Warehouse Management System Market Overview

The global warehouse management system market size was valued at USD 2.7 billion in 2021 and is projected to reach USD 12.3 billion by 2031, growing at a CAGR of 16.3% from 2022 to 2031.

Robust growth in e-commerce industry and increased demand for cloud WMS solutions are driving the growth of the market. In addition, surge in adoption of multichannel distribution networks is fueling the growth of the warehouse management system market. However, high investment required in setting up on-premises WMS for SMEs and concerns regarding data privacy and information security limit the growth of this market. Conversely, the adoption of digital technologies in supply chain management is anticipated to provide numerous opportunities for warehouse management system industry expansion during the forecast period.

Key Market Trends & Insights

- By component, the service segment is expected to witness the highest growth in the upcoming years

- By user type, the SMEs segment is expected to witness the highest growth rate in the market analysis.

- Region wise, Asia-Pacific is expected to witness significant growth during the forecast period.

Market Size & Forecast

- 2021 Market Size: USD 2.7 Billion

- 2031 Projected Market Size: USD 12.3 Billion

- Compound Annual Growth Rate (CAGR) (2022-2031): 16.3%

What is Warehouse Management Sstem (WMS)?

A warehouse management system (WMS) is a collection of guidelines and procedures designed to streamline operations at distribution centers and warehouses so they can accomplish their objectives. Moreover, a warehouse management system's primary duty is to keep track of inventory arrivals and departures. Warehouse management system has various features such as keeping track of the stock's exact location within the warehouse, making the most use of the space at hand, or coordinating work to achieve the highest level of efficiency.

The report focuses on growth prospects, restraints, and analysis of the global warehouse management system market trends. The study provides Porter’s five forces analysis to understand the impact of various factors, such as bargaining power of suppliers, competitive intensity of competitors, the threat of new entrants, threat of substitutes, and bargaining power of buyers on the global warehouse management system market share.

Segment Review:

The global warehouse management system market is segmented into components, user type, deployment models, industry verticals, and regions. Depending on the component, the market is divided into software and services. Based on user type, it is categorized into large enterprises and SMEs. By Deployment model, it is divided into on-premise and cloud-based. Based on industry verticals, it is bifurcated into retail and consumer goods, healthcare and pharmaceuticals, manufacturing, food and beverages, transportation and logistics, automotive and others. Region-wise, it is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

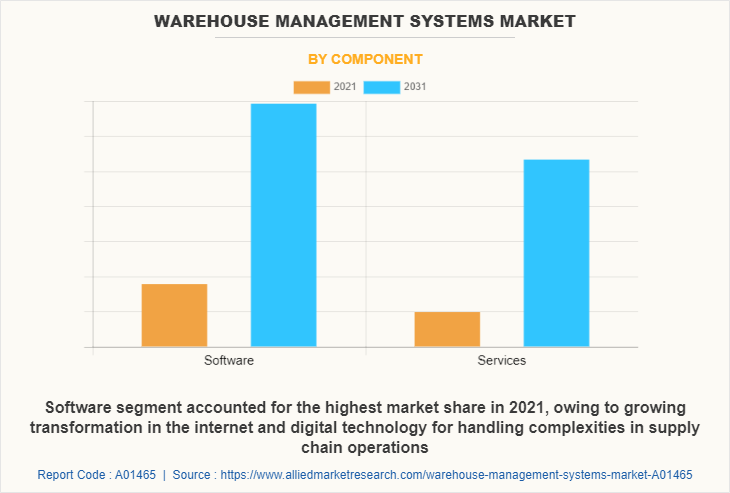

Depending on the component, the software segment dominated the WMS market share in 2022 and is expected to continue this trend during the forecast period, owing to the rapid adoption of the warehouse management system, to decrease order processing errors and delivery lag times. However, the service segment is expected to witness the highest growth in the upcoming years, owing to the rise in the adoption of warehouse management solutions requires precise maintenance by the business to achieve strategic and competitive advantages.

