Asia-Pacific Condiments Market Overview :

The Asia-Pacific condiments market size was $45,762.75 million in 2017 and is projected to reach $71,862.43 million by 2025, growing at a CAGR of 5.8% from 2018 to 2025.

Rapid economic growth and increase in per capita income in Asia-Pacific leads to significant changes in food production. There is a change in the food consumption patterns, owing to increased foreign travel and cross cultural interaction. The marinades segment constitutes a major portion of the Asia-Pacific condiments market, owing to the popularity of meat in Asian countries such as China, Japan, and India. This is anticipated to boost the demand for the Asia-Pacific condiments market, thereby, driving the Asia-Pacific condiments market growth. In addition, rise in demand for the meat & seafood segment further drives the growth of the Asia-Pacific condiments market.

The leading players in the Asia-Pacific condiments market have focused on product launch as their key strategy to gain a significant share in the condiment market. The key players profiled in the report include Kraft-Heinz, Inc., Nestl, Yeo Hiap Seng Ltd, Three Threes Condiments Pty Limited, Hormel Foods Corporation, NutriAsia, Unilever, Kikkoman Corporation, McCormick & Company, Inc., and Del Monte Foods, Inc.

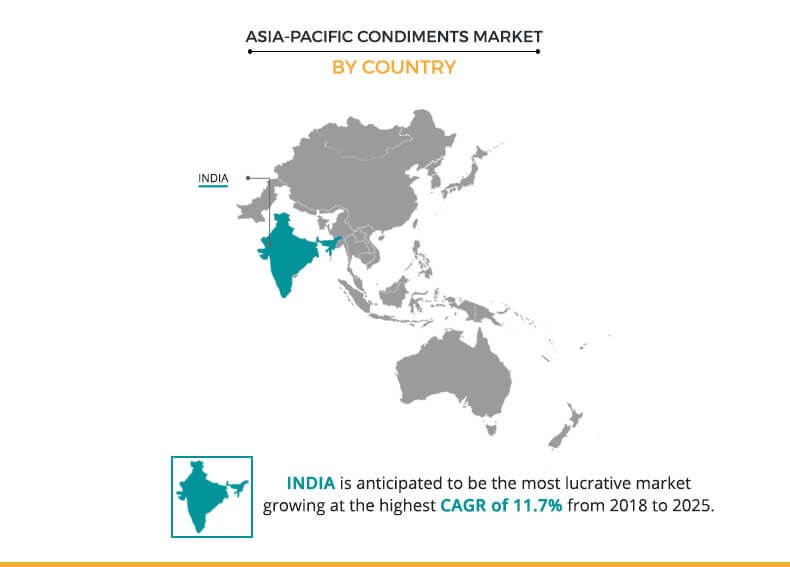

In 2017, Japan accounted for the highest market share in the Asia-Pacific condiments market and is projected to witness high revenue growth from 2018 to 2025, owing to growth in affluence and rise in fast food outlets as well as high consumption of meat in the region. In 2017, the total consumption of poultry meat in Japan was 2,044.05 kilotons compared to 2,020.20 kilotons in 2016. The meat consumption was dominant, which drives the sales of condiments in the market. India is also anticipated to be a lucrative market for condiments owing to highest growth rate in the Asia-Pacific condiments market. This growth is attributed to the rise in consumption of the convenience food and meat & seafood products in the country. People tend to adopt convenient food options, such as fast foods and ready to eat meals, owing to changes in lifestyle of people owing to busy lifestyle and rise in disposable income. This change in consumption pattern is expected to drive the growth of condiments in Asia-Pacific. Fast food, which is the majorly consumed by consumers contains condiments such as sauce.

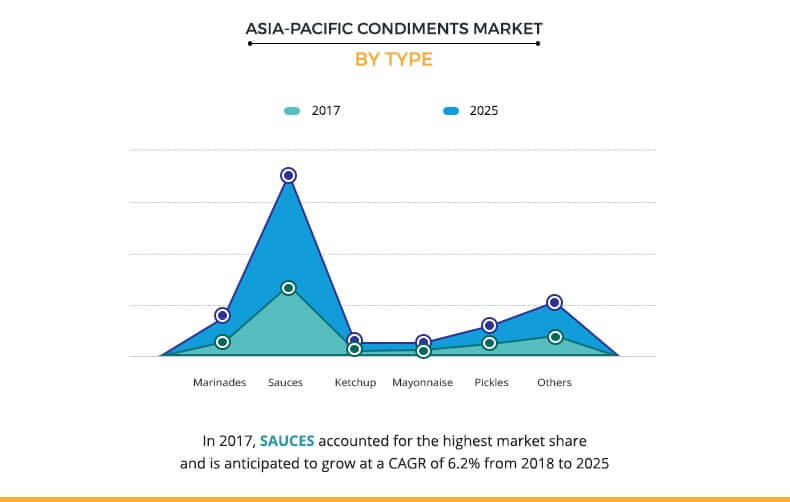

In 2017, the sauce segment accounted for the highest market share in the Asia-Pacific condiments market in terms of value as well as volume as it is the most common condiment consumed in the quick service restaurants and homes in most countries in this region. Sauce is one of the important components in many cuisines cooked across the world. Some of the most common dishes in which sauces are added include Noodles, Shushi, Dumplings, Onigiri, Ramen, and more. Sauce is also popularly used in pizzas, burgers, chicken wings, burritos, and more. A rise in the number of fast food outlets and quick service restaurants throughout the world has increased the demand for sauces, driving the sauces segment in Asia-Pacific condiment market.

