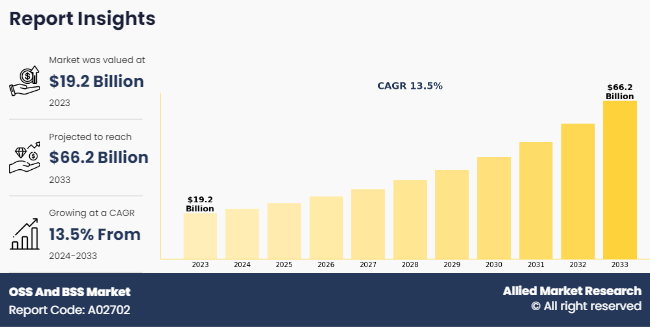

OSS And BSS Market Size and Growth:

The global OSS and BSS market size was valued at USD 19.2 billion in 2023, and is projected to reach USD 66.2 billion by 2033, growing at a CAGR of 13.5% from 2024 to 2033.

Operations support system (OSS) and business support system (BSS) are integral components in the telecommunications and other service-oriented industries. These components mainly support the management of various business and technical operations. OSS refers to a suite of applications or systems telecom operators use to manage their network operations. The primary functions of OSS include network management, service provisioning, fault management, performance management, inventory management, and configuration management. However, BSS includes systems used by telecom operators to manage business operations and customer interactions. The integral functions of BSS are customer management, order management, billing and revenue management, product management, and customer relationship management. By understanding the divergent roles of these two integral components, service providers can optimize network performance and streamline operational processes. Rise in demand for reducing operational expenses (OPEX), along with the growing adoption of convergent billing systems boosts the growth of the OSS & BSS market.

Key Takeaways:

By component, the solution segment held the largest share in the OSS & BSS market in 2023.

By solution type, the network planning & design segment held the largest share in the OSS & BSS market in 2023.

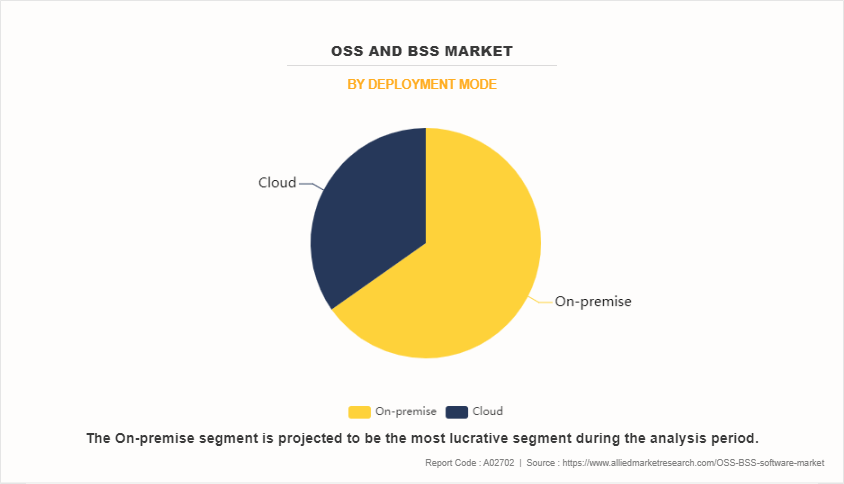

By deployment mode, the on-premise segment held the largest share in the OSS & BSS market in 2023.

By organization size, the large enterprises segment held the largest share in the OSS & BSS market in 2023.

By industry vertical, the IT & telecom segment held the dominant share in the OSS & BSS market in 2023.

By type, the OSS segment held the largest share in the OSS & BSS market in 2023.

