Allulose Market Summary

The global allulose market size was valued at $95.4 million in 2021, and is projected to reach $308.2 million by 2032, growing at a CAGR of 11.7% from 2022 to 2032.

Key Market Trends and Insights

Region wise, North America generated the highest revenue in 2021.

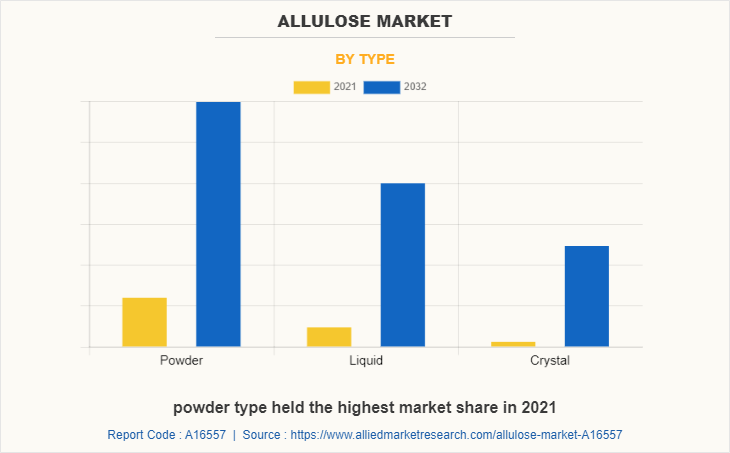

The global allulose market share was dominated by the powder segment in 2021 and is expected to maintain its dominance in the upcoming years

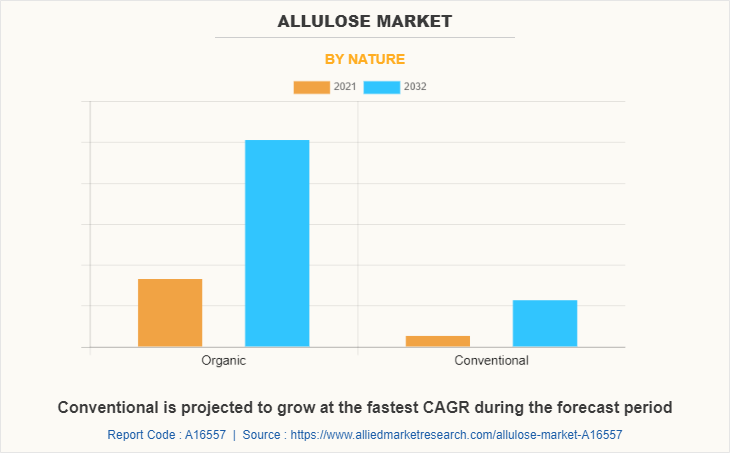

The organic segment is expected to witness the highest growth during the forecast

Market Size & Forecast

- 2021 Market Size: USD 95.4 Million

- 2032 Projected Market Size: USD 308.2 Billion

- Compound Annual Growth Rate (CAGR) (2022-2032): 11.7%

- North America: Generated the highest revenue in 2021

Market Dynamics

Allulose is a low-calorie sweetener and is derived from a variety of sources, including wheat and fruits such as jackfruit, figs, and raisins, making it an ideal natural sweetener for people trying to lose weight. The fact that allulose has numerous health benefits, such as maintaining blood sugar levels and reducing oxidative stress and inflammation, lowering the risk of chronic diseases such as arthritis and irritable bowel syndrome (IBS), is expected to increase the product demand.

Demand for functional ingredients such as allulose, which offers health benefits without sacrificing the flavor or sensory quality of food products, is increasing as the market for functional foods and convenience meals expand. In addition, a taste for wholesome and practical foods has risen owing to an increase in urbanization, a rise in living standards, and an increase in the number of working professionals with busy schedules. The market is expanding as a result of consumers' shifting lifestyles and rising health consciousness. Allulose is recognized as safe by the Food and Drug Administration and it is a great replacement for sugar. These factors are projected to drive the revenue growth of the allulose market growth during the forecast period.

The rise in the availability of low-cost synthetic items and customers’ limited purchasing power are two of the most significant factors hampering the market growth. In addition, not many people are aware of the benefits of plant-based allulose. These factors are anticipated to hamper the market share in the upcoming years.

Small and medium-sized businesses (SMEs) can profit from expensive allulose-based products such as flavorings, puddings, candies, dairy products, and others. In addition, many companies specialize in producing and marketing allulose-based goods. Therefore, these factors are projected to create several growth opportunities for the key players operating in the market in the upcoming years.

