Asia-pacific Tolling and City Congestion Market Overview - 2025

The Asia-Pacific tolling and city congestion was valued at $1,154.9 million in 2017, and is projected to reach $3,932.4 million by 2025, registering a CAGR of 16.7% from 2018 to 2025.The tolling system is an automated mechanism, which helps reduce the delay on toll bridges, toll roads, and toll tunnels without human intervention for toll receivers and payers. It can electronically charge a toll to an established customer account through real-time tracking and monitoring system. The latest innovation in tolling system is the electronic toll collection (ETC) that allows vehicles to pass through a toll facility without stopping at the toll center. This tolling system uses technologies such as radio-frequency identification (RFID), dedicated short-range communication (DSRC), infrared, global navigation satellite system (GNSS)/global positioning system (GPS), and video analytics, for its operation.

Traffic management systems are commonly known as intelligent transportation systems (ITS). These are superior applications, which aim to provide innovative services in different modes of transport and traffic management. They help increase coordination among various users and enable them to stay better informed and make safer and smarter use of transport networks. Smart transportation has various types of applications such as parking management & guidance, passenger information, and in traffic management.

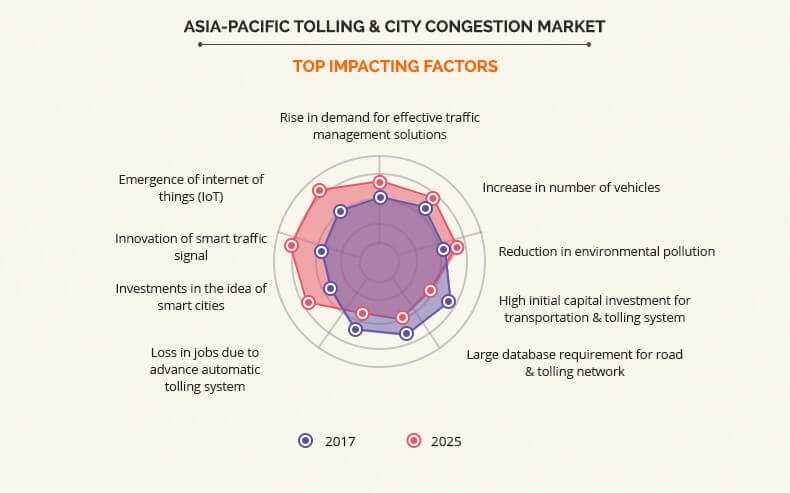

Factors such as rise in demand for efficient traffic management solutions, increase in number of vehicles, and reduction in environmental pollution majorly drive the adoption of tolling & city congestion systems.

However, high capital investment for transportation & tolling system, large database requirement for road & tolling network, and low acceptance ratio restrict the market growth. Furthermore, rise in investments in the idea of smart cities and innovation of smart signal offer lucrative opportunities for the Asia-Pacific tolling & city congestion market.

The key players operating in the Asia-Pacific tolling & city congestion market are Efkon GmbH, Toshiba Corporation, Raytheon, Thales Group, Siemens AG, Kapsch, Conduent (Xerox Corporation), Cubic Transportation, Alstom, and GE transportation.

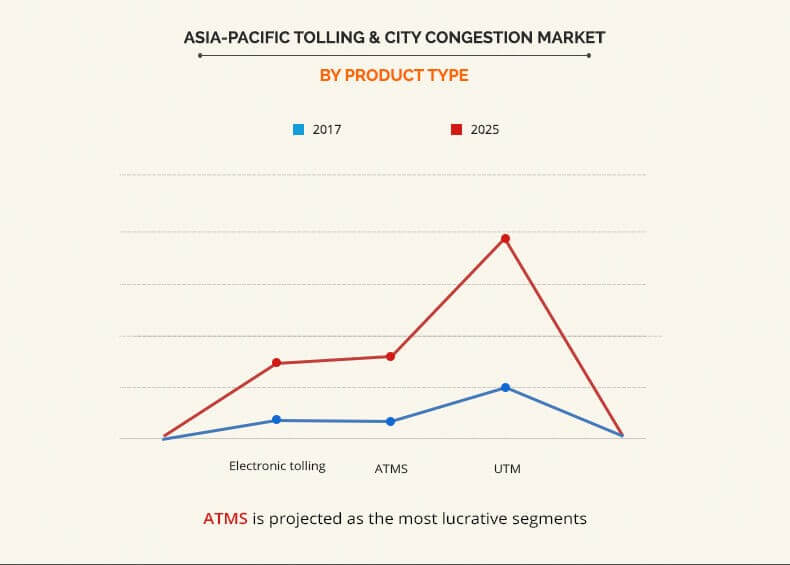

The Asia-Pacific tolling & city congestion market is segmented based on product type and country. Electronic tolling, advanced traffic management solution (ATMS), and urban traffic management (UTM) are studied under the product segment. Based on region, the market is analyzed across Asia-Pacific.

