Algorithmic Trading Market Size & Share:

The global algorithmic trading market was valued at USD 17.0 billion in 2023 and is projected to reach USD 65.2 billion by 2032, growing at a CAGR of 15.9% from 2024 to 2032.

The market is growing rapidly, fueled by advancements in AI, machine learning, and big data analytics. Institutional investors and hedge funds are increasingly adopting algorithmic trading to enhance trading efficiency, reduce transaction costs, and capitalize on market opportunities in real-time. Regulatory support and the rise of high-frequency trading are further boosting market expansion.

Market Introduction and Definition:

Algorithmic trading or automated trading is a form of automation, in which a computer program is used to execute a defined set of instructions or rules that includes the buying or selling of an asset regarding the varying algo trading industry data. The defined sets of instructions or rules are based on timing, quantity, price, or any mathematical model. It offers several benefits to market participants such as it executes trades at the best possible prices; simultaneous automated checks on multiple algo trading market conditions; trades timed correctly and instantly; and reduced transaction costs due to lack of human intervention.

Key Takeaways:

The algorithmic trading industry study covers 20 countries. The research includes a segment analysis of each country in terms of value ($Billion) for the projected period 2024-2032.

More than 1, 500 product literatures, industry releases, annual reports, and other such documents of major Algorithmic trading industry participants along with authentic industry journals, trade associations' releases, and government websites have been reviewed for generating high-value industry insights.

The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global algorithmic trading market forecast and to assist stakeholders in making educated decisions in order to achieve their most ambitious growth objectives.

Key Market Dynamics:

Algorithmic trading, propelled by advancements in technology and data analytics, continues to transform financial markets worldwide. Key trends include the rise of machine learning and AI-driven trading algorithms, the expansion of high-frequency trading (HFT) strategies, and the increasing adoption of algorithmic trading by retail investors are expected to drive the growth of the market. Furthermore, the market presents significant opportunities for market participants to gain a competitive edge and generate higher returns. By leveraging cutting-edge algorithms and data analytics, traders can identify and exploit fleeting market opportunities, optimize trade execution, and manage risk more effectively. Moreover, the expansion of global financial markets and the proliferation of alternative data sources offer new avenues for alpha generation through algorithmic strategies. However, regulatory scrutiny, concerns about systemic risk, and the potential for algorithmic glitches pose significant restraints. As the industry evolves, collaboration between financial institutions, technology providers, and regulators will be essential to navigate the complexities and capitalize on the potential of algorithmic trading responsibly.

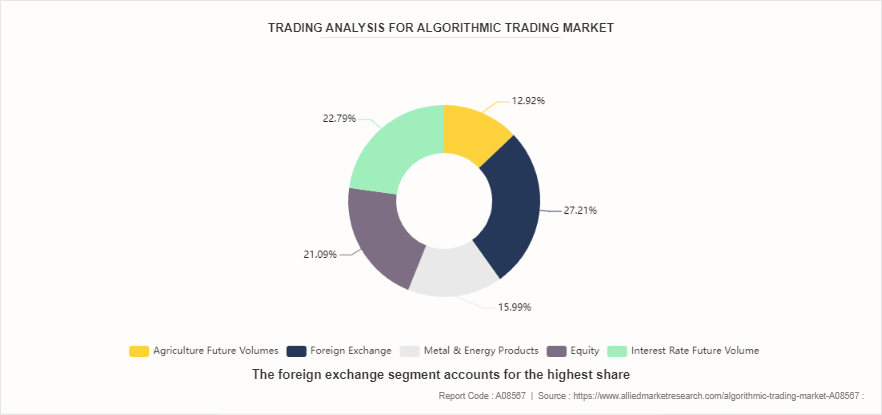

Trading Analysis for Algorithmic Trading Market:

Algorithmic trading has been among the most talked about technologies in recent years. It has given trading firms more power in the rapidly evolving markets by eliminating human errors and changing the way financial markets are interlinked today. Its usage is credited to most markets and even to commodity trading as mentioned in the chart below:

Market Segmentation:

The algorithmic trading market size is segmented on the basis of component, type, deployment mode, type of trader, and region. On the component, it is categorized into solution and services. On the basis of type, it is classified into stock markets, FOREX, ETF, bonds, cryptocurrencies, and others. As per the deployment mode, it is classified into cloud and on-premises. Depending on type of trader, it is divided into institutional investors, long-term traders, short-term traders, and retail investors. Region wise, it is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Regional/Country Market Outlook:

Nearly 80% of equity trades in the U.S. are run by algorithms. Ever since India embraced algorithmic trading in 2008, there has been growing interest to raise this profile for investors and balance out the algorithmic trading market share. This practice is widely referred to as algorithmic trading, where a pre-programmed automated machine executes trade orders. According to several study, algorithmic trading accounted for 60-73% of equity trading in the U.S. Globally, the U.S. financial algo trading industry is the largest and most liquid. Machine-driven trading has been around since the 1970s in the U.S. and has many benefits, faster order processing with lesser scope for errors, trade execution at the best price and low transaction costs. Moreover, in 2008, the Securities & Exchange Board of India issued a circular that Indian exchanges were being opened to algorithmic trading with the introduction of Direct Market Access, which meant institutional investors could trade without human intervention for the first time. The percentage of equities being traded via algorithms went up from 10% in 2011 to 50% by 2019.

