devices Market Overview

The global angiography devices market was valued at $8,780.5 million in 2021, and is projected to reach $15,931.1million by 2031, registering a CAGR of 6.0% from 2022 to 2031. The rise in number of cardiovascular diseases such as heart attack, stroke, and coronary block artery, along with increase adoption of advanced devices and technologies majorly driving the growth of market.

Market Dynamics & Insights

The Angiography devices industry in Europe held a significant share of over 20% in 2021.

The Angiography devices industry in India is expected to grow significantly at a CAGR of 7.7% from 2022 to 2031.

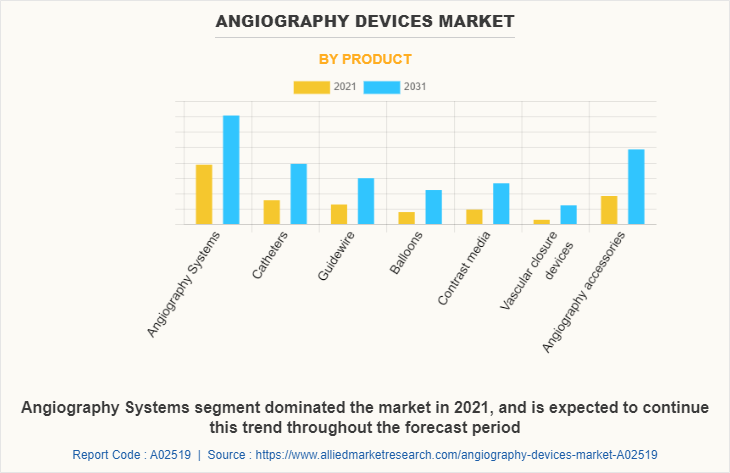

By product type, the Angiography Systems is one of the dominating segment in the market and accounted for the revenue share of over 27.8% in 2021.

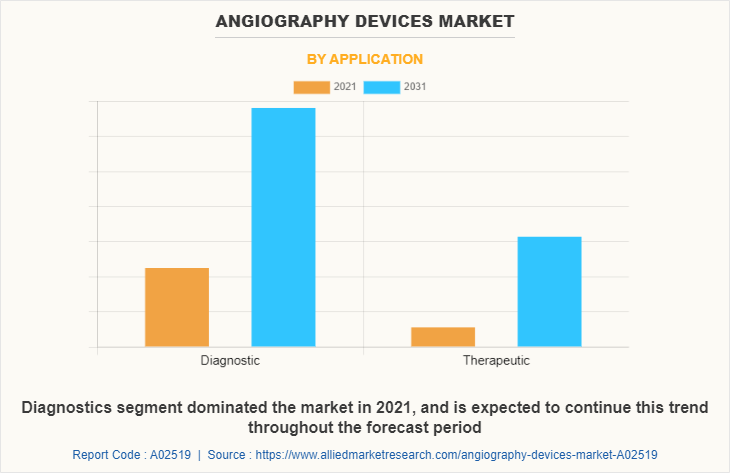

By application, the diagnostics segment is the second dominant segment in the market in 2021.

