Anti-Rheumatics Market Share and Trends

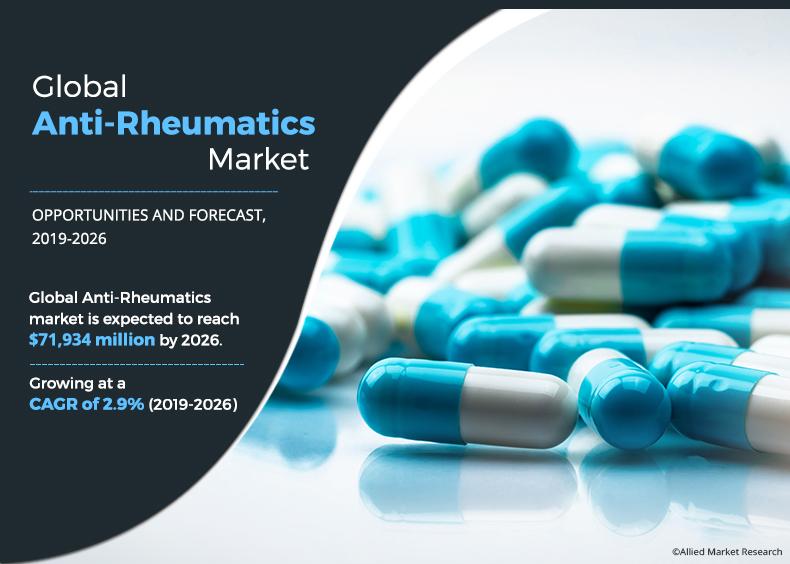

The global anti-rheumatics market size accounted for $57,229 million in 2018 and is expected to reach $71,934 million by 2026, registering a CAGR of 2.9% from 2019 to 2026. Rheumatoid arthritis is a medical condition, which is marked by the presence of warm, swollen, and painful joints. The condition mostly affects both wrists and hands of a person. This medical condition is associated with pain, which worsens over time. The treatment for this condition is achieved by using different drugs, which are known as anti-rheumatics. Furthermore, these drugs are also used to modify the course of the medical condition. For instance, disease-modifying anti-rheumatics drugs are a type of anti-rheumatics drugs that slow down the progression of this disease. Moreover, drugs such as non-steroidal anti-inflammatory drugs are also used in the treatment for rheumatoid arthritis.

The major factors that fuel the growth of the global anti-rheumatics market include rise in incidence of rheumatoid arthritis and surge in geriatric population across the globe. In addition, increase in incidence of obesity worldwide is another major factor that drives the growth of the anti-rheumatics market. However, side effects associated with the medication and higher cost of biologics & biosimilars restrain the growth of the market. On the contrary, developments in the field of biosimilars and novel biologics are anticipated to offer profitable opportunities for the growth of the anti-rheumatics market.

Anti-rheumatics Market Segmentation

The anti-rheumatics market size is studied on the basis of drug class, type, and region to provide a detailed assessment of the market. On the basis of drug class, it is divided into disease modifying anti-rheumatics drugs (DMARD's), nonsteroidal anti-inflammatory drugs (NSAID's), corticosteroids, uric acid drugs, and others. By type, it is divided into prescription-based drugs and over-the-counter drugs. By region, the anti-rheumatics market size is analyzed across North America (the U.S., Canada and Mexico), Europe (Germany, France, the UK, Italy, Spain, and rest of Europe), Asia-Pacific (China, Japan, India, Australia, South Korea, and rest of Asia-Pacific), and LAMEA (Brazil, South Africa, and rest of LAMEA).

Segment Review

According to drug class, the disease modifying anti-rheumatics drugs occupied the largest anti-rheumatics market share in 2018, owing to their action on the medical condition. For instance, DMARDs act on the underlying medical condition rather than acting on the symptoms. Furthermore, the nonsteroidal anti-inflammatory drugs segment is expected to register the fastest growth during the forecast period, owing to the surge in incidences of rheumatoid arthritis associated with pain in the joints.

By Drug Class

Disease Modifying Anti-rheumatic Drugs segment holds a dominant position in 2018 and would continue to maintain the lead over the forecast period.

By type, the prescription-based drugs segment occupied the largest share, owing to rise in the number of specialized hospitals worldwide as the medical condition requires treatment from a specialized medical professional. Furthermore, the over-the-counter drugs segment is expected to exhibit the fastest growth rate during the forecast period, owing to surge in awareness related to treatment options available for rheumatoid arthritis. Moreover, easy availability of NSAIDs over-the-counter is another major factor that contributes to the growth of the anti-rheumatics market.

