Asia-Pacific & MEA OSS & BSS Market Overview

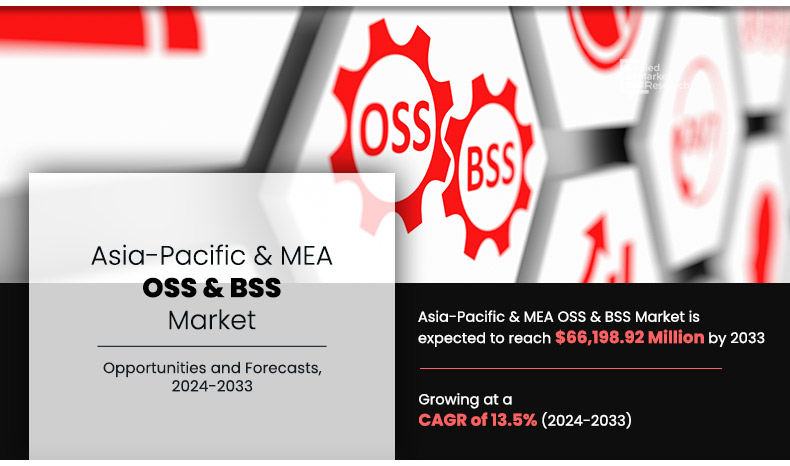

The Asia-Pacific & MEA OSS & BSS Market was valued for USD 19,212.56 million in 2023 and is estimated to reach USD 66,198.92 million by 2033, exhibiting a CAGR of 13.5% from 2024 to 2033.

OSS (operational support systems) and BSS (business support systems) systems are essential for the efficient operation of telecommunications companies, especially mobile, fixed-line, and Internet operators. These two types of systems address a number of specific needs of different functional areas within the telecom businesses and support the business activity and the telecom service they offer to customers. OSS is a set of tools and applications unified under a complete software designed to manage the technical operations and infrastructure of a telecommunications network.

The growth of the Asia-Pacific & MEA OSS & BSS market is driven by factors such as increase in demand for cloud OSS/BSS due to the combined benefits such as flexibility, cost-effectiveness, and technology to support business optimization; prioritized investments by CSPs in network upgrades over OSS/BSS transformations; and exponential growth in data consumption. In addition, surge in the need for low operational costs, and the launch of innovative solutions by major players to gain competitive advantage fuel the market growth. However, difficulties in integrating future OSS/BSS systems into existing ones may hinder market growth. On the contrary, rise in adoption of next-generation OSS & BSS (NGOSS) to improve traditional OSS is expected to provide numerous opportunities for the growth of Asia-Pacific & MEA OSS & BSS market during the forecast period. Thus, each of these factors is anticipated to have a definite impact on the growth of the market in the forecast period.

The Asia-Pacific & MEA OSS & BSS market is segmented on the basis of component, deployment mode, organization size, industry vertical, solution type, type, and region. By component, it is categorized into solutions and services. On the basis of deployment mode, it is divided into on-premise and cloud. By enterprise size, it is segmented into small & medium-sized enterprises and large enterprises. Depending on industry vertical, it is categorized into IT & Telecom, BFSI, Media & Entertainment, Retail & E-commerce, and others. By solution type, it is divided into network planning & design, service delivery, service fulfillment, service assurance, billing & revenue management, network performance management, customer & product management, and others. By type, it is categorized into OSS & BSS. By region, the market is analyzed across Asia-Pacific, Africa, and Middle East.

The report analyzes the profiles of key players operating in the Asia-Pacific & MEA OSS & BSS market such Amdocs, Huawei Technologies Co., Ltd., Telefonaktiebolaget LM Ericsson, Nokia Corporation, Whale Cloud Technology Co., Ltd., AsiaInfo Technologies Limited, NMSWorks Software Private Limited, TelcoDR, Tridens d.o.o., and NEC Corporation. These players have adopted various strategies to increase their market penetration and strengthen their position in the Asia-Pacific & MEA OSS & BSS market.

By enterprise size, the large enterprises segment is expected to grow at the highest growth rate during the forecast period, as large enterprises consist of massive employee structures and artificial neural network systems are employed in large enterprises for gathering employee feedback and other activities. By leveraging AI, large enterprises can gain a competitive advantage by reducing costs, improving productivity, and enhancing overall operations.

