Video Surveillance Market Research, 2032

The Global Video Surveillance Market was valued at $61.8 billion in 2022 and is projected to reach $204.5 billion by 2032, growing at a CAGR of 12.8% from 2023 to 2032. A video surveillance system is a security system that captures images and videos, which can be compressed, stored, or sent over communication networks. Digital video surveillance systems can be used in nearly any environment. Governments, enterprises, financial institutions, and healthcare organizations alike are all expected and required to have a certain level of security and monitoring measures. As a result, there has been a dramatic increase in the demand for security applications such as video surveillance to monitor and record borders, ports, transportation infrastructure, corporate houses, educational institutes, public places, and buildings.

The rise in the need for safety in high-risk areas, the transition from analog surveillance to IP cameras, and the integration of the Internet of Things boost the growth of the global video surveillance market. However, high investment costs and a lack of professional expertise in handling IP cameras hamper the video surveillance market forecast. Furthermore, the increase in the trend toward developing smart cities is expected to offer lucrative opportunities for market expansion.

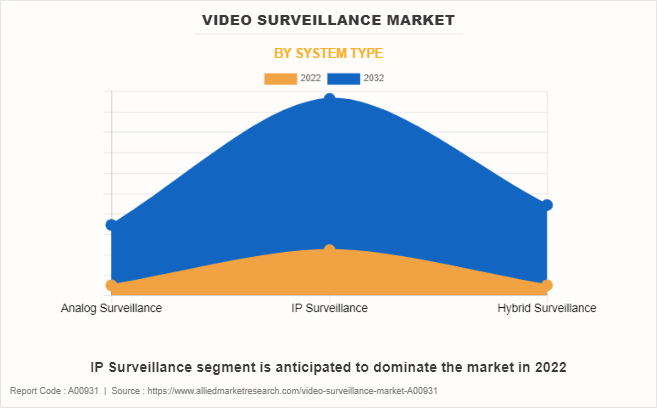

With the increasing adoption of advanced surveillance by the government sector, manufacturers have realized the need for optimum IP surveillance systems. There are many advantages that an intellectual property (IP) camera CCTV system offers over an analog format. IP security cameras send their signals over a network, allowing greater information transfer than an analog signal sent to a digital video recorder (DVR). Network cameras can be wireless and still work through a network and are used in big departmental stores, food chains, malls, factories, workshops, and many other public places to keep a check on activities.

Segment Overview

The video surveillance market is segmented into components, enterprise size, system type, customer type, and application.

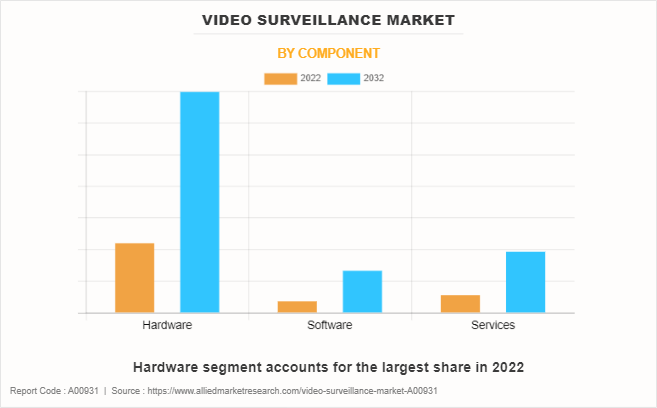

By component, the market is divided into hardware, software, and services. In 2022, the Software segment is expected to grow at a high CAGR from 2023 to 2032.

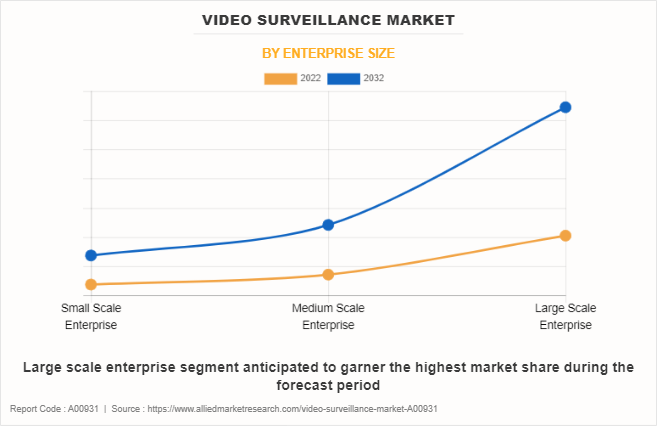

By enterprise type, the video surveillance market is analyzed across small-scale enterprises, medium-scale enterprises, and large-scale enterprises. In 2022, the large-scale enterprise segment dominated the market in terms of revenue and is expected to follow the same trend during the forecast period. However, the Small-Scale Enterprise segment is expected to grow at a high CAGR from 2023 to 2032.

