Anti-Money Laundering Software Market Overview

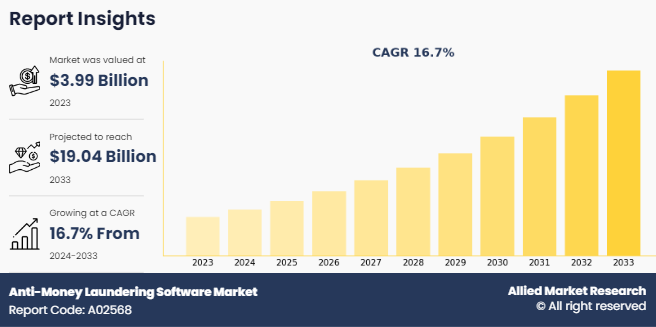

The global anti-money laundering software market size was valued at USD 4 billion in 2023, and is projected to reach USD 19 billion by 2033, growing at a CAGR of 16.7% from 2024 to 2033.

Anti-money laundering (AML) software supports the need for compliance with the increasingly stringent regulations set by regulatory authorities and is utilized in the financial sector and other fields that are connected to it. The AML software market conserves time, money, and resources through the automation of compliance procedures including the detection and reporting of questionable behavior. It prevents or identifies abnormal behavior, lessens false positives, and helps businesses report suspicious transactions accurately.

Key Market Insights

- By deployment, the cloud segment is projected to attain the highest CAGR during the forecast period.

- By component, the services segment is projected to attain the highest CAGR during the forecast period.

- By region, the Asia-Pacific is projected to attain the highest CAGR during the forecast period.

Market Size & Forecast

- 2033 Projected Market Size: USD 19 Billion

- 2023 Market Size: USD 4 Billion

- Compound Annual Growth Rate (CAGR) (2024-2033): 16.7%

The integration of cloud computing and the Internet of Things (IoT) offers significant benefits for businesses and consumers by enhancing data accessibility, real-time analytics, and operational scalability. In the anti-money laundering (AML), this combination enables organizations to monitor large volumes of transactions in real-time, identify suspicious activities, and ensure compliance with regulatory requirements more efficiently. The AML software market combines and deciphers several data points in transaction messages for each client, including the sender and receiver's names, and determines whether either is on any sanction's lists. In addition, the use of advanced technology in conjunction with the IoT can help to improve data management and analytics, as well as provide businesses with a better understanding of their products. Such enhanced factors are expected to provide lucrative opportunities for market growth during the forecast period.

Furthermore, an increase in the use of cutting-edge technologies, increased need for intelligent financial systems, and expanding digitalization are all contributing to the market's expansion. Moreover, the market is anticipated to expand throughout the projected period due to rise in internet service use and developments in AI technology. It is also anticipated that the adoption of cloud computing will enable the scalability, flexibility, and cost-effectiveness of banking systems, as well as the development of machine learning and other advanced technologies to enable real-time data processing and reduce latency.

On the other hand, the rise in online payment modes in bank transactions and rise in adoption of internet solutions are the key factors that are expected to drive the growth of the market in the future. The increase in strict regulations and compliance with anti-money laundering propels global market growth. However, high initial cost and expense considerations are expected to hamper market growth. The lack of consumer knowledge and awareness can deter businesses from adopting these technologies. Furthermore, the surge in integration of advanced technologies is one of the major factors creating numerous opportunities for the market. Moreover, the growing adoption of analytics solutions is expected to offer remunerative opportunities for the expansion of the global market during the forecast period.

The report focuses on growth prospects, restraints, and trends of the anti-money laundering software market analysis. The study provides Porter’s five forces analysis to understand the impact of various factors, such as the bargaining power of suppliers, competitive intensity of competitors, threat of new entrants, the threat of substitutes, and bargaining power of buyers, on the anti-money laundering software market.

AML Software Market Segment Review

The anti-money laundering software market size is segmented into component, product type, deployment, organization size, end user, and region. On the basis of component, it is bifurcated into software and services. By product type, the market is divided into transaction monitoring, KYYC/CDD & sanction screening and cash management & reporting. By deployment, it is segmented into cloud and on-premise. By organization size, the market is classified into large enterprises and small & medium-sized enterprises. By end user, the market is classified into banks & financial institutes, insurance, and gaming & gambling. Region wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