Segment Review

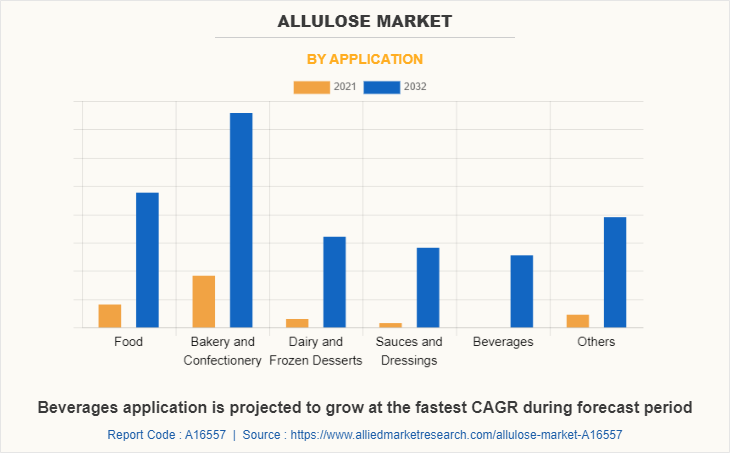

The allulose market is segmented on the basis of nature, type, application, and region. By nature, the market is divided into organic and conventional. By type, the market is classified into powder, liquid, and crystal. By application, the market is classified into food, bakery and confectionery, dairy and frozen desserts, sauces and dressings, beverages, and others. By region, the market is analyzed across North America, Asia-Pacific, and LAMEA.

By nature, the organic sub-segment dominated the market in 2021. The inclination of consumers to spend more on organic food has led to a positive impact on the demand for organic allulose products. As consumers are becoming more aware of organic products as they are derived in a chemical-free manner, it is anticipated to boost the market growth. Moreover, evolving lifestyles and changing trends in the food industry have also boosted the demand for healthy food ingredients. These are predicted to be the major factors affecting the allulose market during the forecast period.

By type, the liquid sub-segment dominated the global allulose market demand in 2021. An increase in demand for liquid allulose, consumer awareness about a healthy diet & nutritional food, and innovation in the allulose industry are the major factors that are expected to drive market growth during the forecast period. The busy lifestyle of consumers has boosted the adoption of the liquid form of allulose. Moreover, liquid allulose serves as an ideal diet supplement for the paleo diet to be used in shakes and various recipes. These factors are projected to drive the segment growth during the forecast period.

By application, the beverages sub-segment is anticipated to show the fastest growth during the forecast period. An increase in consumer awareness and their increasing interest in a healthy lifestyle have led to an increase in demand for healthy beverages. Considering consumers’ interests, companies are launching gluten-free, sugar-free ready-to-drink beverages. Furthermore, growing health awareness and demand for convenience food & beverages is anticipated to drive the segment growth during the forecast period.

By region, North America dominated the global market in 2021 and is projected to remain the fastest-growing region during the forecast period. In North America, the U.S. and Mexico are expected to drive the allulose market. For instance, in Mexico, consumer awareness regarding the benefits of natural sweeteners such as allulose derived from figs, wheat, corn, and others has grown rapidly. This is majorly owing to lifestyle changes, high obesity rates, and decreased physical activity. Therefore, Mexican people are opting for low-calorie alternatives that taste like sweetness for sugar. This factor is anticipated to drive the market share in the upcoming years. Similarly, in the U.S., allulose has been approved as a general-purpose sweetener that can be used in several food & beverages as it acts as an effective replacement for sucrose. High consumption of refined sugar increases the risk of heart disease, diabetes, and others. High sugar consumption also increases the risk of obesity. Hence, the popularity of sugar alternatives such as allulose which is low in calories and has the same sweetness as that of sugar is increasing rapidly in the U.S. The market is expected to grow significantly during the projected period, owing to an increase in demand for natural sweeteners from the region's food and beverage industry. The food and beverage market is likely to develop in the coming years, offering tremendous potential prospects for allulose providers. The regional market is expected to grow due to altering dietary preferences and greater consumer awareness about the importance of maintaining a healthy lifestyle.

Competitive Landscape

The key players profiled in allulose market report include Matsutani Chemical Industry Co. Ltd, Tate & Lyle PLC, CJ Cheil Jedang, Bonumose LLC, Cargill Inc, Ingredion Incorporated, Samyang Corporation, Anderson Global Group, Quest Nutrition, and Apura Ingredients.