By system type, the video surveillance market is analyzed across analog surveillance, IP surveillance, and hybrid surveillance. In 2022, the IP surveillance segment dominated the market in terms of revenue and is expected to follow the same trend during the forecast period.

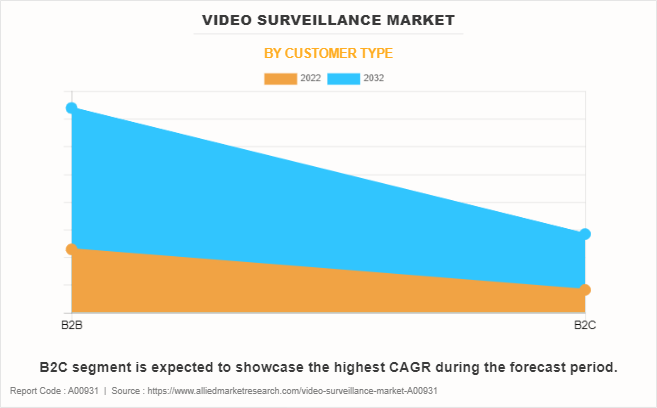

By customer type, the video surveillance market is bifurcated B2B and B2C. In 2022, the B2B segment dominated the market in terms of revenue and is expected to follow the same trend during the forecast period.

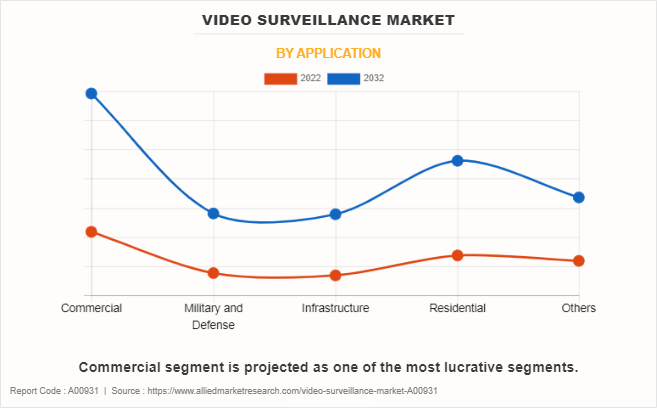

By application, the market is divided into commercial, military and defense, infrastructure, residential, and others. In 2022, the commercial segment dominated the market in terms of revenue and is expected to follow the same trend during the forecast period.

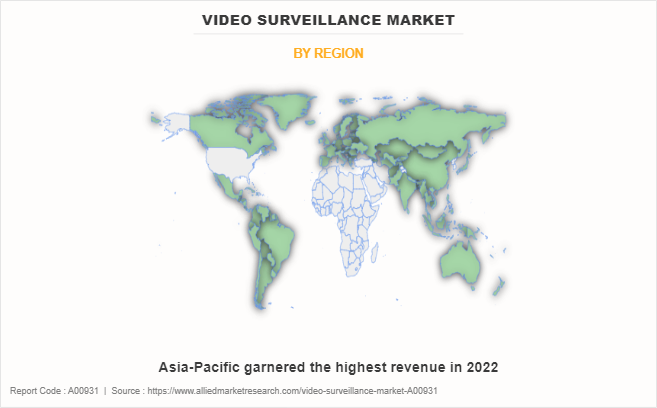

By region, the market is analyzed across North America (the U.S., Canada, and Mexico), Europe (the UK, Germany, France, and the rest of Europe), Asia-Pacific (China, Japan, India, South Korea, and the rest of Asia-Pacific), and LAMEA (Latin America, the Middle East, and Africa). Asia-Pacific, specifically China, remains a significant participant in the video surveillance market. Major organizations and government institutions in the Asia-Pacific region have significantly put resources into action to develop enhanced video surveillance and CCTV camera systems, which is driving the growth of the video surveillance market in the Asia-Pacific region.