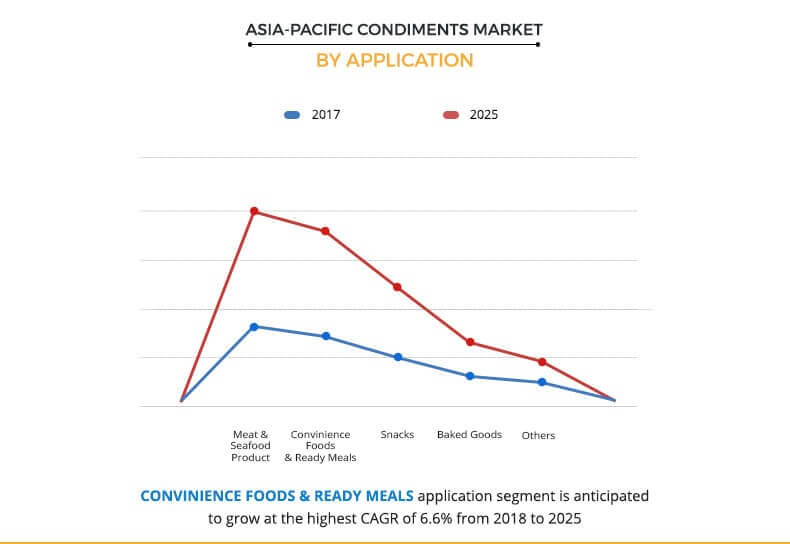

In 2017, meat & seafood was the prominent segment that accounted for the highest share in the Asia-Pacific condiments market. The meat & seafood segment is expected to grow at a 5.3% CAGR during the forecast period, owing to increase in demand for convenient food and meat products as well as rise in the number fast food outlets in the Asia-Pacific region. Popular Asian dishes such as Dumplings, Asian style (BBQ) Barbeque Chicken, Khao Suey, Chilly Chicken, Prawn Tempura, and Shushi requires condiments to enhance characteristics such as taste, color, and aroma; hence, driving the sales of condiments.

Key Benefits for Asia-Pacific Condiments Market :

This report provides a quantitative analysis of the current trends, estimations, and dynamics of the Asia-Pacific condiments market from 2018 to 2025 to identify the prevailing market opportunities.

Porters Five Forces analysis highlights the potency of buyers and suppliers to enable stakeholders to make profit-oriented business decisions and strengthen their supplierbuyer network.

In-depth analysis of the market segmentation assists in determining the prevailing market opportunities.

Major countries in Asia-Pacific are mapped according to their revenue contribution to the condiments industry.

Asia-Pacific Condiments Key Market Segments :

By Type

Marinade

Sauce

Ketchup

Mayonnaise

Pickle

Others

By Application

Meat & Seafood Product

Convenience Food & Ready Meal

Snack

Baked Goods

Others

By Form

Liquid

Paste

Dry

By Country

China

India

Australia

Japan

Indonesia

Thailand

Singapore

Malaysia

Vietnam

Rest of Asia-Pacific

Asia-Pacific Condiments Market Report Highlights

| Aspects | Details |

| By Type |

|

| By Application |

|

| By Form |

|

| By Country |

|

| Key Market Players | Del Monte Foods, Inc., Hormel Foods Corporation, McCormick & Company, Inc., Three Threes Condiments Pty Limited, Unilever, NutriAsia, Kraft-Heinz, Inc, Kikkoman Corporation, Nestl, Yeo Hiap Seng Ltd |

Analyst Review

Condiment is supplemental food used to impart certain flavor, color, and aroma to dishes. Some condiments such as ketchup, mayonnaise, and pickle are served with dishes, whereas some condiments such as pasta sauce, tomato paste, and bouillon are used as ingredients while cooking.

Sauces have been gaining popularity in the Asia-Pacific region as they are served with certain meals such as pizza, noodles, and meat & sea foods as taste enhancers. They are also an important component in many cuisines cooked across the world. Consumers with busy lifestyles look for quick and easy meal solutions that are wholesome. This factor of easy availability coupled with the increase in number of fast food outlets has increased the demand for fast food and ready to eat meals, which in turn supports the growth of the condiments market as condiments are an important part of these meals. Moreover, factors, such as increased income level paired with demand for a more diversified diet, have encouraged consumers to spend more on meat and seafood products. This boosts the sales of the condiments in the Asia-Pacific region. However, fluctuation in cost of raw materials is expected to hamper the growth of the Asia-Pacific condiments market during the forecast period.

The Asia-Pacific condiments market size was $45,762.75 million in 2017 and is projected to reach $71,862.43 million by 2025

The global Asia-Pacific Condiments market is projected to grow at a compound annual growth rate of 5.8% from 2018 to 2025 to reach $71,862.43 million by 2025

Kikkoman Corporation, Hormel Foods Corporation, Del Monte Foods, Inc., Kraft-Heinz, Inc, Nestl, Three Threes Condiments Pty Limited, McCormick & Company, Inc., NutriAsia, Unilever, Yeo Hiap Seng Ltd

Increase in cross-cultural interaction owing to globalization and increased foreign travel drives the Asia-Pacific condiments market. Moreover, rise in the number of fast-food outlets and a surge in retail network supplements the growth of the market.

Loading Table Of Content...