Market Size & Future Outlook

2021 Market Size: $8.7 Billion

2031 Projected Market Size: $15.9 Billion

CAGR (2022-2031): 6.0%

North America: Largest market in 2023

Asia Pacific: Fastest growing market

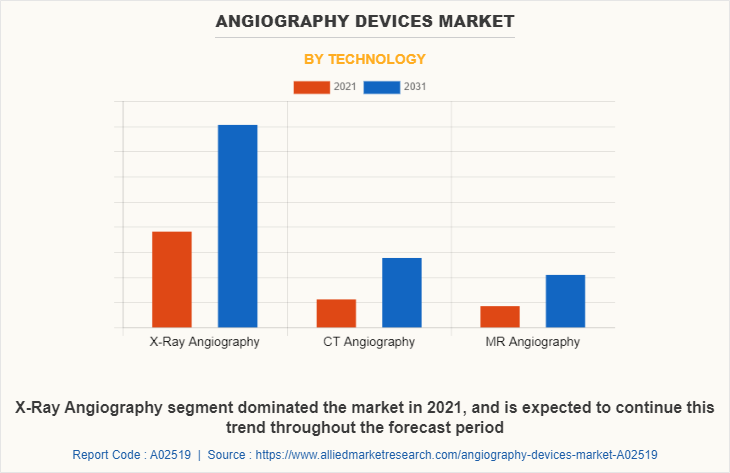

Angiography is a popular medical procedure which uses X-ray for producing detailed images of blood vessels. In advanced angiography, contrast reagents are used for enhancing the visualization of blood vessel. Angiography is used to detect abnormalities or blockages in blood vessels throughout the circulatory system, and in some organs to diagnose heart diseases, kidney functions, aneurysm, retina of the eye, blood clot, arteriovenous in the brain, and diagnose problems with the detect kidney tumors.Angiography using advanced technology such as X-ray angiography, CT angiography, and MR angiography helps clear visualization of blood vessels and determine the exact cause of disease. In X-ray angiography, image intensifiers, and flat-panel detectors are used for giving accurate results and diagnose the diseases at early stage.

Key Market Dynamics

The key factor that dives theAngiography Devices Market Growth, owing to increase in geriatric population prone to chronic heart disease, and rise in prevalence of cardiovascular diseases such as coronary block artery, heart attack, atherosclerosis disease, ischemic stroke, aneurysm, tumors, blood clot in brain, hypertension, myocardial infarction, arrythmia, increase in blockages of blood vessel in heart, brain, kidney and liver and rise in demand for minimally invasive procedure for the diagnosis of diseases. These factors boost the growth of the angiography devices market. According to health hearty 2020 report, the incident rate of heart attacks per 10,000 people is around 190 in people who are over 85 years of age, around 117 for those between 75-84 years of age. For instance, according to the National Center for Health Statistics, every year, more than 795,000 people in the U.S. have a stroke. In addition, according to the Center for Disease Control and Prevention, approximately 87% of all strokes reported are ischemic stroke.

Moreover, increase in unhealthy lifestyle, rise in smoking, uptake of alcohol, surge in use of supplements and steroids increase the cases of heart attack and boost the growth of the Angiography Devices Market Forecast period. For instance, according to statista, in 2020, nearly 29.5% of the German population elder than 15 years of age are smokers and in the age group of 18 to 25 years around 35.2% are smoker. In addition, technological advancements in angiography device market; launch of various angiography devices, strategies among key players such as acquisition, collaboration, and agreement drive the growth of the angiography device market. For instance, in August 2021, in August 2021, Abbott has announced it has received U.S. Food and Drug Administration (FDA) clearance for its latest optical coherence tomography (OCT) imaging platform powered by the company's new Ultreon Software. This innovative imaging software combines OCT with artificial intelligence (AI) to provide physicians an enhanced, comprehensive view of coronary blood flow and blockages to assist physician decision-making and provide the best pathway for treatment.

The angiography devices market is segmented into product type, application, technology, and region. By product type, the market is categorized into angiography systems, catheters, guidewires, balloons, contrast media, vascular closure devices, and angiography accessories. By application, the Angiography Devices Industry market is segmented into diagnostic, and therapeutic. By technology, the market is categorized into X-ray angiography, CT angiography, and MR angiography. The X-ray angiography segment is further classified into image intensifiers and flat-panel detectors.

Region-wise, the Angiography Devices Market Analysis is done across North America (the U.S., Canada, and Mexico), Europe (Germany, France, the UK, Italy, Spain, and rest of Europe), Asia-Pacific (Japan, China, Australia, India, South Korea, and rest of Asia-Pacific), and LAMEA (Brazil, South Africa, Saudi Arabia, and rest of LAMEA).

Segment Review

By Product segment review

On the basis of product, the angiography systems segment has largestAngiography Devices Market Share in 2021. The dominance of this segment can be attributed to increase in use of angiography systems for diagnosis of chronic heart diseases and rise in prevalence of cases regarding block blood vessel of heart and brain.

By Application Review

On the basis of application, the diagnostic segment was the highest Angiography Devices Market Share in 2021, owing to increase in prevalence of heart diseases such as coronary block artery, angina, cardiac arrhythmia, heart attack, myocardial infarction, and rise in cases of heart attack across the world drives the growth of Angiography Devices Market Size in forecats period.

