Adult Diapers Market Research, 2032

The global adult diapers market size was valued at $17.6 billion in 2022, and is projected to reach $38.2 billion by 2032, growing at a CAGR of 8.2% from 2023 to 2032.Adult diapers are made for people suffering from incontinence. For those who are active and dependable for their daily needs, pants-style diapers suit well. They can easily bend over and slide the nappy over their waist and up their legs. People with mobility limitations or those who are bedridden can use tape-style diapers. Adult diapers costs vary depending on the brand, size, and volume of the diapers, impact the growth of the adult diapers industry when it comes to incontinence protection size is an important consideration. A nappy that is the improper size will not be able to adequately prevent spills and leaks, rendering it ineffective against incontinence. Additionally, the discomfort from the incorrect size can exacerbate the problems.

The global market for female hygiene products is expanding as a result of increased awareness and literacy about personal hygiene. Due to several government initiatives and social media campaigns, both the younger and older population are now more aware of the importance of maintaining good personal hygiene. These programs and marketing help people better understand and accept sanitary products, which increases the demand for sanitary goods such as adult diapers.

Adult diapers are one of those necessities for older individuals and younger people, especially for those with bladder leakage and other conditions of the same nature. The importance of such hygienic products to consumers has prompted manufacturers to plan improvements to their product offerings in terms of features and specifications. These makers have been working to improve a number of crucial aspects, including higher absorbency rates, odor reduction, and the use of premium fabric materials that enhance user comfort. With such important qualities, adult diapers fuel the demand among the target market, which ultimately fuels market expansion in terms of value sales.

However, the use of adult diapers has increased among the elderly population who suffer from serious medical issues such as incontinence, chronic diarrhea, or dementia. Branded adult diapers claim high-efficiency features and specifications that increase demand for the product. Branded goods, on the other hand, come with larger price tags. Utilizing the pricing criterion, private label producers offer their goods at a comparably lower cost with comparable qualities as those of branded goods. Therefore, the accessibility of private labelled goods hinders the growth of the market across the globe.

On the other hand, premiumization is the process through which producers highlight a product's better quality and exclusivity in order to increase consumer attractiveness. Instead of being motivated by a need for inexpensive pricing, it is driven by a preference for high-quality goods and services. As a result of the increase in per capita income, consumers are expected to select high-quality goods or services. The majority of branded adult diapers products are in the premium category, which guarantees greater effectiveness. Such products have room for expansion on the global market.

One of the main drivers of the market's overall expansion has been the increased adoption of wearable technology across a variety of vertical consumer goods sectors. The linked device trend has been affecting the market recently, which makes it more convenient and comfortable for its consumers. For instance, one of the major companies in the adult diapers industry, Simavita, has developed wearing adult diapers the trade name SMARTZ. The device provides a variety of functions and data related to wellness and welfare, such as wetness, ambient temperature, managing pressure sores, falls, and other features. Therefore, throughout the projection period, the adoption of wearable technology is expected to offer enormous potential for the adult diapers market growth.

Although urinary incontinence is common in older people, it can affect anyone, at any age. Urinary incontinence affects 15% to 20% of elderly people. The percentages can reach 70% for those who are in nursing homes or have severe medical conditions. The syndrome is frequently caused by obesity, repeated pregnancies, surgeries, and medications, notably diabetic ones. Another risk factor is cognitive decline and strokes. People with limited mobility use disposable diapers, which are absorbent hygiene products. If care is not given, bedsores and bumps will develop if the patient is bedridden. Use of adult diapers advised to avoid unpleasant outcomes and lessen discomfort. Diapers are also necessary for elderly people who have trouble controlling urination, patients recovering from surgery who are prohibited from getting out of bed for a while, members of certain professions whose duties necessitate a prolonged stay at the workplace, and pregnant women who experience a similar issue.

The standards for nappy quality are very high because they are items made for cleanliness. Every producer is required to carefully adhere to the established quality requirements. Modern diapers are primarily made of natural materials, with cellulose and a gelling agent making up the absorbent layer. The non-woven fabric used in the diapers lining, through which the liquid flows, is based on heat-bonded polypropylene. The elastic components (leg cuffs, a belt, and fasteners) are made of polyurethane and natural rubber, while the outer side is made of fabric-like polyethylene film.The rise in women workforce, increase in geriatric population, surge in awareness of biodegradable diapers, and rise in concern regarding personal hygiene are some of the key factors responsible for driving the growth of the overall market.