By region, Asia-Pacific attained the highest growth in 2023. The presence of prominent players such as NEC Corporation, Ericsson, and others is influencing the growth of the Asia-Pacific & MEA OSS & BSS market in Asia-Pacific. Moreover, the rise in government initiatives to strengthen digital infrastructure across the region is further expected to drive the demand for OSS & BSS solutions. However, the Middle East region is projected to be the fastest-growing segment during the forecast period, owing to the availability of cost-effective digital solutions and the rise in the amount of data generation across organizations. In addition, the proliferation of advanced technologies escalates system safety and reduces delays in business operations.

Segment Review

The Asia-Pacific & MEA OSS & BSS market is segmented on the basis of component, deployment mode, organization size, industry vertical, solution type, type, and region. By component, it is categorized into solutions and services. On the basis of deployment mode, it is divided into on-premise and cloud. By enterprise size, it is segmented into small & medium-sized enterprises and large enterprises. Depending on industry vertical, it is categorized into IT & Telecom, BFSI, Media & Entertainment, Retail & E-commerce, and others. By solution type, it is divided into network planning & design, service delivery, service fulfillment, service assurance, billing & revenue management, network performance management, customer & product management, and others. By type, it is categorized into OSS & BSS. By region, the market is analyzed across Asia-Pacific, Africa, and Middle East.

By Component

Solution segment is projected as one of the most lucrative segments.

Competition Analysis

The report analyzes the profiles of key players operating in the Asia-Pacific & MEA OSS & BSS market such as Amdocs, Huawei Technologies Co., Ltd., Telefonaktiebolaget LM Ericsson, Nokia Corporation, Whale Cloud Technology Co., Ltd., AsiaInfo Technologies Limited, NMSWorks Software Private Limited, TelcoDR, Tridens d.o.o., and NEC Corporation. These players have adopted various strategies to increase their market penetration and strengthen their position in the Asia-Pacific & MEA OSS & BSS market.

By Solution Type

Network planning and design segment is projected as one of the most lucrative segments.

Top Impacting Factors

Increase in demand for cloud OSS/BSS

Increase in demand for cloud OSS/BSS, owing to the combined benefits such as flexibility, cost-effectiveness, and technology to support business optimization is the primary factor driving the growth of the Asia-Pacific & MEA OSS & BSS market. In addition, on-premise OSS & BSS solutions have introduced high entry/exit barriers; hence, the communication service providers are shifting their preference toward cloud, due to various benefits such as short lead time to market and agility to deliver and manage network.

In addition, the mobile virtual network operators (MVNO) and new operators are finding it much easier to adopt cloud-based operations support system solutions. Moreover, the entry barriers are low for new operators/MVNOs. For instance, in April 2023, Prodapt launched BoltSpeed, a business support system solution that brings together industry-leading SaaS products such as Salesforce Communications Cloud, Aria, and MuleSoft to offer a one-stop managed services platform for service providers. Such a shift toward the business and operations support system applications on public cloud platforms drives the market growth.

Challenges to integrate future OSS/BSS systems into existing ones

Legacy OSS & BSS platforms are not equipped to support multiple programs. These platforms were designed to work either in a point-to-point or at best a point-to-multipoint manner. It is nevertheless challenging to ensure uniform service delivery across multiple mobility devices via the OSS & BSS platforms, which further expected to limit the market growth. In addition, as users are utilizing multiple mobility devices, OSS & BSS providers might find it difficult to seamlessly deploy services to customers over different interfaces and networks. Moreover, the future OSS & BSS systems need to support voice over IP (VoIP), unified communications (UC), video, high-speed data, and a rapidly growing lineup of digital media applications. Legacy systems are not equipped to keep up with the pace, as well as the service providers find it difficult to upgrade these systems to new ones.

Moreover, large enterprise operators may find it more challenging to switch to the cloud, owing to large captive legacy on-premise systems. Thus, all these factors collectively are anticipated to hamper the growth of the market during the forecast period.

Rise in adoption of next-generation operations support systems (NGOSS) to improve traditional OSS

Market players are improving their traditional OSS & BSS solutions by using modern, modular, highly agile, and scalable approaches to network management systems, fulfillment, assurance, service delivery, and customer care. In addition, the new requirements in IoT, mobile, and cloud such as scalability and interoperability are driving the need for on-demand services.

