AI Infrastructure Market Overview

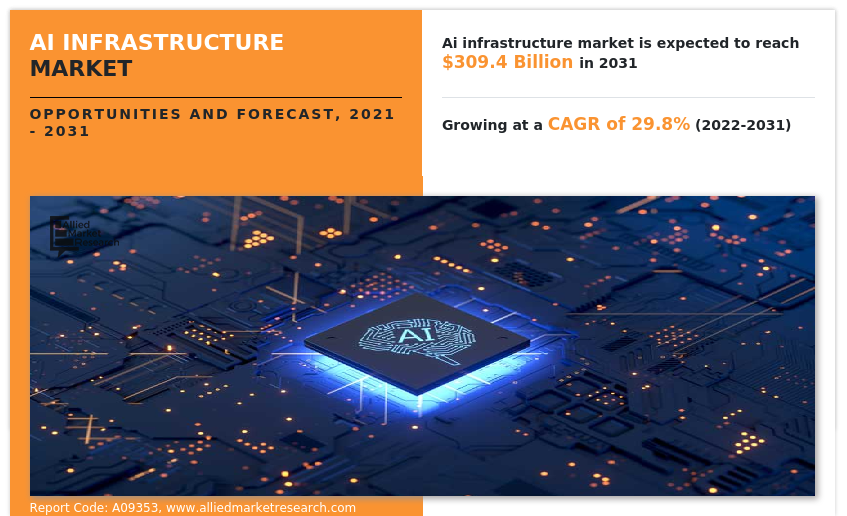

The global AI infrastructure market was valued at USD 23.5 billion in 2021, and is projected to reach USD 309.4 billion by 2031, growing at a CAGR of 29.8% from 2022 to 2031.

This need for flexibility is making cloud, particularly hybrid cloud, the foundation of AI, especially as the need for substantial amounts of data ratchet up. Using hybrid cloud, companies can meet the technology demands of AI at the right cost level for their businesses and their workloads. Infrastructure-as-a-Service (IaaS) offers organizations the ability to use, develop and implement AI without sacrificing performance. However, there are a number of infrastructure elements that organizations need to bear in mind when evaluating potential IaaS providers.

An AI Infrastructure is the technology that enables machine learning. It signifies the combination of artificial intelligence and machine learning solutions to develop and deploy reliable, scalable, and specific data solutions. The pace of AI adoption has accelerated during the Covid-19 crisis but the increased rate of adoption is likely to place significant extra demand on computing resources and supporting infrastructure. When it comes to infrastructure, businesses have to adapt and be flexible.

Furthermore, AI infrastructure offers numerous benefits such as it provides enhanced storage capacity. Furthermore, networking is another key component of AI infrastructure. Good, fast and reliable networks are essential to maximize the delivery of results. Deep learning algorithms are highly dependent on communications, so networks need to keep pace with demand as AI efforts expand. Scalability is a high priority and AI requires a high-bandwidth, low-latency network. It is important to ensure the service wrap and technology stack are consistent for all regions. Such factors provide lucrative opportunities for the AI infrastructure market growth during the forecast period.

On the contrary, big data analytics is heavily used in supply chain management to evaluate operational hazards, improve communication, secure proprietary data, and improve supply chain accessibility. This data is used by industries in a variety of ways, including predictive analytics and the creation of more efficient cloud-based platforms. Data mining, statistics, and machine learning are used in predictive analytics to assess future supply demands, inventory, and customer behavior. Companies use predictive analytics and machine learning to forecast future physical hazards in the supply chain and financial, customer, and other operational risks, thus propel the growth of the AI infrastructure market.

Moreover, AI can involve handling sensitive data such as patient records, financial information and personal data, so the infrastructure must be secured end-to-end with state-of-the-art technology. As companies increase their use of AI, they will place heavier burdens on the network, server and storage infrastructures. Businesses need to make careful choices and identify IaaS providers that can offer cost-effective dedicated servers as a means to boost performance and to enable them to continue investing in AI without increasing their budget. Such factors will help to enhance the market growth during the forecast period.

The AI infrastructure market is segmented on the basis of component, deployment mode, technology, application, end user, and region. By component, it is divided into hardware, software and services. By deployment mode, it is classified into on-premise, hybrid and cloud. On the basis of technology, it is bifurcated into machine learning and deep learning. By application, the market is classified into AI training, inferencing and others. By end user, the market is categorized into enterprises, government and cloud service providers (CSPs). Region wise, it is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

By Component

The hardware segment dominated the AI infrastructure market in 2021, owing to advances in hardware technologies are enabling AI to transform industries worldwide.

