Asia Pacific Voice Over Lte Market Statistics: 2030

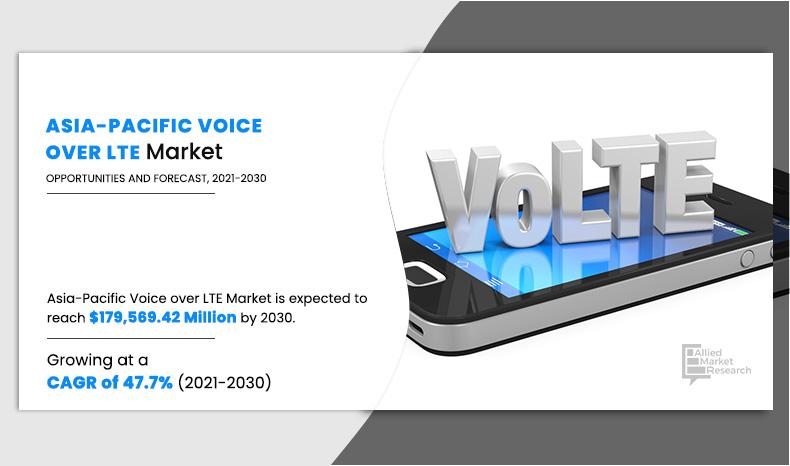

The Asia Pacific Voice Over LTE Market was valued at $3,618.48 million in 2020, and is projected to reach $179,569.42 million by 2030, registering a CAGR of 47.7% from 2021 to 2030.

VoLTE is the technology in which voice calls are made over the LTE (Long Term Evolution) network. It provides superior voice quality and high internet speed over the standard networks. Moreover, VoLTE allows voice and data access simultaneously. The 4G LTE network is the mainstream foundation for the emergence of VoLTE. 4G LTE is around 20 times faster than any 3G broadband technology. Moreover, 4G LTE reduces battery drain rate more efficiently than 3G technology. Despite of the deployment of 4G LTE network for data, several service providers still prefer 3G CDMA and GSM platforms for voice calls. VoLTE is a long-term solution for voice calls as it is designed for the replacement of conventional mobile voice platforms by easy integration of VoIP (Voice over Internet Protocol) services including landline networks.

The Asia Pacific Voice over LTE market growth is influenced by several factors such as rise in demand for improved video and voice quality along with the high-speed internet and increasing investment in VoLTE across Asia Pacific. In addition, a presence of leading VoLTE market players in Asia Pacific fuel the growth of this market. However, delayed acceptance in emerging economies hampered the growth of the market to some extent. On the other hand, advent of the 5G Network connectivity and rise in demand for mobile UC (Unified Communications) are estimated to be opportunistic for the growth of the market.

In addition, the VoLTE technology provides Rich Communication Services (RCS) such as video calling, real time language translation, video voice mail, and instant messaging. These features are the new strengths for mobile vendors to compete against the OTT providers.

On the basis of technology, the voice over IP multimedia subsystem segment dominated the Asia Pacific voice over LTE market in 2020, and is expected to maintain its dominance in the upcoming years. IP Multimedia Subsystem or IMS is a standards-based architectural framework for delivering multimedia communications services such as voice, video and text messaging over IP networks. Voice Over IP Multimedia Subsystem (VoIMS) is a voice over LTE approach that uses IMS. An IP multimedia subsystem is a low-cost network infrastructure compared to other networks. The cost-effectiveness of this technology is driving the VoLTE market in Asia Pacific.

China dominates the Asia Pacific Voice Over LTE Market. The huge presence of subscribers of mobile phones in China is the primary reason for adoption of VoLTE services by telecom operators in the region. Moreover, faster connection speed along with better sound quality are some of the factors driving the growth of the VoLTE services in China. In addition, the launch of 5G services and healthy adoption of these services by people of China is also driving the growth of the VoLTE market in China.

The report focuses on the growth prospects, restraints, and Asia Pacific Voice over LTE market share. The study provides Porter’s five forces analysis of the Asia Pacific Voice over LTE market forecast to understand the impact of various factors such as bargaining power of suppliers, competitive intensity of competitors, the threat of new entrants, threat of substitutes, and bargaining power of buyers on the Asia Pacific Voice over LTE market trends.

Segment Review

The Asia Pacific VoLTE market is segmented on the basis of technology, end user, and country. Based on the technology, it is bifurcated into Voice over IP multimedia subsystem (VoIMS), Circuit Switched Fallback (CSFB), Dual radio or Simultaneous Voice and LTE (SV LTE), Voice over LTE via Generic Access Network and Single Radio Voice Call Continuity. Based on end user, the market is categorized into corporate, commercial and government. Country wise, it is analyzed across China, India, Japan, South Korea, Australia, and rest of Asia Pacific.

Covid-19 Impact Analysis

The COVID-19 outbreak has low impact on the growth of the Asia Pacific VoLTE market, owing to the fact that the government and private sectors in emerging countries are working together to speed up the development of 5G and VoLTE infrastructure in the wake of the pandemic. For instance, in Thailand, mobile network operators (MNO) are joining forces to provide 5G networks to hospitals. The Eastern Economic Corridor (EEC), which is a special development zone of Thailand, mandates that 5G must cover approximately 50% of the area in 2020, which means that the equipment installation must commence this year in industrial areas.

