Alpha Dextrin Market Research, 2034

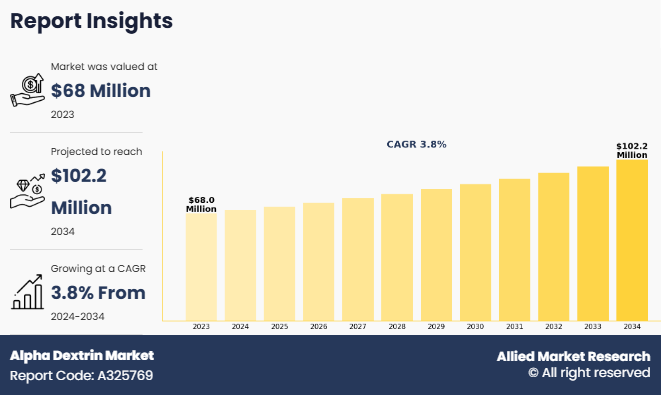

The global alpha dextrin market size was valued at $68 million in 2023, and is projected to reach $102.2 million by 2034, growing at a CAGR of 3.8% from 2024 to 2034. Alpha dextrin is a white, odorless, and tasteless polysaccharide produced through the enzymatic or acid hydrolysis of starch, primarily composed of glucose molecules connected by alpha (α) glycosidic bonds. It is a water-soluble carbohydrate known for its low viscosity and high digestibility, making it suitable for a variety of applications. In industrial use, alpha dextrin functions as a binding agent, filler, carrier, and stabilizer in sectors such as food and beverages, pharmaceuticals, and cosmetics. Its ability to encapsulate active ingredients and enhance the solubility and stability of compounds makes it especially valuable in functional and health-oriented product formulations.

Key Takeaways

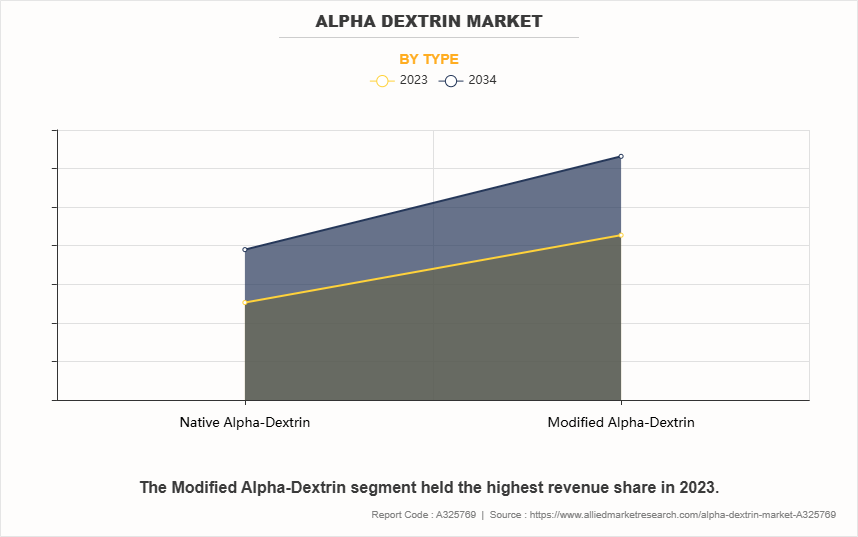

- By type, the modified-alpha dextrin segment dominated the alpha dextrin market in 2023.

- By application, the pharmaceutical segment dominated the alpha dextrin market in terms of revenue in 2023.

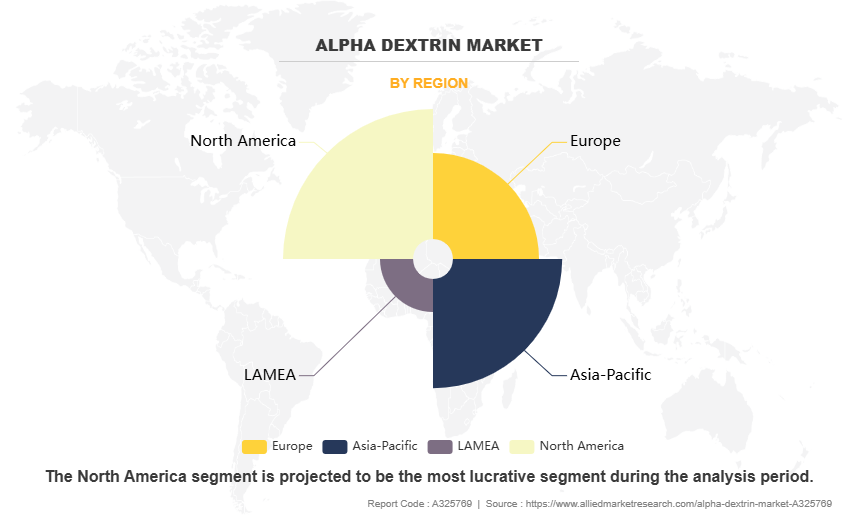

- By region, North America dominated the alpha dextrin market in terms of revenue in 2023. However, Asia-Pacific is anticipated to grow at the highest CAGR during the forecast period.

