Supply Chain Management Market Overview

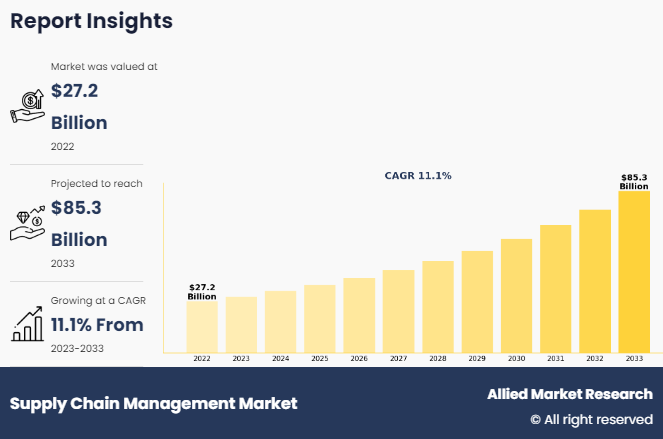

The global supply chain management (SCM) market size was valued at USD 27.2 billion in 2022 and is projected to reach USD 85.3 billion by 2033, growing at a CAGR of 11.1% from 2023 to 2033.

Supply chain management focuses on the development and delivery of goods with higher efficiency and greater speed. Industry players have developed digital SCM systems to improve efficiency in material handling and delivery. The use of supply chain software enables suppliers, manufacturers, logistics providers, and retailers to efficiently manage product creation, order fulfillment, and information tracking. Rise in technological advancements & investments and surge in demand & usage of supply chain management services & software by various large enterprises and small and medium sized enterprise (SMES) drive the global supply chain management market size.

Segment Overview

The supply chain management market is segmented on the basis of by component, solution type, deployment model, enterprise size, industry vertical, and region. By component, the market is bifurcated into solution and services. By solution type, it is classified into transportation management system, warehouse management system, supply chain planning, sourcing & procurement software, and manufacturing execution system. By deployment model, the market is divided into on-premise and cloud based.

By enterprise size, it is bifurcated into small & medium-sized enterprises (Small and medium-sized enterprise (SMEs)) and large enterprises. Depending on industry vertical, it is fragmented into retail & consumer goods, healthcare & pharmaceuticals, manufacturing, food & beverages, transportation & logistics, automotive, and other. By region, the SCM market is analyzed across North America (U.S. and Canada), Europe (UK, Germany, France, Italy, Spain, and Rest of Europe), Asia-Pacific (China, Japan, India, Australia, South Korea, and Rest of Asia-Pacific), and LAMEA (Latin America, Middle East, and Africa).

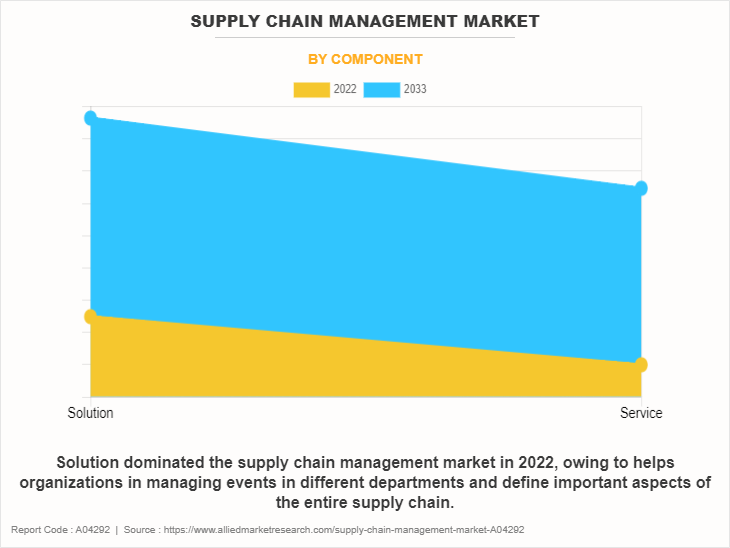

On the basis of component, solution segment dominated the supply chain management market size in 2022 and is expected to maintain its dominance in the upcoming years owing to help the management team to make crucial decisions about business strategies to adopt cost-effective measures and improve operational efficiency. The solution segment is further classified into the transportation management system (TMS), planning & analytics, warehouse & inventory management system, procurement & sourcing, and manufacturing execution system. However, the services segment is expected to witness the highest SCM market share, owing to the adoption of supply chain management services across different industry verticals, as it assures effective functioning of platforms and software.

