Asia-Pacific Coffee Pod and Capsule Market Overview:

The Asia-Pacific coffee pod and capsule market size was valued at $2,646 million in 2017 and is expected to reach $5,918 million by 2025 at a CAGR of 10.6% during the forecast period. Japan accounted the highest revenue share of 22% in 2017.

A coffee pod or a single-serve coffee container is a coffee preparing method that prepares coffee for a single or a double serving. Paper coffee pods, K-cups, and T-discs are the various types of coffee pods available in the market. Consumers can use the respective coffee portion, in pods or capsules, and the machine automatically prepares the coffee. Increase in demand for ready-to-drink coffee drinks majorly drives the market across the Asia-Pacific region. Moreover, other factors such as innovation of technologies, introduction of new flavors, and heavy inflow of investment in R&D activities boost the market growth.

As consumption of coffee products has been on the rise among health-conscious consumers, manufacturers plan to develop new & innovative formulations such as coffee capsules, sugar-free coffee premix, and other products in the market. In addition, market players have adopted new & advanced technologies to introduce innovative products such as coffee pods and capsules, in recyclable and biodegradable packaging. Thus, the introduction of new formulations and adoption of technologies boosts the market growth. Moreover, factors such as growing demand for instant non-alcoholic beverages due to rising disposable income and increasing the popularity of coffee pods and capsules are expected to provide lucrative opportunities for the Asia-Pacific market in the upcoming years.

