Application Transformation Market Insights:

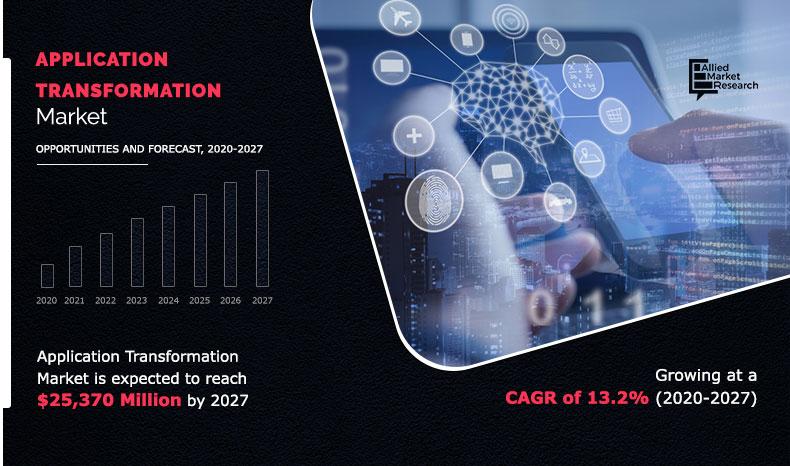

The global application transformation market size was valued at USD 9,214 million in 2019, and is projected to reach USD 25,370 million by 2027, registering a CAGR of 13.2% from 2020 to 2027.

Application transformation is the process to modernize dated applications to meet modern demands. It ensures that the applications in an organization meet updated governance and compliance requirements. The products and services associated with the application transformation are mainly aimed at helping the IT departments to tackle rise in use of social media and mobile computing in the enterprise. It mainly helps business-critical applications to stay aligned and relevant with modern user expectations

On the basis of service type, the application integration segment exhibited the highest growth in the application transformation market in 2019, and is expected to maintain its dominance in the upcoming years, due to rise in demand for integration of dated legacy applications as well as databases with advanced applications. However, the application modernization segment is expected to witness the highest growth, due to factors such as increase in focus among businesses on modernizing and transforming the legacy systems, surge in demand to provide the scalability and agility to business, and growth in demand for modernizing the infrastructure to ensure business continuity.

By Service Type

Cloud Application Migration is projected as one of the most lucrative segments.

By enterprise size, the global application transformation market share was dominated by the large enterprises segment in 2019 and is expected to maintain its dominance in the upcoming years. This is attributed to surge in adoption of application transformation by large enterprises due to various benefits such as improved flexibility, lower operating costs, better collaboration, and improved time to market. However, the small and medium eneterprises segment is expected to witness the highest growth, owing to the ongoing trend of digital transformation in SMEs for generating new revenue streams and compete with larger competitors.

By Organization Size

SME's is projected as one of the most significant segments.

North America dominates the application transformation market. In this region, the countries such as the U.S. and Canada are actively making significant investments in R&Dactivities, contributing the development of advanced technologies.In addition, presence of several key vendors in the region such as Microsoft Corporation, Oracle Corporation, and IBM Corporation, are actively introducing innovative application transformation solutionsthat fuel the market growth. However, Asia-Pacific is expected to observe highest growth rate during the forecast period, due to the emerging adoption of innovative technologies as well as ongoing digital transformation initiatives in Asian countries, such as Australia, Japan, China, and India to tackle the increased demand for software services. For instance, in August 2018, Alibaba Cloud, the cloud computing division of Alibaba Grouplaunched a digital transformation initiative for the Asia-Pacific region.

The report focuses on the growth prospects, restraints, and application transformation market analysis. The study provides Porter’s five forces analysis of the application transformation industry to understand the impact of various factors such as bargaining power of suppliers, competitive intensity of competitors, threat of new entrants, threat of substitutes, and bargaining power of buyers on the application transformation market trends.

By Region

Asia-Pacific region is projected as one of the most significant segments.

Segment Review:

The application transformation market is segmented on the basis of service type, enterprise size, industry vertical, and region. By service type, it is categorized into cloud application migration, application integration, application replatforming, application portfolio assessment, UI/UX modernizations, and others. By enterprise size, it is bifurcated into large enterprises and small & medium enterprises. On the basis of industry vertical, it is categorized as BFSI, IT & telecom, government, healthcare, retail, manufacturing, and others. Region wise, it is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Top Impacting Factors:

The global application transformation market growth is mainly driven by factors such as emergence of cloud technology and increase in consumption of Big Data; high cost associated with the maintenance of legacy applications; and technological development & advancement in application transformation. In addition, ongoing trend of legacy modernization fuels the demand for application transformation. However, difficulty in application transformation due to complexities in the legacy systems is anticipated to hamper the market growth to some extent. On the other hand, rise in adoption of advanced technologies such as 5G, AI, ML, and IoT are expected to provide lucrative opportunities for the market growth during the forecast period. Also, the emerging need for digital transformation is anticipated to be opportunistic for the market growth during the forecast period.