Market Dynamics

The expanding food processing industries across both developed and emerging economies is a significant driver for the alpha dextrin market. Manufacturers are increasingly seeking functional ingredients that enhance product stability, texture, and nutritional value as demand for processed, packaged, and convenience food continues to rise. alpha dextrin, with its versatile properties—such as water solubility, low viscosity, and ability to act as a stabilizer, carrier, and dietary fiber—is gaining traction as a valuable additive in a wide range of food applications, including beverages, bakery products, dairy items, and snacks. Moreover, its clean-label and plant-based nature aligns well with consumer trends favoring natural and transparent ingredients.

Rapid urbanization and rise in disposable incomes are fueling growth in the food processing sector, opening new opportunities for ingredient innovation in developing regions like Latin America, the Middle East, and parts of Asia and Africa. Food companies are also expanding their production capacities and investing in product reformulation to cater to evolving health-conscious preferences, further boosting the demand for ingredients like alpha dextrin. Additionally, the ability of alpha dextrin to encapsulate flavors, mask bitterness, and stabilize emulsions makes it attractive for new product development. The integration of multifunctional ingredients like alpha dextrin is projected to become essential for competitive differentiation with the evolution of the processed food industry.

However, limited awareness about alpha dextrin and its functional benefits remains a key restraint in the market, particularly in developing regions and among small- to mid-sized manufacturers. Alpha dextrin is not as widely recognized or understood as other starch derivatives or dietary fibers like maltodextrin or inulin despite its versatile applications in food, pharmaceuticals, and personal care. This lack of familiarity often results in reluctance in adoption, even when it could enhance product quality, stability, or health value. Many food and nutraceutical companies may continue to rely on conventional ingredients due to insufficient information on alpha dextrin's advantages, such as its solubility, prebiotic properties, and encapsulation capabilities.

Furthermore, end consumers are largely unaware of the presence or role of alpha dextrin in functional products, limiting pull demand in retail segments. The situation is further complicated by a shortage of targeted marketing and educational initiatives from producers and industry associations, which could help raise its profile. Without broader visibility and technical support to demonstrate its value across applications, potential users may overlook alpha dextrin in favor of better-known alternatives. This gap in awareness and technical knowledge slows down its adoption rate and could hinder alpha dextrin market growth despite the inherent functionality and wide-ranging potential of the compound.

Moreover, research and development (R&D) advancements are creating significant opportunities in the alpha dextrin market by unlocking new applications, improving production efficiency, and enhancing product performance. Innovative enzymatic processes and starch modification techniques have enabled more cost-effective and scalable production of alpha dextrin, making it accessible to a wider range of industries. These technological improvements are helping manufacturers develop high-purity, customizable grades of alpha dextrin tailored for specific uses in food, pharmaceuticals, cosmetics, and nutraceuticals. In the pharmaceutical and nutraceutical sectors, R&D is driving innovations in drug and nutrient delivery systems, where alpha dextrin serves as an effective carrier for bioactive compounds, improving their stability and absorption.

Similarly, in the food industry, R&D is expanding the use of alpha dextrin as a prebiotic fiber and fat replacer, meeting growing consumer demand for healthier, low-calorie alternatives. Additionally, advancements in microencapsulation and controlled-release technologies are opening up new possibilities in personal care and clinical nutrition products. These innovations not only enhance the functionality of alpha dextrin but also allow companies to differentiate their offerings in competitive markets. R&D efforts are expected to be a key tool in expanding the commercial potential of alpha dextrin across diverse sectors as research continues to highlight its versatility and health benefits.

The expanding number of pharmaceutical applications for alpha dextrin is considerably driving alpha dextrin market growth. Alpha dextrin, a cyclic oligosaccharide, is increasingly used in pharmaceutical formulations due to its high solubility, biocompatibility, and ability to improve the stability and bioavailability of active pharmaceutical ingredients (APIs). It functions as a drug carrier, encapsulating hydrophobic compounds to increase their water solubility, allowing for more efficient drug administration. This feature is very useful in the formulation of poorly water-soluble medicines, a major difficulty in current drug research.

