Catheters Market Research, 2031

The global catheters market size was valued at $22.7 billion in 2021, and is projected to reach $49.5 billion by 2031, growing at a CAGR of 8.1% from 2022 to 2031. Catheterization is type of co-procedure performed along with varied medical procedures including, angioplasty, cardiac electrophysiology, and neurological surgery. It is a tube that is inserted into bladder, allowing urine to pass freely. There are various types of catheters, such as cardiovascular catheters, neurovascular catheters, urological catheters, and specialty catheters. Catheters are usually used for short time period, for instance, for a number of weeks or months when continuous bladder drainage is needed, but occasionally they are required for long term use. Urinary catheters are used when people have difficulty is passing the urine naturally. It can also be used to empty the bladder before or after surgery.

Growth of the global catheters market is majorly driven by rise in prevalence of cardiovascular diseases along with the increase in demand for minimal invasive surgeries. In addition, significant increase in prevalence of chronic diseases associated with urinary bladder, kidney failures, and others are the major factors that drive the growth during catheters market forecast. In addition, surge in demand for minimal invasive surgeries among patients further fuels the catheters market growth. In addition, increase in incontinence problems owing to rise in geriatric population base across the globe, and increase in demand for sterile & disposable catheters contribute to the market growth. Moreover, development of new catheters by large number of key players fuel the growth of catheters market size.

Furthermore, rise in geriatric population and increase in number of patients suffering from bladder cancer fuel the growth of the catheters market. Furthermore, growth in demand for minimally invasive procedures, due to the recent technological innovations is expected to increase the demand for catheters. For instance, growth in demand for angioplasty over conventional surgeries, owing to its minimally invasive nature, attributes toward the market growth. Furthermore, increase in number of product approvals is expected to provide lucrative catheters market opportunity for the growth of the global catheter market during the forecast period. For instance, in March 2022, Cerus Endovascular has received the U.S food and drugs administration approval for its 027 micro-catheter, which contour neurovascular system.

The COVID-19 outbreak is anticipated to have a short-term negative impact on the growth of the global catheters industry due to on-hold services, such as treatment, diagnostic, and surgical services, to prevent the spread of COVID-19 disease. According to the National Library of Medicine, Jordan imposed strict COVID-19-related lockdown. The strict lockdown was associated with drastic declines in volumes of cardiac catheterization procedures with gradual increase in volumes after partial lifting of the lockdown. However, catheters will be used more often in hospitals as the government and healthcare organizations work to improve medical treatment for COVID-19 patients. The patients who confirmed diagnosis of COVID-19 are being treated with catheters. For instance, in April 2020, Bactiguard introduced a new urinary catheter, BIP Foley TempSensor for continuous temperature monitoring. The company reported in pandemic that it has a urinary catheter combined with integrated temperature monitoring and infection control. Thus, such technological advancements help to drive the growth of the catheter market during the forecast period.

However, due to increase in number of entrants in the domestic market, the quality of catheter devices deteriorates as these manufacturers use cheap and substandard raw material to manufacture the product at low price, restricting the market growth.

Global Catheter Market Segmentation

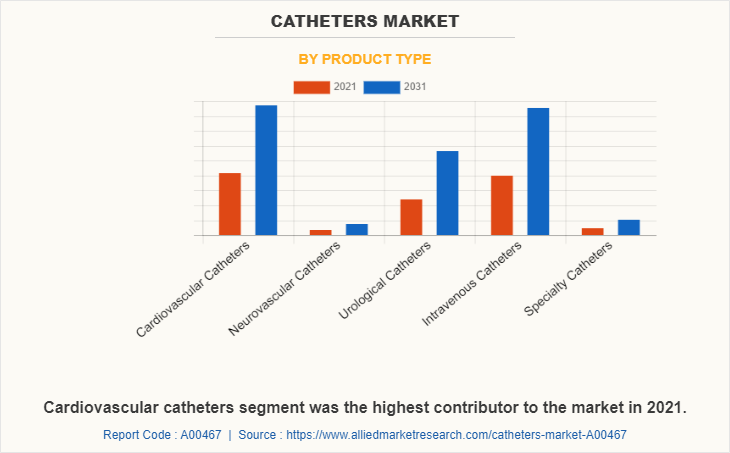

The catheters market is segmented on the basis of product type and region. By product type, the market is categorized into cardiovascular catheters, neurovascular catheters, urological catheters, and specialty catheters. Cardiovascular catheters segment is classified into electrophysiology catheters, percutaneous transluminal coronary angioplasty (PTCA) balloon catheters, intravascular ultrasound (IVUS catheters), percutaneous transluminal angioplasty (PTA) catheters, and others include guiding catheter, angiography catheter, and pulmonary artery catheters. In addition, urological catheter segment is fragmented into dialysis catheter and urinary catheter. Dialysis catheter segment is segmented into hemodialysis catheter and peritoneal catheter. Urinary catheter segment is sub segmented into and foley catheter, intermittent catheter, and external catheters. Furthermore, intravenous catheter segment is divided into central intravenous catheter and peripheral intravenous catheters. Peripheral intravenous catheters is fragmented into integrated catheters and short catheters. Moreover, specialty catheters segment is divided into wound/surgical drain, oximetry, thermodilution, and intrauterine Insemination(IUI) catheters.