Technological development & advancement in application transformation

Rise in demand for accelerating business transformation across the industry verticals has driven innovative product developments and launches by key vendors. Such developments offer a smarter and faster way to application transformations in the organization. For instance, in November 2019, Accenture, one of the leading market players launched myNav, a cloud platform to help organizations simulate and design different cloud solutions and identify the ones which is best fit for their business requirements. In addition, the platform recommends the application transformation approach for its clients to accelerate their innovation in the cloud.

In addition, in May 2020, IBM launched a wide range of advanced artificial intelligence (AI)-powered services and capabilities to help chief information officers (CIOs) to automate different aspects of IT development, operations, and infrastructure. This launch includes accelerator for application modernization with AI; and IBM Watson AIOps that leverages AI to reliably operate enterprise applications. Such developments and advancements significantly drive the growth of the global application transformation market.

Ongoing trend of legacy modernization

Legacy Modernization is the process of transforming Legacy Systems in the organization to reduce IT environment costs & complexity, enable collaboration across platforms, increase data consistency, and improve process flexibility. In the organization, traditional application models and systems are not capable enough to meet the modern business expectations owing to limited adaptability to change, poor delivery speed, and inefficient processes. Hence, there is rise in trend of legacy modernization among the businesses that enable the enterprises to align company’s objectives with its business goals to serve customers efficiently, scale products & services, and improve customer experience. In addition, legacy modernization has led to the accelerated digital transformation initiatives, automated deployments that increased productivity, and enhanced developer experience. Application transformation is the major contributor for legacy modernization; hence, this trend fuels the growth of the application transformation market.

Key Benefits for Stakeholders:

- This study includes the application transformation market analysis, trends, and future estimations to determine the imminent investment pockets.

- The report presents information related to key drivers, restraints, and application transformation market opportunity.

- The application transformation market size is quantitatively analyzed from 2019 to 2027to highlight the financial competency of the industry.

- Porter’s five forces analysis illustrates the potency of buyers & suppliers in application transformation market forecast.

Application Transformation Market Report Highlights

| Aspects | Details |

| By SERVICE TYPE |

|

| By ENTERPRISE SIZE |

|

| By INDUSTRY VERTICAL |

|

| By Region |

|

| Key Market Players | International Business Machines Corporation, Tata Consultancy Services Limited, Cognizant, Fujitsu, Microsoft Corporation, Atos, HCL Technologies, Micro Focus International plc, Accenture, Hexaware Technologies Limited |

Analyst Review

The application transformationmarket is going through enormous transformation and growth. Application transformationhas become the businesses’ answer to requirements of the business 4.0environment. The enterprises are launching large transformation programs to build digital models that support modern business, enhance customer experience, and address new market segments. This has led to the emerging demand for application transformation services.

Rise in demand for accelerating business transformation across the industry verticals offers scope for innovative product developments and launches by key vendors. Suchdevelopments offer a smarter and faster way for application transformations in the organization. For instance,in May 2020, IBM launched a wide range of advanced artificial intelligence (AI)-powered services and capabilities to help chief information officers (CIOs) to automate different aspects of IT development, operations, and infrastructure. This launch includes Accelerator for application modernization with AI; and IBM Watson AIOps that leverages AI to reliably operate enterprise applications.

Moreover, the COVID-19 pandemic has significantly fosteredthe growth rate of the application transformation market as the increase in number of organizations across the globe are moving their operations from traditional IT architecture to cloud-based platforms. In addition, there is emerging need for infrastructure to be reconfigured to meet the organization’s needs. This has led to surge in demand for older applications to be modernized to operate in a cloud environment. This factor primarily drives the growth of the application transformation market.

The CXOs further added that the application transformation market is competitive and comprises number of regional and global vendors competing on the basis of factors such as cost of solutions, reliability, and support services. The growth of the market is impacted by rapid advances in the application transformation offerings, whereas the vendor performance is impacted by COVID-19 conditions and industry development. Owing to the competition, vendors operating in the market are offering advanced application transformation products and services to improve the business performances, driving the market growth. In addition, the key players in themarket are actively adopting the strategies such as new product launches, acquisitions, and collaborations to enhance their market presence. For instance, in November 2020,IBM acquired Instana, an application performance monitoring company. The acquisition is anticipated to enable IBM to help businesses better manage the complexity of modern applications.

Loading Table Of Content...