Alpha dextrin is also employed in controlled-release medication delivery systems, as well as to stabilize delicate chemicals like vitamins and enzymes. An increasing need for novel drug delivery technologies, combined with increased R&D investments and regulatory assistance to advanced excipients, is accelerating their adoption. As the pharmaceutical industry seeks safer and more efficient delivery systems, alpha dextrin's position as a multifunctional excipient is predicted to expand, significantly contributing to increase of alpha dextrin market demand.

Regulatory hurdles are considerably impeding the development of the alpha dextrin industry, particularly given the complex and changing worldwide compliance landscape. While alpha dextrin has been designated as Generally Recognised as Safe (GRAS) for particular uses in the United States, the Food and Drug Administration (FDA) has just launched a new post-market assessment system for food chemicals. This paradigm increases scrutiny and perhaps increases compliance obligations for food makers and chemical suppliers, indicating a move towards more stringent safety assessments for food components that were previously deemed low-risk. Furthermore, the FDA's actions suggest that GRAS notifications, particularly those without strong scientific support, may be reevaluated, which might influence the alpha dextrin approval process.

In Canada, Health Canada has suggested that alpha-cyclodextrin be used as an emulsifying, stabilizing, or thickening ingredient in foods. However, the proposed product will require a premarket evaluation to assure safety and efficacy, and producers must fulfill food-grade criteria outlined in the Food and Drug Regulations or the Food Chemicals Codex. This adds another degree of compliance with regulation for organizations who want to commercialize alpha dextrin in Canada.

The European Union adds regulatory difficulties, with its formalized legal framework and detailed advice sometimes perceived as time-consuming and rigid, particularly for introducing new ingredients to the market. The EU's rigorous rules may delay the licensing and commercialization of alpha dextrin, limiting its market expansion in the area.

Furthermore, inconsistencies in ingredient categorization and approval processes among jurisdictions result in a fragmented regulatory framework. While alpha dextrin is permitted for usage in one jurisdiction, it may still be undergoing review or regulated by differing laws in another, impeding international commerce and market development. This fragmentation requires producers to traverse a complicated web of regulatory regulations, which may be time-consuming and costly.

Overall, the alpha dextrin market confronts substantial regulatory obstacles that limit its expansion. The increased scrutiny from regulatory agencies such as the FDA, the strict premarket evaluations in Canada, the rigid regulatory framework in the EU, and the fragmented global regulatory environment all contribute to the market's limited development. Manufacturers must commit significant efforts to maintain compliance across several jurisdictions, which may discourage new competitors and slow the pace of advancement in the alpha dextrin industry.

Segmental Overview

The alpha dextrin market is segmented into type, application, and region. On the basis of type, the market is categorized into native alpha-dextrin and modified alpha-dextrin. On the basis of application, the market is divided into food, pharmaceutical, industrial, cosmetics, and animal nutrition. Region-wise, the alpha dextrin market is analyzed across North America (U.S., Canada and Mexico), Europe (France, Germany, Italy, Spain, UK, Russia and Rest of Europe), Asia-Pacific (China, Japan, India, South Korea, Australia, Thailand, Malaysia, Indonesia, and Rest of Asia-Pacific) and LAMEA (Brazil, South Africa, Saudi Arabia, UAE, Argentina and Rest of LAMEA)

By Type

By type, the modified alpha dextrin segment garnered highest alpha dextrin market size in 2023 and is anticipated to maintain its dominance during the forecast period owing to its enhanced functional properties, such as improved solubility, stability, and controlled-release capabilities. These attributes make it highly suitable for advanced applications in pharmaceuticals, nutraceuticals, and functional food. Modified alpha dextrin is preferred for its ability to encapsulate sensitive ingredients, mask unpleasant tastes, and improve bioavailability. Its versatility in formulating specialized products gives it a competitive edge over native forms. The segment is expected to retain its lead during the forecast period with ongoing innovations and rising demand for high-performance ingredients.

