Accounts Payable Automation Market Research, 2032

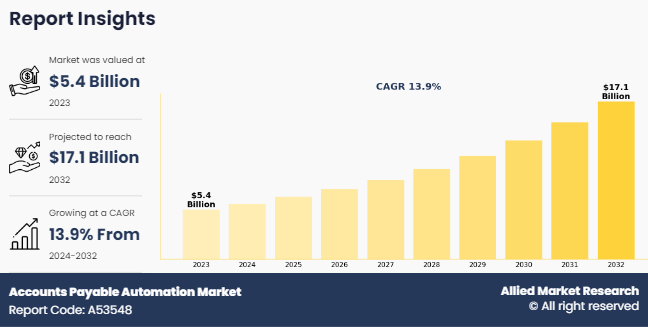

The global accounts payable automation market was valued at $ 5,378.58 million in 2023, and is projected to reach $17,047.16 million by 2032, growing at a CAGR of 13.9% from 2024 to 2032.

Accounts payable automation is the use of devices or procedures to replace the manual operations involved in accounts payable with automated ones. The use of software to automate all or a portion of the accounts payable process is known as AP automation. By digitizing the methods used for receiving, processing, and storing vendor invoices, it strives to improve the efficiency of the accounts payable workflow.

Key Takeaways

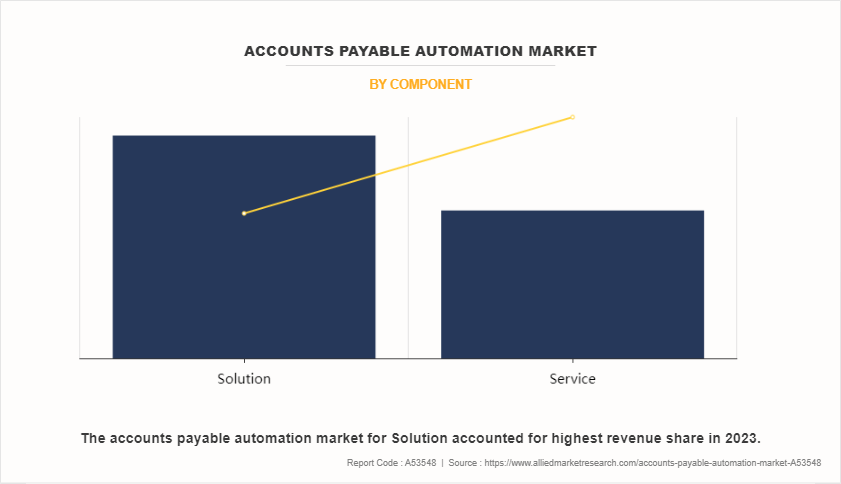

By component, the solution segment led the accounts payable automation market in terms of revenue in 2023.

By deployment mode, the on-premises segment accounted for the highest accounts payable automation market share in 2023.

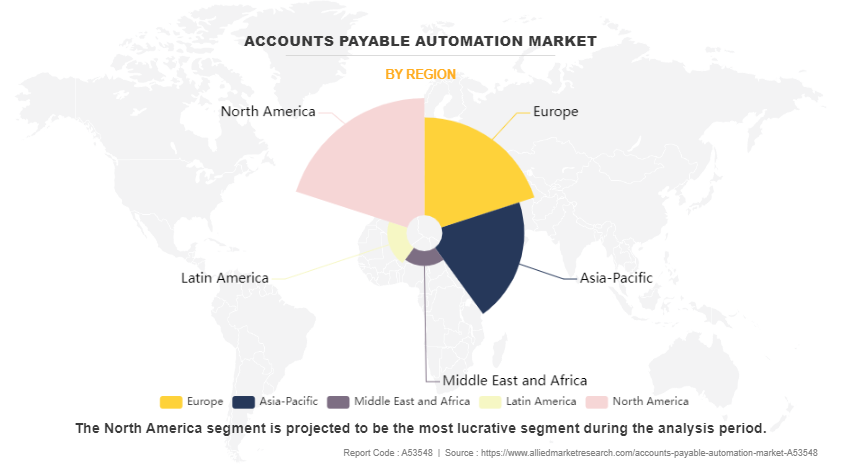

By region, North America generated the highest revenue of accounts payable automation market in 2023.

Accounts payable automation enhances the quality of data, assisting the operator in developing a sustainable business model to meet the demands that have increased the need for accounts payable automation software. In addition, increase in adoption of accounting software for improving the efficiency of the business is driving the growth of the accounts payable automation market. However, the possibility of losing crucial accounting data and the expensive initial cost of software is the issues limiting industry expansion. Moreover, the availability of trained professionals is expected to create lucrative opportunities for the market in upcoming years. Moreover, rise in developments & initiatives toward accounts payable automation is anticipated to provide a potential growth opportunity for the accounts payable automation market.

