Asset Servicing Market Research, 2032

The global asset servicing market was valued at $83.7 billion in 2022, and is projected to reach $264.6 billion by 2032, growing at a CAGR of 12.5% from 2023 to 2032.

Asset servicing refers to administration services provided by a central securities depository (CSD) or custodian in connection with the custody and/or safekeeping of financial instruments. The term describes a group of tasks and activities provided by a custodian to their clients around the assets they have under custody. These activities include the processing of corporate events or the handling of taxes. Asset servicing combines a wide range of infrastructure and portfolio analysis services and provides wealth insight and investment control.

One key factor driving the growth of the asset servicing market is the increasing complexity of investment portfolios. Furthermore, governments and regulatory bodies are continuously implementing new rules and guidelines to safeguard the interests of investors and maintain the stability of financial markets. Asset servicing firms play a vital role in helping their clients navigate this regulatory maze. Thus, the growth of the asset servicing market is driven by the ever-evolving landscape of financial regulations. In addition, with globalization continuing to shape the investment landscape, asset servicing providers are in high demand as they facilitate the seamless management of assets across borders.

However, one of the key factors restraining the growth of the asset servicing market is high costs. Asset servicing firms provide essential and complex services, which require a significant investment in technology, skilled personnel, and infrastructure. As a result, they charge fees to their clients for these services. Moreover, the growth of the asset servicing market is hampered by the rapid pace of technological change and the accompanying cybersecurity risks. On the contrary, increase in popularity of alternative investments is expected to provide lucrative opportunities for the growth of the asset servicing market.

The report focuses on growth prospects, restraints, and trends of the asset servicing market forecast. The study provides Porter’s five forces analysis to understand the impact of various factors such as bargaining power of suppliers, competitive intensity of competitors, threat of new entrants, threat of substitutes, and bargaining power of buyers on the asset servicing market outlook.

Segment Review

The asset servicing market is segmented into services, enterprise size, end user, and region. By service, the asset servicing market is differentiated into fund services, custody and accounting, outsourcing services, securities lending, and others. On the basis of enterprise size, it is segmented into large enterprises and small and medium-sized enterprises. Depending on end user, it is fragmented into capital markets, wealth management firms, and others. Region-wise, the market is segmented into North America, Europe, Asia-Pacific, and LAMEA.

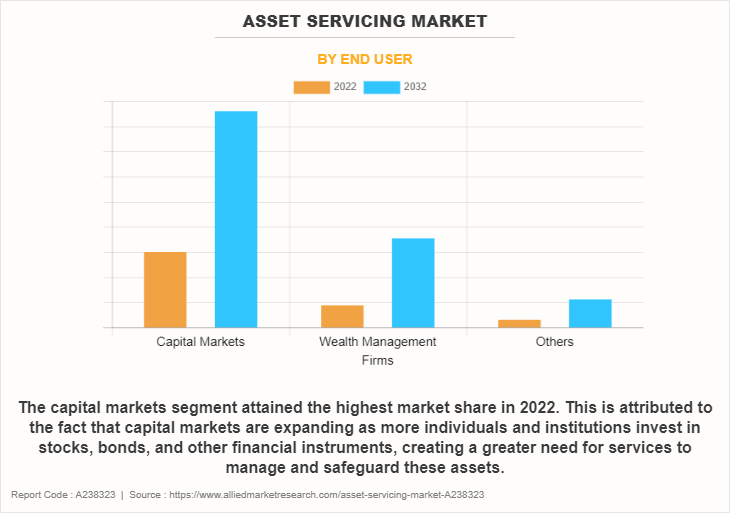

By end user, the capital markets segment dominated the asset servicing market in 2022. This is attributed to the fact that capital markets are expanding as more individuals and institutions invest in stocks, bonds, and other financial instruments, creating a greater need for services to manage and safeguard these assets. However, the wealth management firms segment is expected to be the fastest-growing segment during the forecast period. This is attributed to the fact that as wealth management firms handle the investments of high-net-worth individuals and families, they require specialized services to effectively manage and grow these assets.