Impact of COVID-19 on the Global Allulose Industry

- The COVID-19 pandemic has greatly affected various sectors including the food & beverage industry leading to delays in product approvals, closure of manufacturing units, supply chain constraints, and others. However, allulose which is an excellent sugar alternative has been positively impacted by the coronavirus pandemic.

- The growth of the allulose market during the pandemic can be attributed to rising health consciousness among people regarding food & beverage that they opt for healthier living. For instance, increase in the number of patients suffering from diabetes, hypertension, and heart failure is increasing significantly. According to the International Diabetes Federation (IDF), the number of people suffering from diabetes is estimated to reach 578 million by 2030.

- During the COVID-19 pandemic, it was observed that nearly two-thirds of the hospitalizations in the U.S. were linked to pre-existing health conditions namely diabetes, hypertension, heart failure, and others.

- Owing to the above-mentioned factors, health awareness regarding the consumption of natural sweeteners that are low in calories such as allulose has increased rapidly. Also, the approval received from the Food and Drug Administration (FDA) to promote allulose and its health benefits has provided significant growth opportunities for food manufacturers. These factors have led to a positive impact on the market during the COVID-19 pandemic.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the allulose market forecast, segments, current trends, estimations, and dynamics of the allulose market analysis from 2021 to 2032 to identify the prevailing allulose market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the allulose market segmentation assists to determine the prevailing market opportunity.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global allulose market trends, key players, market segments, application areas, and market growth strategies.

Allulose Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 308.2 million |

| Growth Rate | CAGR of 11.7% |

| Forecast period | 2021 - 2032 |

| Report Pages | 300 |

| By Nature |

|

| By Type |

|

| By Application |

|

| By Region |

|

| Key Market Players | quest nutrition, Matsutani Chemical Industry Co. Ltd., Apura Ingredients, Ingredion Incorporated, Anderson Global Group, Tate & Lyle PLC, Bonumose LLC, CJ Cheiljedang Corp., mcneil nutritionals, cargill |

Analyst Review

The consumption of allulose is increasing rapidly backed by changing consumer attitudes about healthier eating, rising health disorders mainly obesity, diabetes, hypertension, and heart failure, growing consumer awareness for substituting sugar and sugary products, and other factors. Furthermore, the rise in the number of natural sweeteners is gaining significant popularity as low-calorie sweeteners help in reducing the risk of chronic diseases. Allulose is present naturally in figs, raisins, and wheat owing to which it is organically derived without chemical synthesis. Also, the versatility of their applications within the food & beverage industry is one of the prominent factors responsible for the rising adoption of natural sweeteners. In addition, the introduction of new legislation and tax levies placed on sugar is projected to create significant opportunities for manufacturers that aim to reduce the demand for sucrose-based sugar products as consumers are cutting down on their sugar intake. Hence, re-formulating the products with natural and organic sweeteners such as allulose can help the food & beverage manufacturers in marketing their sugar-substitute products such as candies, jellies, beverages, and others. The number of mergers and acquisitions in the pharmaceutical sector has surged recently. Most established businesses are merging in order to strengthen their position in the market amid intense competition. The pharmaceutical sector is increasingly using allulose due to its detoxifying and anti-oxidation properties that help in reducing the risk of various diseases such as diabetes, obesity, and cardiovascular diseases. To maintain the sweetness in numerous cough syrups and vitamin supplements, allulose sugar is used. Owing to the abovementioned factors, the market is likely to experience robust growth in the coming years.

Among the analyzed regions, North America is expected to account for the highest revenue in the market by the end of 2031, followed by Asia-Pacific, and LAMEA. An increase in the prevalence of chronic diseases such as diabetes, obesity, and heart attacks in North America owing to high sugar consumption is estimated to drive the demand for allulose which is an excellent sugar alternative.

The global allulose market size was valued at $95.4 million in 2021, and is projected to reach $308.2 million by 2032

The global Allulose market is projected to grow at a compound annual growth rate of 11.7% from 2022 to 2032 $308.2 million by 2032

cargill, Apura Ingredients, Ingredion Incorporated, CJ Cheiljedang Corp., Matsutani Chemical Industry Co. Ltd., mcneil nutritionals, Tate & Lyle PLC, Anderson Global Group, Bonumose LLC, quest nutrition

By region, North America dominated the global market in 2021

Increase in the number of people suffering from obesity, extensive use of allulose by various manufacturers in the food and beverage industry for a variety of health supplements and beverages, and rapid inclination towards allulose among health-conscious individuals are expected to drive the growth of the global allulose market.

Loading Table Of Content...