By Application

By source, the pharmaceutical segment garnered highest alpha dextrin market share in 2023 and is anticipated to maintain its dominance during the alpha dextrin market forecast period. Its ability to enhance the bioavailability of active pharmaceutical ingredients (APIs) and protect them from degradation makes it highly valuable in tablets, capsules, and liquid drug forms. In addition, alpha dextrin is non-toxic, biocompatible, and exhibits excellent encapsulation properties, which are essential in controlled-release and targeted drug delivery systems. The demand for functional excipients like alpha dextrin is expected to remain strong as pharmaceutical companies continue to innovate in formulation technologies, securing the dominance of the segment during the forecast period.

By Region

Region wise, North America dominated the market in 2023 and is anticipated to maintain its dominance during the forecast period. North America is driven by its well-established food and pharmaceutical industries, robust research and development infrastructure, and growing demand for functional food ingredients and excipients. The region's dominance is supported by the presence of key manufacturers, advanced processing technologies, and a strong regulatory framework that promotes innovation while ensuring product safety and quality. In the food industry, alpha dextrin is widely used for its excellent solubility, stability, and emulsifying properties, catering to the increasing consumer preference for health-oriented and clean-label products.

Competition Analysis

Players operating in the alpha dextrin market have adopted various developmental strategies to expand their alpha dextrin market share, increase profitability, and remain competitive in the market. Key players profiled in this report include Glentham Life Sciences, Sigma Aldrich, Wacker Chemie AG, Chem-Impex International, Fengchen Group Co., Ltd., Aogu Biotech, Cavcon, Zhishang Chemical, Thermo Fisher Scientific Inc. and Cayman Chemical.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the alpha dextrin market analysis from 2023 to 2034 to identify the prevailing alpha dextrin market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the alpha dextrin market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global alpha dextrin market trends, key players, market segments, application areas, and market growth strategies.

Alpha Dextrin Market Report Highlights

| Aspects | Details |

| Market Size By 2034 | USD 102.2 million |

| Growth Rate | CAGR of 3.8% |

| Forecast period | 2023 - 2034 |

| Report Pages | 238 |

| By Type |

|

| By Application |

|

| By Region |

|

| Key Market Players | Chem-Impex International, Aogu Biotech, Wacker Chemie AG, Cavcon, Glentham Life Sciences, Cayman Chemical Company, Sigma Aldrich, Fengchen Group Co., Ltd., Thermo Fisher Scientific Inc., Zhishang Chemical |

Analyst Review

The global alpha-dextrin market is witnessing steady growth, supported by increasing demand across key end-use industries such as food & beverages, pharmaceuticals, and cosmetics. In line with broader trends in the dextrin market, the surge in demand for functional and clean-label ingredients is a major growth driver for alpha-dextrin, particularly in emerging economies like India and China where food processing and pharmaceutical sectors are expanding rapidly.

As modern lifestyles lead consumers to favor convenience, there is a growing shift toward packaged and ready-to-eat food, prompting manufacturers to adopt advanced formulations using functional ingredients like alpha-dextrin for improved texture, stability, and health benefits. In addition, the rise of functional food and nutraceuticals—products aimed at providing specific health benefits—has significantly increased the use of alpha-dextrin for its soluble fiber content and encapsulation properties.

The rise in popularity of organic and non-GMO ingredients has also increased interest in organic alpha-dextrin, particularly among health-conscious consumers. Produced from organic tapioca starch using non-GMO enzymatic treatment, organic alpha-dextrin aligns with the clean-label and sustainable product trends gaining momentum globally. However, potential side effects associated with dextrin consumption, such as bloating or digestive discomfort, are anticipated to limit its use in certain applications. Despite these concerns, increase in consumer awareness of health benefits, combined with rapid industrialization and product innovation in developing regions, is expected to propel the the growth of the alpha-dextrin market during the forecast period.

The alpha dextrin Market registered a CAGR of 3.8% from 2024 to 2034.

Raise the query and paste the link of the specific report and our sales executive will revert with the sample.

The forecast period in the alpha dextrin Market report is from 2024 to 2034.

The top companies that hold the market share in the alpha dextrin Market include Arla Foods Amba, The Bel Group, Fonterra Co-operative Group Limited, The Kraft Heinz Company, Groupe Lactalis S.A, and others.

The alpha dextrin market was valued at $68,000.0 thousand in 2023 and is estimated to reach $102,156.7 thousand by 2034, exhibiting a CAGR of 3.8% from 2024 to 2034.

The alpha dextrin Market report has 2 segments. The segments are type and application

The emerging region in the alpha dextrin Market are likely to grow at a CAGR of more than 4.0% from 2024 to 2035.

North America will dominate the alpha dextrin Market by the end of 2034.

Loading Table Of Content...

Loading Research Methodology...