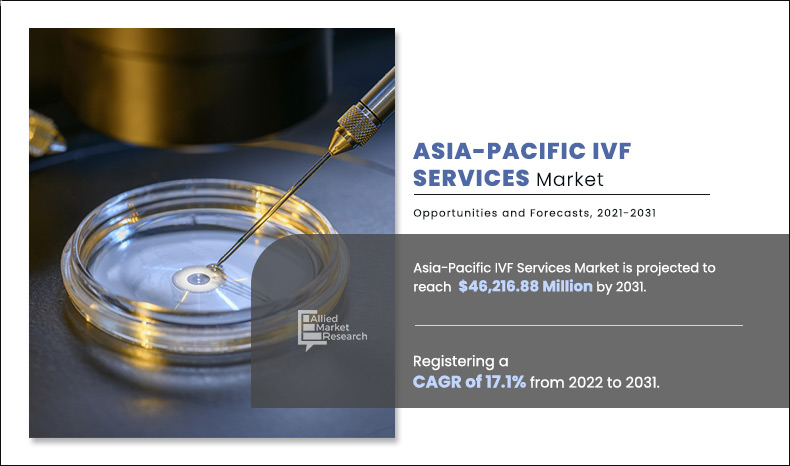

Asia-Pacific IVF Service Market Statistics, 2031

The Asia-Pacific IVF service market size was valued at $9373.2 Million in 2021 and is projected to reach $46216.8 Million by 2031, registering a CAGR of 17.1% from 2022 to 2031. Rise in disposable income has increased the adoption of IVF techniques. Couples who usually opt for IVF treatment belong to the middle-aged group with stable financial conditions. Higher success rate of IVF treatment attracts infertile couples to undergo the procedure, despite high-cost cycle and medications are driving the IVF market in Asia-Pacific.

In vitro fertilization (IVF) process involves fertilization of egg cells by sperm outside the woman’s body and then implanting it in the uterus. It is a type of assisted reproductive technology (ART) based treatment, which is used to treat fertility or genetic problems to assist with conception of child. It is the process of fertilization, which includes extraction of eggs, retrieval of sperm cells, and then manually combining them in laboratory settings to form an embryo. The embryo(s) is then transferred to uterus for further gestation.

In vitro fertilization (IVF) is a type of assisted reproductive technology in which the ovum is artificially fertilized in laboratory settings and then implanted into uterus. IVF is one of the widely used treatments, which assist people with infertility problems including couples, single mothers, and the LGBT community

“The Asia-Pacific IVF service market was slightly negative during the lockdown period owing to a decrease in demand for IVF service. Decrease in the number of consultations for infertility, and sharp cut in income during COVID-19 is anticipated to hamper the market growth”

Historical overview

The market was analyzed qualitatively and quantitatively from 2021-2031. The Asia-Pacific IVF treatment market grew at a CAGR of around 17.1% during 2021-2031. Most of the growth during this period was derived from the China owing to the rise in the number of key players who manufactures IVF service product, rising disposable incomes, as well as well-established presence of domestic companies in the region

Market Dynamics

Growth of the global Asia-Pacific IVF service market is majorly driven by rise in acceptance of IVF procedure, increase in the IVF success rate and rise in awareness among population regarding IVF procedure. The success rate of IVF is on rise with subsequent advancements in technology. New and advanced techniques used in IVF such as pre-implantation genetic diagnosis (PGD), Intracytoplasmic sperm injection (ICSI) and in vitro maturation (IVM) have helped increase the success rates of pregnancy. For instance, according to Assisted Reproductive Technology in Australia and New Zealand (ANZARD) report in September 2021, stated that 19% to 23% increase live birth rate per cycle in women aged 35-39, represented a 20% relative increase in success rates and in those aged 40-44, the live birth rate increased to 10%, representing a 27% increase in success rates over the last 10 years. Thus, this has positively impacted the growth of the Asia-Pacific IVF service market.

As per the data published by National Bureau of Statistics of China, the per capita disposable income of China, in 2021, was increased up to $12,554.646 as compared to previous year income which was $10,409.993 in December 2020. Moreover, governments and private sector authorities provide favorable reimbursement schemes for infertility treatments. For instance, the Australian Government provides reimbursements for IVF cycle that cover unlimited access of IVF treatment for patients.

Increase in infertility rates is one of the major factors that drives the growth of the Asia-Pacific IVF services market. Lifestyle habits such as smoking & excessive alcohol use, increase in prevalence of obesity, excessive emotional stress, PCOS, and fallopian tube obstruction are the major factors that affect the reproductive health of an individual.