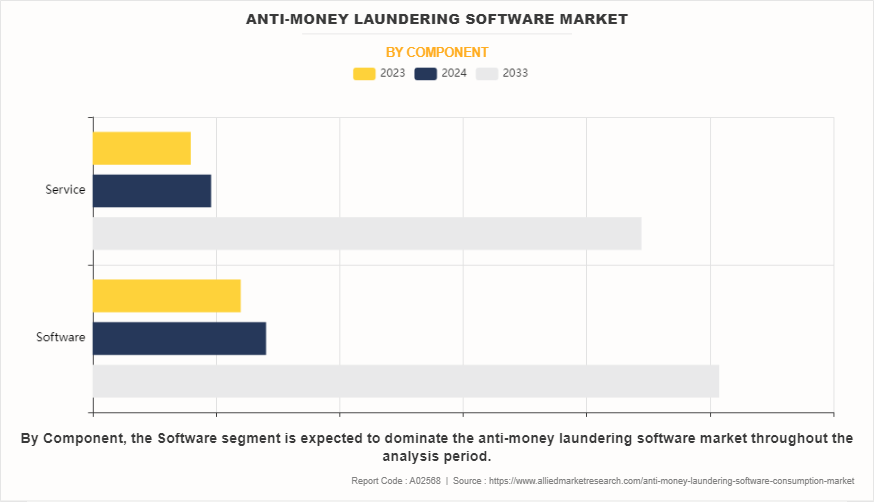

On the basis of component, the software segment dominated the anti-money laundering software industry in 2023, as financial institutions and organizations are increasingly adopting AML software market to meet stringent regulatory requirements related to anti-money laundering and combating financial crimes. However, the services segment is projected to attain the highest CAGR during the forecast period, as organizations are increasingly seeking tailored AML solutions that meet specific regulatory and compliance needs. As a result, demand for professional services like implementation, customization, and training is growing.

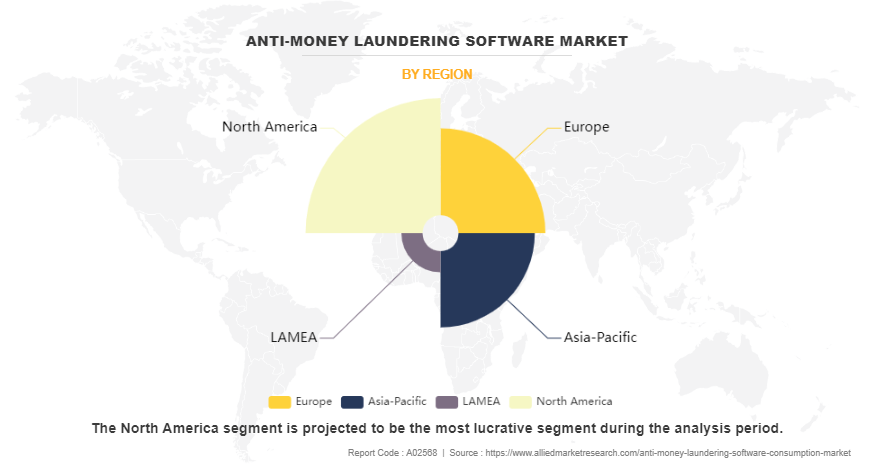

By region, North America dominated the market share in 2023, driven by the region's well-established gaming infrastructure, widespread adoption of digital technologies, and a large base of anti-money laundering software enthusiasts. However, the Asia-Pacific is projected to attain the highest CAGR during the forecast period. This growth is driven by the increasing popularity of anti-money laundering software in countries like China, South Korea, and Japan, where security culture is deeply embedded. The region is also witnessing significant investments in security infrastructure.

What are the Top Impacting Factors in AML Software Market

Driver

Rise in Online Payment Modes in Bank Transactions

The rising trend of online payment options in the BFSI sector to improve optimization is directly influencing the growth of the global anti-money laundering software market. Radical advancements in the payment environment, enabled through communication technologies, require revising present business models and maintenance strategies. Consequently, online payment systems are gaining significant adoption to increase the use of IT and control systems among banking operators, particularly IoT and other digital technologies. As per Barclays, in February 2023, nearly 91.2 % of all eligible card transactions were initiated using digital payments in 2022.

In addition, the increased use of IoT and digital solutions helps finance managers improve payment availability, extend asset lifespans, and enable technical staff to carry out maintenance activities more effectively and proactively. These factors are expected to contribute to the increased installation of anti-money laundering software market opportunity, globally.

Furthermore, the integration of digital payments solutions allows reducing the transaction time and prioritizing of banking maintenance tasks. In addition, the integration of automated systems in payment operations has reduced the rate of errors, such as system errors, as well as improper card detection. Hence, these multiple benefits offered by digital payments used in payment operations and maintenance services will boost the growth of anti-money laundering software market forecast.

Moreover, businesses are continuously involved in promoting digitalization in banking operations. For instance, in May 2023, Quantexa partnered with ING; the collaboration aims to strengthen ING’s risk detection and investigative efforts by utilizing Quantexa’s Decision Intelligence Platform. Such strategies pooling in the securing the payment infrastructure will fuel the demand for anti-money laundering software, which in turn, augment the market growth on a global scale.

Restraint

Lack of Consumer Knowledge and Awareness

The lack of necessary digital knowledge and awareness about payment systems further limits the global anti-money laundering software market trends. There is a possibility that most customers are not entirely aware of the advantages and services that online banking provides. Consumers may not be aware of the benefits of online banking over conventional banking techniques in terms of ease, accessibility, and cost savings. Without an upfront understanding of these advantages, customers can be hesitant to use online banking, which is expected to restrict the global market expansion. In addition, concerns regarding the security of data and payments are rising due to the rising volume of data generation on internet of things (IoT) devices.