Some of the key players in the baby diapers market have been strategizing on entering the global market owing to the rise in demand for adult diapers across the globe due to surge in rate of aging population. For instance, in 2014, Procter & Gamble announced its entry into the North American market. The company has been promoting and selling its adult diaper products brand name—Always Discreet and Always Discreet Boutique.Over the past couple of years, there has been a rise in rate of internet penetration across developing and developed nations. Considering its macro-economic factor, adult diaper manufacturers have been taking steps on going online to promote their product in a much more effective manner. Thus, increase in internet penetration plays an influential role in driving the growth of the global adult diapers in terms of value sales.

Segmental Overview

The adult diapers market is segmented on the basis of product type, end user, distribution channel and region. By product type, the adult diapers market is classified into pant type, pad type, tape type and others. Depending on end user, the market is categorized into women, men and unisex. By distribution channel, it is categorized into e-commerce and offline channel. By region, the market is analyzed across North America, Europe, Asia-Pacific and LAMEA.

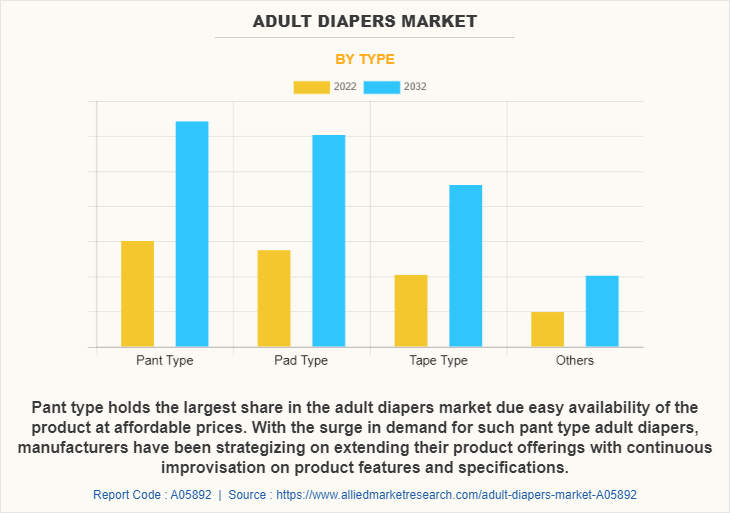

By Type

Depending on type, the pant type segment dominated the adult diapers market share in 2022, garnering around one-third of the market share; however, the tape type is expected to grow at the highest CAGR of 8.6% from 2023 to 2032. In addition, among the popular adult diaper varieties in the international market, pants-style adult diaper sales are higher value. One of the main factors driving the segment's overall growth in terms of value sales is the product's easy accessibility at reasonable pricing. Both disposable and reusable versions of adult diapers in this style are available. As demand for these pant-style adult diapers have been planning to increase their product offers by consistently improving product features and specifications. Companies emphasize the use of high-quality fabric materials and the implementation of modern technology and likley to grow in the adult diapers market forecast period..

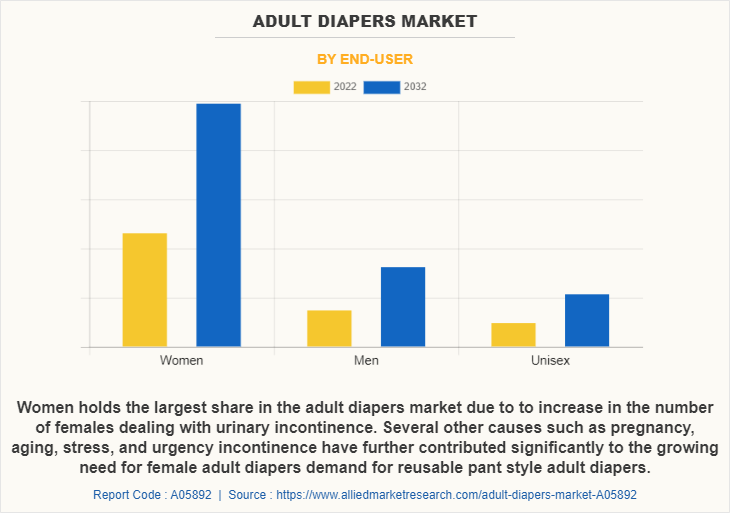

By End User

Depending on the end user, the women dominated the market in 2022, garnering around two-thirds of the market share. However, unisex is expected to grow at the highest CAGR of 8.7% from 2023 to 2032. In addition, due to rise of females suffering from urine incontinence, market has been steadily expanding. The rising demand for female adult diapers has also been greatly influenced by several other factors, including pregnancy, aging, stress, and urgency incontinence. Additionally, because they are portable and allow long-term use, women are becoming more interested in reusable pant-style adult diapers attract customers, companies including Essity, Unicharm, and Kimberly-Clark are developing specialized female incontinence solutions. As a result, the market for adult diapers is witnessing growth at an exponential rate due to greater awareness of the value of personal cleanliness, hence facilitating the adult diapers market demand.