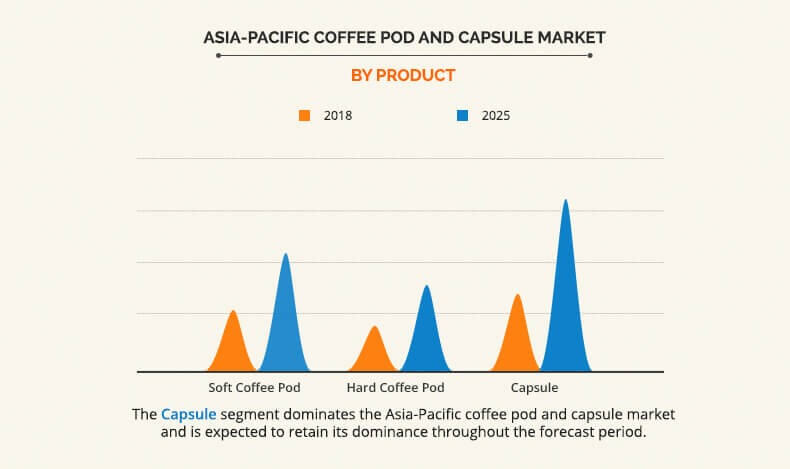

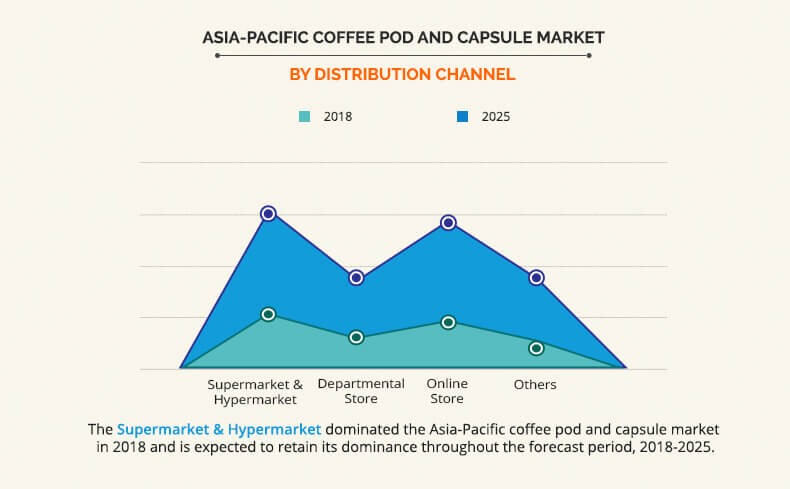

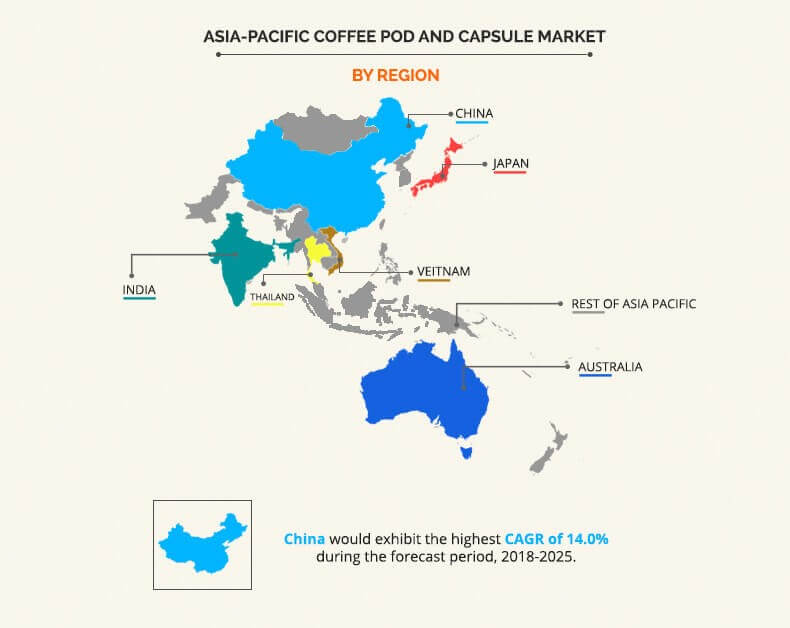

The Asia-Pacific coffee pod and capsule market is segmented based on product, distribution channel, and country. Based on product, it is categorized into a soft coffee pod, hard coffee pod, and capsule. On the basis of distribution channel, it is divided into supermarket & hypermarket, departmental store, online store, and others. By country, it is analyzed across China, India, Japan, Australia, Thailand, Vietnam, and rest of Asia-Pacific.

By product, coffee capsules have gained high popularity among consumers in recent years due to increase in demand for instant non-alcoholic beverages. Coffee capsules are preferred by coffee makers owing to its convenience, ease of use, and wide variety of coffee products and machines. These capsules are more eco-friendly than other coffee pods and hence are preferred by consumers. Thus, increasing use of coffee capsules in offices, catering industries, and other establishments for commercial purposes drives the coffee capsule market.

By distribution channel, the online stores segment is anticipated to grow the fastest in the Asia-Pacific market. E-commerce sector has witnessed significant growth in recent years and is projected to maintain this trend in future. This is due to the fact that interactive websites with detailed information about products, attract consumers to buy from different e-stores, as they not only provide a pleasant shopping experience but also impart knowledge about the products. In addition, sales discounts, fast delivery, and easy payment methods have supplemented the sales of products through online platform. This segment is expected to grow at the highest CAGR of 12.0% during the forecast period.

Country wise, China is anticipated to be the fastest growing segment during the forecast period. Rise in demand for ready-to-drink coffee products, which provide easy, convenient, and quick coffee preparation, is expected to drive the China coffee pod and capsule market. Because of China's aging demographics and busier ways of life, consumers spend less time preparing dinners and refreshments. This fact has inclined them toward single-serve and convenient offerings for in-home coffee consumption, thereby driving the Japan coffee pod and capsule market. In addition, increase in working population and product innovations in the food & beverage industry are anticipated to fuel the market growth.

Key Benefits for Asia-Pacific Coffee Pod and Capsule Market:

The report provides extensive analysis of the current & emerging trends and opportunities in the Asia-Pacific coffee pod and capsule market.

The report provides detailed qualitative and quantitative analyses of current trends and future estimations, which help understand the prevailing market opportunities.

A comprehensive analysis of the factors that drive and restrict the growth of the Asia-Pacific coffee pod and capsule market is provided in the study.

An extensive analysis of the market is conducted by following key product positioning and monitoring the top competitors within the market framework.

The report provides extensive qualitative insights on the potential & niche segments as well as regions exhibiting favorable growth.

Asia-Pacific Coffee Pod and Capsule Market Report Highlights

| Aspects | Details |

| By Product |

|

| By Distribution Channel |

|

| By Country |

|

| Key Market Players | NESTLE S.A., THE KRAFT HEINZ COMPANY, ILLYCAFE S.P.A., URBAN BREW, DR PEPPER SNAPPLE GROUP, INC., GI.MA. SRL, UCC UESHIMA COFFEE CO., LTD., FRESH BREW CO., POD PACK INTERNATIONAL, LUIGI LAVAZZA S.P.A. |

Analyst Review

The Asia-Pacific coffee pod and capsule market is driven by increased coffee consumption across developing countries such as China, India, and many others. For instance, coffee consumption in China has doubled in the last 4 years. Apart from this, expansion in the retail market, growth in young population and surge in awareness regarding health benefits associated with coffee drives the growth of the coffee pod and capsule market. Innovations regarding recyclable packaging of coffee capsules is a new trend that provides a great opportunity to market players. Moreover, a strong distribution network helps manufacturers to sell a wide assortment of coffee pod and capsules, to cater to the preferences, convenience needs and expectations of consumers. However, high prices and growth in environmental concerns regarding the disposal of coffee pod and capsules hinder the market growth.

The Asia-Pacific coffee pod and capsule market size was valued at $2,646 million in 2017 and is expected to reach $5,918 million by 2025

The global Asia-Pacific Coffee Pod and Capsule market is projected to grow at a compound annual growth rate of 10.6% during the forecast period $5,918 million by 2025

POD PACK INTERNATIONAL, URBAN BREW, DR PEPPER SNAPPLE GROUP, INC., FRESH BREW CO., NESTLE S.A., LUIGI LAVAZZA S.P.A., THE KRAFT HEINZ COMPANY, UCC UESHIMA COFFEE CO., LTD., GI.MA. SRL, ILLYCAFE S.P.A.

Market players have adopted new & advanced technologies to introduce innovative products such as coffee pods and capsules, in recyclable and biodegradable packaging. Thus, the introduction of new formulations and adoption of technologies boosts the market growth.

Loading Table Of Content...