Region-wise, North America dominated the asset servicing market share in 2022. This is attributed to the demand for specialized expertise and the trend towards outsourcing, making it a vital part of the region's financial landscape. However, Asia-Pacific is considered to be the fastest-growing region during the forecast period. This is attributed to the region's economic expansion and increase in international interest in Asian investments, highlighting the importance of these services in the financial sector.

The key players operating in the asset servicing market include Northern Trust Corporation, UBS, The Bank of New York Mellon Corporation, Fenergo, JPMorgan Chase & Co., HSBC Group, Credit Agricole, Deutsche Bank AG, Broadridge Financial Solutions, Inc., and CIBC Mellon. These players have adopted various strategies to increase their market penetration and strengthen their position in the asset servicing industry.

Market Landscape and Trends

According to Deloitte, a huge wave of technology disruption is heading toward the asset servicing industry. In the next five years, Robotic Process Automation (RPA), blockchain, and cognitive systems will drive dramatic change and have a profound, lasting impact on service providers’ operations. These disruptive technologies collectively offer enormous potential for asset service providers and asset management group to improve efficiency, reduce risk, and enhance the quality of service to clients. Thus, these factors provide lucrative opportunities for the growth of the asset servicing market.

Furthermore, key players in the asset servicing market adopt various strategies such as partnerships and product launches to expand their product portfolio. For instance, in March 2022, HSBC launched a technology platform to provide private asset administration services to asset owners and managers, as part of the bank’s wider effort to grow its securities services offering in the private asset sector. The new platform, powered by SEI offers private asset investors digital workflow and reporting solutions, allowing them to oversee all aspects of their operating model via a consolidated data stack. Therefore, such strategies provide growth opportunities to the asset servicing market.

The COVID-19 pandemic had a significant impact on the asset servicing market size, owing to the market volatility and uncertainty that led to increased demand for asset servicing as investors sought expert help to navigate the turbulent financial landscape. However, as the pandemic continued, some segments of the asset servicing market faced challenges. Therefore, the asset servicing market experienced changes in demand and the way services were delivered during COVID-19. While some areas saw growth due to increased market complexity, others faced challenges, resulting in a complex and evolving landscape for asset servicing industry.

Top Impacting Factors

Increase in Investment Complexity

One key factor driving the growth of the asset servicing market is the increasing complexity of investment portfolios. In today's financial world, investors are diversifying their holdings across various assets such as CIBC Mellon stocks, bonds, real estate, and alternative investments. With this complexity comes a need for professional asset servicing firms. These firms specialize in handling the administrative and operational aspects of managing these diverse investments. They help investors with tasks such as record-keeping, trade settlement, and performance reporting. As portfolios become more complex, investors are relying on asset servicing providers to ensure that their assets are properly managed and monitored, which in turn fuels the demand for asset servicing. For instance, in February 2023, CIBC Mellon announced that Hamilton Capital Partners Inc. (Hamilton ETFs) extended its use of CIBC Mellon's custody, fund accounting, exchange-traded fund (ETF) servicing, securities lending, foreign exchange processing and settlement services, as well as investment information data access via the NEXEN investment data platform.

Globalization and Market Expansion

The growth of the asset servicing market is propelled by globalization. Investors are increasingly looking beyond their domestic markets to find profitable opportunities. This global perspective means that investments span multiple countries, each with its own set of rules and regulations. Asset servicing firms are well-equipped to handle the intricacies of cross-border investments. They offer services such as foreign exchange, tax reclamation, and custody solutions tailored to international markets. With globalization continuing to shape the investment landscape, asset servicing providers are in high demand as they facilitate the seamless management of assets across borders. For instance, in September 2023, Broadridge Financial Solutions Inc. collaborated with Salesforce to help wealth management firms scale their businesses, accelerate digital transformation, reduce cost, mitigate risk, and increase advisor productivity. Through this collaboration, Broadridge’s books and records data consolidation, securities lending and financial advisor marketing systems will be available to Salesforce Financial Services Cloud (FSC) customers. This trend is expected to persist as investors seek diversification and growth opportunities worldwide, further boosting the asset servicing market growth.