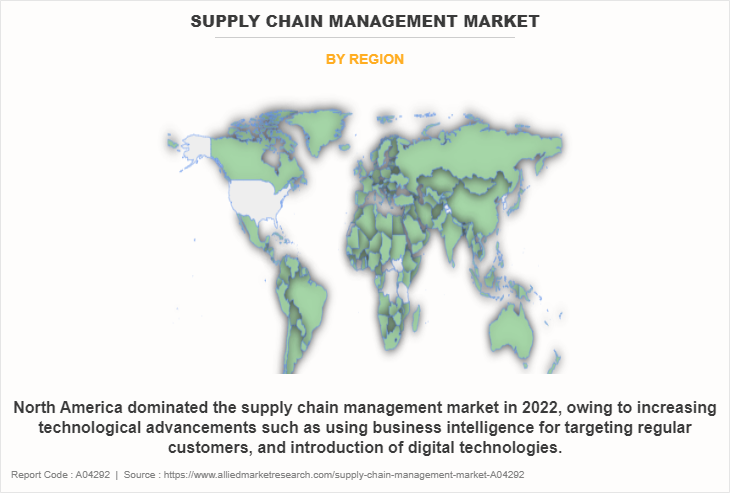

Region wise, the SCM market size was dominated by North America in 2022 and is expected to retain its position during the forecast period, owing to increasing technological advancements such as using business intelligence for targeting regular customers, and introduction of digital technologies has boosted the growth of the market in this region. However, Asia Pacific is expected to witness significant growth during the forecast period, owing to increasing requirement for enhanced supply chain visibility, development of industrial-grade digital technology, and shifting inclination of the suppliers towards cloud-based supply chain management software are acting as growth catalysts for the overall market which drives the growth of the SCM market.

Top Impacting Factors

Rise in technological advancement and investments

Surge in technological advancement and investments drive the operational efficiency and help to increase the business revenue. In addition, these technologies are being used to improve transparency, supply chain visibility, connectivity, and the use of supply chain management. Furthermore, many companies have taken advantage of automation to accomplish efficiencies across their supply chains for decades. This pace of change has accelerated the adoption of the global supply chain management market size due to technological advancements such as cloud based SCM and intelligent automation (IA) which combine with artificial intelligence (AI) and robotic to automate complicated machine processes.

Moreover, major players in this SCM market are investing and integrating advanced software technologies such as cloud computing, AI, machine learning, and other technologies in SCM. For instance, in December 2021, according to Gartner survey, among 211 supply chain professionals, 34% of respondent said that adapting new technology is the most important strategic change in supply chain organizations, such an increase in the adoption and integration of AI-based and cloud based SCM software among key players drives the growth of the SCM market.

For instance, On November 6, 2024, Syngenta Crop Protection and Maersk extended their 4PL partnership for an additional five years, emphasizing responsible logistics through continuous supply chain optimization and innovation. This collaboration focused on sustainable logistics, with both companies committed to reducing greenhouse gas emissions. Over the past eight years, they successfully navigated major disruptions and identified opportunities to reduce emissions. The extended partnership reinforced their commitment to sustainability and innovation in supply chain solutions.

Increase in adoption of SCM software in healthcare and pharmaceutical companies

The healthcare supply chain is an extensive network of systems, components, and processes that collectively work to ensure medicines and other healthcare supplies are manufactured, distributed, and provided to patients. The Supply Chain can be visualized as a back-end program running, which is necessary to integrate all the different processes together. The supply chain implemented ensures availability of medicine/product at right time, minimizing inventory wastage, maximizing patient care, coordination in all departments, and minimizing human error/medication errors.

This can be accomplished by using possible measures i.e., integrating subsystems, streamlining workflow & use of RFID technologies, standard product code, and Global Identification number. Rise in pressure faced by healthcare providers to improve operational efficiency and profitability drive the adoption of SCM software in the healthcare industry. In the current scenario, the healthcare market across the globe is characterized by increase in healthcare costs and national healthcare expenditures.

For instance, On November 19, 2024, Inspirity Health Partners, formed by HumanityCorp and Mayo Clinic Supply Chain Management, gained traction by optimizing resources, cutting costs, and improving efficiency for healthcare providers. They leveraged Mayo Clinic's supply chain expertise to enhance patient care and value. The partnership focused on tailored strategies, lean methodologies, and digital technologies to streamline operations and make data-driven decisions, ultimately improving care quality and operational efficiency.

