Apheresis Market Research, 2031

The global apheresis market was valued at $2.4 billion in 2021, and is projected to reach $5.3 billion by 2031, growing at a CAGR of 8.3% from 2022 to 2031. Apheresis is withdrawal of blood from donor’s body, removal of one or more blood components such as platelets, white blood cells or plasma and transfusion of the remaining blood back into the donor during the process or at the end of the process. In apheresis, the whole blood from a patient or donor’s body is transformed within an instrument that is essentially designed as a centrifuge, in which the components of whole blood are separated. One of the separated portions is then withdrawn and the remaining components are re-transfused into the donor.

The key factors that drive the apheresis market growth include increase in demand for blood components across the globe and surge in government initiatives toward blood donation. In addition, newly approved indications for apheresis treatment such as autoimmune hemolytic anemia, acute disseminated encephalomyelitis, and cardiac neonatal lupus further supplement the market growth. In October 2020, Haemoneticsis, blood management product company, received product approval from FDA (Food and Drug Administration) for NexSys PCS with persona technology, which customizes plasma collection based on an individual donor's body composition.

In addition, in October 2020, Kaneka Corporation, chemicals, food products, and medical devices company launched rheocarna, an adsorption type blood purification device that treats severe form of arteriosclerosis obliterans. Furthermore, increase in the use of plasma donation in the treatment of burnt patients, trauma patients, and patients suffering from serious disorders or major injuries contribute toward the growth of the market. Moreover, in COVID-19 plasma treatment therapy (convalescent plasma) is given to patients admitted due to COVID-19. On the contrary, advancements in the healthcare sector in emerging economies are expected to offer significant profitable apheresis market opportunity for key players.

The COVID-19 outbreak is anticipated to have a positive impact on growth of the global apheresis market. The COVID-19 pandemic stressed healthcare systems globally. Owing to the COVID-19, the coagulation parameters such as platelet count, fibrinogen, D-dimmer, prothrombin time (PT), activated partial thromboplastin time (aPTT), were found as complication in the patients who were severely infected, thus extensive application of plasma therapy treatment was given. The convalescent plasma (CP) therapy is used in patients who got infected due to COVID-19. According to the Article published in Lancet journal, between May 28, 2020, and June 15, 2021, 11558 (71%) of 16287 patients enrolled in recovery were eligible to receive convalescent plasma. CP therapy involves collection of plasma from the patient’s body who has recently recovered from infection and infusion of that collected plasma into the body of individual who is at risk. Thus, above aforementioned factors impacted positively on the growth of the global apheresis market during pandemic.

Apheresis Market Segmentation

Apheresis market is segmented into product, method, procedure, component, end user, and region. On the basis of product, the market is classified into devices, disposable & reagents, and software. By method, it is categorized into centrifugation, membrane separation, and selective adsorption. Depending on procedure, it is divided into donor/automated apheresis and therapeutic apheresis. According to component, it is fragmented into plasma (plasmapheresis), platelets (plateletpheresis), leukocytes (leukapheresis), lymphocytes (lymph apheresis), and RBCS (erythropheresis). By end user, it is segmented into blood centers, hospitals, and others include academic institutions, research institutes (blood institutes), and biopharmaceutical manufacturers. By region, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

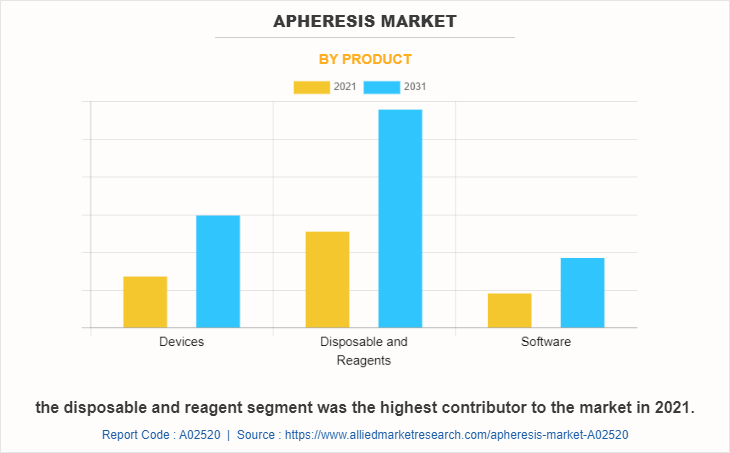

By Product

Depending on product, the disposable & reagent segment was the highest contributor to the market in 2021, and this trend is expected to continue during the forecast period, due to the extensive advancements that are taking place in the development of blood bags, tubing, and disposable kits. However, the same segment is expected to witness considerable growth during apheresis market forecast.

