Aluminum Door And Window Market Size & Forecast, 2031

The global Aluminum Door And Window Market size was valued at $55.8 billion in 2021, and is projected to reach $82.1 billion by 2031, growing at a CAGR of 3.8% from 2022 to 2031. Doors are movable panels that offer a temporary barrier in the doorway between the two enclosures of a house or a building. A window is an opening in a wall to offer cross ventilation and ambient light. It comprises of a window panel and supporting frames. Aluminum door and window typically consist of aluminum frames in combination with mesh, panels, and glass.

Aluminum Door And Window Market Dynamics

For instance, Alteza Aluminum Windows and Doors, a leading provider of aluminum door and window provider, offers customized doors and windows to commercial and non-commercial users. In addition, product launch also helps manufacturers to enhance its market position. For instance, in September 2020, Fenesta Building Systems, a provider of aluminum door and window, introduced ultra-luxury aluminum windows and doors for both, non-residential and residential use.

The novel coronavirus rapidly spread across various countries and regions, causing an enormous impact on the lives of people and the overall community. It began as a human health condition and later became a significant threat to the global trade, economy, and finance. The COVID-19 pandemic halted the production of many components of aluminum door and window due to lockdowns. The economic slowdown initially resulted in reduced spending on various building residential and non-residential building construction projects. However, owing to the introduction of various vaccines, the severity of the COVID-19 pandemic has significantly reduced. As of mid-2022, the number of COVID-19 cases have diminished significantly. This has led to the full-fledged reopening of aluminum door and window market manufacturing companies at their full-scale capacities. Furthermore, it has been more than two years since the outbreak of this pandemic, and many companies have already shown notable signs of recovery.

In addition, the durability of aluminum door and window, along with easy and cost-effective maintenance is expected to drive their demand. Furthermore, the increased focus on sustainability has significantly boosted the use of aluminum door and window, since it has a lower carbon-footprint. This is anticipated to drive the aluminum door and window market growth.