Which are the Leading Companies in Supply Chain Management

The following are the leading companies in the supply chain management market.

DESCARTES SYSTEMS GROUP INC

Blue Yonder Group, Inc.

körber ag

SAP SE

Infor

Manhattan Associates, Inc.

Oracle Corporation

EPICOR SOFTWARE CORPORATION

Kinaxis

IBM Corporation.

Market Drivers

The supply chain management market is expected to witness significant growth in the upcoming years. This is attributed due to the increase in the adoption of robotics and automation in warehouses which has reduced labor costs, minimized errors, and accelerated product movement, driving the global SCM market by streamlining operations and increasing throughput. In addition, the increase in demand & usage of supply chain management services & software by various enterprises and industries boost the growth of the global supply chain management software market size. Moreover, the surge in the adoption of SCM software in healthcare and pharmaceutical companies positively impacts growth of the supply chain management software industry. In addition, the surge in cloud-based supply chain management systems offering businesses more flexibility, scalability, and cost-effectiveness, with better data access and easier updates, contributes toward market expansion.

For instance, On February 25, 2025, sedApta announced a strategic partnership with Kerr Consulting to optimize global supply chain processes. This collaboration combined sedApta's digital transformation expertise with Kerr's advanced technological solutions. The partnership aimed to improve planning, traceability, and operational resilience, helping customers adapt to market changes. It also strengthened sedApta's presence in the US market. Both companies expressed enthusiasm for the partnership, highlighting its benefits for manufacturing and distribution clients, including integrated solutions, enhanced efficiency, and global expansion.

However, the upfront investment required for implementing advanced SCM systems like ERP, AI, IoT, and blockchain, can be prohibitive for smaller businesses, creating a barrier for those with limited budgets. In addition, the shortage of professionals with the necessary skills and expertise to manage complex supply chains and advanced technologies can impede the growth of the SCM industry. Furthermore, the stringent government regulations pertaining to various regulations, such as trade, environmental, labor, and data protection laws, hinders the growth of the market.

On the contrary, the supply chain management market is expected to offer numerous opportunities for new players in the market. The growth of e-commerce sector has led to the surge in the demand for fast, reliable, and cost-efficient deliveries, offering remunerative opportunities for expansion of the supply chain management software market during the forecast period. In addition, the development of free trade agreements and global trade initiatives offers lucrative opportunities for businesses to expand their reach and reduce operational costs. Moreover, the surge in the adoption of automation such as robotics, autonomous vehicles, and drones provides streamlined supply chain operations, reduces errors, enhances speed, and improves efficiency, offering faster, cost-effective last-mile delivery. This is expected to offer new avenues for the growth of the market.

For instance, On January 21, 2025, Symbotic partnered with Walmart to automate its supply chain, deploying software and robotics at 42 regional distribution centers in the U.S. The 12-year agreement, starting January 15, 2025, made Symbotic's technology exclusive to Walmart during that period. Walmart used miniaturized automation systems in stores for order fulfillment and scaled automation in distribution centers across several states in 2024.

What are the Current Market Trends Shaping the Industry

One of the significant trends in supply chain management is digital transformation and automation, revolutionizing supply chains across industries. Businesses are adopting robotics, AI, machine learning, and IoT technologies to streamline operations, enabling predictive analytics, real-time tracking, and automated decision-making. These advancements improve inventory management, demand forecasting, and route optimization. In addition, Robotic Process Automation (RPA) automates manual tasks like invoice processing, order fulfillment, and procurement, reducing errors and enhancing speed.

For instance, On January 6, 2025, KION GROUP AG announced its collaboration with Accenture and NVIDIA to optimize supply chains using advanced AI and simulation technologies. At CES in Las Vegas, they showcased how clients could design and enhance warehouses with NVIDIA Omniverse's digital twin technology. This partnership aimed to improve warehouse performance with AI-driven solutions, automated forklifts, smart cameras, and robotics. The collaboration underscored their commitment to innovation and creating agile, efficient supply chains.