Segment Review

The accounts payable automation market is segmented on the basis of component, deployment mode, organization size, industry vertical, and region. By component, it is divided into solution and service. By deployment mode, it is bifurcated into on-premises and cloud. By organization size, it is categorized into large enterprises and small and medium-sized enterprises. By industry vertical, it is classified into BFSI, consumer goods and retail, IT & telecom, manufacturing, healthcare, government, and others. Region-wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

By component, the solution segment attained the highest accounts payable automation market size in 2023. This is attributed to the fact that software developers and vendors are predicting future consumption trends, benchmarking usage across facilities, and gaining insights into alternative business models utilizing statistics, artificial intelligence, and machine learning approaches. Furthermore, businesses are implementing IoT-based analytical solutions for financial accounting and invoicing.

By region, North America attained the highest market size in 2023 as users in the region are seeking accounting systems tailored to their specific needs, as opposed to generic accounting applications. Furthermore, companies in the region are continuously developing their software and applications to match current digitization.

The report analyzes the profiles of key players operating in the accounts payable automation market such as SAP Ariba, Sage Group plc, Tipalti Inc., Zycus Inc., FIS, Bottomline Technologies, Inc., Comarch SA, FinancialForce, AvidXchange, and Procurify Technologies Inc. These players have adopted various strategies to increase their market penetration and strengthen their position in the accounts payable automation market.

Market Landscape and Trends

Many organizations introduced the advantages of accounts payable (AP) automation solutions after the switch to remote working. For instance, in September 2022, Oracle NetSuite launched NetSuite AP Automation to assist businesses in addressing labor-intensive and time-consuming accounts payable (AP) operations. By making it quicker and simpler to process invoices and pay suppliers from inside NetSuite, NetSuite AP Automation, the only solution that integrates banking services into a cloud enterprise resource planning (ERP) system, helps businesses increase profitability. As a result, businesses are able to effectively grow their end-to-end accounts payable operations and better manage their outgoing cash flows.

Furthermore, various key players partnered with other software development organizations to boost their efficiency for accounts payable automation. For instance, in November 2022, Cashbook partnered with Medius, a leading provider of accounts payable automation and wider spend management solutions, through their Radius partner program for independent software developers (ISVs). Cashbook's partnership with the Radius program enabled both Medius and Cashbook customers to better regulate their working capital, and increase business liquidity through improvements in DSO, lower deductions, faster invoice dispute resolution and an efficient collections process.

The COVID-19 pandemic has a significant impact on the accounts payable automation market, owing to increase in usage and adoption of online & digitalized platforms for financial operations globally. The accounts payable automation market is experiencing massive growth as various businesses and the banking industry are increasingly relying on software to execute their financial operations. Moreover, the need for more dynamic and remote access to corporate financial records and systems by people who primarily need to access financial accounts regularly, correct information to make choices and manage financial affairs has risen as owing to remote working. This, in turn, has become one of the major growth factors for the accounts payable automation market during the global health crisis.

Top Impacting Factors

Rise in need to digitize the financial audit processes

Growing digitization is altering how customers and organizations engage, as well as creating a new forum for idea exchange. Further, the growth of the market is also attributed to factors such as the use of accounts payable (AP) automation solutions, which enable businesses to have more visibility and control over internal business processes. This, combined with the ability of AP departments to focus on more strategic tasks like finding additional cost-saving opportunities, is enabling businesses to gain a competitive advantage. For instance, in January 2023, Nimbello, a provider of purchase-to-pay cloud software for accounts payable (AP) professionals, announced its entry into the accounts payable automation market. It provides businesses with advanced, user-friendly software platform that enables them to automate their AP processes. Clients rely on the digital automation process to grow their financial processes, secure the vendor supply chain, release cash, improve efficiency, and offer insights into corporate spending. Thus, growing need to digitize the financial audit processes is fueling the growth of the accounts payable automation market.

Increase in demand for advance technology to speed up payment process

Manual account payable techniques are ineffective, costly, and subject to error. The account payable system simplifies payment procedures while allowing businesses to keep their relationships with their vendors and suppliers. The account payable automation system offers insight throughout the whole AP process, from invoice production to receipt generation, assuring correct approval, precise allocation, fast payment, and spending management. Furthermore, it can easily be linked with enterprise resource planning (ERP), increasing flexibility and improving the efficiency of the payment process. Accounts payable automation, which includes dashboards, account choices, compliance policies, routing rules, and approvals, ensures that an organization's activities are conducted effectively. Thus, rise in demand for advanced technologies in accounting services to speed up payment process is boosting the accounts payable automation market growth.