Aluminum Door And Window Market Segmental Overview

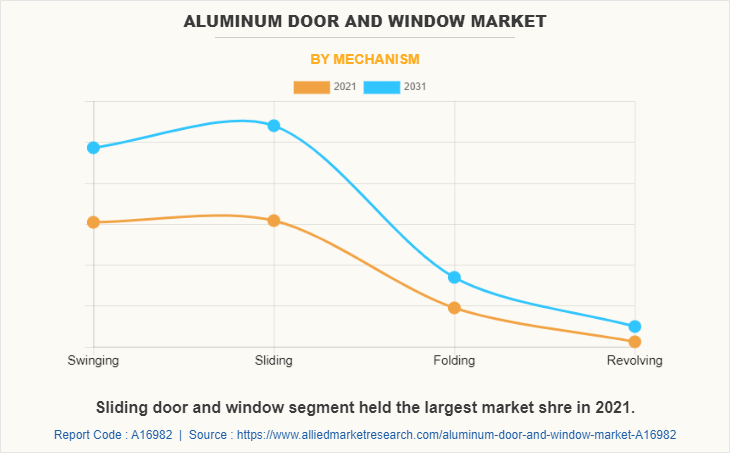

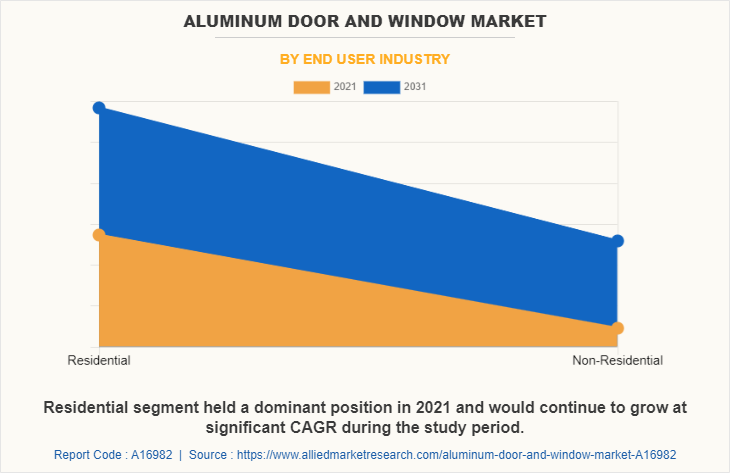

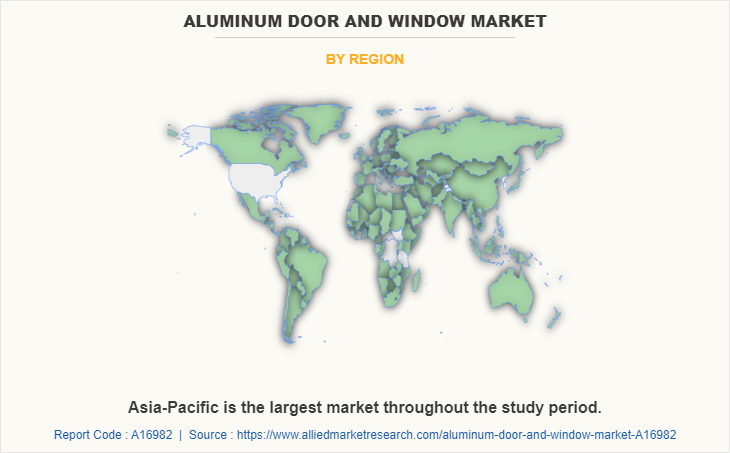

The aluminum door and window market is segmented into Product Type, Mechanism and End User Industry. By product type, the market is bifurcated into door and window. On the basis of mechanism, the market is categorized into swinging, sliding, folding, and revolving. And, on the basis of end user, it is categorized into residential and non-residential. Region-wise, the Aluminum window and door market is analyzed across North America, Europe, Asia-Pacific, and LAMEA. Asia-Pacific held the largest aluminum door and window market share in 2021, accounting for the highest share, and is anticipated to maintain this trend during the forecast period. This is attributed to increase in spending building construction projects for residential and non-residential purpose.

Competition Analysis

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the aluminum door and window market analysis from 2021 to 2031 to identify the prevailing aluminum door and window market opportunity.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the aluminum door and window market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global aluminum door and window market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the aluminum door and window market players.

- The report includes the analysis of the regional as well as global aluminum door and window market trends, key players, market segments, application areas, and aluminum door and window industry growth strategies.

Aluminum Door And Window Market Report Highlights

| Aspects | Details |

| By Product Type |

|

| By Mechanism |

|

| By End User Industry |

|

| By Region |

|

| Key Market Players | Bradnam's Windows & Doors, Ply Gem Holdings Inc., Geeta Aluminium Co. Pvt. Ltd., Hume Doors & Timber Pty Ltd, AluPure, ykk ap inc., JELD-WEN, Inc., andersen corporation, Apogee Enterprises Inc., Rustica hardware, marvin windows and doors, Alumil, PGT Innovations, Inc., Contractors Wardrobe, Inc., fenesta building systems, Pella Corporation, Fletcher Building Limited |

Analyst Review

The aluminum door and window market has witnessed significant growth in past few years, owing to surge in spending on building construction activities.

The rise in trend of home remodeling activities, especially in high income countries in the regions of North America and Europe, has fueled the demand for aluminum doors and windows. In addition, rise in urbanization is positively influencing the residential building construction sector; thereby increasing the demand in the aluminum doors and windows market. The aluminum door and window market experiences a significant demand in tropical regions, such as Latin America and southern Asia owing to the fact that aluminum doors and windows are more durable to moisture and humidity. Furthermore, the global tourism sector is driving the demand for construction of highly elegant guests’ accommodations, which in turn, drives the demand for high-end aluminum doors and windows.

By product type, the door segment, and by mechanism type, the swinging segment are widely installed by homeowners and building developers. It is also estimated that the residential sector is expected to grow at a significant CAGR.

Moreover, the concept of sustainable development is becoming the focus area of everyone across the globe; thus, driving the demand for products having lower carbon foot print. Aluminum is one of such materials, having low carbon-footprint. Doors and windows made of aluminum are recyclable, long lasting, and are easy to maintain. Therefore, rise in demand for sustainable products is anticipated to provide lucrative opportunities for the market growth

Development of cost efficient aluminum door and windows is a major upcoming trend in the market.

Aluminum doors and windows are extensively used in new building projects as well as home remodeling projects, owing to its aesthetic appearance and long serving life.

Asia-Pacific is the largest regional market for Aluminum Door And Window.

$55,839.1 Million is the estimated industry size of Aluminum Door And Window.

Alumil, Andersen Corporation, Apogee Enterprises Inc., Bradnam's Windows & Doors, Contractors Wardrobe, Inc. and Fenesta Building Systems are some of the top companies to to hold the market share in Aluminum Door And Window.

Based on product type, the door holds the maximum market share of the Aluminum Door And Window in 2021.

The company profile has been selected on factors such as geographical presence, market dominance (in terms of revenue and volume sales), various strategies and recent developments.

The Aluminum Door And Window is projected to reach $ 82,098.6 million by 2031.

Loading Table Of Content...