Furthermore, end-to-end visibility is another one of the supply chain technology trends, allowing businesses to monitor every stage from raw materials to final delivery using IoT sensors, GPS tracking, and blockchain. This transparency helps companies make data-driven decisions, anticipate disruptions, and manage risks, especially in critical industries like food and pharmaceuticals. In addition, there is a growing trend toward the adoption of cloud-based supply chain solutions for enhanced visibility, collaboration, and scalability. These platforms enable real-time data sharing, allowing businesses to quickly respond to demand changes, track inventory, and coordinate with global suppliers. This is expected to significantly boost the supply chain management market Size, as more businesses recognize the benefits of improved visibility, efficiency, and collaboration, further driving trends in supply chain management towards digital transformation, automation, and the use of advanced analytics to optimize operations and make more informed, data-driven decisions.

For instance, On October 15, 2024, Syntax Systems announced its acquisition of Argon Supply Chain Solutions, a firm specializing in warehouse management and supply chain optimization. This acquisition enhanced Syntax's capabilities and expanded its reach in the UK and South Africa. The integration of Argon's expertise, particularly in partnership with SAP, benefited both companies' employees and customers. Supported by Novacap, this marked Syntax's seventh acquisition, further strengthening its position in the SAP ecosystem and various industry verticals.

The report focuses on growth prospects, restraints, and analysis of the global supply chain management industry. The study provides Porter's five forces analysis to understand the impact of various factors, such as bargaining power of suppliers, competitive intensity of competitors, the threat of new entrants, threat of substitutes, and bargaining power of buyers on the global supply chain management market share.

Government Initiatives

Many countries have initiated programs to improve the efficiency and transparency of supply chain management (SCM) processes. These initiatives aim to streamline operations, reduce delays, and enhance the overall performance of global supply chains.

Furthermore, governments worldwide are driving the adoption of digital technologies in supply chains, such as blockchain and artificial intelligence (AI), to improve traceability, reduce fraud, and increase efficiency. Notable examples include the use of blockchain in tracking the provenance of goods in sectors like food and pharmaceuticals, ensuring transparency and safety. China's push for smart logistics systems, including the use of AI for demand forecasting and inventory management, is another example of how technology is reshaping the SCM landscape.

For instance, On January 2025, India and the EU agreed to collaborate on developing cutting-edge technologies and securing critical raw material supply chains to strengthen economic ties. During a visit to Brussels, Commerce Minister Piyush Goyal and European Commissioner Maros Sefcovic discussed building a fair and equitable trade agenda and working towards a Free Trade Agreement (FTA). The collaboration aimed to reduce dependencies on non-market economies and enhance economic ties between India and the EU.

Furthermore, many countries have introduced regulations to enhance data security within supply chains, aligning with global data protection laws. These laws are prompting companies to invest in secure data management systems and improve supply chain visibility, ensuring compliance with legal requirements and reducing the risk of cyberattacks. Open data initiatives and digital platforms are enabling businesses to share critical information with stakeholders, fostering greater collaboration across the supply chain. For instance, recently the Indian Government has streamlined domestic warehousing for logistics companies, supply chain owners, and integrated logistics, benefiting the warehousing sector through various programs and policies.

Competitive Analysis

On November 2023, Epicor, a global leader of industry-specific enterprise software designed to promote business growth, acquired Elite EXTRA, a leading provider of cloud-based last mile delivery solutions. The acquisition expands Epicor's ability to help its customers across the make, move, and sell industries simplify last mile logistics and compete in a hyper-competitive market more effectively.

On October 2023, LSQ, a leading provider of working capital finance and payments solutions, partnered with Infor Nexus, the leading global supply chain platform and a division of Infor. This partnership intends to provide network of suppliers access early payments through an LSQ FastTrack supply chain finance program.

On October 2023, IBM partnered with Amazon Web Services (AWS) to enhance its offerings with generative AI capabilities, enabling clients to integrate AI quickly into their business and IT operations on AWS.

On February 2024, Blue Yonder, a leading supply chain solutions provider, acquired Flexis AG, a flexible, innovative software technology provider specializing in production optimization and transportation planning and execution. Through this acquisition it intends to help companies with highly configurable products and expansive suppliers to plan and optimize their complex production facilities and network structures.

On April 2023, Oracle launched AI and Automation capabilities Oracle Fusion Cloud Applications Suite that help customers accelerate supply chain planning, increase operational efficiency, and improve financial accuracy. The updates include new planning, usage based pricing, and rebate management capabilities within Oracle Fusion Cloud Supply Chain & Manufacturing (SCM) and enhanced quote-to-cash processes in Oracle Fusion Applications.