Region-wise, the warehouse management system market was dominated by North America in 2021 and is expected to retain its position during the forecast period, owing to the need for manufacturers to automate warehouse management procedures to reduce costs in this region. However, Asia Pacific is expected to witness significant growth during the forecast period, owing to the new technological acceptance and developing digital transformation due to the increasing competition among market players in this region.

Top Impacting Factors:

Robust Growth in the E-commerce Industry

- The growth in the e-commerce industry is directly influencing the adoption of WMS solutions, as it helps in improving the accuracy of store-level inventory and multiplying the order and fulfillment options. This leads to reconfigured traditional warehouses by retailers with a major focus on e-commerce, and they are investing a significant amount of funds in in-store WMS solutions.

- For instance, in May 2022, Wabash, the visionary leader of connected solutions for the transportation, logistics, and distribution industries, introduced the creation of a new tech-enabled Wabash Parts distribution network. This unifies and expands Wabash’s parts distribution capabilities across all product lines, and provides immediate scale to grow. This is enhancing the e-commerce channel which in turn drives WMS market growth.

- Furthermore, the rise in e-commerce sales further accelerates consumer spending on warehouse management systems owing to its feature of better inventory tracking and traceability. According to the Census Bureau’s Annual Retail Trade Survey (ARTS) release, e-commerce sales increased by $244.2 billion or 43% in 2020, the first year of the pandemic, rising from $571.2 billion in 2019 to $815.4 billion in 2020. Such robust growth in the e-commerce industry will significantly drive the move toward the growth of the warehouse management system industry.

Increased Demand for Cloud WMS Solutions

- Growing demand for cloud warehouse management system (WMS) solutions owing to its features such as better scalability, effective labor, traceable materials, optimized supply chain, and other internal automation benefits. These inherent advantages enable companies to optimally manage their inventory and supply chain needs, from labor and space requirements to equipment and fulfillment. Hence, the remarkable adoption of cloud-based WMS solutions is observed around the world, which is expected to drive warehouse management system market growth worldwide.

- Moreover, the cloud WMS has a significant ability to manage inventory, order placements, and warehouse automation capabilities. Furthermore, benefits from an integrated WMS and ERP solution to manage depository and more through a comprehensive cloud-based ERP solution. This enables employees to remove all the hassle of dealing with multiple in-house systems and all the maintenance and tech upgrades, which eventually drives the WMS market size.

- In addition, as technology progression is on a surging trend, the introduction of microservices software that uses APIs is acting as major advancement to interconnect with one another’s independent solutions, which further enabled integration capabilities of cloud technology. For instance, in September 2022, Enterprise software provider Yonyou Network Technology launched next-gen cloud ERP product for overseas users. This ERP helps businesses to make better decisions by providing accurate inventory data. ERP inventory management systems also enable businesses to control their logistics, operations, finance, and inventory from a singular system reducing errors and improving efficiency. This, in turn, is expected to drive warehouse management system market growth.

- Furthermore, larger organizations are also switching to cloud-based warehouse management systems, as it allows organizations to offload exhausting tasks such as maintenance, infrastructure administration, and timely upgrades, among other tasks. Hence, the inherent features of cloud-based WMS solutions are expected to boost warehouse management system market trends.

Key Warehouse Management System Companies:

The following are the leading companies in the warehouse management system market. These players have adopted various strategies to increase their market penetration and strengthen their position in the industry.

- Blue Yonder Group, Inc.

- HighJump Software, Inc. (Koeber)

- IBM Corporation

- Infor Inc.

- Manhattan Associates, Inc.

- Oracle Corporation

- PSI Logistic (PSI AG)

- SAP SE

- Softeon, Inc.

- Tecsys, Inc.

Digital Capabilities:

The relevance of warehouse management systems in wireless technologies, such as automation, the Internet of Things (IoT), and AI-enabled systems is growing, owing to their advantages like efficient work processes and improved accuracy. These technologies are becoming the highest priority techniques in average every sector. For instance, according to the article published by Korber, in June 2022, digitization and process automation is the highest supply chain priority for 84% of all businesses. In addition, Automation can take many different forms, organizations can experiment with several strategies to enhance picking performance and accuracy within a warehouse operation such as Automated Mobile Robots (AMR).

