Aquafeed Market Research, 2034

Market Introduction and Definition

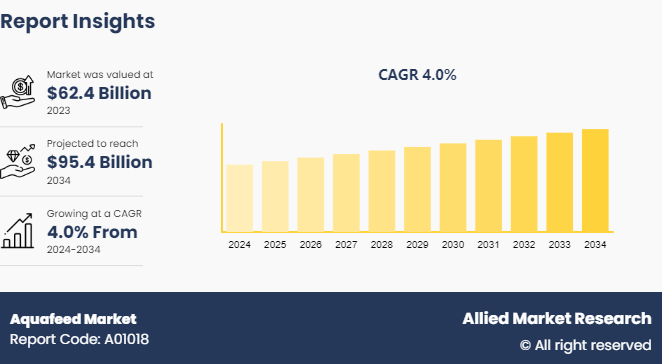

The global aquafeed market size was valued at $62.4 billion in 2023, and is projected to reach $95.4 billion by 2034, growing at a CAGR of 4% from 2024 to 2034. Aquafeed is specialized feed formulated for farmed aquatic animals like fish, crustaceans, and mollusks to ensure optimal growth, health, and production efficiency. It comes in various types, including pelleted feed, which is versatile and suitable for different species and growth stages; extruded feed, processed under high temperature and pressure for enhanced digestibility; floating feed, which stays on the water’s surface for easy monitoring; sinking feed, designed for bottom-feeding species; and natural feed, which includes live or frozen prey such as worms and plankton. Each type is tailored to meet the nutritional needs and feeding behaviors of specific aquatic species in aquaculture systems.

Key Takeaways

The aquafeed market study covers 20 countries. The research includes a segment analysis of each country in terms of value ($Million) for the projected period 2023-2034.

More than 1, 500 product literatures, industry releases, annual reports, and other such documents of major aquafeed industry participants along with authentic industry journals, trade associations' releases, and government websites have been reviewed for generating high-value industry insights.

The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global markets and to assist stakeholders in making educated decisions in order to achieve their most ambitious growth objectives.

Key Market Dynamics

The growing aquaculture industry significantly boosts the aquafeed market share due to the increasing global appetite for seafood. As aquaculture expands to meet rising fish consumption and address seafood shortages, there is a greater need for specialized feed to support the health and growth of farmed aquatic species. This surge in aquaculture activities drives the demand for various types of aquafeed tailored to different species and growth stages, ensuring optimal production efficiency and quality. Furthermore, advancements in aquaculture practices, including improved farming techniques and species diversification, create a need for more sophisticated feed solutions. Feed manufacturers are continually innovating to provide nutritionally balanced and efficient feeds, which enhances the overall performance and sustainability of aquaculture operations. As the aqua feed industry evolves, so does the demand for aquafeed, reflecting the sector's role in meeting global seafood demands while promoting sustainable and responsible aquaculture practices during the aquafeed market forecast.

Environmental concerns significantly restrain the aquafeed market by highlighting the ecological impact of feed production and ingredient sourcing. The use of fishmeal and fish oil, derived from wild fisheries, raises sustainability issues, as overfishing and resource depletion are major environmental concerns. This has led to increased scrutiny and regulatory pressures on the aquafeed industry to adopt more sustainable practices. Feed manufacturers face challenges in sourcing environmentally friendly ingredients while maintaining cost-effectiveness, which limit their ability to meet aquafeed market demand.

Sustainable feed solutions create significant aquafeed market opportunities in the market by addressing environmental concerns and meeting the growing demand for eco-friendly products. As consumers and regulatory bodies increasingly prioritize sustainability, aquafeed manufacturers that adopt alternative protein sources, such as plant-based or insect meals, position themselves favorably. These alternatives reduce reliance on traditional fishmeal, helping to mitigate overfishing and resource depletion. By integrating agricultural by-products and using microalgae or yeast, manufacturers can develop feeds that are not only more sustainable but also potentially more cost-effective in the long run. This shift towards environmentally responsible feed ingredients can enhance market appeal and open up new opportunities within the aquafeed industry.