Competitive Analysis

The key players profiled in the report include Teledyne FLIR LLC, Verkada Inc., Eagle Eye Networks, Inc., Zhejiang Dahua Technology Co., Ltd, Canon Inc., BCD International, Inc., Panasonic Corporation, Infinova Corporation, HONEYWELL Commercial Security (HONEYWELL INTERNATIONAL INC.), Motorola Solutions, Inc. These key players have adopted strategies such as product portfolio expansion, mergers & acquisitions, agreements, geographical expansion, and collaborations to enhance their market penetration for CCTV camera systems.

Country Analysis

North America-wise, the U.S. acquired a prime share in the video surveillance market in the North American region and is expected to grow at a CAGR of 13.01 % during the forecast period of 2023-2032. The U.S. holds a dominant position in the video surveillance market, owing to an increase in several applications in the commercial, industrial, and residential sectors, which fuels the demand for video surveillance cameras and equipment in the region.

In Europe, the Rest of Europe dominated the Europe Video surveillance market share in terms of revenue in 2022 and is expected to follow the same trend during the forecast period. Furthermore, France is expected to emerge as one of the fastest-growing countries in Europe's Video surveillance industry with a CAGR of 14.05%, owing to the rise in per capita income and the increase in penetration of technological advancements in surveillance and security systems across the region.

In Asia-Pacific, the Rest of Asia-Pacific holds a dominant market share in the Asia-Pacific region and is expected to follow the same trend during the forecast period, owing to an increase in investment activities by the government in transportation infrastructure across the region. However, China is expected to emerge with the highest CAGR in the video surveillance market in this region.

In LAMEA, the Middle East is growing the fastest in the video surveillance market because of its growing economy, increasing disposable income, and rise in demand for enhanced technologies in countries such as Dubai and Abu Dhabi. Moreover, the Latin America region is expected to grow at a high CAGR of 12.14% from 2023 to 2032, owing to a growing economy.

Top Impacting Factors

The video surveillance market overview is expected to witness notable growth owing to the rise in the need for safety in high-risk areas, growth in the transition from analog surveillance to IP cameras, and the integration of IoT in surveillance cameras. Moreover, emerging trends toward the development of smart cities and an increase in the adoption of spy and hidden cameras are expected to provide lucrative opportunities for the growth of the market during the forecast period. On the contrary, high investment and a lack of professional expertise in handling IP cameras limit the growth of the video surveillance market.

Historical Data & Information

The video surveillance market is highly competitive, owing to the strong presence of existing vendors. Vendors of video surveillance with extensive technical and financial resources are expected to gain a competitive advantage over their competitors because they can cater to market demands. The competitive environment in this market is expected to increase as technological innovations, product extensions, and different strategies adopted by key vendors increase.

Recent new product developments in the video surveillance market

- In January 2022, Panasonic Corporation announced the development of technology for the mass production of far-infrared aspherical lenses suitable for improving the performance of cameras and sensors. These lenses are made of chalcogenide glass, having excellent transmission characteristics in the far infrared.

- In August 2022, the Romanian National Administration of Penitentiaries signed a contract with Motorola Solutions to deploy 2100 body-worn cameras to enhance safety and security in all prisons across the country.

- In May 2022, Panasonic Corporation and Leica Camera AG announced an agreement for a new comprehensive and expanded business alliance. Both companies collaborated to develop new technologies and solutions under the name of "L2 Technology" (L squared Technology).

Recent acquisitions in the video surveillance market

- In May 2022, Motorola Solutions announced the acquisition of Videotec S.p.A., a provider of ruggedized video security solutions based in Italy. Videotec's fixed and Pan, Tilt, and Zoom (PTZ) cameras are designed to withstand the extreme conditions and hazardous environments of critical infrastructure, specifically ports, energy, and transportation, where video security is imperative.

- In April 2022, Motorola Solutions announced the acquisition of Calipsa, Inc., a technology leader in cloud-native advanced video analytics based in London, U.K. Calipsa's scalable platform enables businesses to optimize security with AI-powered analytics that verify alarms, enable content-based searches, detect tampering, and assess the health of cameras in real-time

- In March 2022, Motorola Solutions announced the acquisition of Ava Security Limited, a global provider of cloud-native video security and analytics, based in London, U.K. Ava Security's scalable, secure, and flexible cloud solution provides enterprises with real-time visibility and powerful analytics to optimize their operations and detect anomalies and threats.