Top Impacting Factors

The key factors that drive the growth of the Asia-Pacific tolling & city congestion industry are rise in demand for effective traffic management solutions, increase in number of vehicles, and reduction in environmental pollution. However, high initial capital investment for transportation & tolling system, large database requirement for road & tolling network and loss in jobs owing to the advanced automatic tolling system hamper the growth of the market to a certain extent. The market witnessed significant growth owing to investments in the idea of smart cities, innovation of smart traffic signal, and emergence of Internet of Things (IoT). Each of these factors is anticipated to have a definite impact on the Asia-Pacific tolling & city congestion market during the forecast period.

Rise in demand for effective traffic management solutions

Increase in number of vehicles leads to traffic congestion, if conventional traffic management systems are used. For instance, Los Angeles is the most congested city in the world where citizens spend on an average 102 hours in traffic during peak time, which is followed by San Francisco, Moscow, and others. Moreover, in Asia-Pacific, the major cities that face high traffic congestion include Dhaka, New Delhi, and Mumbai. Thus, there is a rise in the demand for smart transportation network, which is expected to help reduce traffic congestion and thus, enhance the safety, sustainability, and efficiency of the transportation network. There is a rapid increase in the number of vehicles on the road, which creates traffic congestions. Consequently, most of the consumers are now availing smart transportation options that can easily direct them toward the road that is less congested.

Increase in number of vehicles

Rise in disposable incomes results in a rapid increase in the sale of vehicles, in many developed or developing countries. This increase in adoption of vehicles leads to problems such as car parking space issue along with traffic snarls and congestion. For instance, the problem related to traffic in Amsterdam was solved by implementing TrafficLink SCM system that is connected to the traffic system of the national government. Furthermore, TrafficLinks SCM system resolved the conflict between North Holland and the national government by optimizing efficient traffic flow. It was achieved by initializing a single screen that allows both the parties to manage or monitor traffic in their respective region. The implementation of the traffic management system has reduced the problem of traffic congestion in the city. The joint monitoring of vehicles & traffic by North Holland and the national government is creating significant demand for the tolling and city congestion market.

High initial capital investment for transportation & tolling system

Smart transportation is in high demand owing to its advantages such as time saving, cost-efficiency, high security, and fast speed over the traditional transportation system. Developed countries such as the U.S. and the UK can afford the capital investment required for smart transportation. However, it is deemed expensive in the developing countries such as Philippines, Pakistan, and others, due to lack of information and awareness about the technology in these countries. Thus, high capital investment is a major factor that hampers the growth of the tolling and city congestion market, in the developing as well as the underdeveloped countries.

Investments in the idea of smart cities

The development of smart cities and connected transport infrastructure is supported by the governments of several countries owing to rapid growth of economies and rapid adoption of advanced technologies worldwide. Countries such as Australia, Japan, China, and those from North America that include Canada, the U.S., and Mexico, have initiated the installation of digital infrastructure to facilitate connectivity between vehicles and infrastructure to gather important information to reduce traffic congestion and make roads safer.

Key Benefits For Stakeholders

- This study comprises an analytical depiction of the Asia-Pacific tolling & city congestion market along with current trends and future estimations to depict the imminent investment pockets.

- The overall market potential is determined to understand the profitable trends to gain a strong foothold.

- The report presents information related to key drivers, restraints, and opportunities with a detailed impact analysis.

- Porter’s Five Forces analysis illustrates the potency of the buyers and suppliers in the industry.

- The report includes the market share and trends of the key players in the Asia-Pacific tolling & city congestion market.

Asia-Pacific Tolling and City Congestion Market Report Highlights

| Aspects | Details |

| By Product Type |

|

| By Region |

|

Analyst Review

Asia-Pacific tolling & city congestion market holds high potential for the transportation industry. The current business scenario witnessed an increase in the demand for effective traffic management solutions, particularly in the developing countries of Asia-Pacific. The key players operating in the industry have adopted various techniques to provide advanced and innovative product offerings to the customers.

The Asia-Pacific tolling & city congestion market is driven by the rise in demand for efficient traffic management solutions, increase in the number of vehicles, and reduction in environmental pollution.

However, high capital investment for transportation & tolling system, large database required for road & tolling network, and low acceptance ratio restrict the growth of the market. Furthermore, investments in the idea of smart cities and innovation of smart signal create lucrative opportunities for the Asia-Pacific tolling & city congestion market

The key players operating in the Asia-Pacific tolling & city congestion market are Efkon GmbH, Toshiba Corporation, Raytheon, Thales Group, Siemens AG, Kapsch, Conduent (Xerox Corporation), Cubic Transportation, Alstom, and GE transportation.

Loading Table Of Content...