Value Chain of Aquafeed Market

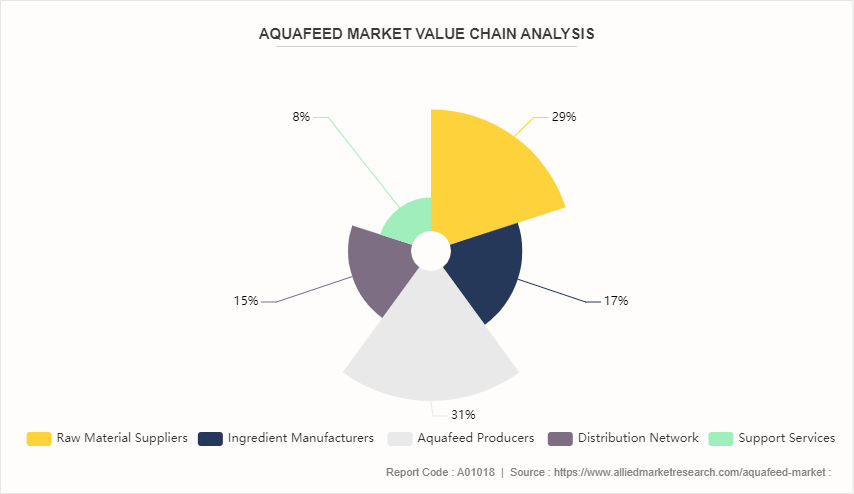

The value chain of the Aquafeed Market begins with raw material suppliers, who provide ingredients such as fishmeal, fish oil, soybean meal, corn, wheat, and other plant-based proteins. These suppliers include fishing companies, agricultural producers, and processors of plant-based ingredients. Next, ingredient manufacturers process these raw materials into more refined products, such as concentrated proteins or specialized additives like vitamins, minerals, and amino acids. Aquafeed producers then formulate and manufacture the feed, combining these ingredients according to specific recipes designed for different aquatic species and life stages. This process involves advanced technologies for mixing, extrusion, and pelletizing to create feeds with optimal nutritional profiles and physical characteristics.

The aquafeed moves through a distribution network, which may include wholesalers, distributors, and sometimes direct sales from manufacturers to large aquaculture operations. These channels ensure the feed reaches various end-users, including fish farms, hatcheries, and commercial aquariums. Throughout the chain, equipment manufacturers supply machinery for feed production, storage, and delivery systems. Research and development play a crucial role, with feed companies, academic institutions, and specialized labs continuously working to improve feed formulations, increase sustainability, and enhance fish health and growth rates with proper fish meal.

Market Segmentation

The aquafeed market is segmented into additive, end use, and region. By additives, the market is fragmented into vitamins, minerals, antioxidants, amino acids, enzymes, acidifiers, and binders. By end use, the global aquafeed market is divided into fish, mollusks, crustacean, and others. Region wise, the market is analyzed across North America, Europe, Asia-Pacific, Latin America and Middle East and Africa.

Regional/ Country Market Outlook

The Asia Pacific region dominates the aquafeed market due to its leading role in global aquaculture production and seafood consumption. Countries like China, India, and Vietnam are major players in aquaculture, driven by high domestic demand for fish and seafood as well as export opportunities. The region’s extensive and diverse aquaculture operations require significant volumes of aquafeed to support various species at different growth stages, making it a key market for feed manufacturers. Additionally, favorable climatic conditions and large freshwater and marine resources contribute to the growth of aquaculture in this region.

