IoT Monetization Market Size & Insights:

The global iot monetization market was valued at USD 396.6 billion in 2022, and is projected to reach USD 25.1 trillion by 2032, growing at a CAGR of 51.7% from 2023 to 2032.

Rise in adoption of cloud platforms and increase in internet connectivity are the major factors that drive the growth of the global IoT monetization market. In addition, surge in use of consumer electronics devices is expected to fuel the growth of the global IoT monetization market trends. However, lack of IoT standards across platforms and rise in privacy as well as security concerns are the major factors that impede the growth of the global market. Also, according to a Capgemini research report, 70% of enterprises do not get service revenues from their IoT products.

Companies that want to generate revenue from IoT need to convert the information from smart and connected products into services by using the product's data stream to involve customers with additional services, or by offering the entire product as a service, which is expected to provide lucrative opportunities for the growth of the global market. Furthermore, an increase in number of smart lighting and smart city projects is anticipated to provide lucrative growth opportunities for the global IoT monetization market in the upcoming years.

Internet of Things (IoT) monetization is a process that generates revenue from IoT-enabled products and services. Owing to the growth in dependence of the users on the IoT-based products and solutions, the companies charge the users for some extra features or for the entire product as a service. With the beginning of the Internet era along with increase in advancements in technology, almost every device is now interconnected to each other. In addition, due to the emergence of the IoT, numerous offices as well as homes have become smart and are operating through these connected devices. Also, rise in usage of smart devices such as tablets and smartphones are expected to fuel the global IoT monetization market growth.

Segment Review:

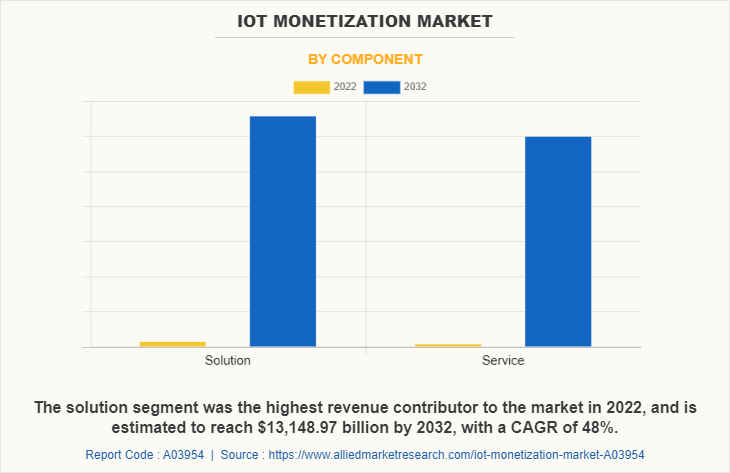

The IoT monetization market is segmented into component, organization size, industry vertical, business functions, and region. In terms of component, the market is bifurcated into solutions and service. Based on organization size, it is classified into large enterprises and small & medium sized enterprises. According to business function, the market is classified into marketing & sales, IT, finance, supply chain, and operations. As per industry vertical, it is divided into retail, IT & telecom, manufacturing, transportation & logistics, healthcare, BFSI, energy & utilities, and others. Region wise, it is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

On the basis of component, the global IoT monetization market share was dominated by the solution segment in 2022 and is expected to maintain its dominance in the upcoming years. Owing to advances in technologies enabling IoT monetization to transform industries globally, from BFSI, to manufacturing, healthcare, and others, are anticipated to propel the growth of the market in the coming years. However, the service segment is expected to witness the highest growth, as IoT monetization service reduce the time and costs associated with optimizing systems in the initial phase of deployment.

By region, North America dominated the market share in 2022 for the IoT monetization market. The increasing investments in advanced technologies such as cloud-based services, artificial intelligence (AI), machine learning (ML), business analytics solution, and IoT to improve businesses and customer experience are anticipated to propel the growth of the IoT monetization market. However, Asia-Pacific is expected to exhibit the highest growth during the forecast period. This is attributed to the increase in penetration of digitalization and higher adoption of advanced technology which are expected to provide lucrative growth opportunities for the market in this region.

