Africa And Middle East Sugarcane Syrup Market Overview:

The Africa and Middle East sugarcane syrup market size is expected to be reach $2,074 million by 2023. Sugarcane syrup is a thick viscous, amber to golden colored syrup, which possesses a sweet flavor. The manufacturing of sugarcane syrup consists of two different sets of operations. In the first of these, the sugarcane juice is extracted from the sugarcane stalks, partially purified, and then followed by boiling to syrup. The second step consists of purifying the syrup with lime and baking soda, followed by continuous evaporation till the syrup with desired consistency is formed. Once the syrup reaches the desired consistency, it is allowed to cool before packaging. In case of commercial products, preservatives are added before packaging.

Sugarcane syrup made from sugarcane is widely used as a natural sweetener and flavoring agent by food industries for a variety of food products. It is widely used in the preparation of various bakery products such as waffles, cakes, pancakes, bread rolls, and French toast, as it helps retain moisture and prolong freshness, thus increasing their shelf life. In addition, it is used for flavoring a wide range of food products such as hot cereal, ice cream, sausages, fruit juices, corn fritters, baked beans, fresh donuts, and baked apples. Moreover, using sugarcane syrup in the preparation of bakery products is one of the traditional bakery practices. This is anticipated to increase the demand for sugarcane syrup in the market. Health benefits associated with sugarcane syrup has increased its consumption and usage among households, thereby driving the growth of Africa and Middle East sugarcane syrup market.

However, rise in health issues and increase in concerns among consumers towards weight gain, high cholesterol, obesity, and diabetes have led to the preference in consumption of food and beverages consisting of low calories and low-intensity sweeteners, which is expected to hamper the market growth. Moreover, availability of alternatives such as natural as well as artificial sweeteners hampers the growth of the sugarcane syrup market. On the contrary, changes in taste preferences, increase in health consciousness, and desire to live a healthy life are anticipated to provide lucrative opportunities for market growth.

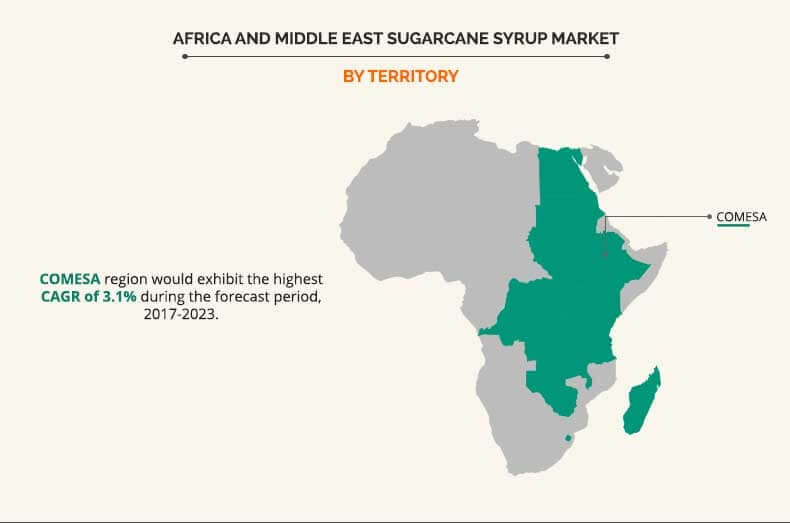

On the basis of territory, the report segments the Africa and Middle East sugarcane syrup industry into Malawi, Southern African Development Community (SADC) and Common Market for Eastern and Southern Africa (COMESA), West Africa, and Middle East. SADC is anticipated to hold the major share in this market in 2017. Moreover, Malawi is expected to witness high growth during the forecast period.

Key players profiled in the report include ILLOVO SUGAR (PTY) LTD, Super Syrups, Tongaat Hulett, Atlanta Sugar SA (Pty) Ltd., Sunshine Sugar, FROZY EGYPT, Kenana Sugar Company, White Nile Sugar Company (WNSC) Co. Ltd., GM Sugar Uganda Limited, and Kinyara Sugar Works Ltd.

Key Benefits

- The report provides an extensive analysis of the current & emerging market trends and opportunities in the Africa and Middle East sugarcane syrup industry.

- The report provides detailed qualitative and quantitative analysis of current trends and future estimations that assists to evaluate the prevailing market opportunities.

- Comprehensive analysis of factors that drive and restrict the growth of the market is provided.

- Extensive analysis of the market is conducted by following key product positioning and monitoring the top competitors within the market framework.

- The report provides extensive qualitative insights on the potential and niche segments or regions exhibiting favorable growth.

Africa and Middle East Sugarcane Syrup Market Report Highlights

| Aspects | Details |

| By Territory |

|

| Key Market Players | Alteo Limited, Associated British Foods plc (Illovo Sugar (Pty) Ltd), Sango Bay Estates Limited, Tongaat Hulett Limited, Star Africa Corporation Limited, Nzoia Sugar Company Limited, RCL Foods Limited, White Nile Sugar Company Co. Ltd, Mumias Sugar Company Limited, BKB Ltd. (Atlanta Sugar SA (Pty) Ltd), Superdoll Trailer Manufacture Co. Ltd. (Kagera Sugar Limited), GM Sugar Uganda Limited, Kenana Sugar Company, Sunshine Sugar, The Mehta Group (Sugar Corporation of Uganda Limited), Umfolozi Sugar Mill (Pty) Ltd, Royal Swaziland Sugar Corporation, Kinyara Sugar Works Ltd, Super Syrups, Gledhow Sugar Company (Pty) Limited U |

Analyst Review

In Africa and Middle East, sugarcane is the most cost-effective source of sugar. Sugarcane syrup is obtained by successive evaporation of sugarcane juice. Expansion of global urban population, increase in demand for on-the-go food products, and surge in purchasing power of consumers fuel the demand for various confectionery products. Despite increase in health consciousness among consumers, the demand for premium, indulgent foods particularly bakery & confectionery products is on a rise. Ease of processing and cost reduction of production operations have changed the preferences of bakery food manufacturers, and they opt to use sugarcane syrups instead of refined or powdered sugar, thereby fueling the demand for sugarcane syrup.

The sugarcane syrup industry possesses high growth potential in the developing regions such as China and India, owing to improvement in lifestyle, changes in taste preferences, and dietary habits. Improved living style of consumers further fosters the adoption of health drinks, thus boosting the market growth. The beverages industry is taking efforts to address the rapid changes in demands of consumers. Collaborations and acquisitions are the key strategies followed by the companies to gain a stronger foothold in the market, as in-house capacity building would be difficult for some of the novice players in the market.

The Africa and Middle East sugarcane syrup market size is expected to be reach $2,074 million by 2023

The global Africa and Middle East Sugarcane Syrup market is projected to grow at a compound annual growth rate of 1.8%

Key players profiled in the report include ILLOVO SUGAR (PTY) LTD, Super Syrups, Tongaat Hulett, Atlanta Sugar SA (Pty) Ltd., Sunshine Sugar, FROZY EGYPT, Kenana Sugar Company, White Nile Sugar Company (WNSC) Co. Ltd., GM Sugar Uganda Limited, and Kinyara Sugar Works Ltd.

Malawi is expected to witness high growth during the forecast period.

Health benefits associated with sugarcane syrup has increased its consumption and usage among households, thereby driving the growth of Africa and Middle East sugarcane syrup market.

Loading Table Of Content...