Rise in infertility rates is not only due to lifestyle changes but also due to increase in incidences of various diseases such as sexually transmitted diseases and fertility-related diseases. Thus, surge in infertility cases is anticipated to drive the growth of the Asia-Pacific IVF services market. In addition, as per Central Intelligence agency, the fertility rate is in general declining and is expected to continue for the next 50 years. As per their data, the fertility rate (2020 est.) in India, China, Japan, Australia, New Zealand, South Korea, Thailand, Singapore, Malaysia, Indonesia, the Philippines, and Vietnam are 2.35, 1.6, 1.43, 1.74, 1.87, 1.29, 1.54, 0.87, 2.43, 2.04, 2.92, and 1.77.

Fertility tourism provides steady prospects for the growth of the Asia-Pacific IVF service market. Fertility tourism not only helps economy of developing countries but also facilitates benefits to patients, as prices are lower compared to developed countries. The cost of one IVF cycle in North America is approximately $15,000 to $30,000, whereas in Thailand, the treatment costs roughly $3,587.

In addition, according to the report of CNY fertility in 2021, the IVF treatment in India can range from $1,317 to $4,610 per cycle and medications may cost from $800 to $1000. In addition, higher age limit and relaxed regulations on fertility coupled with lower costs is anticipated to drive the IVF services in India. Furthermore, donor egg IVF services are not available in some countries such as Germany and Italy, due to which patients prefer to travel to Asia, where donor egg IVF is allowed. Hence, patients opt for lower cost fertility destinations; thereby, creating newer opportunities for the growth of the IVF services market in Asia-Pacific.

However, complications associated with IVF treatment such as multiple pregnancies and birth defects limit the adoption of IVF services. Success rates of IVF depends on the number of embryos transferred, which can lead to multiple pregnancies. The complications that arise from multiple pregnancies include high blood pressure and complications related to delivery. Furthermore, due to multiple pregnancies, a child can incur several health-related problems such as low birth weight and premature birth. In addition, one of the potential risks associated with IVF treatment is ectopic pregnancy, where the embryo gets implanted outside the woman’s womb, resulting in life threatening situations. For instance, as per the article published by National Library of Medicine in 2020, approximately 0.8% to 8.6% patients undergoing IVF treatment may suffer from ectopic pregnancies. These factors limit the adoption of IVF procedures; thereby, hindering the market growth.

COVID-19 Impact on the Asia-Pacific IVF service Market

The COVID-19 outbreak is anticipated to have a negative impact on the growth of the global Asia-Pacific IVF service market. Many countries across the globe adopted nationwide lockdowns, which directly impacted the key driver fertility tourism, owing to flight cancellations, travel bans & quarantines, restriction of all indoor/outdoor events, emergency declaration. A huge number of clinics and hospitals were restructured to increase the hospital capacity for the patient diagnosed with COVID-19. Non-urgent visits of people were discouraged in fertility clinics and elective fertility treatments were being postponed owing to direct contact of physicians to people who want to get IVF treatment. Subsequently, these factors led to cancellation of many scheduled IVF procedures and anticipated to hinder the growth of the Asia-Pacific IVF service market during the pandemic.

Segmental Overview

The Asia-Pacific IVF service market is segmented based on cycle type, end user and country. Based on type the market is segmented into fresh IVF cycle(non-donor), thawed IVF cycle (non- donor) and donor eggs IVF cycle. Based on end user, market is divided into fertility clinics, hospitals, surgical centers and clinical research institutes. Region-wise, the market is analyzed across Asia-Pacific.

By Cycle Type: Based on cycle type, the market is segmented into fresh IVF cycle (non-donor), thawed IVF cycle (non-donor) and donor eggs IVF cycle. The fresh IVF cycles (non-donor) segment dominated the market in 2021 and is expected to continue this trend during the forecast period, owing to rise in prevalence of infertility among female population and increase in the number of product launch for IVF technology.

By end user: Based on end user, the market is divided into fertility centers, hospital, surgical centers and clinical research institutes. The fertility clinics segment dominated the market in 2021 and is expected to continue this trend during the forecast period, owing to increase in the number of fertility clinics and rise in the expenditure by government to develop healthcare infrastructure.

Delayed pregnancy trends have steadily increased in the past few years. In older women (more than 40 years), eggs produced by the reproductive system are immature for the process of fertilization. This results in the risk of genetic disorders in the egg. Furthermore, due changes in lifestyles, such as the increased prevalence of obesity and stress, lack of exercise, improper eating habits, lack of nutrition has increased the cases of premature menopause result in reduced healthy egg production and increased chances of miscarriage. For instance, according to the article by Obstetrics and Gynecology in September 2021, stated that prevalence of premature menopause in Indian women was 3.7%, out of which 2.1% of women had experienced natural premature menopause. Thus, rise in trend of delayed pregnancy in women is anticipated to drive the growth of the Asia-Pacific IVF services market.