Top Impacting Factors:

Continuous rise in the volume of enterprise data:

Organizations are becoming aware of the opportunities embedded in their enterprise data due to a continuous rise in the volume of unstructured data. Enterprises can convert raw or aggregated data based on multiple data sources into something insightful and valuable through IoT monetization, which in turn helps make right business decisions. Companies have experienced exponential rise in volume, variety, and speed of data after the adoption of data monetization. This also makes way for different opportunities that help mark the growth of the business. A lot of industry verticals use analytics and business intelligence tools to create IoT monetization opportunities by leveraging all their data assets along with structured and unstructured data within enterprise systems. For instance, retailers are using IoT monetization primarily to automate the process of analyzing billions of transactions. Moreover, financial service companies adopt IoT monetization to analyze thousands of trades to be able to capture profit from minor market inefficiencies.

Rise in market for smart cities and connected cars:

The benefits of Internet of Things (IoT) are majorly being experienced among consumer domains, such as transport and connected homes, which in turn drive the growth of the IoT monetization market forecast in smart cities and smart cars. Moreover, integrating IoT devices into cars’ systems enables additional functionality. Smart cars allow individuals to cool down or heat up cars before going for a drive, which is also one of the major factors expected to drive the growth of the IoT monetization market in smart cars. Furthermore, energy consumption and smart home technologies are also the biggest adopters of Internet of Things (IoT) and continue to drive the growth of the market owing to the significant rise in smart cities’ initiatives. By using internet connectivity, smart homes allow homeowners to control various devices and appliances in the home from remote locations. In addition, the manufacturers plan to connect maximum number of home devices to the internet in the upcoming years, which provides numerous opportunities for the growth of the IoT monetization market.

Growth in penetration of IoT:

IoT has already started to transform and disrupt entire industries, such as home devices and other appliances. Followed by the smart home, connected cars are also dominating the Internet of Things, which are the major factors driving the growth of the market. Moreover, number of businesses are increasingly adopting IoT monetization solutions, which fuel the growth of the market. For instance, 35% of manufacturing organizations are already taking advantage of smart sensors, and other 18% are expected to use them in coming years. Furthermore, according to a survey by Capgemini, 65% of the companies are allocating budget to IoT over the next 12 months, which is anticipated to drive the growth of the IoT monetization market. Thus, the rise in penetration of IoT devices in numerous industry verticals is expected to generate massive amount of data. This is anticipated to generate the need for IoT monetization solution, which fuels the growth of the market.

COVID-19 Impact Analysis

The COVID-19 pandemic has had a significant impact on the IoT monetization industry. While some sectors experienced challenges, others witnessed opportunities for growth and innovation. One of the positive impacts of the pandemic on the IoT monetization market was the increased demand for remote monitoring and automation solutions. With restrictions on physical access and the need for social distancing, industries such as healthcare, manufacturing, and logistics sought IoT technologies to enable remote monitoring of equipment, processes, and assets. This drives the adoption of IoT solutions that facilitates real-time data collection, analytics, and control, allowing businesses to ensure operational continuity and optimize efficiency even with limited on-site personnel.

Additionally, the pandemic accelerated digital transformation initiatives across industries, further fueling the adoption of IoT solutions. As businesses looked to adapt to the changing landscape, they increasingly turned to IoT-enabled applications and services to optimize operations, improve supply chain resilience, and enhance customer experiences. This surge in IoT implementation created monetization opportunities for IoT platform providers, solution developers, and service providers. However, the COVID-19 pandemic also posed challenges to the IoT monetization industry. Disruptions in supply chains and manufacturing processes impacted the production and deployment of IoT devices and solutions. Economic uncertainties and budget constraints led to delays in investment decisions and reduced spending on IoT projects.

Furthermore, certain sectors heavily dependent on IoT, such as retail and hospitality, faced significant setbacks due to lockdowns and reduced consumer demand. This led to a temporary slowdown in IoT monetization within those sectors. Overall, while the COVID-19 pandemic presented challenges, it also acted as a catalyst for digital transformation and the adoption of IoT solutions across industries. The long-term impact on the IoT monetization industry will depend on how businesses navigate the changing landscape, adapt to evolving customer needs, and continue to innovate in the post-pandemic era.