Economic factors further bolster Asia Pacific’s dominance. The region benefits from relatively lower production costs, which makes aquaculture and feed production more economically viable, thus helping drive the aquafeed market growth. Governments in countries such as China and India are investing in aquaculture infrastructure and technology, fostering growth and increasing feed demand. Furthermore, the growing middle-class population in Asia Pacific is driving higher seafood consumption, amplifying the need for efficient and high-quality aquafeed solutions. The combination of robust aquaculture practices, economic advantages, and increasing consumer demand makes Asia Pacific the most significant and influential region in the global aquafeed market.

Industry Trends:

According to a new forecast by the World Bank, by 2030, Asian countries are likely to account for 70% of global fish consumption. China is one of the rapidly developing economies, which is anticipated to provide 38% of the worldwide seafood. China and other Asian countries are investing in developing the aquaculture industry. It may create demand for aquafeed.

The Government of India launched an all-new aquafeed at its Global Bio-India 2023 event. The new aquafeed is India’s first vegan aquafeed and called as Bio Guru 3F Pro: Bio-fermented Fish Feed. This launch is said to be India's entry into cruelty-free aquaculture.

Competitive Landscape

The major players operating in the aquafeed market include Cargill Incorporated, Archer Daniels Midland Company, Alltech Inc., Purina Animal Nutrition, Nutreco N.V., Aller Aqua A/S, BioMar A/S, Dibaq Aquaculture, Beneo GmbH and Charoen Pokphand Foods PCL.

Recent Key Strategies and Developments

In February 2024, Skretting, a Norway-based leading aquafeed-producing company, announced the launch of its all-new production facility in Surat, India. The new facility is said to be equipped with state-of-the-art technology with three production lines, which are expected to have a production capacity of around 50, 000 metric tons per annum.

In March 2023, Alltech unveiled Alltech Aqua Health, a new aquafeed that focuses on boosting aquatic animal health through enhanced nutritional profiles and immune support. The feed aims to address common health issues in aquaculture and promote overall wellbeing.

In October 2022, Cargill Aqua Nutrition introduced Cargill Aqua Advance, a new line of aquafeed focused on sustainability and performance. The feed utilizes alternative protein sources and aims to improve feed conversion ratios, aligning with the company’s commitment to reducing the ecological footprint of aquaculture.

Key Sources Referred

- World Bank

- Feed & Additive Magazine

- International Feed Industry Federation

- Network of Aquaculture Centers in Asia-Pacific

- Food and Agriculture Organization (FAO)

- Global Seafood Alliance

- Department of Fisheries

- National Oceanic and Atmospheric Administration

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the aquafeed market analysis from 2024 to 2034 to identify the prevailing aquafeed market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the aquafeed market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global aquafeed market trends, key players, market segments, application areas, and market growth strategies.

Aquafeed Market Report Highlights

| Aspects | Details |

| Market Size By 2034 | USD 95.4 Billion |

| Growth Rate | CAGR of 4% |

| Forecast period | 2024 - 2034 |

| Report Pages | 290 |

| By Additives |

|

| By End Consumption |

|

| By Region |

|

| Key Market Players | Alltech Inc., Nutreco N.V., purina animal nutrition, Cargill Incorporated, Aller Aqua A/S, Archer Daniels Midland Company, Charoen Pokphand Foods PCL., BENEO GmbH, BioMar A/S, Dibaq Aquaculture |

The global aquafeed market size was valued at $62.4 billion in 2023, and is projected to reach $95.4 billion by 2034

The global Aquafeed market is projected to grow at a compound annual growth rate of 4% from 2024 to 2034 reach $95.4 billion by 2034

The key players profiled in the reports includes Dibaq Aquaculture, BioMar A/S, Archer Daniels Midland Company, Aller Aqua A/S, Charoen Pokphand Foods PCL., BENEO GmbH, purina animal nutrition, Alltech Inc., Nutreco N.V., Cargill Incorporated

The Asia Pacific region dominates the aquafeed market due to its leading role in global aquaculture production and seafood consumption

Growing Aquaculture Industry, Rising Fish Consumption, Increasing Awareness of Aquatic Animal Health

Loading Table Of Content...