On the other hand, the popularity of network functions virtualization (NFV) and software-defined networking (SDN) is increasing across the telecom sector, which further fuel the growth of market. As network operators are transforming their networks with SDN and NFV, next-generation operations support systems (NGOSS) are well-suited to operate in the dynamic, on-demand world. Thus, such factors together are anticipated to change the way networks run and augment the adoption of next-generation OSS, thereby providing remunerative opportunities for the expansion of the regional market during the forecast period.

Recent Product Launch in the Asia-Pacific & MEA OSS & BSS Market

In April 2023, Prodapt launched BoltSpeed, a business support system solution that brings together industry-leading SaaS products such as Salesforce Communications Cloud, Aria, and MuleSoft to offer a one-stop managed services platform for service providers.

In February 2024, Totogi launched its comprehensive BSS Wholesale Platform.

Totogi's platform transforms the telecom sector by enabling operators (Mobile Network Operators) to easily enroll and support MVNOs (Mobile Virtual Network Operators) of any size with its, turnkey solution.

Key Benefits for Stakeholders

The study provides an in-depth Asia-Pacific & MEA OSS & BSS market analysis along with the current trends and future estimations to elucidate the imminent investment pockets.

Information about key drivers, restrains, and opportunities and their impact analysis on the Asia-Pacific & MEA OSS & BSS market size is provided in the report.

The Porter’s five forces analysis illustrates the potency of buyers and suppliers operating in the Asia-Pacific & MEA OSS & BSS industry.

The quantitative analysis of the global Asia-Pacific & MEA OSS & BSS market for the period 2022–2032 is provided to determine the Asia-Pacific & MEA OSS & BSS market potential.

Asia-Pacific & MEA OSS & BSS Market Report Highlights

| Aspects | Details |

| By Component |

|

| By Solution Type |

|

| By Deployment Mode |

|

| By Organization Size |

|

| By Deployment Mode |

|

| By Type |

|

| By Region |

|

| Key Market Players | NMSWORKS SOFTWARE (P) LTD, ASIAINFO TECHNOLOGIES LIMITED, HUAWEI TECHNOLOGIES CO., LTD., TRIDENS D.O.O., NOKIA CORPORATION, TELEFONAKTIEBOLAGET LM ERICSSON, TELCODR INC., WHALE CLOUD TECHNOLOGY CO., LTD., NEC CORPORATION (NETCRACKER), AMDOCS LIMITED |

Analyst Review

According to the CXOs of leading companies, OSS/BSS solutions and services help enterprises improve their operational efficiency. The current business scenario is witnessing an upsurge in the usage of OSS across various verticals such as IT & Telecom enterprises, BFSI, retail, Media & Entertainment, government, and manufacturing. OSS provides enterprises with services such as capacity management for the network, service delivery, and proactive monitoring of the different network layers in relation to incident reports, and collection, distribution, and usage data. The adoption of OSS solutions is gaining momentum, as it brings about tremendous business value and revolutionary changes to the telecom industry.

The adoption of OSS/BSS solutions has increased significantly among communications service providers (CSPs) for activities such as taking a customer’s order, creating a bill, configuring network components, and managing faults. On the other hand, software-as-a-service (SaaS) has gained momentum with major software companies adopting cloud-based approaches to better serve their customers while reducing costs. This has led to the popularity of solutions such as Nokia OSS as a service, which is a hosted business model for Nokia Performance Manager (NPM). It helps clients to manage the capacity and performance of 2G, 3G, and LTE networks. For the service quality manager (SQM), these solutions give an accurate real-time view of service quality across IT and mobile broadband networks.

Moreover, the telecom industry is observing a major transformation, with traditional telecom services no longer driving more revenues. Hence, there is increasing need for implementing the novel services to the market. To tackle this requirement, CSPs are prioritizing and deploying cutting-edge OSS solutions with essential functionalities such as automation, fast service provisioning, fault tolerance, and a central repository for data. OSS & BSS solutions focus on the cost-saving potential through process automation, reduction in manual errors, and improved resource management This in turn is expected to propel the market growth. . In addition, companies are heavily investing in R&D activities to develop advanced telecom technologies, including operations support systems solutions, which is opportunistic for the market.

Loading Table Of Content...