Future Outlook

The future of the supply chain management market looks promising, fueled by advancements in automation, AI, and cloud-based solutions. These technologies will streamline operations, enhance speed, and improve data-driven decision-making. Real-time visibility through IoT, blockchain, and GPS will enable proactive management, while the emphasis on sustainability and e-commerce growth will drive demand for efficient, tech-driven solutions. Overall, the market is poised for significant growth, with technology at the heart of boosting operational efficiency and meeting global demand.

What are the Key Benefits for Stakeholders:

This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the SCM market size analysis from 2022 to 2033 to identify the prevailing supply chain management software market size.

The supply chain management market research is offered along with information related to key drivers, restraints, and opportunities.

Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

In-depth analysis of the supply chain management market forecast assists to determine the prevailing supply chain management market opportunities.

Major countries in each region are mapped according to their revenue contribution to the supply chain technology.

Market player positioning facilitates benchmarking and provides a clear understanding of the present position of supply chain management industry.

The report includes the analysis of the regional as well as global supply chain management market trends, supply chain technology trends, key players, market segments, application areas, and market growth strategies

Supply Chain Management Market Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 85.3 billion |

| Growth Rate | CAGR of 11.1% |

| Forecast period | 2022 - 2033 |

| Report Pages | 374 |

| By Industry Vertical |

|

| By Component |

|

| By Solution Type |

|

| By Deployment Mode |

|

| By Enterprise Size |

|

| By Region |

|

| Key Market Players | körber ag, Manhattan Associates, Inc., IBM Corporation, SAP SE, Infor, Kinaxis, EPICOR SOFTWARE CORPORATION, THE DESCARTES SYSTEMS GROUP INC, Oracle Corporation, Blue Yonder Group, Inc. |

Analyst Review

Supply chain management is the management of the flow of goods & services and SCM manages all processes that transform raw materials into final products. It involves the active streamlining of a business's supply-side activities to maximize customer value and gain a competitive advantage in the marketplace. Moreover, supply chain management (SCM) represents an effort by suppliers to develop and implement supply chains that are as efficient and economical as possible. Supply chains cover everything from production to product development to the information systems needed to direct these undertakings.

The global supply chain management market is expected to register high growth due to the rise in demand and increase in awareness of the benefits of SCM solutions, such as transportation management systems, planning & analytics, forecasting accuracy, warehouse & inventory management, supply chain optimization, procurement & sourcing, waste minimization, manufacturing execution and relevant synthesis of business data. In addition, the rapidly growing adoption of information technology and technical breakthroughs improves and supports the overall supply chain, contributing to market expansion. With surge in demand for supply chain management, various companies have established alliances to increase their capabilities.

In addition, with further growth in investment across the globe and the rise in demand for supply chain management, various companies have expanded their current product portfolio with increased diversification among customers. For instance, in March 2022, Logility, Inc., introduced upgrades to its software for improved planning capabilities across the product lifecycle. The new upgrade offers visualization of the global relationships of users with their interconnected network through supply chain network maps. The software also exhibits new Product Lifecycle Management (PLM) dashboards for improved analysis of product performance and speed-to-market.

Moreover, with the increase in competition, major market players have started acquisition of companies to expand their market penetration and reach. For instance, September 2021, Accenture acquired MacGregor Partners, a leading supply chain consultancy and technology provider specializing in intelligent logistics and warehouse management to expand Accenture’s supply chain network and fulfillment transformation capabilities powered by Blue Yonder technology.

The global supply chain management market size was valued at USD 27.2 billion in 2022, and is projected to reach USD 85.3 billion by 2033

The global supply chain management market is projected to grow at a compound annual growth rate of 11.1% from 2023-2033 to reach USD 85.3 billion by 2033

The key players that operate in the supply chain management market are IBM Corporation, Blue Yonder Group, Inc., Kinaxis, Manhattan Associates, Inc., Oracle Corporation, SAP SE, Epicor Software Corporation, HighJump, Infor, THE DESCARTES SYSTEMS GROUP INC.

North America dominated in 2022 and is projected to maintain its leading position throughout the forecast period.

Rise in technological advancement & investments and surge in demand & usage of supply chain management services & software by various enterprises and industries boost the growth of the global supply chain technology.

Loading Table Of Content...

Loading Research Methodology...