By Technology Review

On the basis of technology, the X-Ray angiography segment was the highest revenue contributor to the Angiography Devices Industry in 2021, owing to rise in high adoption of X-Ray angiography for diagnosis of narrowing of the arteries in the brain, and blockages in blood vessel and rise in awareness regarding use of X-Ray angiography for treatment of diseases.

By Region review

By Region

North America segment dominated the market in 2021, and is expected to continue this trend throughout the forecast period

On the basis of region, North America dominated the angiography device market in 2021, owing to rise in number of chronic heart disease cases, presence of key players advancement in healthcare in the region, robust healthcare infrastructure, presence of key players, and rise in healthcare expenditure.

Competitive Landscape

Some of the major companies that operate in the global Angiography devices market are Abbott Laboratories, Angiodynamics, Inc., Boston Scientific Corporation, B. Braun Melsungen AG, General Electric Company, Koninklijke Philips N.V., Medtronic Inc., Merit Medical Systems, Inc., Siemens Healthcare Gmbh, and Shimadzu Corporation.

Key Benefits for Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the angiography devices market analysis from 2021 to 2031 to identify the prevailing angiography devices market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the angiography devices market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global angiography devices market trends, key players, market segments, application areas, and market growth strategies.

Angiography Devices Market Report Highlights

| Aspects | Details |

| Market Size By 2031 | USD 15.9 billion |

| Growth Rate | CAGR of 6% |

| Forecast period | 2021 - 2031 |

| Report Pages | 310 |

| By Product |

|

| By Technology |

|

| By Application |

|

| By Region |

|

| Key Market Players | shimadzu corporation, b.braun melsungen ag, General Electric Company, Medtronic, Inc., Merit Medical Systems, Inc., AngioDynamics, Inc., Siemens Healthcare, Abbott Laboratories, Boston Scientific Corporation, Koninklijke Philips N.V. |

Analyst Review

This section provides various opinions of top-level CXOs in the angiography devices market. In accordance with several interviews conducted, the angiography devices market is expected to witness a significant growth in the future, owing to increase in prevalence of heart diseases across the world.

Rise in geriatric population, increase in unhealthy lifestyle and rise in smoking, uptake of alcohol boosts the growth of angiography devices market. Rise in number of heart attack cases has led to an increase in number of therapies to treat heart diseases, resulting in an increase in the need for prognostic and diagnostic, especially angiography. Angiography serves this purpose by predicting the best approach for diagnosis the various diseases such as atherosclerosis, peripheral arterial disease, a brain aneurysm, angina and clot in veins and arteries of heart and brain, understanding the characteristics of the tumor, predicting the probability of tumor recurrence, and improving the patient stratification along with real-time monitoring of therapies. Increase in number of healthcare professionals have preferred angiography to choose the appropriate treatment and understand the onset of the diseases. Angiography devices is expected to help improve the patient survival rate and reduce the cost of treatment for heart patients, owing to the help provided in prediction of the drug therapeutic targets.

However, lack of skilled professionals and high cost of angiography devices is expected to hamper the growth of the market up to some extent during the forecast period. On the contrary, rise in advancements in technical skills and increase in number of product type approvals are expected to provide opportunities for the growth of the global angiography market in the future.

Further, North America is expected to witness highest growth, in terms of revenue, owing to increase in technological advancement of angiography devices and increase in prevalence of chronic heart diseases. Asia-Pacific is expected to register the fastest CAGR during the forecast period, owing to increase in geriatric population that are more prone to diseases and rise in awareness regarding of angiography devices.

The key factors that drive the growth of market are increase in the prevalence of geriatric population that are prone to heart disease, rise in prevalence of ischemic stroke, surgeries, heart diseases such as chest pain, heart attack, and stroke across the world, rise in awareness regarding health benefits associated with angiography device such as minimal invasive, quick and early diagnosis without any pain and rise in healthcare expenditure

The total market value of Angiography devices Market is $8,780.5 million in 2021

North America is the largest regional market for Angiography Devices

The market value of Angiography devices in 2031 was15,931.1 Million

Abbott Laboratories, Angiodynamics, Inc., Boston Scientific Corporation, B. Braun Melsungen AG re the top companies to hold the market share in Angiography Devices

The base year for the report is 2021

Yes, Angiography devices Market companies are profiled in the report

No, there is no value chain analysis provided in the Angiography devices Market report

Loading Table Of Content...