Depending on component, the hardware segment dominated the AI infrastructure market in 2021 and is expected to continue market trends during the forecast period. Owing to advances in hardware technologies are enabling AI to transform industries worldwide, from financial services, to manufacturing, healthcare, and many others, drive the market growth. However, services segment highest growth in AI infrastructure market share in the upcoming year. The adoption of AI infrastructure services allows businesses to improve workflows, increase efficiency, and lower expenses all at the same time.

By Region

The Asia-Pacific is estimated to be the fastest growing segment with the CAGR of 36% during the forecast period.

By region, the North America dominated the market share in 2021 for the AI infrastructure market. Owing to high concentration of artificial intelligence solution vendors in the region are anticipated to provide lucrative growth opportunities for the market in this region. However, Asia-Pacific is expected to exhibit highest growth during the forecast period, owing to its ongoing rapid digital transformation trends that are expected to increase the scope for AI infrastructure industry in this region.

Top Impacting Factors

Increase in Investments in Artificial Intelligence (AI)-based Systems:

Businesses and organizations across all industries are increasing their investment in artificial intelligence to create competitive advantage through improved customer insights, enhanced employee efficiency, and accelerated innovation. The potential of artificial intelligence technology to efficiently assess the acquired data and use to predict future steps in real time with the help of complex algorithms aids in productivity development; for instance, Netflix can recommend movies based on its users' prior watching experiences.

Moreover, artificial intelligence has transformed business management in the modern business environment by integrating workflow management tools and trend forecasting. This acts as the primary driver of the artificial intelligence market. In addition, increase in investment in artificial intelligence technology and machine learning notably contributes toward the market growth.

Furthermore, many small start-ups and tech organizations have invested in the adoption of open-source artificial intelligence platforms to increase efficiency in their value chains, which fosters the growth of the global market. Moreover, increase in availability of low-cost, high-quality artificial intelligence technology is expected to contribute to the expansion of the AI infrastructure industry.

Increase in Customer Satisfaction and Adoption of Reliable Cloud Applications:

In the past few years, machines have surpassed humans at recognizing speech, images, and faces. AI-based solution is being deployed across varied industry verticals to reduce costs, improve efficiency, and boost customer satisfaction by enhancing key areas of customer experience.

Sooner or later, employees at call centers are expected to be replaced by artificial intelligence (AI) technology for responding to enquiries and to provide enhanced client services, which, in turns, drives the growth of the market. Moreover, rapid developments in powerful and affordable cloud computing infrastructure are expected to have a strong impact on the growth potential of the global AI infrastructure market. Furthermore, cloud-based technologies are reliably improving IT environment incorporating changes and modifying the current business structure. Cloud computing enables businesses to organize and exchange pertinent data and information in real time, which acts as the key driving factor for the market.

Rise in Collaboration Between Industries and AI & ML Solution:

Rise in collaboration between various industries and artificial intelligence & machine learning companies to integrate cutting-edge technology to digitize various critical processes of the companies and to provide new services to end users drives the growth of the global AI infrastructure market. For instance, in September 2021, CaixaBank partnered with Revelock to develop a solution based on artificial intelligence to prevent fraud in digital banking channels. The major purpose of this collaboration is to offer enhanced security to end users by providing biometrics technology for digital banking, which fosters the growth of the market.

In addition, the solution continuously assesses users’ online interactions and compares them with risk patterns, providing enhanced security to all CaixaBank’s online banking users, which, in turn, propels the growth of the market. Furthermore, financial firms have witnessed that end users are increasingly demanding on-the-spot answers and guidance across digital channels, which, in turn, is driving the collaboration between financial firms and artificial intelligence companies.

For instance, in August 2021, Synechron and Kasisto partnered to humanize conversational artificial intelligence customer engagement for the banking and financial services industry, which can engage with customers via human-like conversations across voice, text, and touch modalities; deliver hyper-personalized next best action suggestions; and guide users on their individual financial journey.

In addition, this collaboration will bring conversational artificial intelligence capabilities and next generation of cognitive customer engagement, allowing top tier organizations to deliver a best-in-class and humanized digital transformation experience to institutions across the banking and finance industry. Thus, increase in number of such collaborations drives the growth of the AI infrastructure market.

COVID-19 Impact Analysis

The current estimation of 2031 is projected to be higher than pre-COVID-19 estimates. The market has witnessed significant growth in the past few years, and is expected to further exhibit notable growth, due to outbreak of the COVID-19 pandemic. This is attributed to surge in need of artificial intelligence among enterprises to improve their customers’ needs and to upsurge their revenue opportunity. In addition, use of AI infrastructure technologies for managing growing volume of data generated from various devices in an organization drives the AI infrastructure market forecast.

Many businesses invested in AI-based solutions to ease the increasing complexity of the IT needs of many business enterprises during the period. According to a survey conducted by the Australian data and IT services provider, Appen Limited in March 2021, more than 55% of the respondents reported accelerating their artificial intelligence and related investments post the outbreak of COVID-19. Such factors showcased the growing opportunities for the market during the period.