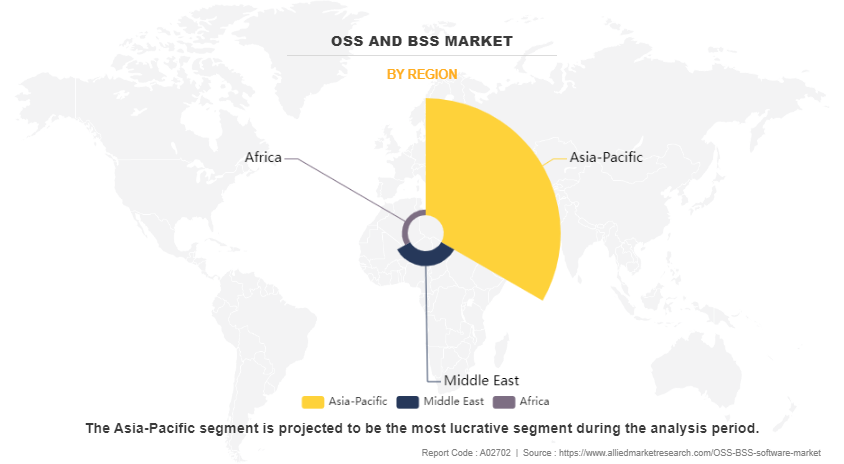

Region-wise, North America held the largest market share in 2023. However, Asia-Pacific is expected to witness the highest CAGR during the OSS and BSS market forecast period.

In addition, surge in trend of outsourcing the OSS & BSS services, along with the growing complexity of telecommunication networks presents a significant growth prospect for the OSS & BSS market. However, the interoperability issues between legacy and new systems and increase in data security & privacy concerns among businesses hamper the OSS and BSS market growth. On the contrary, the growing adoption of cloud technology transforming the telecom industry and the increasing adoption of next-generation operating systems are expected to offer remunerative opportunities for the expansion of the OSS and BSS industry during the forecast period.

The report focuses on growth prospects, restraints, and analysis of the global OSS & BSS market trend. The study provides Porter’s five forces analysis to understand the impact of various factors, such as bargaining power of suppliers, competitive intensity of competitors, the threat of new entrants, threat of substitutes, and bargaining power of buyers on the global OSS and BSS market share.

Segment Review:

The OSS & BSS market is segmented on the basis of component, solution type, deployment mode, organization size, industry vertical, and type. By component, the market is bifurcated into solution and service. By solution type, the market is classified into network planning & design, service delivery, service fulfillment, service assurance, customer & product management, billing & revenue management, network performance management and others. By deployment mode, the market is categorized into on-premise and cloud. By organization size, the market is bifurcated into small & medium-sized-enterprises and large enterprises. By industry vertical, the market is divided into IT & telecom, BFSI, media & entertainment, retail & e-commerce, and others. By type, the market is classified into OSS and BSS. Region-wise, the market is analyzed across North America (U.S. and Canada), Europe (UK, Germany, France, Italy, Spain, and Rest of Europe), Asia-Pacific (China, Japan, India, Australia, South Korea, and Rest of Asia-Pacific), and LAMEA (Latin America, Middle East, and Africa).

By Deployment Mode

By deployment mode, the on-premise segment dominated the OSS & BSS market in 2023 and is expected to maintain its dominance in the upcoming years, as operators can scale their on-premise infrastructure according to their specific growth plans and operational needs, allowing them to manage and optimize resources, perform maintenance. However, the cloud segment is expected to witness the highest growth, owing to factors such as due to the need for greater control, security, customization, and performance. Furthermore, increase in adoption of 5G to surge the demand cloud-based OSS & BSS solutions is expected to drive the significant growth prospect of the OSS and BSS market size.

By Region

Region-wise, the OSS & BSS market was dominated by Asia-Pacific in 2023 and is expected to retain its position during the forecast period, owing to the shift towards cloud computing and network virtualization, along with the presence of a large number of solution providers operating in the market has boosted the growth of the OSS & BSS industry in this region. However, Africa is expected to witness significant growth during the forecast period, owing to the rapid expansion of telecommunication networks, along with the growing emphasis on delivering personalized services to enhance customer satisfaction. Further, recent breakthroughs in technical developments are entirely revolutionizing the landscape of IT in several sectors and, in turn, driving the implementation of OSS & BSS solutions.

