Asia-Pacific Smartwatch Market Outlook: 2022

Asia-Pacific Smartwatch Market is expected to garner $28,596 million by 2022, registering a CAGR of 69.8% during the forecast period 2016-2022.

Smartwatches are wearable computing devices, which perform all generic wristwatch operations along with numerous smartphone functions or features. They are equipped with technological innovations capable of displaying digital media. Furthermore, a smartwatch facilitates operations such as notifications, navigation, application synchronization, and Bluetooth connectivity to place calls or send/receive messages using Internet access.

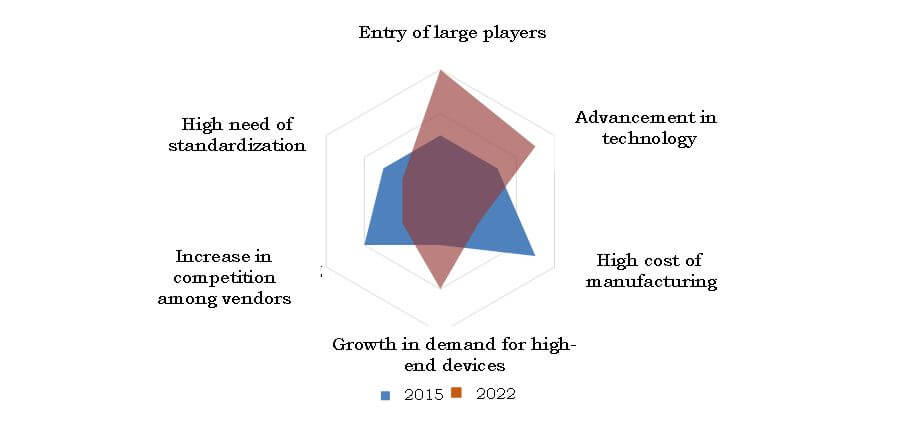

Technological advancements, entry of large players, growth in the use of utility watches, and demand for high-end devices drive the market for smartwatches in the Asia-Pacific region. However, the Asia-Pacific smartwatch market growth is hampered by design roadblocks, a higher need for standardization, and high cost of manufacturing. Nonetheless, the impact of these factors is estimated to be minimal due to the introduction of new technologies.

This technology has witnessed increased adoption in the current business scenario, particularly in developing countries, as innovative techniques are adopted by companies to provide customers with advanced and innovative product offerings.

Extension smartwatches are largely adopted in the Asia-Pacific region. Among the operating systems, Android-based smartwatches exhibited the highest revenue, owing to the increase in the adoption of Android-powered smartphones in the current scenario. However, Windows OS is expected to show the fastest growth rate in this market.

China exhibits the highest adoption of smartwatches; however, Australia is expected to grow at a faster pace, predicting a lucrative market growth for this technology during the forecast period.

The report incorporates various growth prospects and restraints of Asia-Pacific smartwatch market. Porter’s Five Forces analysis for the market is explained, which comprises the impact of suppliers, competitors, new entrants, substitutes, and buyers and depicts the value chain analysis for the market.

Key market players such as Apple Inc., Google Inc., Garmin Ltd., Fitbit, Inc., Motorola Mobility LLC., Sony Corporation, Samsung, Huawei Technologies Co., Ltd., Pebble, and Nike, Inc. are highlighted with information on business overview, financials, product portfolios, investments, and recent strategies & developments. Companies have currently developed smart watches for athletic purposes by upgrading their products, thus enhancing their market share. These watches provide features such as heart rate monitors, sensors, and others.

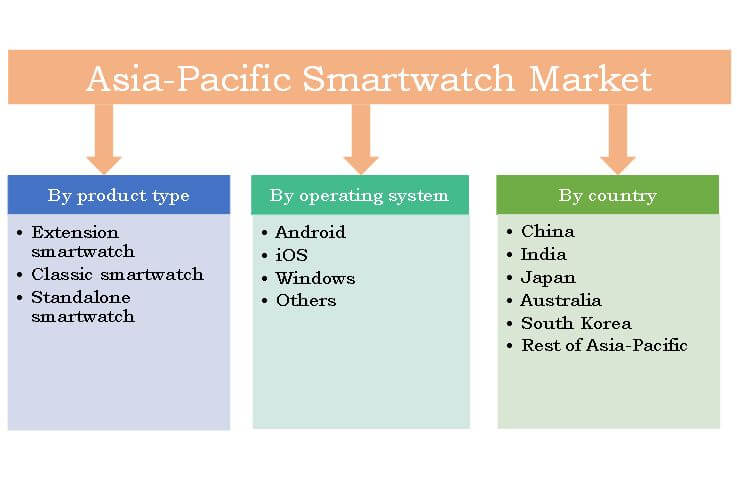

Segment Overview

The Asia-Pacific smartwatch market is segmented based on product type, operating system, and country. Product type segment includes extension, standalone, and classic smartwatches. In the year 2015, extension smartwatches generated the highest revenue worldwide. However, the classic smartwatch sub-segment is anticipated to exhibit the highest growth from 2016 to 2022.