Region wise, the market is analyzed across North America (the U.S., Canada, and Mexico), Europe (Germany, France, the UK, Italy, Spain, and rest of Europe), Asia-Pacific (Japan, China, Australia, India, South Korea, and rest of Asia-Pacific), and LAMEA (Brazil, Saudi Arabia, South Africa, and rest of LAMEA).

By Product Type

Depending on product type, the cardiovascular catheter segment dominated the market in 2021, and this trend is expected to continue during the forecast period, owing to rise in prevalence of cardiovascular diseases along with the increase in demand for minimal invasive surgeries. In addition, rise in usage to evaluate and confirm the presence of diseases related to heart such as valve disease, coronary artery disease, and diseases related to the aorta further drive the growth of cardiovascular catheter segment. However, the urological catheter segment is expected to witness considerable growth during the forecast period, owing to increase in usage of urological catheters, due to increase in prevalence of end-stage renal diseases, kidney problem, and urinary tract infection.

By Region

Region wise, North America garnered the major catheter market share in 2021, and is expected to continue to dominate during the forecast period, owing to increase in the product launches and the increase in number of regulatory approvals in the developed countries of North America positively impacting the market growth. However, Asia-Pacific is expected to register the highest CAGR of 11.9% from 2022 to 2031, owing to increase in demand for catheters due to rise in incidence of cardiovascular diseases and immunological & neurological diseases.

Competitive Analysis

The key players that operate in the global catheters market include Abbott Laboratories, Becton Dickinson And Company, Boston Scientific Corporation, B. Braun Melsungen AG, Teleflex Incorporated, Johnson & Johnson, Medtronic, Inc., Edwards Lifesciences Corporation, Cook Medical, and Stryker Corporation.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the catheters market analysis from 2021 to 2031 to identify the prevailing catheters market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the catheters market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global catheters market trends, key players, market segments, application areas, and market growth strategies.

Catheters Market Report Highlights

| Aspects | Details |

| By Product Type |

|

| By Region |

|

| Key Market Players | B. Braun Melsungen AG, Edwards Lifesciences Corporation, Johnson and Johnson, Cook Medical Inc., Medtronic Plc, Abbott Laboratories, Becton, Dickinson and Company, Stryker Corporation, Boston Scientific Corporation, Teleflex Incorporated |

Analyst Review

Rise in demand for minimally invasive surgeries for the diagnosis and treatment of cardiovascular, neurological, and other diseases drive the growth of the catheters market. Limited availability of plasma donors hinders the market growth. Further, catheter-based surgeries are minimally invasive and require shorter recovery times. Surgeries performed with the help of catheters are less invasive and led to faster recovery.

Catheters help visualize and examine inaccessible parts of the body, further increasing the quality of treatment. The key players in catheters market launch products with higher flexibility, ease of use, and are made of materials resistant to growth of infectious organisms. Furthermore, rise in prevalence of cardiovascular diseases and urinary tract infection(UTI) has increased the use of cardiovascular and urological catheters. The key players have increased their investment in R&D of catheters that help reduce the risk of catheter-associated infections due to the rise in number of people suffering from catheter-based infection,. In addition, increase in reimbursement rates for catheters increases the use of catheters for various therapeutic and diagnostic purposes.

The market gains interest of healthcare companies, owing to focus on preventive facilities provided to patients who are undergoing critical surgeries, which are more complex than other health conditions. This leads to increase in utilization of catheters, driving the growth of the market.

North America is expected to witness highest growth, in terms of revenue, owing to rise in geriatric population, presence of key players, and advancements in healthcare investments. Asia-Pacific was the second largest contributor to the market in 2021 and is expected to register fastest CAGR during the forecast period, owing to increase in number of urinary bladder cancer and kidney failure cases and unmet needs from advanced catheters. However, inadequate quality assurance and price competition at domestic levels are expected to hamper the market growth.

Catheter is a thin tube which is made from medical grade materials. They are medical devices that can be inserted in the body to treat diseases or perform a surgical procedure.

The total market value of catheters market is $22,659.21 million in 2021.

The forecast period for catheters market is 2022 to 2031

The market value of catheters market in 2031 is $49,469.93 million.

The base year is 2021 in catheters market

Top companies such as Abbott Laboratories, Becton Dickinson and Company, Boston Scientific Corporation, B. Braun Melsungen AG, Johnson & Johnson, Medtronic Inc. and Stryker Corporation held a high market position in 2021.

Cardiovascular catheter segment is the most influencing segment owing to rise in cardiovascular diseases that necessitate the use of catheters in diagnostic as well as surgical cardiac procedures.

Loading Table Of Content...