Competitive Analysis:

Recent Developments in the Global OSS and BSS Industry

- In February 2024, Ericsson partnered with MTN Group for continued delivery to MTN of two flagship products from the Ericsson Business and Operations Support Systems portfolio, Ericsson Charging and Ericsson Mediation. These solutions are integrated with Ericsson Dynamic Activation (EDA) from the Ericsson Network Management portfolio.

- In December 2023, Nokia partnered with Innova, to create and deliver programmable network solutions. The partnership accelerates the digital transformation of enterprises in industries such as banking/financial services, transportation and logistics, technology, life sciences, retail, and industrial sectors.

- In September 2022, Amdocs launched Amdocs Charging, which combines the best of industry capabilities in charging and business support systems, from both Amdocs and Openet to support convergent monetization of new services across standalone 5G and beyond. Leading service providers, including two tier-one operators in North America, are already using Amdocs Charging to unite disparate monetization efforts across their IT and network.

Top Impacting Factors:

Rise in Need for Lower Operational Expenses and Enhanced Customer Experiences

Digital service providers in regions including Asia-Pacific and the Middle East are modernizing IT, telecom businesses, and network systems to improve customer experience and unveil various opportunities for new business and new revenue models by reducing operational expenses. This factor is expected to increase the adoption of OSS & BSS solutions and services across major industries such as telecom, BFSI, and retail & e-commerce. For instance, in March 2023, MTN introduced a program of work to migrate various systems to Microsoft Azure. It is called Project Nephos, and its principal aim is to deliver maximum value as early as possible by identifying the workloads most suited to being redeployed on Azure. This BSS & OSS platform automated end-to-end fulfillment processes and reduced operational costs by migrating subscribers as well as consolidating multiple BSS & OSS systems.

Moreover, CSPs are finding it tough to add new customers with unmet needs, and with customer loyalty at an all-time low, operators seek ways to differentiate their products from those of their competitors. This factor is enabling the proliferation of OSS & BSS solutions among operators to enhance customer experiences and improve customer loyalty.

Growth in Regulatory Support and Government Initiatives

Globally, governments are increasingly focused on data protection and privacy regulations, such as the European Union's General Data Protection Regulation (GDPR) and the California Consumer Privacy Act (CCPA). OSS & BSS solutions, with their robust security features, may often help end-users to comply with these regulations by proposing secure and privacy-improving compliance solutions. Furthermore, the push towards digital government services (e-government) increases the demand for reliable and efficient OSS and BSS solutions to manage the digital infrastructure and services. Hence, compliance with data protection regulations is expected to propel the growth prospect for the OSS & BSS market.

Moreover, governments and regulatory bodies in numerous countries are actively investing in smart city initiatives, which require advanced OSS and BSS systems to manage integrated services and infrastructure, including utilities, transportation, and public safety. Thus, OSS & BSS solutions have the prospective to support these smart city initiatives by offering secure and convenient to improve urban living, enhance operational efficiency, and ensure sustainable growth. Thus, the rapid growth in smart city initiatives is expected to accelerate the market growth.

Challenges to Integrate Future OSS/BSS Systems into Existing Ones

Legacy OSS & BSS platforms are not equipped to support multiple programs. These platforms were designed to work either in a point-to-point or at best a point-to-multipoint manner. It is nevertheless challenging to ensure uniform service delivery across multiple mobility devices via the OSS & BSS platforms, which is further expected to limit the market growth. In addition, as users are utilizing multiple mobility devices, OSS & BSS providers might find it difficult to seamlessly deploy services to customers over different interfaces and networks.

Moreover, the future OSS & BSS systems need to support voice over IP (VoIP), unified communications (UC), video, high-speed data, and a rapidly growing lineup of digital media applications. Legacy systems are not equipped to keep up with the pace, as well as the service providers find it difficult to upgrade these systems to new ones. Moreover, large enterprise operators may find it more challenging to switch to the cloud, owing to large captive legacy on-premise systems. Thus, all these factors collectively are anticipated to hamper the growth of the market during the forecast period.