In February 2024, China's securities regulator tightened scrutiny of derivative businesses in the stock market and announced punishment of a hedge fund company for excessive, high-frequency trading in share index futures. The announcements represent the latest of a series of measures by the watchdog to revive investor confidence in a stock market wallowing near five-year lows. In addition, The China Securities Regulatory Commission (CSRC) will strengthen supervision of derivatives including DMA-Swap products.

In July 2023, CAC, the National Development and Reform Commission, the Ministry of Education (MOE) , the Ministry of Science and Technology (MST) , the MIIT, and the MPS jointly published the Generative AI Regulation, came into force on August 15, 2023, targeting a broader scope of generative AI technologies.

In 2010, SEBI approved the launch of Smart Order Routing for investors to place their trades with the confidence of getting the best price possible from exchanges. This was followed by the NSE offering Tick by Tick data and Co Location servers to members.

Industry Trends

In September 2023, the Shanghai Stock Exchange, the Shenzhen Stock Exchange and the Beijing Stock Exchange, under the guidance of the China Securities Regulatory Commission, respectively formulated and issued the notice on matters related to the Reporting of the Stock Algorithm Trading and the notice on strengthening the regulation of algorithm trading to put the use of algorithm trading under closer scrutiny.

In April 2023, the MST published the Draft Ethical Review Measure for public consultation, focusing on the ethical review of science and technology activities that have ethical risks, such as the research and development (R&D) of AI technologies.

Competitive Landscape

The major players operating in the algorithmic trading market include Software AG, Metaquotes Software Corp., Argo SE, Tata Consultancy Services, Symphony Fintech Solutions Pvt Ltd., and Refinitiv Ltd. Other players in algorithmic trading market include 63moons, Algo Trader AG, Virtu Financial, Tethys and others.

Recent Key Strategies and Developments

For instance, in September 2022, CoinShares, Europe’s largest and longest standing full-service digital asset investment and trading group, launched HAL, a leading crypto-assets trading strategies platform. HAL aims to simplify and democratize crypto trading. It is designed to enable more users to boost their trading with professional algorithms, a simple user experience, fair and transparent pricing, and educational content.

For instance, in March 2021, Cowen, an American multinational independent investment bank and financial services company launched an algorithmic trading solution to help institutional clients navigate algo trading market dynamics caused by increased?volumes of?retail?trading.

Key Sources Referred

U.S. Securities and Exchange Commission (SEC)

Commodity Futures Trading Commission (CFTC)

Financial Conduct Authority (FCA)

European Securities and Markets Authority (ESMA)

Key Benefits For Stakeholders

This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the algorithmic trading market analysis from 2024 to 2032 to identify the prevailing algorithmic trading market size opportunities.

The algorithmic trading market forecast is offered along with information related to key drivers, restraints, and opportunities.

Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

In-depth analysis of the algorithmic trading market segmentation assists to determine the prevailing market opportunities.

Major countries in each region are mapped according to their revenue contribution to the global market.

Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

The report includes the analysis of the regional as well as global algorithmic trading market trends, key players, market segments, application areas, and algorithmic trading market growth strategies.

Algorithmic Trading Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 65.2 Billion |

| Growth Rate | CAGR of 15.9% |

| Forecast period | 2024 - 2032 |

| Report Pages | 200 |

| By Component |

|

| By Deployment Mode |

|

| By Type |

|

| By Type Of Trader |

|

| By Region |

|

| Key Market Players | Symphony Fintech Solutions Pvt Ltd., Tethys, 63moons, Software AG, Argo SE, Tata Consultancy Services (TCS), Refinitiv Ltd, Algo Trader AG, Virtu Financial, Metaquotes Software Corp |

The global Algorithmic Trading Market in 2023 was valued at $17.0 billion.

By type, the stocks market segment held the highest market share in 2023.

By region, North America held the highest market share in terms of revenue in 2023.

The algorithmic trading market is expected to reach $65.2 billion by 2032.

The major players operating in the algorithmic trading market include Software AG, Metaquotes Software Corp., Argo SE, Tata Consultancy Services, Symphony Fintech Solutions Pvt Ltd., and Refinitiv Ltd.

Loading Table Of Content...