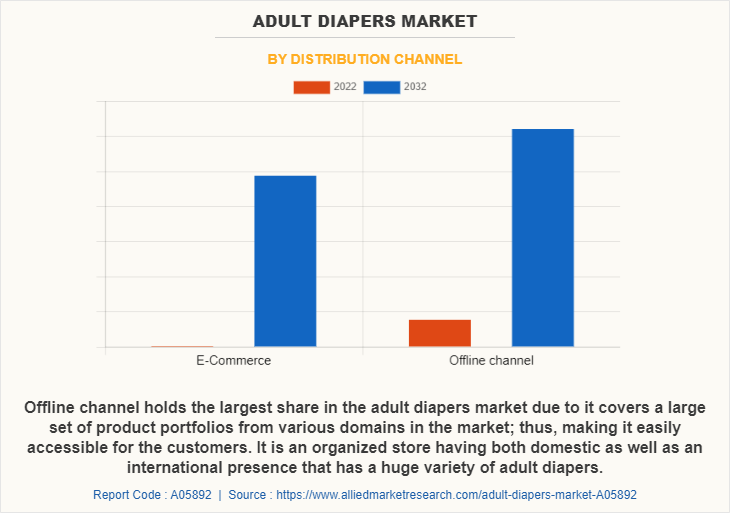

By Distribution Channel

Depending on the distribution channel, the offline channel dominated the market in 2022, garnering majority of the market share; however, e-commerce is expected to grow at the highest CAGR of 8.3% from 2023 to 2032. In addition, the offline channel offers a broad range of product portfolios from numerous market sectors, making it simple for clients to access. It is a well-organized store with a large selection of adult diapers and a presence both domestically and internationally. These kinds of stores provide customers with access to niche products that are available on the market. As a result, the development of offline channels in several regions creates profitable openings for the expansion of the market. Manufacturers promote their own products through these channels and encourage hypermarket and supermarket chains to expand the visibility of the product, which significantly increases the demand for adult diaper market.

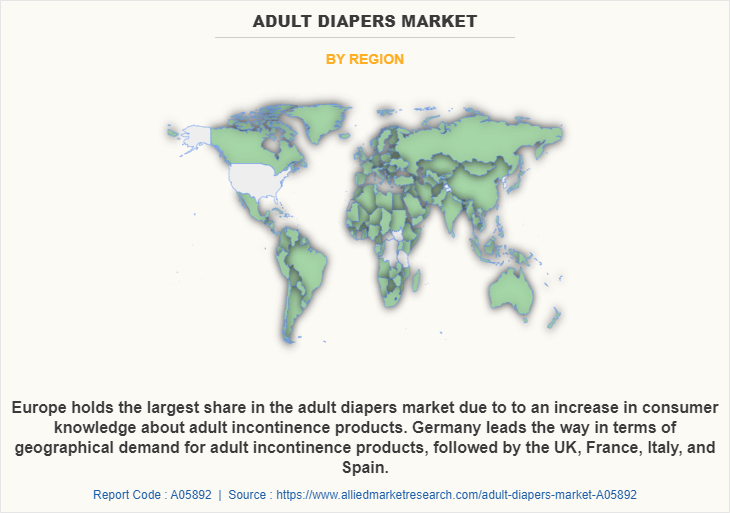

By Region

Region wise, Europe dominated the market in 2022, garnering a market share of 32.6%. Because consumers are becoming more knowledgeable about adult incontinence products, adult diapers are in high demand in the European market. In terms of geographic demand for adult incontinence products, Germany is in the lead, followed by the UK, France, Italy, and Spain. Due to a combination of a reduced birthrate and an increase in life expectancy, Germany's population is ageing at one of the fastest rates in the world. As a result, older people have a greater need for incontinence products. According to ec.europa.eu, in 2021, 20.8% of Europeans will experience urine incontinence to some extent. Hence, the demand for adult incontinence products such as adult diapers is rising as the prevalence of urine incontinence among the global population rises. Furthermore, such rising urine incontinence issues are expected to create demand in the market.

Competitive Analysis

Some of the major players analyzed in this report are Tykables, Drylock Technologies NV, Linette, Nobel Hygiene Pvt. Ltd., Abena A/S, Attends Healthcare Products Inc., Rearz Inc., Kimberly-Clark Corporation, Principle Business Enterprises, Inc. and The Procter & Gamble Company.

Some Examples of Acquisition in the Global Adult Diapers Market

- In February 2022, Kimberly-Clark Corporation acquired a majority stake in Thinx, Inc., which is a leading reusable period and incontinence underwear company, in order to expand its portfolio.