Key Benefits for Stakeholders:

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the oss and bss market analysis from 2023 to 2033 to identify the prevailing oss and bss market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the oss and bss market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global oss and bss market trends, key players, market segments, application areas, and market growth strategies.

OSS And BSS Market Report Highlights

| Aspects | Details |

| Forecast period | 2023 - 2033 |

| Report Pages | 330 |

| By Component |

|

| By Solution Type |

|

| By Deployment Mode |

|

| By Organization Size |

|

| By Industry Vertical |

|

| By Type |

|

| By Region |

|

| Key Market Players | NMSWorks Software (P) Ltd, Huawei Technologies Co., Ltd., AsiaInfo Technologies Limited, Telefonaktiebolaget LM Ericsson, TelcoDR Inc., Whale Cloud Technology Co., Ltd., Amdocs Limited, Nokia Corporation, NEC Corporation (Netcracker), Tridens D.o.o. |

Analyst Review

The global OSS & BSS market is witnessing decent growth, due to the increasing demand for improved network management, the shift towards cloud-based OSS and BSS solutions, and the growing trend of AI and machine learning in OSS and BSS systems enhancing automation and predictive maintenance. According to CXOs of the leading companies in the market, telecom operators are increasingly focusing on offering personalized and real-time services to improve customer satisfaction and loyalty. Advanced BSS systems enable detailed customer insights and targeted marketing efforts. Furthermore, the growing need to provide consistent and seamless customer support across multiple channels (such as online, mobile, and in-store) needs integrated OSS and BSS platforms that deliver a unified view of customer interactions. Thus, the improved customer experience factor, integrated with improved security, makes OSS & BSS an attractive option for consumers, driving demand in the OSS And BSS market size.

Moreover, the emergence of OTT services and partnerships with content providers need flexible OSS & BSS solutions to manage and monetize these services effectively. This includes handling complex billing arrangements and ensuring seamless service delivery. Besides, increased competition in global markets pushes operators to invest in advanced OSS and BSS technologies to differentiate their offerings, making the OSS & BSS market more competitive globally. In addition, the competitive environment is often expected to intensify with the rise in technological innovations, product extensions, and different strategies adopted by key vendors, such as product launches, partnerships, agreements, and technology initiatives, among others.

Key players in the OSS & BSS market such as Amdocs, Ericsson, Huawei, and Nokia, account for a significant share of the market. With larger requirements for OSS & BSS, companies introduced various strategies to strengthen their market position capabilities. For instance, in September 2022, Amdocs launched Amdocs Charging, which combines the best of industry capabilities in charging and business support systems, from both Amdocs and Openet to support convergent monetization of new services across standalone 5G and beyond. Leading service providers, including two tier-one operators in North America, are already using Amdocs Charging to unite disparate monetization efforts across their IT and network.

Moreover, with the increase in competition, major market players have started the acquisition and partnership of companies to expand their market penetration and reach. For instance, in February 2024, Ericsson and MTN Group renewed their partnership agreement for constant delivery to MTN of two flagship products from the Ericsson Business and Operations Support Systems portfolio, Ericsson Mediation and Ericsson Charging. These solutions are primarily integrated with Ericsson Dynamic Activation (EDA) from the Ericsson Network Management portfolio. As part of the partnership, Ericsson is likely to provide these solutions for the next five years across MTN’s pan-African market. Also, the partnership includes the modernization of MTN Group’s Business Support Systems (BSS) ecosystem, allowing best-in-class features and capabilities that aid in exploring monetization streams and new business models, such as the Internet of Things (IoT) and 5G technology.

The total market value of OSS And BSS market is $19.2 billion in 2023.

The market value of OSS And BSS market in 2033 is $66.2 billion.

The forecast period for OSS And BSS market is 2024 to 2033.

The base year is 2023 in OSS And BSS market.

The growth is driven by increasing demand for seamless network services, the adoption of 5G technology, the rise of cloud-based OSS/BSS solutions, and the need for real-time analytics to enhance customer experience.

Loading Table Of Content...

Loading Research Methodology...