Moreover, the COVID-19 impact has prompted every company and business to shift their business operations towards a remote work environment. As a result of the dire situation, companies began to implement the BYOD program or enterprise-owned equipment. Therefore, the need for high internet speed and better voice quality for proper communication has increased. Moreover, during the COVID due to WFH policies the demand for best in market smartphones and LTE enabled internet providers demand increased significantly. However, the shortage of revenue generation and delay in implementation of 5G services in many regions during COVID also hampered the Asia Pacific voice over LTE market growth.

By Technology

Voice Over Lte Via Generic Access Network segment is projected as one of the most lucrative segments.

Top Impacting Factors

The Asia Pacific VoLTE Market is influenced by several factors such as rise in demand for improved video and voice quality along with the high-speed internet and increasing investment in VoLTE across Asia Pacific. In addition, presence of leading VoLTE market players in Asia Pacific fuels the growth of the market. However, delayed acceptance in emerging economies hampers the growth of the market to some extent. On the other hand, advent of the 5G Network connectivity and rise in demand for mobile Unified Communications (UC) are estimated to be opportunistic for the growth of the market.

Rise in demand for improved video and voice quality along with high-speed internet VoLTE technology allows voice calls over an LTE network. This technology harnesses data capabilities of LTE coupled with the traditional voice services on to the same LTE network. Hence, it empowers network operators to provide rich video, voice, and messaging services. Moreover, VoLTE enable operators to provide a set of standards based on services such as Rich Communication Services (RCS) that comprise video, real time language translation, instant messaging, voice mail, and video calling. Furthermore, the call quality associated with the network generations such as 2G and 3G was not high-definition. This has led to the emergence of 4G VoLTE to meet rise in demand for enhanced video and voice quality. For instance, according to the various studies, VoLTE delivers six times better call quality than 2G and up to three times that of 3G.

By End User

Corporate segment is projected as one of the most lucrative segments.

Presence Of Leading Volte Market Players In Asia Pacific

Asia Pacific has the highest number of VoLTE subscribers as well as operators across the globe. For instance, the number of subscriptions in this region is about 4.2 billion which accounts for around 53% of the total number of VoLTE subscriptions around the globe. In addition, the mobile network providers such as Bharati Airtel Limited, Reliance Jio, Vodafone, Digi, Yes 4G, U Mobile, and Dialog have ventured into the VoLTE technology and are heavily investing in this technology to provide enhanced services. Aforementioned factors significantly boost growth of the Asia Pacific Voice Over LTE Industry.

Emergence of 5G

5G network deployments are rolling out across numerous markets around the world, and its adoption rate is about four times that of its 4G LTE predecessor. This has led to the emerging need for networks that have been relying on 2G and 3G for voice to allow voice calls on 5G smartphones. VoLTE supports 5G LTE devices and enables 5G users to reap the benefits of voice over services effectively. The VoLTE technology's advantages in higher voice quality and voice-data concurrence capability are essential for 5G. For instance, as 5G no longer supports circuit-switched fallback (CSFB) for voice, it relies on VoLTE to provide voice service to their customers. Hence, emergence of 5G is expected to create lucrative growth opportunities for the Asia Pacific voice over LTE market.

By Country

China is projected as one of the most significant country

Key Benefits For Stakeholders

- his study includes the Asia Pacific Voice Over LTE Market analysis, trends, and future estimations to determine the imminent investment pockets.

- he report presents information related to key drivers, restraints, and Asia Pacific Voice Over LTE Market opportunity.

- he Asia Pacific Voice over LTE market size is quantitatively analyzed from 2020 to 2030 to highlight the financial competency of the industry.

- Porter’s five forces analysis illustrates the potency of buyers & suppliers in Asia Pacific Voice Over LTE industry.

Asia Pacific Voice Over LTE Market Report Highlights

| Aspects | Details |

| By TECHNOLOGY |

|

| By END USER |

|

| By COUNTRY |

|

| By Key Market Players |

|

Analyst Review

In accordance with several interviews conducted of the top level CXOs, the Asia-Pacific region is witnessing an increased adoption of VoLTE technology from developing economies such as India and China. Moreover, the VoLTE market signifies a promising picture for the telecommunication sector. The current business scenario has witnessed an upsurge in the deployment of VoLTE services in developed as well as the developing regions. The companies adopt efficient techniques in an effort to provide the customers with advanced and innovated services. Moreover, the deployment of 5G services across the region is also driving the growth of the market, especially in countries such as China, Japan and South Korea.

In addition, from a growth perspective, Asia-Pacific is one of the most attractive markets for VoLTE technology due to increasing investment in technology by mobile operators such as SK Telcom, LG Uplus, Huawei Technologies and China Mobile and capturing a large customer base among developed and developing countries in the region.

Among the technologies used in deploying VoLTE services, Circuit-switched fallback (CSFB) has the highest market share due to its widespread acceptance as the ultimate solution for providing voice services through LTE. Although the technology requires specific modifications to the hardware infrastructure and uses multiple data transition elements, it is still a cost-efficient solution for voice provisioning over LTE. However, Voice Over LTE Via Generic Access Network (VOLGA) is expected to be the fastest growing technology due to short-term service acceleration as well as long-term investment protection, which are designed to deliver profitable telephony services.

Loading Table Of Content...