- In October 2020, Kimberly-Clark Corporation acquired Softex Indonesia, which is a leading Indonesian personal care products company, to expand and strengthen its portfolio.

Some Examples of Expansion in the Global Adult Diapers Market

- In February 2022, Kimberly-Clark Corporation opened a new manufacturing facility in Lagos, Nigeria in order to increase product capacity and better serve its consumer.

Some Examples of Partnership in the Global Adult diapers Market

- In May 2020, Nobel Hygiene partnered with Zoom Car to deliver personal care products such as adult diapers across the region.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the adult diapers market analysis from 2022 to 2032 to identify the prevailing adult diapers market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global adult diapers market trends, key players, market segments, application areas, and market growth strategies.

Adult Diapers Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 38.2 billion |

| Growth Rate | CAGR of 8.2% |

| Forecast period | 2022 - 2032 |

| Report Pages | 410 |

| By Type |

|

| By End-User |

|

| By Distribution channel |

|

| By Region |

|

| Key Market Players | Linette, Abena A/S, Tykables, Principle Business Enterprises, Inc., Drylock Technologies NV, Rearz Inc., Nobel Hygiene Pvt. Ltd., Attends Healthcare Products Inc., Kimberly-Clark Corporation, The Procter & Gamble Company |

Analyst Review

According to the insights of the CXOs of leading companies, along with the rise in the number of ageing population and geriatric population drives the demand for adult diapers products in the global market. From the manufacturers’ point of view, continuous product innovation and development that caters to varying needs and requirements of target customer is one the key influential factor in driving the growth of adult diapers market. As a result, manufacturers have been producing different types of fabric materials for higher absorbency rates, and more importantly users find it comfortable enough to wear it for longer duration. With the advent of wearable technology in various consumer sectors, some of the key adult diapers manufacturers are now strategizing on introducing wearable adult diapers that cater to the target customers’ convenience factor.

The rise in the rate of internet penetration around the major parts of the world makes way for manufacturers to initiate several key online marketing programs as online platforms are one of the easiest ways to create awareness about the specifications and features of adult diapers products among the target customers. One of the primary drivers for the increase in demand for adult diapers is the increased post-pregnancy complication across the globe. Many new market players are expected to enter the adult diapers forecast period, attracted by profitable growth and high-profit margins.

Another factor that influences the demand for adult diapers is the rise in demand for comfortable material for diapers around the globe. Consequently, the demand for adult diapers has diapers multifold increase in forecast years, especially in the developed countries of North America and Europe regions including but not limited to the U.S., Canada, The UK, and Germany. Hence, the growth of adult diapers is expected to grow across the globe in the forecast period.

Some of the major players analyzed in this report are Tykables, Drylock Technologies NV, Linette, Nobel Hygiene Pvt. Ltd., Abena A/S, Attends Healthcare Products Inc., Rearz Inc., Kimberly-Clark Corporation, Principle Business Enterprises, Inc. and The Procter & Gamble Company.

By end user, the women were the highest revenue contributor in 2021. In addition, due to rise of females suffering from urine incontinence, the adult diapers market has been steadily expanding. Moreover, as a result of rising recognition of the importance of personal hygiene, the market for adult diapers is expanding.

Region wise, Europe dominated the market in 2022, garnering a market share of 32.6%. Adult diapers are in high demand in the European market as a result of customers' growing awareness of adult incontinence solutions. As the prevalence of urinary incontinence among the global population rises, so does the demand for adult incontinence products.

An increase in awareness toward personal hygiene is one of the trends in the adult diapers market. In addition, there is an increase in the awareness related to younger as well as the aged population about their personal hygiene due to various government initiatives and the number of campaigns on social media.

The adult diapers market size was valued at $17,558.7 million in 2022 and is estimated to reach $38,150.1 million by 2032, registering a CAGR of 8.2% from 2023 to 2032. The rise in number of incontinence customers has opened immense opportunities for key adult diapers manufacturers to innovate their product offerings in terms of its absorbency level, odor control, comfortability, and skin friendliness.

n the post-pandemic period, the demand for adult diapers is expected to retain its growth. The innovations of the engaged stakeholders in the market will help to create innovative adult diapers products, which will help gain consumer attention and will help the market grow. Furthermore, the increase in online penetration will further lead to market proliferation.

Depending on the type, the pant type segment dominated the market in 2022. In addition, pants-style adult diapers have higher value sales among the widely used adult diapers on the global market. The product's easy accessibility at fair prices is one of the key factors promoting the segment's overall growth in terms of value sales.

Germany and U.S. have enormous market in the adult diapers market. This is attributed to the huge number of players in the region offering wide range of products at lucrative prices as well as purchasing power of population in this countries contributing in the growth.

Loading Table Of Content...

Loading Research Methodology...