The trends in the IVF services market keep changing with the growth in need for efficient technologies that save time, cost, and efficiency of the procedure resulting in better success rates. Specialty IVF clinics offer various types of IVF services and are equipped with technologically advanced IVF devices. Furthermore, as per ICMR (Indian Council of Medical Research), in 2021, there were 508 registered assisted reproductive technology (ART) clinics under the National Registry of ART clinics and Banks in India. Therefore, rise in number of fertility clinics is anticipated to promote the growth of the IVF services market in the future.

By Cycle Type

Fresh IVF Cycles (Non-Donor) segment held a dominant position in 2021 and would continue to maintain the lead over the forecast period.

Competition Analysis

Some of the major companies that operate in the Asia-Pacific IVF service market include Bourn Hall Fertility Center, Southend Fertility and IVF, Morpheus Life Sciences Pvt. Ltd., Bloom Fertility Center, Manipal Fertility, Cloudnine Fertility, and Chennai Fertility Center.

Some examples of product launch in the market

In March 2020, Gurugram Hospital, launched a Specialized Infertility Program and Awareness Campaign to make infertile couples aware about medical advancement by sharing IVF success stories with the audience on how the availability of modern and advanced technology is helping couples embracing parenthood.

By End User

Hospitals was holding a dominant position in 2021 and would continue to maintain the lead over the analysis period.

In 2020, Fujifilm Irvine Scientific launched a vitrification media solution named Vit Kit-NX, it is a media aimed to safeguard embryos and achieve high survival rates. Thus, rise in number of product approval, product launch and partnership for the IVF service is anticipated to drive the market growth.

Partnership in the market

In 2020, Morula IVF Jakarta, a chain of fertility clinics, established partnerships with 14 Women and Children Hospitals, categorized as Morula Satellite Clinics. The company plans to expand its strategic partnerships by introducing its satellite programs into 300 Morula Satellite Clinics within the next five years. Moreover, the company has expanded its number of partnerships by signing 60 partnerships in 2021.

By Country

China was holding a dominant position in 2021 and would continue to maintain the lead over the analysis period.

Key Benefits for Stakeholders

- The study provides an in-depth analysis of the Asia-Pacific IVF service market and the current trends & future estimations to elucidate imminent investment pockets.

- It presents a quantitative analysis of the market from 2022 to 2031 to enable stakeholders to capitalize on the prevailing market opportunities.

- Extensive analysis of the market based on procedures and services assists us to understand the trends in the industry.

- Key players and their strategies are thoroughly analyzed to understand the competitive outlook of the Asia-Pacific IVF service market.

Asia-Pacific IVF service Market Report Highlights

| Aspects | Details |

| By Cycle Type |

|

| By End User |

|

| By Asia-Pacific |

|

| By Key Market Players |

|

Analyst Review

IVF services are considered essential in couples embracing parenthood. The Asia-Pacific IVF Service Market is expected to witness growth during the forecast period owing to rise in prevalence of infertility rate and increase in awareness about its success rates.

Rise in adoption of key strategies, such as collaboration, acquisition, agreement, and partnership by key players of IVF service accounts the growth of market. For instance, in 2020, Morula IVF Jakarta a chain of fertility clinics, established partnerships with 14 Women and Children Hospitals, categorized as Morula Satellite Clinics. The company plans to expand its strategic partnerships by introducing its satellite programs into 300 Morula Satellite Clinics within the next five years.

Moreover, the company has expanded its number of partnerships by signing 60 partnerships in 2021. Moreover, rise in product launch and product approval for IVF service drives the market growth. For instance, in 2020, Fujifilm Irvine Scientific launched a vitrification media solution named Vit Kit-NX, it is a media aimed to safeguard embryos and achieve high survival rates. Thus, rise in number of product approval, product launch and partnership for the IVF service is anticipated to drive market growth

The total market value of Asia-Pacific IVF Service market is $9,373.2 million in 2021 .

The forecast period in the report is from 2022 to 2031

The market value of Asia-Pacific IVF Service market in 2022 was $11,196.7 million

The base year for the report is 2021.

Yes, Asia-Pacific IVF Service companies are profiled in the report

The top companies that hold the market share in Asia-Pacific IVF Service market are Bourn Hall Fertility Center, Southend Fertility and IVF, Morpheus Life Sciences Pvt. Ltd., Bloom Fertility Center, Manipal Fertility, Cloudnine Fertility, and Chennai Fertility Center.

The key trends in the Asia-Pacific IVF Service market are an increase in the IVF success rate, increase in infertility rate, and delayed pregnancies in woman.

Loading Table Of Content...