Reduction in invoice processing times

Since the accounts payable automation system provides companies with 24/7 access, a real-time view of the status of invoices, and on-demand reporting capabilities, organizations are able to utilize it to make data-driven choices for the success of their operations. The system also enables a variety of business stakeholders, such as officers, managers, and accountants to successfully carry out their tasks, hence minimizing user-related payment concerns. Further, rise in need to reduce the amount of past-due payments and to enhance compliance with controlled user access and credentials, which reduces fraudulent transactions, are the main factors driving the growth of the accounts payable automation industry. Moreover, the key players are increasingly providing new solutions in the market in workflow automation to boost their market positions in the industry. For instance, in October 2022, Intellinetics, Inc., a provider of solutions and services that enable and accelerate digital transformation, announced the launch of IntelliCloud Payables Automation System (IPAS) that automates the entire invoice-to-pay-to-reconciliation AP process. Thus, reduction in invoice processing times through AP software is propelling the growth of the accounts payable automation market.

Key Benefits For Stakeholders

This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the accounts payable automation market analysis from 2023 to 2032 to identify the prevailing accounts payable automation market opportunity.

The market research is offered along with information related to key drivers, restraints, and opportunities.

Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders to make profit-oriented business decisions and strengthen their supplier-buyer network.

In-depth analysis of the accounts payable automation market segmentation assists to determine the prevailing accounts payable automation market forecast.

Major countries in each region are mapped according to their revenue contribution to the global accounts payable automation market outlook.

Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

The report includes the analysis of the regional as well as global accounts payable automation market trends, key players, market segments, application areas, and market growth strategies.

Accounts Payable Automation Market Report Highlights

| Aspects | Details |

| Forecast period | 2023 - 2032 |

| Report Pages | 245 |

| By Component |

|

| By Deployment Mode |

|

| By Enterprise Size |

|

| By Industry Vertical |

|

| By Region |

|

| Key Market Players | FinancialForce, AvidXchange, Procurify Technologies Inc., fis, SAP Ariba, Sage Group plc, Bottomline Technologies, Inc., Tipalti Inc., Zycus Inc., Comarch SA |

Analyst Review

The accounts payable automation market is witnessing a rise, owing to increase in demand for automated accounting software, growth in internet of things (IoT) & cloud-based service use, and increase in acceptance of these technologies. In addition, the benefits of the accounts payable automation including quick data input procedure, high accuracy, lower operating costs, and increased tax compliances are anticipated to drive the market in the future. In addition, organizations are able to use fewer human resources owing to the most recent accounting software, which has resulted in more effective use of capital and better management of the existing resources.

The COVID-19 outbreak had a significant impact on the accounts payable automation market and accelerated the usage and adoption of accounting payable automation owing to the trend of remote working globally. Moreover, during this global health crisis, the adoption of accounts payable automation technology increased among large and small retailers. Thus, promoting the demand for the market, thereby accelerating the revenue growth.

Furthermore, market players are adopting various strategies for enhancing their services in the market and improving customer satisfaction. For instance, in August 2021, Stampli, a leader in AI-driven accounts payable (AP) automation, introduced a new partner program for accounting firms, bookkeeping services, resellers, consultants, and ERP providers to expand their offerings with Stampli’s award-winning AP automation and payments software. The program combines accounts payable communications, documentation, and payments with Stampli's robust AP automation to assist partners in modernizing the invoice management process for their mid-market and corporate clients. Moreover, some of the key players profiled in the report include SAP Ariba, Sage Group plc, Tipalti Inc., Zycus Inc., FIS, Bottomline Technologies, Inc., Comarch SA, FinancialForce, AvidXchange, and Procurify Technologies Inc. These players have adopted various strategies to increase their market penetration and strengthen their position in the industry.

AI and Machine Learning Integration are the upcoming trends of Accounts Payable Automation Market in the world.

The leading application of accounts payable automation is streamlining and optimizing the invoice processing workflow.

North America is the largest regional market for Accounts Payable Automation.

The estimated industry size of Accounts Payable Automation $17,047.16 million by 2032.

The report analyzes the profiles of key players operating in the accounts payable automation market such as SAP Ariba, Sage Group plc, Tipalti Inc., Zycus Inc., FIS, Bottomline Technologies, Inc., Comarch SA, FinancialForce, AvidXchange, and Procurify Technologies Inc. These players have adopted various strategies to increase their market penetration and strengthen their position in the accounts payable automation industry.

Loading Table Of Content...

Loading Research Methodology...