For instance, AMRs are vehicles that can transport items independently without the need for physical guides or markers by using sensors and processors onboard. Moreover, robots can cut down on the amount of time needed to move around the property. The robot may then transport a variety of products, including packing, to the following place. Also, a robot in a production environment could transport finished products to retail locations or raw materials there. Many companies are adopting automation technologies to provide optimized solutions to industries.

For instance, in May 2022, Softeon introduced a mobile robot platform, and continued expansion of its software support for materials handling systems, especially for mobile robots and put walls. Such developments further propel the driving growth of the warehouse management system market.

Furthermore, IoT is ideal for automation that can streamline workloads and render more visibility into warehouse operations. IoT consists of interconnected things with embedded sensors that can exchange and collect data in real-time. For instance, each item that has to be tracked in a supply chain or inventory management has an RFID tag attached, providing crucial information to support key decision-making. Moreover, several large and small businesses are adopting and developing IoT-enabled smart platforms.

For instance, in July 2021, Amazon introduced its 3.6 million-square-foot fulfillment center in Mt. Juliet. One of several sizable Amazon fulfillment centers in the state, it has 80,000 square feet of office space and a fully automated warehouse system. Such improvements further contribute to the rising growth of warehouse management system market.

End-User Adoption:

The growing digitalization in warehouse management systems by several organizations in many sectors is accelerating end-user adoption. In order to achieve complete product traceability, digital warehousing refers to logistics facilities that use technology to streamline procedures and flows. With manual inventory control and task organization in traditional warehousing, there is a considerable risk of mistakes and delays. On the other hand, digitization improves the speed and accuracy of the various processes, allowing for, among other benefits, real-time stock control and accelerated delivery times. For instance, according to McKinsey, with the help of digital twins, digital warehouse designs and can boost efficiency by 20% to 25%.

Moreover, businesses that adopt digitization have begun incorporating AR/VR and the Industrial IoT (Internet of Things) in their production and logistics processes to obtain information on their supply chains in real-time. For instance, in October 2021, Zyter and Qualcomm partnered to implement a state-of-the-art, IoT-based smart warehouse for OneScreen. The warehouse will feature LiDAR-based digital twins, autonomous mobile robots (AMR), AR/VR technologies, IoT sensors, and a robust warehouse management system.

Furthermore, for warehouses to run smoothly, agility and efficiency are essential, and RFID technology is one of the newest developments available currently. Additionally, recent years have seen significant advancement in barcode technology, giving rise to RFID (Radio Frequency Identification) technology. The identification codes are scanned by this system using radio waves, which makes them easier to read. Many different organizations are providing RFID solutions for correct control and storage of warehouse stock.

For instance, in Sept 2021, SimplyRFID introduced RFID-powered inventory management tools, the company has been helping businesses eliminate the need for barcode technology for inventory tracking through its RFID-powered inventory management tools. With barcodes becoming increasingly outdated due to their inaccurate and slow nature, RFID technology has grown in popularity due to its impressive efficiency.

Government Initiatives:

Various companies and government bodies are collaborating to strengthen R&D in different industries with evolving productive alliances that lead to indigenous design, development, manufacturing, and deployment of cost-effective warehouse management products and solutions. For instance, in March 2022, the Union government emphasized the execution of PM GatiShakti National Master Plan encompassing the seven engines for economic transformation, seamless multimodal connectivity and logistics efficiency.

The GatiShakti Master plan for expressways, 100 new cargo ports with a multimodal logistics park, and initiatives to connect urban mobility to trains would offer new storage and logistics facilities across the nation the much-needed boost. Quick service restaurants, poultry, ready-to-eat food, ice cream, dairy products, confectionery & pastry products, fruits & vegetables, pharmaceuticals, and other items will be stored, handled, and transported in large part at this facility. This engagement will augment the indigenous Intellectual Property and create new avenues for wider adoption and monetization of home-grown 5G products & solutions. This execution will further help to create more opportunities in warehouse management system market.