Recent product launches in the video surveillance market

- In August 2022, Teledyne FLIR announced the release of the Neutrino LC CZ 15-300, a Neutrino IS series model of mid-wavelength infrared (MWIR) camera modules with integrated continuous zoom (CZ) lenses. Designed for integrated solutions requiring crisp, long-range, SD or HD MWIR imaging, the ITAR-free Neutrino IS series offers size, weight, power, and cost benefits to original equipment manufacturers (OEM) and system integrators for airborne, unmanned, C-UAS, security, ISR, and targeting applications.

- In May 2022, Teledyne FLIR Defense launched SeaFLIR 240 and TacFLIR 240, the additions to its line of high-definition, multi-spectral surveillance systems developed for a variety of maritime and land-based operations.

- In April 2022, Teledyne FLIR launched the Hadron 640R combined radiometric thermal and visible dual camera module. The Hadron 640R design is optimized for integration into unmanned aircraft systems (UAS), unmanned ground vehicles (UGV), robotic platforms, and emerging AI-ready applications where battery life and run-time are mission-critical.

- In April 2020, Dahua Technology launched a professional retail epidemic safety protection solution to help retailers maintain safe operations and improve business efficiency during the pandemic, as well as providing upgraded plans to increase ROI after business resumption.

- In March 2022, Eagle Eye Networks launched Eagle Eye LPR (license plate recognition), which uses artificial intelligence (AI) in a true cloud-based system for high accuracy in all kinds of challenging conditions. Eagle Eye LPR operates on readily available security cameras, making it affordable and practical for today's business owners.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the video surveillance market from 2022 to 2032 to identify the prevailing video surveillance market opportunity.

- The market research is offered along with information related to the video surveillance market size, key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders to make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the video surveillance market segmentation assists in determining the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global video surveillance market growth.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes an analysis of the regional as well as global video surveillance market trends, key players, market segments, application areas, and market growth strategies.

Video Surveillance Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 204.5 billion |

| Growth Rate | CAGR of 12.8% |

| Forecast period | 2022 - 2032 |

| Report Pages | 459 |

| By Component |

|

| By Enterprise Size |

|

| By System Type |

|

| By Customer Type |

|

| By Application |

|

| By Region |

|

| Key Market Players | Canon Inc., HONEYWELL Commercial Security (HONEYWELL INTERNATIONAL INC.), Infinova Corporation, Verkada Inc., BCD International, Inc., Panasonic Corporation, Teledyne FLIR LLC., Eagle Eye Networks, Inc., Motorola Solutions, Inc., Zhejiang Dahua Technology Co., Ltd |

Analyst Review

Video surveillance systems are expected to gain high traction in the military & defense and infrastructure industry verticals by 2032. The current business scenario is witnessing an increase in the demand for surveillance systems, particularly in developing countries such as China and India, due to the implementation of government mandates related to public safety and security. Companies in this industry are adopting various strategies, such as merger and acquisition activities, to strengthen their business position in the competitive matrix.

The video surveillance market is steadily gaining traction owing to the rise in demand for enhanced technologies in surveillance systems such as the integration of IoT, and AI, and the increased adoption of IP cameras over analog cameras for surveillance and monitoring. A shift from analog to IP technologies, cloud solutions for storage, and the rise of video surveillance-as-a-service (VSaaS) present new, untapped opportunities for security solution providers.

Smart city projects have created a huge demand for surveillance of the market. Moreover, the deployment of solar-powered cameras designed for remote areas is driving the demand for the incorporation of advanced technologies to enhance the data reservoir for efficient monitoring system operations.

The video surveillance market provides numerous growth opportunities to market players such as Teledyne FLIR LLC, Infinova Corporation, Zhejiang Dahua Technology Co., Ltd., and BCD International, Inc.

The upcoming trends in the global Video Surveillance Market include the widespread adoption of artificial intelligence, edge computing, and advanced analytics for enhanced security and operational efficiency.

Commercial is the leading application of Video Surveillance Market.

Asia-Pacific is the largest regional market for Video Surveillance.

The global video surveillance market was valued at $61,844.7 million in 2022.

Teledyne FLIR LLC, Verkada Inc., Eagle Eye Networks, Inc., Zhejiang Dahua Technology Co., Ltd, Canon Inc., BCD International, Inc., Panasonic Corporation, Infinova Corporation, HONEYWELL Commercial Security (HONEYWELL INTERNATIONAL INC.), Motorola Solutions, Inc.

Loading Table Of Content...

Loading Research Methodology...