By Type

Prescription based drugs segment holds a dominant position in 2018 and would continue to maintain the lead over the forecast period.

By region, North America accounted for the major anti-rheumatics market share in 2018 and is expected to continue this trend owing to, easy availability of the anti-rheumatics. Moreover, surge in geriatric population in the region is another major factor that fuels the growth of anti-rheumatics market in North America. On the other side, Asia-Pacific is estimated to register the fastest growth during the forecast period, owing to surge in awareness related to the use of anti-rheumatics. The constantly evolving life science industry drives the growth of the market in the developing economies such as India, China, and Malaysia.

By Region

Asia-Pacific region would exhibit the highest CAGR of 3.7% during 2019-2026.

The global anti-rheumatics market is highly competitive and the prominent players in the market have adopted various strategies to garner maximum market share. These include collaboration, product launch, partnership, and acquisition. Major players operating in the market include Pfizer, Inc., Johnson & Johnsons, Bristol-Myers Squibb Company, F. Hoffmann-La Roche Ltd., Celegene Corporations, MedImmune, LLC, Takeda Pharmaceutical Company Ltd., Biogen Inc., Celltrion Inc., and Amgen Inc.

Key Benefits for Stakeholders:

- This report entails a detailed quantitative analysis along with the current global anti-rheumatics market trends from 2019 to 2026 to identify the prevailing opportunities along with the strategic assessment.

- The anti-rheumatics market forecast is studied from 2019 to 2026.

- The market size and estimations are based on comprehensive analysis of key developments in the industry.

- A qualitative analysis based on innovative products facilitates strategic business planning.

- The development strategies adopted by the key market players are enlisted to understand the competitive scenario of the market

Anti-Rheumatics Market Report Highlights

| Aspects | Details |

| By Drug Class |

|

| By Type |

|

| By Region |

|

| Key Market Players | F. HOFFMANN-LA ROCHE LTD., Amgen Inc., Novartis AG, Merck & Co., Inc, Eli Lilly And Company, Pfizer Inc., AbbVie Inc., UCB S.A., BRISTOL-MYERS SQUIBB COMPANY, Johnson & Johnson |

Analyst Review

Rheumatoid arthritis is a chronic inflammatory medical condition in which the body’s immune system attacks its own tissues such as joints. This leads to painful swelling in the joints of a patient. The drugs used for the treatment of rheumatoid arthritis are called anti-rheumatics. Furthermore, there are different types of drugs that are used to treat this condition. For instance, disease modifying anti-rheumatic drugs are employed to modify the course of the medical condition. Similarly, other types of drugs such as nonsteroidal anti-inflammatory drugs are employed to treat the pain associated with the condition.

The utilization of anti-rheumatics has witnessed a significant growth, owing to surge in incidences of rheumatoid arthritis. The other factors that propel the utilization of different anti-rheumatics include increase in geriatric population across the globe, as the medical condition is more predisposed in elderly patients. Conversely, high price of the biologicals is a major factor that hinders the growth of the market. Whereas, surge in awareness related to the use of anti-rheumatics is expected to present lucrative opportunities for the key players during the forecast period.

The total market value of Anti-Rheumatics market is $57228.5 million in 2018.

The forcast period for Anti-Rheumatics market is 2019 to 2026

The market value of Anti-Rheumatics market in 2019 is $58888.1 million

The base year is 2018 in Anti-Rheumatics market

The top companies such as, Eli Lilly And Company, Abbvie Inc., Pfizer Inc., UCB S.A., and Johnson & Johnson, held a high market position in 2018. This is due to the strong geographical presence of these key players across the globe.

Nonsteroidal anti-inflammatory drug segment is the most influencing segment growing in the Anti-Rheumatics market. This is due to the role NSAIDs play in in managing joint pain in the patients suffering from rheumatoid arthritis.

The key trend in the Anti-Rheumatics market is the rise in prevalence of rheumatoid arthritis across the globe. This leads to surge in demand for anti-rheumatics required for the treatment of rheumatoid arthritis which in turn fuels the growth of the market.

Asia-Pacific has the highest growth rate in the market which is growing due to the contribution of the following emerging countries such as India with a CAGR of 4.6%. This is due to surge in awareness related to use of anti-rheumatics in the treatment of rheumatoid arthritis.

Loading Table Of Content...