Key Benefits for Stakeholders:

- The study provides an in-depth IoT monetization market analysis along with the current trends and future estimations to elucidate the imminent investment pockets.

- Information about key drivers, restraints, and opportunities and their impact analysis on the IoT monetization market size is provided in the report.

- The Porter’s five forces analysis illustrates the potency of buyers and suppliers operating in the IoT monetization industry.

- The quantitative analysis of the global IoT monetization market for the period 2022–2032 is provided to determine the IoT monetization market potential.

IoT Monetization Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 25.1 trillion |

| Growth Rate | CAGR of 51.7% |

| Forecast period | 2022 - 2032 |

| Report Pages | 405 |

| By Industry Vertical |

|

| By Component |

|

| By Business Function |

|

| By Organization Size |

|

| By Region |

|

| Key Market Players | Microsoft Corporation., Amdocs, Inc., Thales Group, SAP SE, Cisco Systems, Inc., Telefonaktiebolaget LM Ericsson, Oracle Corporation, Intel Corporation, IBM Corporation, General Electric Co. |

Analyst Review

According to the insights of the CXOs of the leading companies, IoT data were expected to account for 10% of all the data registered globally in 2020. However, adopters of IoT companies as well as governments around the world have started to take steps to maximize the benefits and capture the potential value of streaming big data, which is estimated to drive the overall adoption of IoT monetization solutions in different industry verticals. Furthermore, key areas such as smart homes, smart cars, smart cities, and IoT-based agriculture is expected to provide key opportunities for the IoT monetization market in the upcoming years.

The IoT monetization industry presents promising growth prospects throughout the forecast period, due to the ongoing adoption of these solutions among the second and third ranking companies in the telecom sector. Also, leading companies in Telco business are already deploying 5G and IoT and they will adopt the IoT monetization solutions due to its potential benefits to stay competitive in the market. Also, the adoption of IoT monetization solutions has increased in the automotive & transportation industry as the automotive manufacturers are extensively using IoT, which fuels the growth of the market. It is easier to support cities, towns, and states, globally to meet the rise in demand for surface transportation systems through connected cars and intelligent transportation systems such as sensors and communication & traffic control technologies. Consumer electronics is also one of the emerging application segments of the IoT monetization market and is anticipated to grow during the forecast period due to increase in number of smart appliances that can be connected to smartphones and the Internet. The demand for smart consumer electronics is expected to increase with its rise in use in building smart offices, smart cities, and smart buildings.

Furthermore, according to Cisco, the revenue from Internet of Things is expected to increase to about $19 trillion in a few years. There is a rise in the adoption of number of IoT devices in the developing economies such as China and India, which boosts the growth of the market. Furthermore, continuous increase in the adoption of IoT devices among different industry verticals is expected to provide numerous opportunities for the market growth. However, according to a Capgemini report, less than 30% of organizations generate service revenue from their connected products due to several challenges such as security and privacy concerns, lack of standards, and need of significant investments. This number is anticipated to increase in the future.

The global IoT monetization market is highly competitive owing to the strong position of the existing vendors. These companies have economies of scale and a huge geographical presence. The market is largely dominated by major vendors such as Amdocs, IBM Corporation, Ericsson, SAP SE, Oracle, Thales Group, Cisco Systems, Inc., and others. However, these players have adopted various strategies to enhance their product & service offerings and increase their market penetration.

Global IoT Monetization Market is Expected to Reach $25096.43 Billion by 2032.

The North America is the largest market for the IoT Monetization.

Rise in adoption of cloud platforms and increase in internet connectivity are the major factors that drive the growth of the global IoT monetization market.

The key growth strategies for IoT Monetization include product portfolio expansion, acquisition, partnership, merger, and collaboration.

Amdocs, Inc., IBM Corporation, Ericsson, SAP SE, Oracle, Thales Group, Cisco Systems, Inc., Aria Systems, Inc., Intel Corp., and General Electric Co.

Loading Table Of Content...

Loading Research Methodology...