Furthermore, the growing development by the government to provide a smart warehouse management system is driving the growth of the warehouse management system market. For instance, in January 2022, the Government of India developed a roadmap to roll out Online Storage Management (OSM) in the country. Through the integration of State portals with the national portal, the OSM plans to establish a single source of data for the food grains held in the nation for the central pool.

Additionally, over the DCP States, the OSM will create an ecosystem of storage management programs, each of which will be able to record the Minimum Storage Specifications (MSS). Moreover, such developments boost the warehouse management systems market growth and help to provide more opportunities for organizations.

Key Benefits for Stakeholders:

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the Warehouse management system market analysis from 2021 to 2031 to identify the prevailing warehouse management system market forecast.

- The warehouse management systems market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the Warehouse management system market growth assists to determine the prevailing warehouse management system market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global WMS market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global WMS market share, key players, market segments, application areas, and market growth strategies.

Warehouse Management Systems Market Report Highlights

| Aspects | Details |

| Market Size By 2031 | USD 12.3 billion |

| Growth Rate | CAGR of 16.3% |

| Forecast period | 2021 - 2031 |

| Report Pages | 264 |

| By Component |

|

| By Deployment Model |

|

| By Enterprise Size |

|

| By Industry Vertical |

|

| By Region |

|

| Key Market Players | Manhattan Associates, Inc., Tecsys, Inc., Infor Inc., HighJump Software Inc., Softeon, Inc., IBM CORPORATION, Blue Yonder Group, Inc., PSI Logistics, Oracle Corporation, SAP SE |

Analyst Review

The rapidly increasing instances of data breaches, along with other factors, such as cloud-based services, real-time inventory data management, and increasing digital transformation, have significantly increased the focus on data loss protection solutions across the world. A warehouse management system facilitates quicker product delivery, lowers distribution costs, and shortens lead times, which is driving the need for warehouse management services with a strategic focus on various organizations. Multiple large enterprises in the fortune global 500 have been investing in the warehouse management system market for more than a decade. Currently, the market studied has been emerging as a critical security strategy within reach of mid-sized enterprises.

Key providers in the warehouse management system market are Manhattan Associates, Inc., IBM Corporation, and Oracle Corporation. With the growth in demand for warehouse management services, various companies have established acquisitions to increase their solutions offerings. For instance, in January 2022, IBM acquired Enivize to achieve environmental goals and sustain stability initiatives. It aimed to help companies gain supply chain solutions by cutting waste through right-sizing inventory and reducing the carbon footprint of shipments and logistics.

In addition, with the surge in demand for warehouse management systems, a range of companies have expanded their current services to continue with the rising demand in the market. For instance, in September 2022, Oracle NetSuite launched NetSuite Ship Central, a mobile application, that helps organizations to optimize operations, eliminate manual processes, and accelerate customer deliveries. Similarly, in January 2021, PSI partnered with RMD logistics to put in force the PSI warehouse management system from the PSI-Cloud and help the virtual transformation and the boom in performance in intralogistics, in addition to the optimization of cross-region processes. This strategic launch and partnership are expected to drive market growth.

The warehouse management systems market is projected to reach $12,273.15 million by 2031.

The warehouse management systems market is estimated to grow at a CAGR of 16.3% from 2022 to 2031

The key players profiled in the report include Blue Yonder Group, Inc., HighJump Software, Inc.(koeber), IBM Corporation, Infor Inc., Manhattan Associates, Inc., Oracle Corporation, PSI Logistic (PSI AG), SAP SE, Softeon, Inc., and Tecsys, Inc.

Robust growth in e-commerce industry, surge in adoption of multichannel distribution networks, and increased demand for cloud WMS Solution contributes toward the growth of the market.

The key growth strategies of warehouse management systems market players include product portfolio expansion, mergers & acquisitions, agreements, geographical expansion, and collaborations.

Loading Table Of Content...