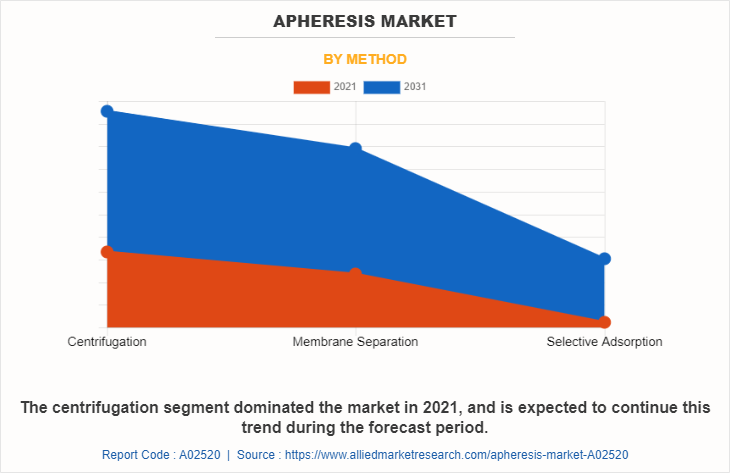

By Method

By method, the centrifugation segment dominated the apheresis market size in 2021, and this trend is expected to continue during the forecast period, owing to the predominant use of centrifugation in the preparation of blood components such as packed red blood cells (PRBCs) and fresh frozen plasma (FFP) in a single-step heavy spin.However, the membrane separation segment is expected to witness considerable growth during the forecast period, as membrane filters play a pivotal role in filtration of plasma from other cellular components to achieve specific cell separation.

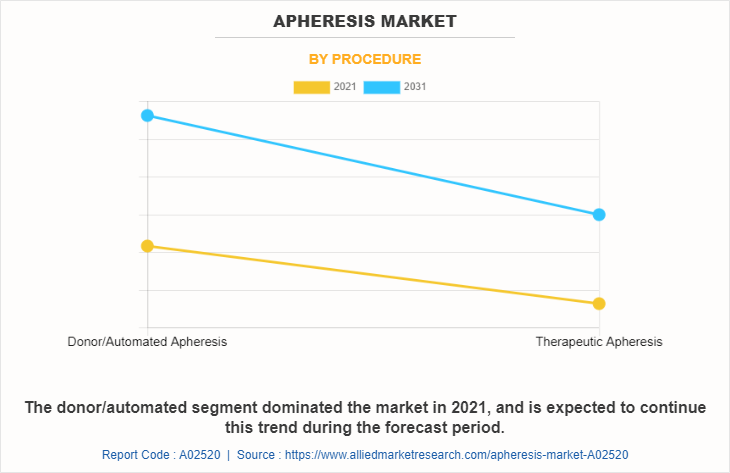

By Procedure

By procedure, the donor/automated segment dominated the apheresis market share in 2021, and this trend is expected to continue during the forecast period, as blood centers have major share in the global apheresis market, which supplement the growth of the donor apheresis segment. Furthermore, surge in apheresis platelet donation and apheresis plasma donations have contributed to the market growth.However, the therapeutic apheresis segment is expected to witness considerable growth during the forecast period owing to rise in patient base suffering from chronic disorders, apheresis is performed for the removal of disease mediator in plasma (autologous/allogenic antibodies), removal diseased cells (sickle or parasite-infected red cells), removal of excess cells (essential thrombocythemia), and replacement with normal blood components.