The operating systems segment comprises Android, iOS, Windows, and other operating systems. Android dominated the market, in terms of revenue, in 2015, and is projected to continue its dominance during the forecast period, whereas Windows OS is expected to grow at the highest growth rate.

The countries considered in the report are China, Japan, India, South Korea, Australia, and rest of Asia-Pacific. China is expected to dominate the market, whereas Australia is projected to grow at a highest CAGR.

Top factors impacting the Asia-Pacific smartwatch market

Entry of large players

Widespread adoption of smartwatches has led to increased number of players to penetrate in the market. Well-established manufacturers invest in R&D and product advancements, offering latest technology and economies of scale that benefit the users as well. This enables small market players to provide similar specifications, providing an impetus to their products. Samsung, Apple, Microsoft, Google, and others provide more featured products to the customers and help the market to gain visibility. These companies possess a wide customer base, which increases the competition.

Advancement in technology

Smartwatch manufacturing companies invest considerably in R&D to devise optimum solutions to gain a higher market share. The smartwatch industry witnessed continuous growth gradually with enhanced feature range, such as notification alerts, internet connectivity, and others. Growth in technological features and advancements is expected to drive the smartwatch market during the forecast period.

High cost of manufacturing

The manufacturing cost of smartwatches is high and the components integrated in these watches are expensive. In addition, the marketing and promotional activities of smartwatches incur high cost, which increases the overall cost of the product. Companies are heavily funding R&D activities to add more features and make the products competitive. However, the overall impact of this factor is expected to reduce during the forecast period.

TOP IMPACTING FACTORS

KEY BENEFITS

- The report analyzes various smartwatches that are currently prevalent in the Asia-Pacific smartwatch market and the factors that drive its growth.

- The overall market potential is determined by understanding the profitable trends to gain stronger market coverage.

- The report presents information regarding key drivers, restraints, and opportunities with a detailed impact analysis.

- Asia-Pacific smartwatch market analysis includes market estimates from 2014 through 2022 including market size based on product type, operating system, and country.

- Current and future trends adopted by key market players are highlighted to determine overall competitiveness and imminent investment pockets of the market.

Asia Pacific Smartwatch Market Report Highlights

| Aspects | Details |

| By Type |

|

| By Opreating System |

|

| By Country |

|

| Key Market Players | Garmin Ltd., Nike, Inc., Motorola Solutions, Inc., Apple Inc., Huawei Technologies Co., Ltd., Fitbit, Sony Corporation, Pebble Technology Corporation, Google Inc., Samsung Electronics Co. Ltd. |

| COMPANIES MENTIONED IN THE REPORT | TAG Heuer, Intel Corporation, New Balance Athletic Shoe, Inc., LG Electronics,, Neptune, COGITO, Titan Company Limited, Michael Kors, Nixon Inc., Polar Electro, BLOCKS Wearables Ltd, Vector, Microsoft Corporation, Tencent Inc., Alibaba Group Holding Limited, iShuashua, Fossil Group Inc., Casio Computer Co., Ltd., Citizen Holdings Co., Ltd., Dot Incorporation, Medifast Inc. |

Analyst Review

Smartwatch market is projected to depict a prominent growth from 2016 to 2022 in the Asia-Pacific region, owing to technological advancements, entry of large players, growth in use of utility watches, and demand for high-end devices. However, to a certain extent, the market growth is hampered due to factors such as design roadblock, higher need for standardization, and high cost of manufacturing. The smartwatch market is still in its nascent stage and some of the emerging economies in the Asia-Pacific region are yet untapped.

Smartwatch is increasingly adopted in China, owing to the large-scale production of cost-efficient Android-powered smartwatches. Among the types, extension smartwatch generated the highest revenue in 2015. However, the classic smartwatch is expected to witness fastest growth during the forecast period. Based on operating systems, Android generated the highest revenue in 2015.

Google Inc., Huawei Technologies Ltd., and Samsung Electronics Ltd., are some of the leading market players that occupy a prominent revenue share; and have adopted product launch, partnership, and collaboration as their key strategies to sustain in the market. The technological agreements and collaborations of the market players across the region is further anticipated to propel the growth of smartwatch market. Additionally, small companies are increasingly producing smartwatches with updated technology systems to embed additive features in their products. Effective use of components provided by the OEMs, technology innovations of R&D along with the reduction in development time and cost, should also support the rising growth of the market during the forecast period. Effects of restraints such as high cost of smartwatches, complications in the design and specific design standards would minimize in years to come.

Loading Table Of Content...