Further, the increased use of IoT, in particular for networking of a large number of projects, has given rise to new threats and hazards associated with IT security. Which in turn restricts consumers from adopting digital payment options and further limits the market growth. Moreover, trust difficulties can occur as a result of consumers' lack of understanding of the security practices and procedures used by banks for online banking. Thus, a lack of knowledge and awareness between consumers about financial operations and other confidential information causes unethical privacy, which is hindering the anti-money laundering software market growth.

Opportunity

Growth in Adoption of Analytics Solutions

The constantly growing technological advancements and emerging technologies such as several analytical technologies further provide lucrative opportunities for the growth of the global anti-money laundering software market. In addition, analytics plays a crucial role in enhancing the effectiveness of AML software industry and helping financial institutions and other organizations combat money laundering and financial crimes more efficiently. Moreover, banking institutions, processing firms, technology businesses, and merchants have an opportunity to provide advanced payment solutions and capitalize on the expanding market for cashless transactions because of the wide availability of analytics-based payment solutions. Such aforementioned measures are expected to provide numerous opportunities for the global anti-money laundering software market.

Furthermore, analytics solutions, particularly advanced data analytics and machine learning algorithms, can analyze vast amounts of transactions and customer data in real-time, which has propelled the analytics technology growth in the global AML software industry. Additionally, analytics can help financial institutions assess the risk associated with specific transactions or customers. The businesses are incorporating various strategies such as product launch, partnership.

Which are the Leading Companies Anti-Money Laundering Software

The following are the leading companies in the market. These major players have adopted various key development strategies such as business expansion, new product launches, and partnerships, which help to drive the growth of the anti-money laundering software market globally.

LexisNexis Risk Solutions

Thomson Reuters Corporation

HyperVerge Technologies Private Limited

Moody’s Corporation

SAS Institute Inc.

Eastnets Holding Ltd.

ACI Worldwide, Inc.

NICE Actimize

IMTF

Verafin Solutions ULC.

Recent Developments in Anti-Money Laundering Software Industry

In June 2023, Google Cloud launched Anti Money Laundering AI (AML AI), an artificial intelligence (AI)-powered product designed to help global financial institutions more effectively and efficiently detect money laundering.

Anti-Money Laundering Software Market Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 19 billion |

| Growth Rate | CAGR of 16.7% |

| Forecast period | 2023 - 2033 |

| Report Pages | 370 |

| By Component |

|

| By Product Type |

|

| By Deployment |

|

| By Organization Size |

|

| By End-User |

|

| By Region |

|

| Key Market Players | NICE Actimize, HyperVerge Technologies Private Limited, ACI Worldwide, Inc., Eastnets Holding Ltd., IMTF, Moody’s Corporation, Verafin Solutions ULC, LexisNexis Risk Solutions, Thomson Reuters Corporation, SAS Institute Inc. |

Analyst Review

The anti-money laundering software industry continues to evolve. CXOs are evaluating the opportunities and challenges regarding this emerging technology. Decision-making is an important aspect of every organization including the BFSI sector. A combination of digital technologies with analytical methods can provide the best result in achieving better decision-making. In addition, IT infrastructure transformation is one of the main advantages of anti-money laundering software. Such factors are expected to provide lucrative opportunities for market growth during the forecast period.

Furthermore, anti-money laundering software can enable innovation and collaboration by providing an open and modular architecture that allows developers and partners to build and integrate new applications and services. However, businesses also recognize the challenges associated with anti-money laundering software. One significant restraint is that anti-money laundering software requires a large number of investments in infrastructure, high-speed internet capabilities, and expertise, which can be a limitation to entry for small-scale enterprises.

Furthermore, data privacy and security-related privacy and regulatory problems must be addressed. Businesses must deliver services in accordance with the unique demands and specifications of their organization, considering elements like scalability, dependability, and cutting-edge security. By addressing these challenges, businesses can unlock the full potential of anti-money laundering software market to transform their payment operations, create value, and gain a competitive advantage in their industry. For instance, in June 2023, Google Cloud launched Anti Money Laundering AI (AML AI), an artificial intelligence (AI)-powered product designed to help global financial institutions more effectively and efficiently detect money laundering.

The Anti-Money Laundering (AML) market has been evolving rapidly, driven by advancements in technology, increasing regulatory requirements, and the growing complexity of financial crime.

Software is the leading component of the Anti-Money Laundering Software Market.

North America will be the largest regional market for Anti-Money Laundering Software in 2023.

$19 billion is the estimated industry size of Anti-Money Laundering Software in 2033.

LexisNexis Risk Solutions, Thomson Reuters Corporation, HyperVerge Technologies Private Limited, Moody’s Corporation, SAS Institute Inc., Eastnets Holding Ltd., ACI Worldwide, Inc., NICE Actimize, IMTF, and Verafin Solutions ULC. are the top companies to hold the market share in Anti-Money Laundering Software

Loading Table Of Content...

Loading Research Methodology...