By Component

By component, the plasma (plasmapheresis) segment dominated the market in 2021, and this trend is expected to continue during the forecast period, owing to its wide utilization across renal & metabolic diseases and hematologic & neurologic disorders. However, the platelet pheresis segment is expected to witness considerable growth during the forecast period, due to soaring number of platelet apheresis procedures across the globe.

By Component

The plasma (plasmapheresis) segment dominated the market in 2021, and is expected to continue this trend during the forecast period.

By End user

By end user, blood centers segment dominated the market in 2021, and this trend is expected to continue during the forecast period, as donor apheresis forms a major constituent of the apheresis industry, and maximum donor apheresis procedures are performed in the blood centers across the globe. However, the other end user segment is expected to witness considerable growth during the forecast period, as biopharmaceutical manufacturers are the major contributors to the robust growth of this segment, owing to increase in demand for plasma-based drugs.

By End User

The blood centers segment dominated the market in 2021, and is expected to continue this trend during the forecast period

By Region

Region-wise, North America dominated the apheresis market size in 2021, and is expected to be dominant during the forecast period, owing to the early adoption of novel apheresis systems and increase in prevalence of blood-related disorders in this region.

However, Asia-Pacific is expected to register highest CAGR of 9.3% from 2021 to 2031, owing to presence of high population base and surge in geriatric population (more susceptible to chronic injuries and disorders).

By Region

North America garnered the largest revenue share in 2021. However, Asia-Pacific is anticipated to grow at the highest CAGR during the forecast period.

Competitive Analysis

The key players operating in the global Apheresis market include Asahi Kasei Corporation, B. Braun Melsungen AG, Cerus Corporation, Fresenius Kabi, Haemonetics Corporation, Charles River Laboratories International, Inc, Kaneka Corporation, Kawasumi Laboratories Inc, Nikkiso Co. Ltd, Terumo BCT.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the apheresis market analysis from 2022 to 2031 to identify the prevailing apheresis market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the apheresis market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global apheresis market trends, key players, market segments, application areas, and market growth strategies.

Apheresis Market Report Highlights

| Aspects | Details |

| Market Size By 2031 | USD 5.3 billion |

| Growth Rate | CAGR of 8.3% |

| Forecast period | 2021 - 2031 |

| Report Pages | 270 |

| By Product |

|

| By Method |

|

| By Procedure |

|

| By End User |

|

| By Component |

|

| By Region |

|

| Key Market Players | Terumo BCT, Inc, Asahi Kasei Medical Co., Ltd, Nikkiso Co., Ltd, B. Braun Melsungen AG, Charles River Laboratories International, Inc., Kaneka Corporation, Fresenius Kabi, Haemonetics Corporation, Cerus Corporation, Kawasumi Laboratories Inc |

Analyst Review

Rise in number of donor apheresis procedures have strongly contributed to the global market growth. Moreover, increase in demand for blood components globally is expected to offer profitable opportunities for the expansion of the market. In addition, therapeutic apheresis is majorly carried out among patients suffering from Good pasture syndrome, preeclampsia, and eclampsia in pregnancy, which has piqued the interest of several companies to manufacture efficient and advanced apheresis systems.

Surge in advancements of disposables associated with the apheresis procedures has largely contributed in the market revenue and is expected to maintain this trend throughout the forecast period. Single-cycle apheresis procedures consume multiple disposable parts, and such intensive consumption of disposables significantly contributes toward revenue generation. Moreover, single-use products curb the risk of infection, which is of high significance in the apheresis as well as transfusion procedures.

Increase in awareness toward blood donations and rise in government initiatives promoting blood donations drive the market growth. Upsurge in healthcare expenditure in the emerging economies is anticipated to offer lucrative opportunities for the market expansion.

Apheresis procedures involve separation of desired components from the blood, while the remaining is either returned to the donor or the patient.

The total market value of apheresis market is $2,383.41 million in 2021.

The forecast period for apheresis market is 2022 to 2031

The market value of apheresis market in 2030 is $5,300.57 million.

The base year is 2021 in apheresis market.

Top companies such as, Asahi Kasei Corporation, B. Braun Melsungen AG, Cerus Corporation, Fresenius Kabi, Haemonetics Corporation held a high market position in 2021.

Loading Table Of Content...

Loading Research Methodology...