Furthermore, surge in investment in AI based technology by various private sectors such as healthcare and medical research to fight against the pandemic propels the growth of the market. Moreover, according to several research surveys, 80% of the enterprises’ revenue growth will be dependent on new digital offerings before 2022, which drives the growth of the AI infrastructure market.

In addition, while estimating the AI infrastructure market size, AMR has considered the impact of COVID-19 on each country, and the estimated numbers are completely dependent on the current ongoing situation of COVID-19 in each country. However, there is still no clarity on the deeper impact that it is having across businesses, industrial sectors, and organizations, due to factors such as continuous increase in number of COVID-19 cases with different rate and changes in lockdown period.

Key Benefits for Stakeholders

The study provides an in-depth AI infrastructure market analysis along with the current trends and future estimations to elucidate the imminent investment pockets.

Information about key drivers, restrains, and opportunities and their impact analysis on the AI infrastructure market size is provided in the report.

The Porter’s five forces analysis illustrates the potency of buyers and suppliers operating in the AI infrastructure industry.

The quantitative analysis of the global AI infrastructure market for the period 2021–2031 is provided to determine the AI infrastructure market potential.

AI Infrastructure Market Report Highlights

| Aspects | Details |

| Market Size By 2031 | USD 309.4 billion |

| Growth Rate | CAGR of 29.8% |

| Forecast period | 2021 - 2031 |

| Report Pages | 323 |

| By Deployment Mode |

|

| By Technology |

|

| By End-Users |

|

| By Application |

|

| By Component |

|

| By Region |

|

| Key Market Players | Alphabet Inc., Microsoft Corporation, Intel Corporation, NVIDIA Corporation, Samsung Electronics Co., Ltd., Micron Technology, Inc., IBM Corporation, Amazon.com, Inc., Toshiba Corporation, Oracle Corporation |

Analyst Review

According to CXOs of the leading companies, over the time, businesses have seen various changes in the business processes, operations, and industrial automation. Moreover, businesses are shifting towards the digital platform and increasing implementation of Industry 4.0 to cope with ongoing tough business competition, which, creates the need for seamless solution to meet these requirements. This increases eventually escalates the adoption of AI infrastructure market.

Furthermore, demand for AI-based systems has been increasing in the past few years and is expected to continue this trend in the coming years as well, owing to increasing market competitiveness and rising quality standards, which are enabling the development of AI-based applications that can automate business operations while maintaining quality and efficiency in due time. Moreover, increasing application and accuracy of AI infrastructure has increased its demand for government and public sector organizations to promote automation. In addition, owing to growing digital and internet penetration in many regions of the world are promising new opportunities for the growth of the AI infrastructure market.

Key providers of the market such as IBM Corporation, Microsoft Corporation, and Google LLC account for a significant share in the market. With larger requirement from AI infrastructure solution, various companies are establishing partnerships to increase artificial intelligence capabilities. For instance, in October 2020, IBM Corporation announced partnership with ServiceNow to help companies reduce operational risk and lower costs by applying artificial intelligence to automate IT operations. The solution is engineered to help IBM and ServiceNow clients realize deeper, artificial intelligence-driven insights from their data, create a baseline of a typical IT environment, and take succinct recommended actions on outlying behavior to help prevent and fix IT issues at scale.

Together, IBM and ServiceNow can help companies free up valuable time and IT resources from maintenance activities, to focus on driving the transformation projects necessary to support the digital demands of their businesses.

Moreover, market players are expanding their business operations and customers by increasing their acquisition. For instance, in January 2022, Oracle Corporation announced the acquisition of Federos, an artificial intelligence and machine learning services provider.

The acquisition extends Oracle Communications’ application portfolio by adding artificial intelligence-optimized assurance, analytics, and automation solutions to manage the availability and performance of critical networks and systems. This expands Oracle’s ability to deliver end-to-end network and service assurance, enabling communication service providers and enterprises to increase operational efficiency while significantly lowering costs and reducing customer attrition.

The global AI infrastructure market was valued at USD 23.5 billion in 2021, and is projected to reach USD 309.4 billion by 2031,

The AI Infrastructure market is projected to grow at a compound annual growth rate of 29.8% from 2021-2031 to reach USD 309.4 billion by 2031

Alphabet Inc., Amazon.com, Inc., IBM Corporation, Intel Corporation, Micron Technology, Inc., Microsoft Corporation, NVIDIA Corporation, Oracle Corporation, Samsung and Toshiba Corporation.

The North America is the largest market for the AI Infrastructure.

Factors such as rise in artificial intelligence maturity in the modern business enterprises and everyday lifestyle of people are signaling significant growth opportunities for the future of global market. In addition, surge in digital and internet penetration around the world is positively impacting the growth of the market.

Loading Table Of Content...

Loading Research Methodology...