Rise of Alternative Investments

One major growth opportunity for the asset servicing market is the increasing popularity of alternative investments. Alternative investments include assets such as private equity, hedge funds, real estate, and venture capital. These investments have gained traction as they offer diversification and potentially higher returns compared to traditional assets such as stocks and bonds. However, they come with complex structures and unique operational challenges. Asset servicing firms are well-positioned to provide specialized services for these alternative investments.

In addition, asset servicing companies offer fund administration, valuation, and reporting services tailored to the needs of alternative investment managers. As more investors allocate their funds to these non-traditional assets, the demand for expert asset servicing providers in this niche grows. This trend provides lucrative growth opportunities for asset servicing firms that can adapt and expand their capabilities to support alternative investments effectively.

Key Benefits for Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the asset servicing market analysis from 2022 to 2032 to identify the prevailing asset servicing market opportunity.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- The Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders to make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the asset servicing market segmentation assists to determine the prevailing asset servicing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as asset servicing market trends, key players, market segments, application areas, and market growth strategies.

Asset Servicing Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 264.6 billion |

| Growth Rate | CAGR of 12.5% |

| Forecast period | 2022 - 2032 |

| Report Pages | 125 |

| By Service |

|

| By Enterprise Size |

|

| By End User |

|

| By Region |

|

| Key Market Players | J.P. Morgan Chase and Co., Credit Agricole, HSBC Group, Northern Trust Corporation, UBS, Fenergo, Deutsche Bank AG, Broadridge Financial Solutions, Inc., CIBC Mellon, The Bank of New York Mellon Corporation |

Analyst Review

Asset servicing is a profitable sector considering the current challenging economic environment. It is characterized by stringent regulations, demanding investors, and fierce competition. The evolving landscape is compelling asset managers to revisit their IT strategy, to reduce operational costs and improve efficiencies. As a result, they have been increasingly adopting outsourcing strategies to achieve strategic goals.

Furthermore, technological advancements such as blockchain and automated trading, are driving the demand for innovative asset servicing solutions, contributing to the growth of the asset servicing market. For instance, in June 2021, Northern Trust launched a machine learning-powered document, capture capability, as the foundation of a multi-year investment to digitize alternative asset servicing and enhance the experience for asset owner clients that invest in complex private markets and unlisted assets.

The COVID-19 pandemic had a significant impact on the asset servicing market, owing to the market volatility and uncertainty that led to increase in demand for asset servicing as investors sought expert help to navigate the unstable financial landscape. However, as the pandemic continued, some segments of the asset servicing market faced challenges. Therefore, the asset servicing market experienced changes in demand and the way services were delivered during COVID-19. While some areas saw growth due to increased market complexity, others faced challenges, resulting in a complex and evolving landscape for asset servicing firms.

The key players in the asset servicing market include Northern Trust Corporation, UBS, The Bank of New York Mellon Corporation, Fenergo, JPMorgan Chase & Co., HSBC Group, Credit Agricole, Deutsche Bank AG, Broadridge Financial Solutions, Inc., and CIBC Mellon. Major players operating in this market have witnessed significant adoption of strategies that include business expansion and partnership to reduce supply and demand gap. With increase in awareness and rise in demand for asset servicing across the globe, major players are collaborating their product portfolio to provide differentiated and innovative products.

The upcoming trends for asset servicing market are globalization and automation.

The largest regional market for Asset Servicing is North America.

The asset servicing market size was valued at $83,681.52 million in 2022 and is projected to reach $264,626.01 million by 2032, growing at a CAGR of 12.5% from 2023 to 2032.

The key players operating in the asset servicing market include Northern Trust Corporation, UBS, The Bank of New York Mellon Corporation, Fenergo, JPMorgan Chase & Co., HSBC Group, Credit Agricole, Deutsche Bank AG, Broadridge Financial Solutions, Inc., and CIBC Mellon.

Loading Table Of Content...

Loading Research Methodology...